North America Finance Advisory Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Corporate Finance, Accounting Advisory, Tax Advisory, Transaction Services and Others), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), By Industry Vertical (BFSI, IT and Telecom, Manufacturing, Retail and E-Commerce), By Delivery Mode (On-Site Consulting, and Others), and

Industry: Information & TechnologyNorth America Finance Advisory Services Market Insights Forecasts to 2035

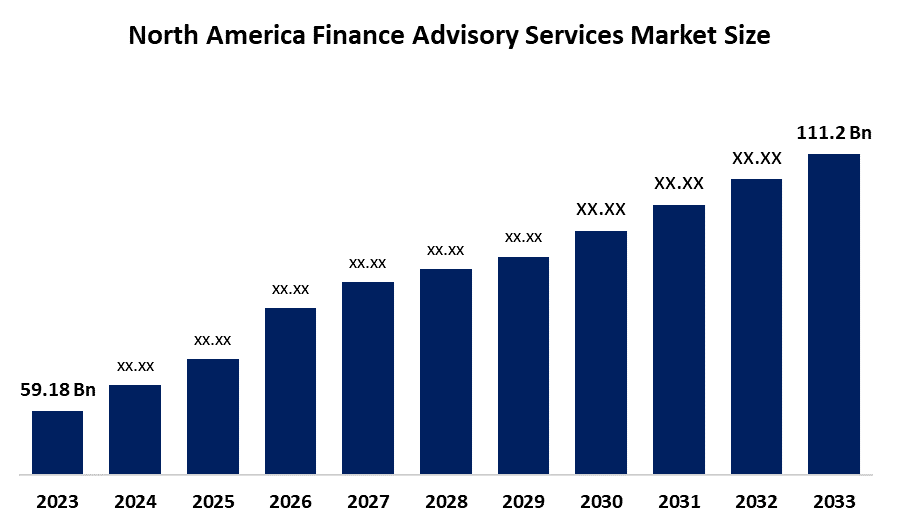

- The North America Finance Advisory Services Market Size Was Estimated at USD 59.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The North America Finance Advisory Services Market Size is Expected to Reach USD 111.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Finance Advisory Services Market size is anticipated to reach USD 111.2 billion by 2035, growing at a CAGR of 5.9% from 2025 to 2035. The market is driven by businesses and individual investors seeking to maximize their financial portfolios, and the need for professional advice and strategic planning has grown in importance as the situation becomes more complicated.

Market Overview

Financial advisory is the process that helps clients get guidance and suggestions on their financial decisions. Financial advisors use their expertise and experience to help clients make correct decisions among the options such as investments, retirement planning, taxes, insurance, and others. The growing intricacy of financial markets and the increasing application of digital transformation. The more complicated financial markets are, the greater the need for professionals providing advice, and a well-planned strategy has become for both companies and private individuals who want to enhance their financial portfolios.

In 2024, the financial advisory market in North America was heavily dominated by the United States, which had a share of 87.88%. The countries' strong capital markets, large adviser networks, and solid fiduciary regulations were among the major factors that led to this situation. Automated investment services are already handling half of trillion-dollar portfolios, with Vanguard leading the pack at $206.6 billion and Schwab coming in second with $65.8 billion.

In March 2025, various advisory firms from the U.S. came out with AI-enhanced planning tools that were designed for instant personalization and easy multi-channel usage that would make complete financial planning less complicated for different types of clients.

TFAC gives the public the chance to express their views while the Department of Commerce develops its export-oriented trade finance education strategies. Whole manufacturers profit from the economies of scale, high-tech machines, and strict quality and safety regulations adherence, which make them the major suppliers of various end-use industries.

Report Coverage

This research report categorizes the market for the North America Finance Advisory services Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America finance advisory services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America finance advisory services market.

North America Finance Advisory Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 59.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.9% |

| 2035 Value Projection: | USD 111.2 Billion by |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Service Type, By Industry Vertical |

| Companies covered:: | Advise-Financial, Corporate Forensics Advisory Wells Fargo, Advisors, Ameriprise Financial, Financial Engines, Financial Advocates, Financial Advisory Services Inc. Focus Financial Network Inc., KPMG Corporate Finance LLC, Focus Financial Partners Focus, Financial Partners, And others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The finance advisory services market in North America is driven by Prospera, Coast Capital and Sunshine Coast Credit Unions have disclosed their intention to merge, thus making Canada’s largest credit union by purpose nationwide. The Canadian banking industry, which is quite stable with only 6 banks that control more than 80% of the total deposits, guarantees a steady growth of financial institutions in the country. The competitive environment is being revised through the introduction of the title protection for financial planners and the implementation of a consumer-driven banking framework. The rich are moving their money to Canadian cities like Toronto, Vancouver, Montreal, and Calgary, which keeps the demand for the luxury sector high. Cross-border estate and tax planning are still considered the most profitable services in the financial advisory market of North America.

Restraining Factors

The finance advisory services market in North America is restrained by Schwab's announcement in June 2025 to cut ETF fees by up to 50% is a clear indicator of the growing rivalry in the pricing area. An increase in a passive investment approach has to be defended by the advisers through comprehensive consulting and giving access to alternative assets. The use of online collaboration tools is one of the ways in which veteran advisers are making their working lives longer, but companies will also require formal mentoring and AI-backed onboarding programs to ensure that they have the necessary skills in the North American financial advisory market.

Market Segmentation

The North America finance advisory services market share is categorised into service type, organization size, industry vertical and delivery mode.

- The investment services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America finance advisory services market is segmented by service type into corporate finance, investment services, accounting advisory, tax advisory, transaction services and others. Among these, the investment services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the year 2024, the financial advisory market in North America was dominated by investment services, which captured 36.34% of the market share. At present, multi-asset mandates are not only limited to the incorporation of funds of private equity, ESG overlays, but also involve the portfolios of direct indexing that are appealing to the digital-native investors. The North America financial advisory market for investment services is estimated to grow increasingly as the rising alternative allocations will require customized structuring.

- The large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on organization size, the North America finance advisory services market is segmented into large enterprises, small and medium-sized enterprises. Among these, the large enterprises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Market growth is driven in 2024, large companies had a share of 66.05% of the North America financial advisory market, due to the use of cloud tools and AI-based productivity that drastically reduces the disadvantages of their large size. The part of the North America financial advisory market connected to SMEs will grow as small firms are getting specialized in ESG consulting and crypto tax planning.

- The BFSI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America finance advisory services market is segmented by industry vertical into BFSI, IT and telecom, manufacturing, retail and e-commerce. Among these, the BFSI segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, BFSI made up 29.78% of the North American financial advisory sector, with intricate regulations and large amounts of money as the main drivers, while IT and telecommunication were heading towards the fastest 6.61% CAGR due to the plentiful liquidity events and digital currency holdings.

- The on-site consulting segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on delivery mode, the North America finance advisory services market is segmented into on-site consulting and others. Among these, the on-site consulting segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. On-site consulting held a massive 72.29% of the North American financial advising market share during the year 2024; however, the remote consulting is said to grow substantially at a rate of 9.15% CAGR, since customers are becoming more and more familiar with video, shared screens, and digital signatures. The financial advisory market in North America gets a boost as businesses serve international clients through virtual communication instead of setting up new offices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America finance advisory services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advise-Financial

- Corporate Forensics Advisory

- Wells Fargo Advisors

- Ameriprise Financial

- Financial Engines

- Financial Advocates

- Financial Advisory Services Inc.

- Focus Financial Network Inc.

- KPMG Corporate Finance LLC

- Focus Financial Partners

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, Peter Stumbles and Dirk Vater were announced as the new co-leaders of Bain & Company’s global financial services practice. The new dual leaders will assume the position at the start of 2026, based in North America and Europe, respectively.

In February 2025, KORT Payments announced an agreement to acquire the direct marketing business from Paysafe Direct LLC.

In January 2025, Focus Financial Partners Inc., an interdependent partnership of wealth management, business management, and related financial services firms, announced that it had entered into a definitive agreement under which Seattle, WA-based Merriman Wealth Management, LLC, would join Focus Partners Wealth, LLC.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Finance Advisory Services Market based on the below-mentioned segments:

North America Finance Advisory Services Market, By Service Type

- Corporate Finance

- Accounting Advisory

- Tax Advisory

- Transaction Services

- Others

North America Finance Advisory Services Market, By Organization Type

- Large Enterprises

- Small and Medium-Sized Enterprises

North America Finance Advisory Services Market, By Industry Vertical

- BFSI

- IT and Telecom

- Manufacturing

- Retail

- E-Commerce

Frequently Asked Questions (FAQ)

-

Q: What is the North America finance advisory services market size?A: The North America Finance Advisory Services Market size is expected to grow from USD 59.18 billion in 2024 to USD 111.2 billion by 2035, growing at a CAGR of 5.9% during the forecast period 2025-2035.

-

Q: What is the finance advisory services, and their primary use?A: Financial advisory is the process that helps clients get guidance and suggestions on their financial decisions. Financial advisors use their expertise and experience to help clients make correct decisions among the options such as investments, retirement planning, taxes, insurance, and others. The growing intricacy of financial markets and the increasing application of digital transformation

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the Prospera, Coast Capital and Sunshine Coast Credit Unions have disclosed their intention to merge, thus making Canada’s largest credit union by purpose nationwide. The Canadian banking industry, which is quite stable with only 6 banks that control more than 80% of the total deposits, guarantees a steady growth of financial institutions in the country.

-

Q: What factors restrain the North America finance advisory services market?A: The market is restrained by Schwab's announcement in June 2025 to cut ETF fees by up to 50% is a clear indicator of the growing rivalry in the pricing area. Increasingly, the passive investment approach has to be defended by the advisers through comprehensive consulting and giving access to alternative assets

-

Q: How is the market segmented by service type?A: The market is segmented into corporate finance, accounting advisory, tax advisory, transaction services and others.

-

Q: Who are the key players in the North America finance advisory services market?A: Key companies include Advise-Financial, Corporate Forensics Advisory, Wells Fargo Advisors, Ameriprise Financial, Financial Engines, Financial Advocates, Financial Advisory Services Inc., Focus Financial Network Inc., KPMG Corporate Finance LLC, and Focus Financial Partners.

Need help to buy this report?