North America Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Source (Sugar & Molasses-Based, Grain-Based, and Second Generation), By Purity (Denatured and Undenatured), By Application (Fuel & Its Additives, Industrial Solvents, Beverages, Disinfectant, Personal Care and Others), and North America Ethanol Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsNorth America Ethanol Market Insights Forecasts to 2035

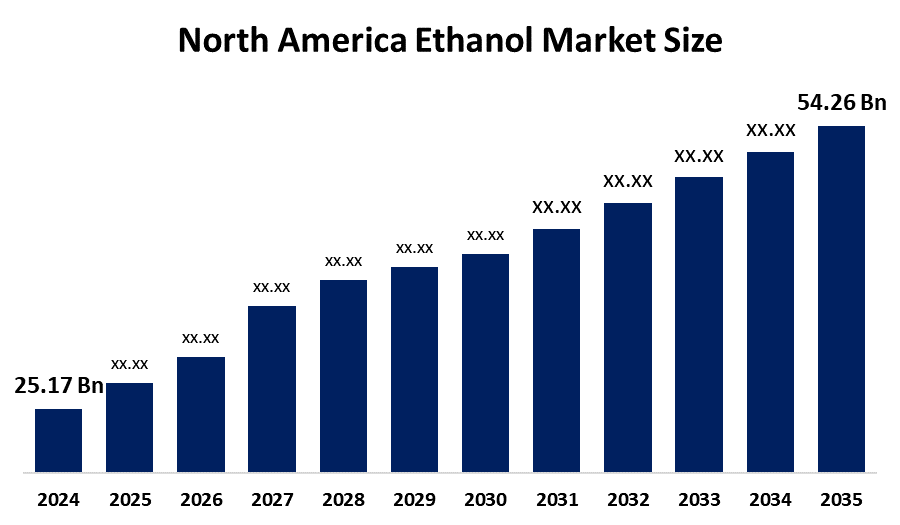

- The North America Ethanol Market Size Was Estimated at USD 25.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.23% from 2025 to 2035

- The North America Ethanol Market Size is Expected to Reach USD 54.26 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Ethanol Market size is anticipated to reach USD 54.26 Billion by 2035, growing at a CAGR of 7.23% from 2025 to 2035. The market is driven by rising government mandates for biofuel blending in gasoline.

Market Overview

The North American ethanol market operates in a dynamic phase that shows changing consumer behavior and new government regulations. The growing focus on renewable energy sources has created increased interest in biofuels, which include ethanol that comes from multiple feedstock sources like corn and sugarcane. Ethanol serves as a common ingredient for the production of beverages, pharmaceuticals, personal care products, and industrial solvents. Industrial and potable ethanol demand growth results from three factors include rising healthcare costs, increasing sanitizer and disinfectant consumption, and the constant expansion of chemical production.

In April 2024, Verbio announced the commercial production of ethanol from corn at its biorefinery facility in Nevada, Iowa.

U.S. ethanol production reached a total of 15.4 billion gallons throughout the year 2022. The American Petroleum Institute (API) and ethanol groups have agreed on reforms to US biofuel policy that they would like to see, teeing up a last-minute lobbying campaign to get the provisions included in federal budget legislation in January 2026. The United Kingdom signed a trade agreement with the United States in 2025, which established duty-free import rights for U.S. ethanol while removing a 19% tariff that previously restricted exports and allowing 1.4 billion liters of additional fuel to be exported by 2026.

Report Coverage

This research report categorizes the market for the North America ethanol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America ethanol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America ethanol market.

North America Ethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.23% |

| 2035 Value Projection: | USD 54.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Source,By Purity,By Application |

| Companies covered:: | POET, LLC Archer Daniels Midland Valero Energy Corp Green Plains Inc. The Andersons, Inc Alto Ingredients, Inc. Flint Hills Resources Cargill, Inc Alco Energy Canada Suncor Energy & Cenovus Energy Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethanol market in North America is driven by the U.S. Renewable Fuel Standard (RFS), which establishes mandatory requirements that require the blending of designated volumes of renewable fuels into the national fuel supply. The rising environmental concerns about climate change and air pollution have created a strong public demand for cleaner fuels that produce lower carbon emissions. Ethanol prices typically decline below the cost of petroleum gasoline blendstock, which creates an incentive for fuel blenders and consumers to use ethanol because of government financial support.

Restraining Factors

The ethanol market in North America is hindered by Ethanol producers face production cost changes and profit fluctuations because corn prices shift in response to weather conditions, crop production and worldwide market demand. The effort to eliminate internal combustion engines drives the rising use of electric vehicles, which creates a persistent challenge for the industry.

Market Segmentation

The North America ethanol market share is categorised into source, purity and application.

- The sugar & molasses-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America ethanol market is segmented by source into sugar & molasses-based, grain-based, and second-generation. Among these, the sugar & molasses-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the existing government policies for biofuel blending, together with energy security requirements, which have led ethanol-producing countries to establish mandatory blending targets that benefit sugarcane-rich areas, bringing guaranteed demand for ethanol produced from sugar and molasses.

- The denatured segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on purity, the North America ethanol market is segmented into denatured and undenatured. Among these, the denatured segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by its widespread applicability across fuel blending and industrial uses. Denatured ethanol is preferred in fuel ethanol programs because its additives render the product unsafe for human consumption, which enables governments to treat it as non-beverage alcohol for tax purposes. The regulatory framework provides producers and fuel blenders a simplified path to compliance which supports their efforts to distribute products and expand ethanol blending operations.

- The fuel & its additives segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America ethanol market is segmented by application into fuel & its additives, industrial solvents, beverages, disinfectant, personal care and others. Among these, the fuel & its additives segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the rising ethanol blending mandates in gasoline. Governments are increasing blending ratios because they want to decrease fossil fuel use while achieving lower tailpipe emissions, which results in higher ethanol usage for transportation fuels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America ethanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- POET, LLC

- Archer Daniels Midland

- Valero Energy Corp

- Green Plains Inc.

- The Andersons, Inc

- Alto Ingredients, Inc.

- Flint Hills Resources

- Cargill, Inc

- Alco Energy Canada

- Suncor Energy & Cenovus Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Cultura Technologies, announced that its newly formed brand, CreditCrop, had joined the Clean Fuel Credit Consortium, a multi-company collaboration with Verdova, Vericap, and JAG Group Inc.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Ethanol Market based on the below-mentioned segments:

North America Ethanol Market, By Source

- Sugar & Molasses-Based

- Grain-Based

- Second Generation

North America Ethanol Market, By Purity

- Denatured

- Undenatured

North America Ethanol Market, By Application

- Fuel & its Additives

- Industrial Solvents

- Beverages

- Disinfectants

- Personal Care

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America ethanol market size?A: The North America Ethanol Market size is expected to grow from USD 25.17 billion in 2024 to USD 54.26 billion by 2035, growing at a CAGR of 7.23% during the forecast period 2025-2035.

-

Q: What is ethanol, and its primary use?A: The North American ethanol market operates in a dynamic phase that shows changing consumer behavior and new government regulations. The growing focus on renewable energy sources has created increased interest in biofuels which include ethanol that comes from multiple feedstock sources like corn and sugarcane.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the U.S. Renewable Fuel Standard (RFS) establishes mandatory requirements which require the blending of designated volumes of renewable fuels into the national fuel supply.

-

Q: What factors restrain the North America ethanol market?A: The market is restrained by Ethanol producers face production cost changes and profit fluctuations because corn prices shift in response to weather conditions, crop production and worldwide market demand.

-

Q: How is the market segmented by source?A: The market is segmented into sugar & molasses-based, grain-based, and second generation.

-

Q: Who are the key players in the North America ethanol market?A: Key companies include POET, LLC, Archer Daniels Midland, Valero Energy Corp, Green Plains Inc., The Andersons, Inc, Alto Ingredient, Inc., Flint Hills Resources, Cargill, Inc, Alco Energy Canada, and Suncor Energy & Cenovus Energy.

Need help to buy this report?