North America Cooling Towers Market Size, Share, and COVID-19 Impact Analysis, By Type (Open Circuit, Closed Circuit, and Hybrid), By Material (FRP, Steel, Concrete, Wood and HDPE), By Application (HVAC, Power Generation, Oil & Gas and Industrial), and North America Cooling Towers Market Insights, Industry Trends, Forecast to 2035

Industry: Machinery & EquipmentNorth America Cooling Towers Market Size Insights Forecasts to 2035

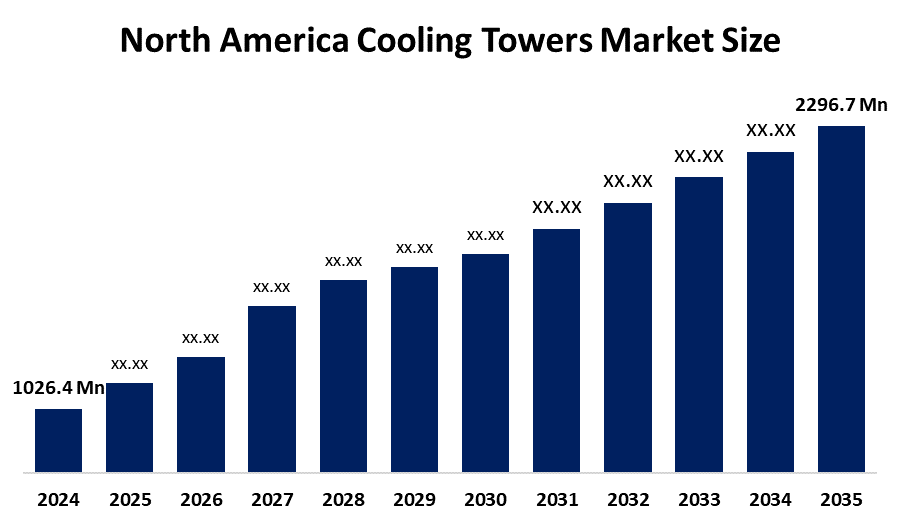

- The North America Cooling Towers Market Size Was Estimated at USD 1026.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.6% from 2025 to 2035

- The North America Cooling Towers Market Size is Expected to Reach USD 2296.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Cooling Towers Market Size is anticipated to Reach USD 2296.7 Million by 2035, Growing at a CAGR of 7.6% from 2025 to 2035. The market is driven by an increasing demand for energy-efficient cooling towers, coupled with stringent emission norms will accelerate product adoption across industrial, commercial, and utility-scale applications.

Market Overview

The cooling towers market includes devices that are capable of taking out the heat from water and releasing it to the air. A cooling tower is an exclusive heat exchanger that, through water and air contact, gets rid of excess heat from industrial operations or HVAC systems. The cooling is done by vaporising a little bit of water, hence transferring its latent heat to the atmosphere, which in turn cools the rest of the water for recirculation. Cooling towers are primarily used in large commercial buildings, hospitals, hotels, shopping malls, and data centers for comfort cooling and climate control purposes.

In June 2025, SPX Cooling Technologies, LLC came out with the new, higher-capacity models of its already-established Marley OlympusV adiabatic fluid coolers. The new models offer a wide range of cooling solutions that can be applied to various industries, including HVAC systems for commercial buildings, industrial processes, and data centres.

The U.S. Department of Energy (DOE) announced a total of $40 million that will be divided among 15 projects, which are supposed to create the next generation of cooling solutions that will be high-performing and very energy-efficient for data centres. And this is the case because, to cooling energy consumption is included, the total energy used by data centres can go up to 40%. The first reason behind this is the ever-increasing market for cloud computing and AI-based services. Cooling towers are very important in these energy-hungry places as they keep the right temperature through cooling.

Report Coverage

This research report categorizes the market for the North America cooling towers market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America cooling towers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America cooling towers market.

North America Cooling Towers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1026.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.6% |

| 2035 Value Projection: | USD 2296.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 174 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Material, By Application and COVID-19 Impact Analysis |

| Companies covered:: | SPX Technologies Inc, Babcock & Wilcox Enterprises In, Baltimore Aircoil Company, EVAPCO, Inc., Delta Cooling Towers, Inc., Babcock & Wilcox Enterprises, Hamon Corporation, Composite Cooling Solutions, Thermal Care, Inc., Enexio, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cooling towers market in North America is driven by the enormous growth in data handling, cloud computing, and AI infrastructures is a major factor. Data centers need non-stop cooling for mission-critical applications, hence the demand for specialized cooling towers that are capable of high thermal load with the least possible downtime. A large number of the industrial and commercial cooling systems in the U.S. and Canada have already become obsolete. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies have established policies that require higher levels of water conservation and lower thermal discharge to be achieved.

Restraining Factors

The cooling towers market in North America is restrained by investing in industrial-scale cooling towers is considerable at first, and hence, it becomes difficult for small and medium-sized businesses to afford them. The U.S. Environmental Protection Agency (EPA), along with local authorities, have set high standards with respect to water consumption and thermal discharge. Cooling towers can emit fine water droplets, which contain Legionella bacteria, and thus create a risk of Legionnaires’ disease.

Market Segmentation

The North America cooling towers market share is categorised into type, material, and application.

- The open circuit segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cooling towers market is segmented by type into open circuit, closed circuit, and hybris. Among these, the open circuit segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The open circuit was the largest segment with a revenue share of 46.56% in 2024. This is due to the industry being solid, and its adaptability to various applications like power generation and manufacturing is remarkable. Besides, they provide great operational benefits, such as reduced initial investments and more convenient upkeep. Nevertheless, the situation is changing as water shortage is becoming a major problem.

- The concrete segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on material, the North America cooling towers market is segmented into FRP, steel, concrete, wood and HDPE. Among these, the concrete segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by their durability and long-life span are the factors that make them perfect for high-capacity operations. Moreover, the fact that they can endure harsh weather and need almost no upkeep puts them in a very advantageous position when it comes to large-scale industrial and power generation uses.

- The power generation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cooling towers market is segmented by application into HVAC, power generation, oil & gas and industrial. Among these, the power generation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the massive demand for electric power in the world economy which is constantly changing and becoming more dynamic. The segment is mainly supported by the frequent need for electricity in the thermal power plants as their main operation cooling is also now efficient thanks to the continued advancements in hot water-cooling technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America cooling towers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SPX Technologies Inc

- Babcock & Wilcox Enterprises In

- Baltimore Aircoil Company

- EVAPCO, Inc.

- Delta Cooling Towers, Inc.

- Babcock & Wilcox Enterprises

- Hamon Corporation

- Composite Cooling Solutions

- Thermal Care, Inc.

- Enexio

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2025, Delta Cooling Towers introduced its newest and largest cooling tower model at the AHR Expo in Orlando in February, expanding its line of High-Density Polyethylene (HDPE) cooling solutions.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America cooling towers market based on the below-mentioned segments:

North America Cooling Towers Market, By Type

- Open Circuit

- Closed Circuit

- Hybrid

North America Cooling Towers Market, By Material

- FRP

- Steel

- Concrete

- Wood

- HDPE

North America Cooling Towers Market, By Application

- HVAC

- Power Generation

- Oil & Gas

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the North America cooling towers market size?A: The North America cooling towers market size is expected to grow from USD 1026.4 million in 2024 to USD 2296.7 million by 2035, growing at a CAGR of 7.6% during the forecast period 2025-2035.

-

Q: What is cooling towers, and its primary use?A: The cooling towers market includes devices that are capable of taking out the waste heat from water and discharging it to the air. A cooling tower is an exclusive heat exchanger that, through water and air contact, gets rid of excess heat from industrial operations or HVAC systems.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the enormous growth in data handling, cloud computing, and AI infrastructures is a major factor. Data centers need non-stop cooling for mission-critical applications, hence the demand for specialized cooling towers that are capable of high thermal load with the least possible downtime

-

Q: What factors restrain the North America cooling towers market?A: The market is restrained by investing in industrial-scale cooling towers is considerable at first, and hence, it becomes difficult for small and medium-sized businesses to afford it.

-

Q: How is the market segmented by type?A: The market is segmented into open circuit, closed circuit, and hybrid.

-

Q: Who are the key players in the North America cooling towers market?A: Key companies include SPX Technologies Inc., Babcock & Wilcox Enterprises In, Baltimore Aircoil Company, EVAPCO, Inc., Delta Cooling Towers, Inc., Babcock & Wilcox Enterprises, Hamon Corporation, Composite Cooling Solutions, Thermal Care, Inc., and Enexio.

Need help to buy this report?