North America Direct Selling Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Level Marketing, Multi-Level Marketing), By Application (Wellness, Cosmetics, Household Goods, and Others), and North America Direct Selling Market Insights Forecasts to 2035

Industry: Consumer GoodsNorth America Direct Selling Market Insights Forecasts to 2035

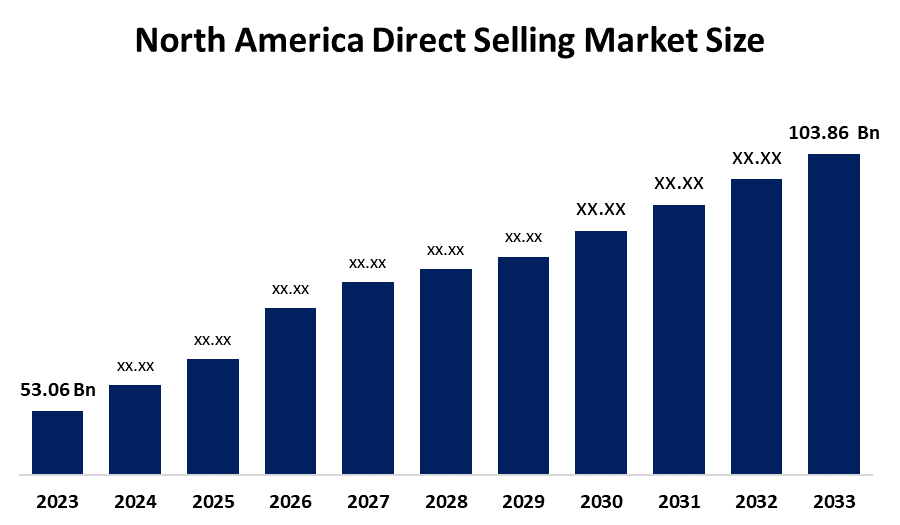

- The North America Direct Selling Market Size Was Estimated at USD 53.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.3% from 2025 to 2035

- The North America Direct Selling Market Size is Expected to Reach USD 103.86 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Direct Selling Market size is anticipated to reach USD 103.86 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035. The market is driven by the beauty and personal care segment is experiencing significant growth with the rise in consumer awareness regarding health and wellness, along with the increased demand for natural and organic products.

Market Overview

Direct selling or person-to-person retail is a business model where individual sellers deliver products straight to consumers. Direct selling is a retail channel that encompasses the direct sales of goods and services to buyers, eliminating the need for conventional retail outlets. With the changing consumer preferences and the emergence of new business models facilitated by the internet, direct-to-consumer (D2C) distribution has become more common. Thus, direct selling is a lively and rapidly advancing channel for the distribution of goods and services marketing.

In the United States, direct selling was responsible for retail sales of $34.7 billion and the support of 5.4 million entrepreneurs who used the direct selling channel for their products or services, thus allowing the buyers' personalized experience for millions of customers during 2024.

Direct selling revenue is anticipated to rise with a CAGR of 5.0% making its way up to $75.2 billion by the end of 2025, where 2.3% will be the growth in 2025. In 2023, the retail sales trends in America were $62632 million. A continuous drop of 3.8% resulted in the direct selling industry's yearly retail sales of $62,632 million.

In February 2024, Cecred revealed its new line of hair care products for the general public that had been inspired by hair customs from around the world. The company collaborated with Ulta Beauty to supply its products to 1,400 outlets by April 2025.

According to statistics, the direct selling retail sales in Canada for the year 2020 stood at US$3.09 billion, thus placing the country at the 13th position in the world. Additionally, it was reported that during the same time period, direct selling was done by 1.39 million Canadians and that almost half of them resided in large cities. On January 2025, the Federal Trade Commission put forth a fresh proposed regulation that could be really detrimental and completely unwarranted to the direct selling medium. DSA has detailed the FTC announcement in a note that was shared on January 14, 2025.

Report Coverage

This research report categorizes the market for the North America Direct Selling Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America direct selling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America direct selling market.

North America Direct Selling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 53.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.3% |

| 2035 Value Projection: | USD 103.86 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Stryker Corporation, Arthrex, Inc., Smith & Nephew plc, ConMed Corporation, Medtronic plc, Johnson & Johnson, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The direct selling market in North America is driven by the fast-growing e-commerce in North America. In August 2024, the renowned pharmaceutical company Pfizer came up with a digital platform called PfizerForAll, which is intended for patients suffering from migraines and respiratory problems. The platform, which is allied with telehealth provider UpScriptHealth, Alto Pharmacy, and Instacart, is facilitating direct sales and providing information on Pfizer products as the pharmaceutical industry is transforming into direct-to-consumer (D2C) models. Younique, a popular direct selling firm in Canada, is responding to the consumer demand for sustainability by using eco-friendly packaging for its skincare products starting in November 2024.

Restraining Factors

The direct selling market in North America is restrained by the industry regularly faces a difficulty in the form of the public perceiving certain practices as either pyramid schemes or high-pressure sales. The rapid growth and the hassle-free operation of e-commerce and traditional retail channels bring about the strong competition that causes prices to drop, and also obliges direct selling companies to highlight their value propositions. The industry undergoes a lot of regulatory scrutiny as well as legal challenges from government organizations such as the Federal Trade Commission (FTC) in the U.S. Following the legal restrictions concerning the claims of earnings, the claims of products, and the plans of compensation can be very expensive and lengthy.

Market Segmentation

The North America direct selling market share is categorised into type and application.

- The single-level marketing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America direct selling market is segmented by type into single-level marketing, multi-level marketing. Among these, the single-level marketing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by due to its simplicity, emphasis on direct sales, and target for entrepreneurs in search of a clear and freewheeling income.

- The wellness segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America direct selling market is segmented into wellness, cosmetics, household goods, and others. Among these, the wellness segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The wellness sector showed the highest market growth with a 35.34% revenue share in 2024. A growing concern for health and wellness continues to push the cosmetics and dietary supplements markets, thus creating a demand for new and innovative products that need to be explained, thus opening an opportunity for the direct selling market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America direct selling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corporation

- Tupperware Brands Corp

- Nu Skin Enterprises Inc

- Direct Selling News

- S4DS Software

- Direct Sales Recruiting LLC

- Direct Scale

- Power Distributors

- Selling Simplified

- Direkt Sales

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In July 2025, the Direct Sellers Association of Canada announced a partnership with Brock University in Ontario, Canada. Together, they lead an educational program called Fundamental Sales Skills for Direct Sellers that promotes and supports the professionalization and long-term success of direct sellers.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Direct Selling Market based on the below-mentioned segments:

North America Direct Selling Market, By Type

- Single-Level Marketing

- Multi-Level Marketing

North America Direct Selling Market, By Application

- Wellness

- Cosmetics

- Household Goods

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America direct selling market size?A: The North America Direct Selling Market size is expected to grow from USD 53.06 billion in 2024 to USD 103.86 billion by 2035, growing at a CAGR of 6.3% during the forecast period 2025-2035.

-

Q: What is direct selling, and its primary use?A: Direct selling or person-to-person retail is a business model where individual sellers deliver products straight to consumers. Direct selling is a retail channel that encompasses the direct sales of goods and services to buyers, eliminating the need for conventional retail outlets. With the changing consumer preferences and the emergence of new business models facilitated by the internet, direct-to-consumer (D2C) distribution has become more and more common.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the fast-growing e-commerce in North America. In August 2024, the renowned pharmaceutical company Pfizer came up with a digital platform called PfizerForAll, which is intended for patients suffering from migraines and respiratory problems. The platform, which is allied with telehealth provider UpScriptHealth, Alto Pharmacy, and Instacart, is facilitating direct sales and providing information on Pfizer products as the pharmaceutical industry is transforming into direct-to-consumer (D2C) models.

-

Q: What factors restrain the North America direct selling market?A: The market is restrained by the industry, regularly facing a difficulty in the form of the public perceiving certain practices as either pyramid schemes or high-pressure sales. The rapid growth and the hassle-free operation of e-commerce and traditional retail channels bring about the strong competition that causes prices to drop, and also obliges direct selling companies to highlight their value propositions.

-

Q: How is the market segmented by application?A: The market is segmented into wellness, cosmetics, household goods, and others

-

Q: Who are the key players in the North America direct selling market?A: Key companies include Amway Corporation, Tupperware Brands Corp, Nu Skin Enterprises Inc, Direct Selling News, S4DS Software, Direct Sales Recruiting LLC, Direct Scale, Power Distributors, Selling Simplified, and Direkt Sales.

-

Q: What is the North America direct selling market size?A: The North America Direct Selling Market size is expected to grow from USD 53.06 billion in 2024 to USD 103.86 billion by 2035, growing at a CAGR of 6.3% during the forecast period 2025-2035.

-

Q: What is direct selling, and its primary use?A: Direct selling or person-to-person retail is a business model where individual sellers deliver products straight to consumers. Direct selling is a retail channel that encompasses the direct sales of goods and services to buyers, eliminating the need for conventional retail outlets. With the changing consumer preferences and the emergence of new business models facilitated by the internet, direct-to-consumer (D2C) distribution has become more and more common.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the fast-growing e-commerce in North America. In August 2024, the renowned pharmaceutical company Pfizer came up with a digital platform called PfizerForAll, which is intended for patients suffering from migraines and respiratory problems. The platform, which is allied with telehealth provider UpScriptHealth, Alto Pharmacy, and Instacart, is facilitating direct sales and providing information on Pfizer products as the pharmaceutical industry is transforming into direct-to-consumer (D2C) models.

-

Q: What factors restrain the North America direct selling market?A: The market is restrained by the industry, regularly facing a difficulty in the form of the public perceiving certain practices as either pyramid schemes or high-pressure sales. The rapid growth and the hassle-free operation of e-commerce and traditional retail channels bring about the strong competition that causes prices to drop, and also obliges direct selling companies to highlight their value propositions.

-

Q: How is the market segmented by application?A: The market is segmented into wellness, cosmetics, household goods, and others

-

Q: Who are the key players in the North America direct selling market?A: Key companies include Amway Corporation, Tupperware Brands Corp, Nu Skin Enterprises Inc, Direct Selling News, S4DS Software, Direct Sales Recruiting LLC, Direct Scale, Power Distributors, Selling Simplified, and Direkt Sales.

Need help to buy this report?