North America Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Non-Dairy Milk, Non-Dairy Cheese, Non-Dairy Desserts, Non-Dairy Yogurt, and Others), By Packaging Type (PET Bottles, Cans, Cartons, Others), By Distribution Channel (On-Trade, Off-Trade), and North America Dairy Alternatives Market Insights Forecasts to 2035

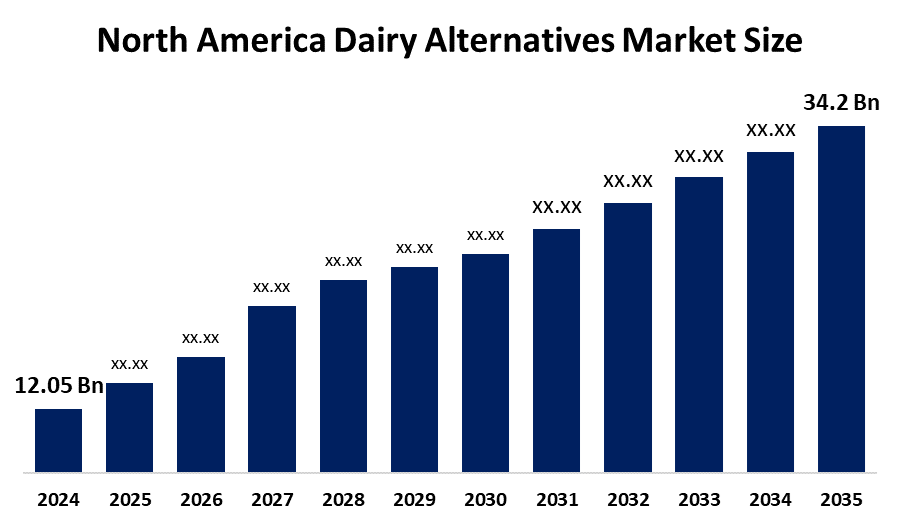

Industry: Consumer Goods- The North America Dairy Alternatives Market Size Was Estimated at USD 12.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.95% from 2025 to 2035

- The North America Dairy Alternatives Market Size is Expected to Reach USD 34.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Dairy Alternatives Market Size is anticipated to reach USD 34.2 Billion by 2035, Growing at a CAGR of 9.95% from 2025 to 2035. The market is driven by greater demand owing to shifts in the nutrition trends and consumers' eating habits. The growing cases of lactose intolerance and milk allergies will further trigger demand.

Market Overview

Dairy alternative products include supermarkets that generally stock plant-based dairy alternative products, which include various milk options such as soy, almonds, rice, and flax. In addition to these, frozen desserts, spreads, and cheese are also available. The increasing trend of lactose-free drinks as substitutes for cow's milk is expected to boost the growth of the Canadian dairy alternative market in the next few years. The rising demand for lactose-free products, consumer preferences shifting to organic and healthful food items, and a rise in the prevalence of milk allergy cases will be some of the drivers of the market growth in Canada.

In April 2023, Saputo announced that it would be taking over a dairy processing plant in Canada to improve its operational capabilities in North America. In 2024, Health Canada announced a new version of its Food Guide with plant-based proteins on par with animal ones and saying to Canadians to include more often protein foods that plant origin.

The United States has an annual almond production of approximately 2,002,742 metric tons, which is equivalent to 80% of the almond production. The U.S. market for dairy alternatives held the largest revenue share of 84.1% in 2023. Government assistance is the major contributor to the growth of the non-dairy products in the nation.

In recent years, the USA and Canada have seen a growing demand for dairy substitutes, primarily due to the higher disposable income and altered lifestyle, fashion, and diet habits. Soymilk has been the main product segment of the dairy alternatives market in the U.S. The nation is one of the top soybean producers in the world. Government assistance is the major factor stimulating the sales of non-dairy products in the country

Report Coverage

This research report categorizes the market for the North America dairy alternatives market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America dairy alternatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America dairy alternatives market.

North America Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.95% |

| 2035 Value Projection: | USD 34.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Packaging Type, By Distribution Channel |

| Companies covered:: | Danone North America, Blue Diamond Growers, The Hain Celestial Group, Earth’s Own Food Company, Oatly Inc., Pacific Foods, Kite Hill, Ripple Foods, Califia Farms, Miyoko’s Creamery, Others, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The dairy alternatives market in North America is driven by a progressive switch to products that offer more than just a basic diet. In the year 2024, off-trade channels represented 87.68% of sales, which clearly showed the superiority of supermarkets, hypermarkets, and online platforms as these were the places the consumers not only did their weekly shopping but also compared prices of different brands. The share of convenience stores and warehouse clubs was relatively small, but the latter is growing as Costco and Sam's Club are increasing their organic and plant-based assortments to lure high-income families living in suburbs.

Restraining Factors

The dairy alternatives market in North America is restrained by the consumers' lack of knowledge concerning the products without milk. The lack of awareness regarding the nutritional aspect could be a problem for those who are on a healthy and balanced diet but are not exclusively using milk as their main source of protein. The 2024 Californian harvest saw an upsurge in price that was caused by drought-reduced output, which in turn led companies like Blue Diamond to either bear the cost of reduced profit or to increase the prices for retailers.

Market Segmentation

The North America dairy alternatives market share is categorised into product type, packaging type, and distribution channel.

- The non-dairy milk segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America dairy alternatives market is segmented by product type into non-dairy milk, non-dairy cheese, non-dairy desserts, non-dairy yogurt, and others. Among these, the non-dairy milk segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the year 2024, non-dairy milk gained a lion's share of the market value, which was 54.27%, due to its first-mover advantage and extensive retail availability. At the same time, non-dairy cheese is expected to rise with the highest of 9.58% CAGR through 2030 as the brands deal with the melt, stretch, and flavor complexity problems of the past. The consumers' growing demand for beverages with different flavors has led to the introduction of a range of flavored drinks made up of dairy alternatives.

- The cartons segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on packaging type, the North America dairy alternatives market is segmented into PET bottles, cans, cartons, others. Among these, the cartons segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In the year 2024, cartons made up 52.34% of the market share, and the use of aseptic technology contributed to this figure. The main features of this technology are the possibility of storing the product at room temperature and a lower cold-chain cost, thus giving brands more advantages, especially those that focus on pantry-stocking trends and export markets. The companies Tetra Pak and SIG Combibloc are leading this market by providing multi-layer barriers that keep the products safe from light and oxygen.

- The off-trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America dairy alternatives market is segmented by distribution channel into on-trade, off-trade. Among these, the off-trade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the year 2024, off-trade segment represented 87.68% of sales, which clearly showed the superiority of supermarkets, hypermarkets, and online platforms as these were the places the consumers not only did their weekly shopping but also compared prices of different brands. The share of convenience stores and warehouse clubs was relatively small, but the latter is growing as Costco and Sam's Club are increasing their organic and plant-based assortments to lure high-income families living in suburbs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America dairy alternatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danone North America

- Blue Diamond Growers

- The Hain Celestial Group

- Earth’s Own Food Company

- Oatly Inc.

- Pacific Foods

- Kite Hill

- Ripple Foods

- Califia Farms

- Miyoko’s Creamery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, RIND by Dina & Joshua launched a new plant-based product, Bleu Crumbles. These crumbles replicate the tangy flavor and creamy consistency of traditional bleu cheese, offering a versatile option for various dishes, including salads, dips, burgers, sandwiches, and baked goods.

In July 2025, US-based milk alternatives brand MALK Organics announced the launch of a new product, shelf-stable Vanilla Almond.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Dairy Alternatives Market based on the below-mentioned segments:

North America Dairy Alternatives Market, By Product Type

- Non-Dairy Milk

- Non-Dairy Cheese

- Non-Dairy Desserts

- Non-Dairy Yogurt

- Others

North America Dairy Alternatives Market, By Packaging Type

- PET Bottles

- Cans

- Cartons

- Others

North America Dairy Alternatives Market, By Distribution Channel

- On-Trade

- Off-Trade

Frequently Asked Questions (FAQ)

-

Q: What is the North America dairy alternatives market size?A: The North America Dairy Alternatives Market size is expected to grow from USD 12.05 billion in 2024 to USD 34.2 billion by 2035, growing at a CAGR of 9.95% during the forecast period 2025-2035.

-

Q: What are dairy alternatives, and their primary use?A: Dairy Alternatives Product includes the supermarkets that generally stock plant-based dairy alternative products, which include various milk options such as soy, almonds, rice, and flax. In addition to these, frozen desserts, spreads, and cheese are also available. The increasing trend of lactose-free drinks as substitutes for cow's milk is expected to boost the growth of the Canadian dairy alternative market in the next few years.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by progressive switch to products that offer more than just a basic diet. In the year 2024, off-trade channels represented 87.68% of sales, which clearly showed the superiority of supermarkets, hypermarkets, and online platforms as these were the places the consumers not only did their weekly shopping but also compared prices of different brands.

-

Q: What factors restrain the North America dairy alternatives market?A: The market is restrained by the consumers' lack of knowledge concerning the products without milk. The lack of awareness regarding the nutritional aspect could be a problem for those who are on a healthy and balanced diet, but are not exclusively using milk for their main source of protein

-

Q: How is the market segmented by product type?A: The market is segmented into non-dairy milk, non-dairy cheese, non-dairy desserts, non-dairy yogurt, and others.

-

Q: Who are the key players in the North America dairy alternatives market?A: Key companies include Danone North America, Blue Diamond Growers, The Hain Celestial Group, Earth’s Own Food Company, Oatly Inc., Pacific Foods, Kite Hill, Ripple Foods, Califia Farms, and Miyoko’s Creamery.

Need help to buy this report?