North America Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Type (Endosteal Implants, Subperiosteal Implants, Trans steal Implants, Intramucosal Implants, Accessories, Root-Form Dental Implants and Plate-Form Dental Implants), By Material (Titanium, Zirconia, and Others), By Design (Tapered Implants and Parallel-Walled Implants), By End-User (Dental Clinics, Dental Hospitals, Dental Academic and Research Institutes, Dental Laboratories, and Others), and North America Dental Implants Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareNorth America Dental Implants Market Insights Forecasts to 2035

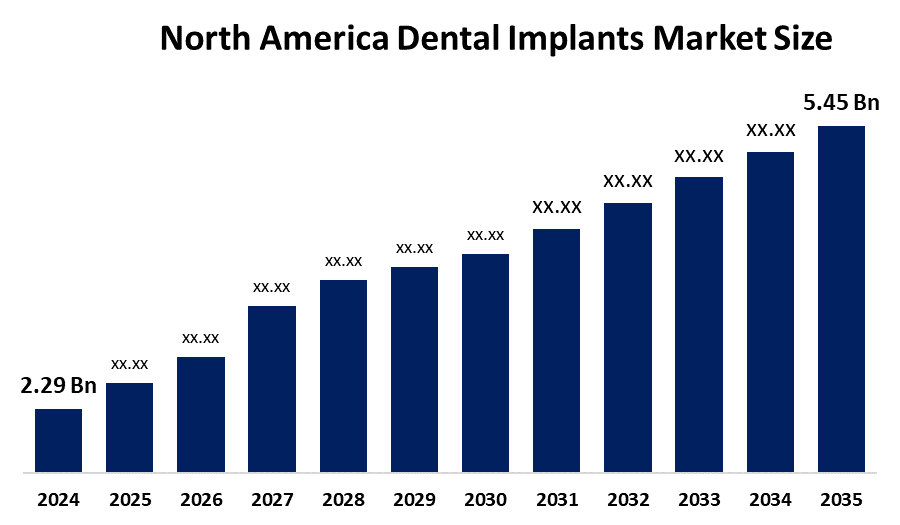

- The North America Dental Implants Market Size Was Estimated at USD 2.29 billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.2% from 2025 to 2035

- The North America Dental Implants Market Size is Expected to Reach USD 5.45 billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America dental implants market size is anticipated to reach USD 5.45 billion by 2035, growing at a CAGR of 8.2% from 2025 to 2035. The North America dental implants market is driven by the increasing adoption of dental implants by both patients and professionals. Technological advancements in implant materials and techniques are playing a key role in improving the overall success rate of dental implants.

Market Overview

The North America dental implants market refers to the global or regional industry involved in the manufacturing, distribution, and sale of dental implants, related surgical instruments, and associated products. Dental implants are utilized across a broad spectrum of dental treatments, ranging from the replacement of a single missing tooth to complex restorations involving multiple teeth and complete arch rehabilitation in partially or fully edentulous individuals. Dental implants contribute to improved chewing ability, speech clarity, and overall oral health, strengthening their role in contemporary dental care. The North American dental implants market is experiencing significant growth due to the increasing adoption of dental implants by both patients and professionals. Technological advancements in implant materials and techniques are playing a key role in improving the overall success rate of dental implants.

Key opportunities in the North American dental implants market include the growing demand for zirconia and other metal free implants due to their aesthetic and biocompatible properties, as well as the rising adoption of single-stage, minimally invasive procedures that reduce treatment time. Government initiatives, such as North America, account for a significant share of the global dental implants market, underpinned by advanced healthcare systems and insurance frameworks

Report Coverage

This research report categorizes the market for the North America dental implants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America dental implants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the North America dental implants market.

North America Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.29 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.2% |

| 2035 Value Projection: | USD 5.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Material |

| Companies covered:: | Adin Dental Implant Systems,Bicon,Bio Horizons,Dentium USA,Dentsply Sirona,Envista Holdings Corporation And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American dental implants market is driven by the rising interest in aesthetic dental treatments. As more people prioritize their facial appearance, dental implants are increasingly preferred over traditional options. Many patients choose implants to achieve a more natural-looking smile, which conventional dentures often fail to provide. Dental implants offer a permanent solution that closely resembles natural teeth, appealing to those seeking both functionality and visual appeal. They provide a stable and lifelike alternative to bridges or dentures, boosting confidence in social situations. Additionally, implants help maintain the jawbone structure, reducing the risk of bone loss commonly associated with dentures.

Restraining Factors

The dental implants market in North America faces several challenges, including the high cost of the procedure, typically ranging from $3,000 to $4,800 per implant in the U.S., and limited insurance coverage for such treatments. Market growth is also affected by a shortage of trained dental professionals, patient concerns about potential complications, the availability of lower-cost alternatives such as dental bridges, and broader economic factors that influence discretionary healthcare spending.

Market Segmentation

The North America dental implants market share is classified into type, material, design, and end-user.

- The endosteal implant segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America dental implants market is segmented by type into endosteal implants, subperiosteal implants, transosseous implants, intramucosal implants, accessories, root-form dental implants, and plate-form dental implants. Among these, the endosteal implants accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. Endosteal implants integrate directly into the jawbone (osseointegration), leading to high success rates (often >95%) and long-term durability. They are suitable for a wide range of indications from single tooth replacement to complex full arch restoration, making them the go-to choose for most dental professionals. Endosteal implants account for the majority of clinical use and trade due to their high success rates and wide applicability.

- The titanium implant segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America dental implants market is segmented by material into titanium, zirconia, and others. Among these, the titanium implant dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Titanium implants dominate due to their high biocompatibility and long-term success, while zirconia implants are gaining popularity for their aesthetic and hypoallergenic benefits. Titanium integrates exceptionally well with bone through osseointegration, the direct structural and functional connection between implant and bone. This results in high success and survival rates in the long term, which has positioned titanium as the gold standard in implantology.

- The tapered implant segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America dental implants market is segmented by design into tapered implants and parallel-walled implants. Among these, tapered implants dominated the share in 2024 and anticipated to grow at a significant CAGR during the forecast period. Tapered implants are widely preferred due to better primary stability and easier placement in limited bone areas, driving the majority of clinical procedures. Because of higher initial stability, tapered implants are more suitable for immediate load protocols, which are increasingly used to reduce treatment time.

- The dental clinic segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The North America dental implants market is segmented by end-user into dental clinics, dental hospitals, dental academic and research institutes, dental laboratories, and others. Among these, the dental clinics segment accounts for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Dental clinics provide easy access and handle the majority of routine implant cases. Dental clinics are also the primary adopters of endosteal and tapered implants due to their suitability for outpatient procedures. Additionally, growing patient preference for clinic-based care, flexible financing options, and cosmetic dentistry services further support the strong demand for dental implants through clinics across the U.S. and Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America dental implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adin Dental Implant Systems

- Bicon

- Bio Horizons

- Dentium USA

- Dentsply Sirona

- Envista Holdings Corporation

- Henry Schein, Inc.

- Institut Straumann AG

- Osstem Implant Co. Ltd.

- ZimVie

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, ZimVie Inc. formed a strategic distribution partnership with Osstem Implant Co., Ltd., a leading global provider of dental implants and integrated dental technologies. This partnership is intended to expand ZimVie’s presence in the fast-growing Chinese implant market, which sees over sold annually, while enhancing customer access to its innovative implant offerings.

- In June 2025, INSTITUT STRAUMANN AG announced plans to invest between USD and at its Villeret site in Switzerland over the next five years. The Villeret facility will continue producing high-value products, including the recently launched IEXCEL high-performance implant system.

- In March 2025, Dentsply Sirona participated in the Academy of Osseointegration Annual Meeting in Seattle, WA, from March . The company highlighted its latest innovation, the MIS LYNX implant, and hosted a Corporate Forum focused on the ongoing advancements in implant dentistry.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America dental implants market based on the below-mentioned segments:

North America Dental Implants Market, By Type

- Endosteal Implants

- Subperiosteal Implants

- Trans steal Implants

- Intramucosal Implant

- Accessories

- Root Form Dental Implants

- Plate Form Dental Implants

- Others

North America Dental Implants Market, By Material

- Titanium

- Zirconia

- Others

North America Dental Implants Market, By Design

- Tapered Implants

- Parallel Walled Implants

- Others

North America Dental Implants Market, By End-User

- Dental Clinics

- Dental Hospitals

- Dental Academic and Research Institutes

- Dental Laboratories

- Others

Frequently Asked Questions (FAQ)

-

Q. What is the current size and forecast of the North America dental implants market?A. The North America dental implants market was valued at USD 2.29 billion in 2024 and is expected to reach USD 5.45 billion by 2035, growing at a CAGR of 8.2% during the forecast period.

-

Q. Which dental implants type dominated the North America market in 2024?A. The endosteal implant segment held the largest market share in 2024 due to its high success rate, wide clinical applicability, and strong preference among dental professionals.

-

Q. Which material leads the North America dental implants market?A. Titanium implants dominated the market in 2024 owing to their superior biocompatibility, durability, and long-term clinical performance, while zirconia implants are gaining popularity for aesthetic reasons

-

Q. Which end-user segment accounts for the largest share of dental implants procedures?A. Dental clinics accounted for the largest share in 2024, as they handle most routine implant procedures and widely adopt endosteal and tapered implants for outpatient treatments.

-

Q. What are the key drivers and restraints of the North America dental implants market?A. Market growth is driven by rising demand for aesthetic dental treatments, technological advancements, and increasing adoption of dental implants, while high treatment costs, limited insurance coverage, and shortages of skilled professionals restrain market expansion.

Need help to buy this report?