North America Distributed Natural Gas Fueled Generation Market Size, Share, and COVID-19 Impact Analysis, By Type (Internal Combustion Engine Gas, Turbine Gas), By Application (Residential, Commercial & Industrial), and North America Distributed Natural Gas Fueled Generation Market Size Insights, Industry Trends, Forecast to 2035

Industry: Energy & PowerNorth America Distributed Natural Gas Fueled Generation Market Size Insights Forecasts to 2035

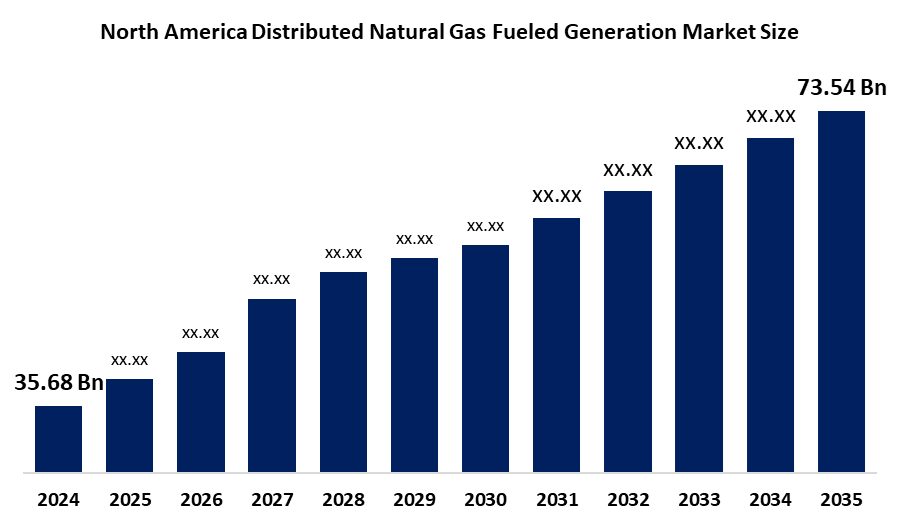

- The North America Distributed Natural Gas Fueled Generation Market Size Was Estimated at USD 35.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.8% from 2025 to 2035

- The North America Distributed Natural Gas Fueled Generation Market Size is Expected to Reach USD 73.54 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Distributed Natural Gas Fueled Generation Market Size is anticipated to reach USD 94.36 Billion by 2035, growing at a CAGR of 6.8% from 2025 to 2035. The market is driven by an increasing energy demand and growing climate concerns. As decentralization of energy production allows on-site power production, reduction in transmission losses and increased energy efficiency.

Market Overview

The Distributed Generation Market Size of Natural Gas involves the consumption of small electricity generation systems, like natural gas gensets, microturbines, and fuel cells, that are powered by natural gas and located at or very close to the consumer's point of use. These systems, in comparison to traditional power plants, not only deliver greater energy reliability but also minimize the loss of energy during transmission. The market comprises sales of various related products and services, including natural gas and electricity generation equipment. Its use in residential areas is mainly for space heating, water heating, cooking, and drying clothes, and there is an increasing trend in the adoption of smart home energy management systems.

Crusoe, a company specialising in artificial intelligence data center's development, has, in February 2025, signed a long-term framework agreement with KDP to set up several co-located AI data centers in Alberta, Canada, that will be powered by the natural gas plants. The Frontier Group of Companies LLC declared that National Fuel Gas Supply Corp. would supply gas for the conversion of the coal-fired power plant of Frontier to a gas-fired plant, which will supply power for the data center located next to it.

The Ontario government has unveiled Energy for Generations, the province's first-ever integrated energy plan - a detailed strategy for the future energy requirements, and a means to provide electricity for the most competitive economy among the G7 countries in 2025, and also for new housing support. North America, especially the U.S., has plenty of natural gas reserves and strong pipeline networks, which will not only guarantee a constant and inexpensive fuel supply but also stimulate market growth.

Report Coverage

This research report categorizes the market for the North America Distributed Natural Gas Fueled Generation Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America distributed natural gas fueled generation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America distributed natural gas fueled generation market.

North America Distributed Natural Gas Fueled Generation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 35.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.8% |

| 2035 Value Projection: | 73.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | General Electric, Cummins Inc., Caterpillar Inc., Siemens Energy, Wartsila Corporation, Capstone Turbine Corporation, Mitsubishi Power, Bloom Energy Corporation, FuelCell Energy, Inc., Utilities & Integrators, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Distributed Natural Gas Fueled Generation Market Size in North America is driven by the demand for a dependable and on-site electric power supply has been steadily growing. Power failures, even for a short duration, are not acceptable in most, if not all, industrial, commercial, hospital, and data center facilities. The aspect of reducing reliance on the main grid and, thus, eliminating losses incurred as a result of either power outages or transmission failures. Natural gas systems, besides low cost, also provide cleaner energy than diesel. The U.S. and Canada, to mention but a few, have great natural gas reserves and a well-developed pipeline network that guarantees the smooth and cost-effective delivery of fuel.

Restraining Factors

The Distributed Natural Gas Fueled Generation Market Size in North America is restrained by the expensive and continuous maintenance to must be managed from the start. Natural gas, while less polluting than coal, is still a fossil fuel emitting carbon and its use as a transition fuel is being doubted due to the world's and countries' increasingly stricter net-zero emissions targets.

Market Segmentation

The North America distributed natural gas fueled generation market share is categorised into type and application.

- The internal combustion engine gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Distributed Natural Gas Fueled Generation Market Size is segmented by type into internal combustion engine gas, turbine gas. Among these, the internal combustion engine gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the residential, commercial and industrial situations, where the need for backup power is constantly increasing, where rapid startups and the reliability elements are crucial.

- The commercial & industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America distributed natural gas fueled generation market is segmented into residential, commercial & industrial. Among these, the commercial & industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the increasing demand for decentralised and dependable energy solutions across industrial and commercial sectors. These industries, particularly manufacturing, data processing, luxury shopping, and healthcare, need uninterrupted power to have productivity, safety, and operational efficiency, especially in the case of the power outage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America distributed natural gas fueled generation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric

- Cummins Inc.

- Caterpillar Inc.

- Siemens Energy

- Wartsila Corporation

- Capstone Turbine Corporation

- Mitsubishi Power

- Bloom Energy Corporation

- FuelCell Energy, Inc.

- Utilities & Integrators

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2025, Cummins Inc. and Liberty Energy Inc. announced that the industry’s first natural gas variable speed, large displacement engine to power Liberty’s digiPrime hydraulic fracturing platform will be deployed in the first half of 2025.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America distributed natural gas fueled generation market based on the below-mentioned segments:

North America Distributed Natural Gas Fueled Generation Market, By Type

- Internal Combustion Engine Gas

- Turbine Gas

North America Distributed Natural Gas Fueled Generation Market, By Application

- Residential

- Commercial & Industrial

Frequently Asked Questions (FAQ)

-

What is the North America distributed natural gas fueled generation market size?The North America distributed natural gas fueled generation market size is expected to grow from USD 35.68 billion in 2024 to USD 73.54 billion by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

What is distributed natural gas fueled generation, and its primary use?The distributed generation market of natural gas involves the consumption of small electricity generation systems, like natural gas gensets, microturbines, and fuel cells, that are powered by natural gas and located at or very close to the consumer's point of use.

-

What are the key growth drivers of the market?Market growth is driven by the demand for a dependable and on-site electric power supply has been steadily growing. Power failures, even for a short duration, are not acceptable in most, if not all, industrial, commercial, hospital, and data center facilities.

-

What factors restrain the North America distributed natural gas fueled generation market?The market is restrained by the expensive and continuous maintenance to be managed from the start. Natural gas, while less polluting than coal, is still a fossil fuel emitting carbon and its use as a transition fuel is being doubted due to the world's and countries' increasingly stricter net-zero emissions targets.

-

How is the market segmented by type?Who are the key players in the North America distributed natural gas fueled generation market?

Need help to buy this report?