North America Feed Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Sub Additive (Carbohydrases, Phytases, and Others), By Animal (Aquaculture, Poultry, Ruminants, and Others), and North America Feed Enzymes Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureNorth America Feed Enzymes Market Insights Forecasts to 2035

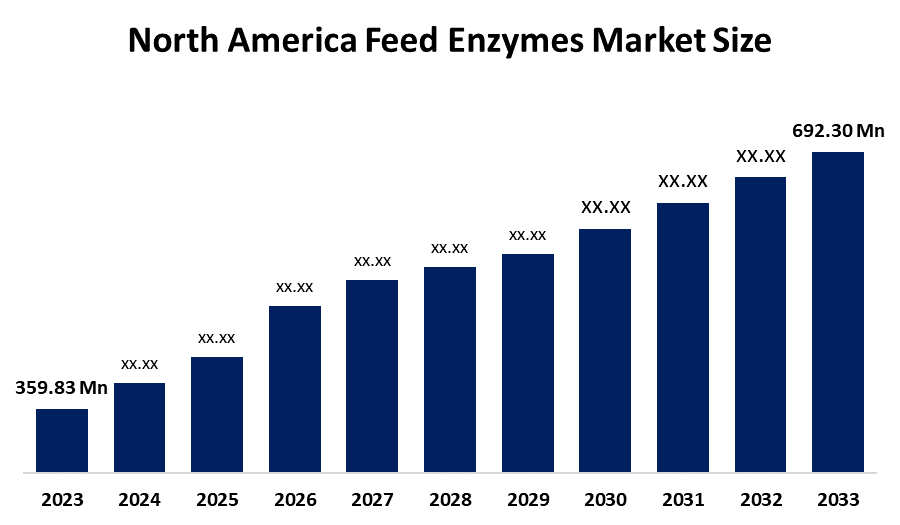

- The North America Feed Enzymes Market Size Was Estimated at USD 359.83 Million in 2024.

- The Market Size is Growing at a CAGR of 6.13% between 2025 and 2035.

- The North America Feed Enzymes market is Anticipated to Reach USD 692.30 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America feed enzymes Market Size is anticipated to hold USD 692.30 Million by 2035, Growing at a CAGR of 6.13% from 2025 to 2035. The North America feed enzymes market offers opportunities driven by rising demand for efficient livestock nutrition, growing focus on digestive health, sustainable farming practices, and increased adoption of enzyme-based feed solutions to enhance productivity and reduce feed costs.

Get more details on this report -

Market Overview

The North America feed enzymes market is experiencing strong growth driven by rising demand for high-quality animal protein and increasing emphasis on improving livestock health and productivity. Feed enzymes play a crucial role in enhancing nutrient absorption, improving gut health, and reducing overall feed costs, making them essential in modern animal nutrition programs. The region’s shift toward sustainable and efficient farming practices further accelerates enzyme adoption across poultry, swine, ruminants, and aquaculture sectors. Regulatory support for safe feed additives, advancements in enzyme biotechnology, and growing awareness among farmers about optimized feed efficiency also contribute to market expansion. Additionally, increasing investment in precision nutrition and the presence of leading enzyme manufacturers strengthen the market’s long-term growth outlook.

Report Coverage

This research report categorizes the market for the North America feed enzymes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America feed enzymes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America feed enzymes market.

North America Feed Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 359.83 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.13% |

| 2035 Value Projection: | USD 692.30 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Animal, By Sub Additive |

| Companies covered:: | BASF SE, DSM-Firmenich AG, Cargill Inc., Archer Daniels Midland Company, IFF Danisco Animal Nutrition (International Flavors and Fragrances Inc.), Adisseo, Novonesis A/S, Novus International, Elanco Animal Health Inc., Alltech Inc., AB Vista (Associated British Foods), Kemin Industries, Inc., Huvepharma EOOD, Evonik Industries AG, Brenntag SE, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising animal protein demand and improved feed efficiency boost enzyme adoption.

The North America feed enzymes market is driven by rising demand for high-quality animal protein, which pushes farmers to enhance feed efficiency and livestock performance. Increasing awareness of gut health, improved nutrient absorption, and reduced feed costs are key motivators for enzyme adoption. Growing sustainability pressures and the need to lower environmental impacts also encourage the use of enzymes to reduce waste and optimize digestion. Additionally, advancements in enzyme biotechnology and supportive regulatory frameworks further strengthen market growth across livestock sectors.

Restraining Factors

High costs, regulatory challenges, and variable performance limit widespread enzyme usage.

The North America feed enzymes market faces restraints from high enzyme production costs, variable enzyme performance across different feed types, strict regulatory approvals, and limited awareness among small-scale farmers about advanced feed technologies.

Opportunities

Precision nutrition, sustainable farming, and biotech innovations create strong market potential.

The North America feed enzymes market offers strong opportunities driven by increasing adoption of precision livestock nutrition, rising demand for sustainable farming practices, and growing preference for natural feed additives. Advancements in enzyme biotechnology, along with supportive regulations promoting efficient and eco-friendly feed solutions, further enhance market potential. Expanding poultry, swine, and aquaculture production also boosts demand for high-performance enzyme formulations.

Market Segmentation

The North America feed enzymes market share is classified into sub additive and animal.

- The carbohydrases segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America feed enzymes market is segmented by sub additive into carbohydrases, phytases, and others. Among these, the carbohydrases segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Carbohydrases dominate due to broad use in poultry feeds, and phytases are quickly growing because of sustainability-driven demand to improve phosphorus utilization and reduce feed costs.

- The poultry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America feed enzymes market is segmented by animal into aquaculture, poultry, ruminants, and others. Among these, the poultry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is also expected to grow at a notable CAGR during the forecast period, supported by expanding broiler and layer production, rising demand for affordable protein, and increasing adoption of enzyme-based feed solutions to enhance efficiency and reduce feed costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America feed enzymes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- DSM-Firmenich AG

- Cargill Inc.

- Archer Daniels Midland Company

- IFF Danisco Animal Nutrition (International Flavors and Fragrances Inc.)

- Adisseo

- Novonesis A/S

- Novus International

- Elanco Animal Health Inc.

- Alltech Inc.

- AB Vista (Associated British Foods)

- Kemin Industries, Inc.

- Huvepharma EOOD

- Evonik Industries AG

- Brenntag SE

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America feed enzymes market based on the following segments:

North America Feed Enzymes Market, By Sub Additive

- Carbohydrases

- Phytases

- Others

North America Feed Enzymes Market, By Animal

- Aquaculture

- Poultry

- Ruminants

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America feed enzymes market size?: North America feed enzymes market size is expected to grow from USD 359.83 Million in 2024 to USD 692.30 Million by 2035, growing at a CAGR of 6.13% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Rising animal protein demand and improved feed efficiency boost enzyme adoption.

-

Q: What factors restrain the North America feed enzymes market?A: High costs, regulatory challenges, and variable performance limit widespread enzyme usage.

-

Q: How is the market segmented by sub additive?A: The market is segmented into sub additive into carbohydrases, phytases, and others.

-

Q: Who are the key players in the North America feed enzymes market?A: Key companies include BASF SE, DSM-Firmenich AG, Cargill Inc., Archer Daniels Midland Company, IFF Danisco Animal Nutrition, Adisseo, Novonesis A/S, Novus International, Elanco Animal Health Inc., Alltech Inc., AB Vista, Kemin Industries, Huvepharma EOOD, Evonik Industries AG, and Brenntag SE.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?