North America Food Coating Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Type (Sugars & Syrups, Cocoa & Chocolates, Fats & Oils, Spices & Seasonings, Flours, Batter and Crumbs, and Others), By Application (Bakery, Confectionery, Snacks, Dairy, Meat, and Others), and North America Food Coating Ingredients Market Insights Forecasts to 2035

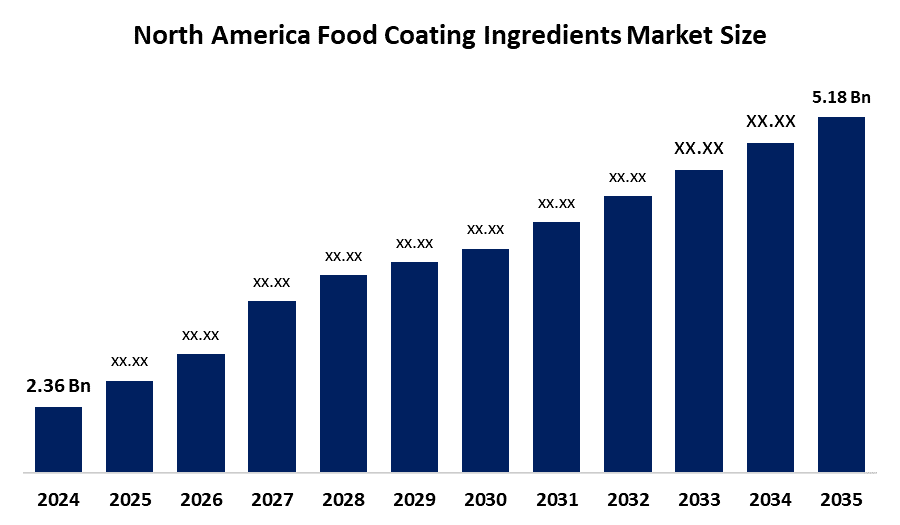

Industry: Food & Beverages- The North America Food Coating Ingredients Market Size Was Estimated at USD 2.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.41% from 2025 to 2035

- The North America Food Coating Ingredients Market Size is Expected to Reach USD 5.18 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Food Coating Ingredients Market Size is Anticipated to Reach USD 5.18 Billion by 2035, Growing at a CAGR of 7.41% from 2025 to 2035. The market is driven by the increasing consumer preference for value-added products with enhanced flavor, texture and broader consumer appeal. The growing use of coatings in both traditional and premium segments is a clear indication of their role in product diversification.

Market Overview

Food coating additives are substances that are used for the covering of food products to improve their texture, flavor, and appearance and to prolong their life. Usually, these substances are derived from nature, such as starches, flours, proteins, and gums that create an invisible protective layer around the food. Coating systems are increasingly being used in tandem with the expansion of snack categories and premium food offerings as they align with consumer preferences for variety and quality. Additionally, the use of these chemicals can bring about a drastic change in the visual aspect of food, making it more attractive to buyers.

Chicago is the leading city in the North American food coating ingredients market, and it produces around 28-30% of the total capacity of North American food coating ingredients, which is worth USD 850-900 million in 2023. The country also experienced a significant rise in the use of local food coating ingredients due to the growing trend of ready-to-eat outlets and consumption. For instance, the United States had 7,108 Domino's restaurants located there as of May 2025.

In August 2025, Griffith Foods introduces OptiTender, a clean-label marinade that is capable of tenderizing and satisfies the ever-increasing demand for natural ingredients. In North America, 85% of consumers prefer unprocessed or minimally processed foods, while 54% of them are worried about the over-processing of meat products.

In Canada, the regulatory authority with respect to food packaging issues is the Canadian Food Inspection Agency (CFIA) and the Health Products and Food Branch (HPFB) of Health Canada. The main dry-coated products among the salted snacks for North American consumers, both the US and Canada, are potato chips. Besides, these regions are the major markets for frozen food that demand coatings for longer shelf life. Accordingly, the need for food coating materials in North America is likely to grow further.

Report Coverage

This research report categorizes the market for the North America Food Coating Ingredients Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America food coating ingredients market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America food coating ingredients market.

North America Food Coating Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.36 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.41% |

| 2035 Value Projection: | USD 5.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | PGP International, Newly Weds Foods, Archer Daniels Midland Company, Cargill, Ingredion Inc, Bunge, Puratos, Barry Callebaut, Clasen Quality Coatings, Inc., Baron Spices & Seasonings, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Food Coating Ingredients Market Size in North America is driven by the higher demand for ready-to-eat and processed products. As per forecasts, the convenience food in North America will reach $164.8 billion in 2023, marking a 12.3% increase from the previous year. The International Food Information Council (IFIC) in its annual Food & Health Survey for 2023 indicated that 72% of the United States population has the habit of eating convenience foods regularly, which is a significant rise of 7% compared to the previous year of 65%. This is a considerable increase of 28% in demand for whole-grain coatings over the previous year, leading to the production of new formulas with natural ingredients by manufacturers. The rise of fast-food restaurants in North America has also directly influenced the food coating ingredients market positively.

Restraining Factors

The Food Coating Ingredients Market Size in North America is restrained by the prices of the primary raw materials for food coating ingredients, such as starches, flours, and proteins, which may fluctuate based on the agricultural conditions and the performance of the supply chain. Food safety rules and regulations demand that the manufacturers of food coating ingredients maintain the products' compliance with the health and safety standards. The cost of such regulations, which include clean labeling requirements and allergen labeling, can be very high, and thus, it can be very difficult. As customers increasingly demand foods that are healthy, clean-label, and made of natural ingredients, the manufacturers of food coating ingredients have to live up to these expectations while still maintaining the product's functionality.

Market Segmentation

The North America food coating ingredients market share is categorised into type and application.

- The sugars & syrups segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Food Coating Ingredients Market Size is segmented by type into sugars & syrups, cocoa & chocolates, fats & oils, spices & seasonings, flours, batter and crumbs, and others. Among these, the sugars & syrups segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sugars & syrups were the largest segment with a revenue share of 32.85% in 2024. Sugar alcohols find application in a variety of products such as confectionery, baked goods, snacks, and beverages due to their ability to sweeten, give texture, and add shine. The demand for sugar-free coatings as an indulgence with a health-friendly choice has led to the reformulation of these ingredients for new applications. The versatility of these substances comes from their ability to pair with both natural and artificial flavors, which allows the producers to widely distribute their products among different markets.

- The confectionery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America Food Coating Ingredients Market Size is segmented into bakery, confectionery, snacks, dairy, meat, and others. Among these, the confectionery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by taste and texture enhancement, and coatings were also effective in stabilising and prolonging the life of chocolates, candies, and dragees. The consumers' requirement of indulgence, along with their innovative character, has led the industry to produce coatings that are more and more personalized and characterized by unique flavors, sophisticated finishes, and attractive looks. The trend of small, individual, and high-quality confectionery products has also brought the significance of coatings to the fore, as they ensure consistent quality and sensory experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Food Coating Ingredients Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PGP International

- Newly Weds Foods

- Archer Daniels Midland Company

- Cargill

- Ingredion Inc

- Bunge

- Puratos

- Barry Callebaut

- Clasen Quality Coatings, Inc.

- Baron Spices & Seasonings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2025, Akorn Technology launched a breakthrough in sustainable shelf-life extension for cucumbers, an edible coating that it says could revolutionise the way cucumbers are packed, distributed, sold and consumed by replacing single-use plastic wraps.

In January 2025, Innophos launched a New Shelf-Life Extension Solution for Bread-LEVAIR ESL helps boost profitability and reduce waste

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Food Coating Ingredients Market Size based on the below-mentioned segments:

North America Food Coating Ingredients Market, By Type

- Sugars & Syrups

- Cocoa & Chocolates

- Fats & Oils

- Spices & Seasonings

- Flours, Batter and Crumbs

- Others

North America Food Coating Ingredients Market, By Application

- Bakery

- Confectionery

- Snacks

- Dairy

- Meat

- Others

Frequently Asked Questions (FAQ)

-

What is the North America food coating ingredients market size?The North America Food Coating Ingredients Market size is expected to grow from USD 2.36 billion in 2024 to USD 5.18 billion by 2035, growing at a CAGR of 7.41% during the forecast period 2025-2035.

-

What are food coating ingredients, and their primary use?Food coating additives are substances that are used for the covering of food products to improve their texture, flavor, and appearance and to prolong their shelf life. Usually, these substances are derived from nature, such as starches, flours, proteins, and gums that create an invisible protective layer around the food. Coating systems are increasingly being used in tandem with the expansion of snack categories and premium food offerings, as they align with consumer preferences for variety and quality

-

What are the key growth drivers of the market?Market growth is driven by the higher demand for ready-to-eat and processed products. As per forecasts, the convenience food in North America will reach $164.8 billion in 2023, marking a 12.3% increase from the previous year. The International Food Information Council (IFIC) in its annual Food & Health Survey for 2023 indicated that 72% of the United States population has the habit of eating convenience foods regularly, which is a significant rise of 7% compared to the last year's figure of 65%.

-

What factors restrain the North America food coating ingredients market?The market is restrained by the prices of the primary raw materials for food coating ingredients such as starches, flours, and proteins, which may fluctuate based on the agricultural conditions and the performance of the supply chain. Food safety rules and regulations demand that the manufacturers of food coating ingredients maintain the products' compliance with the health and safety standards

-

How is the market segmented by solution type?The market is segmented into sugars & syrups, cocoa & chocolates, fats & oils, spices & seasonings, flours, batter and crumbs, and others.

-

Who are the key players in the North America food coating ingredients market?Key companies include PGP International, Newly Weds Foods, Archer Daniels Midland Company, Cargill, Ingredion Inc., Bunge, Puratos, Barry Callebaut, Clasen Quality Coatings, Inc., and Baron Spices & Seasonings.

Need help to buy this report?