North America Cold Chain Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Refrigerated Storage, Refrigerated Transport), By Temperature (Chilled, Frozen), By End User (Meat and Seafood, Fruits and Vegetables, Bakery and Confectionery, Dairy and Frozen Products, Pharmaceuticals, and Others), and North America Cold Chain Market Insights Forecasts to 2035

Industry: Information & TechnologyNorth America Cold Chain Market Insights Forecasts to 2035

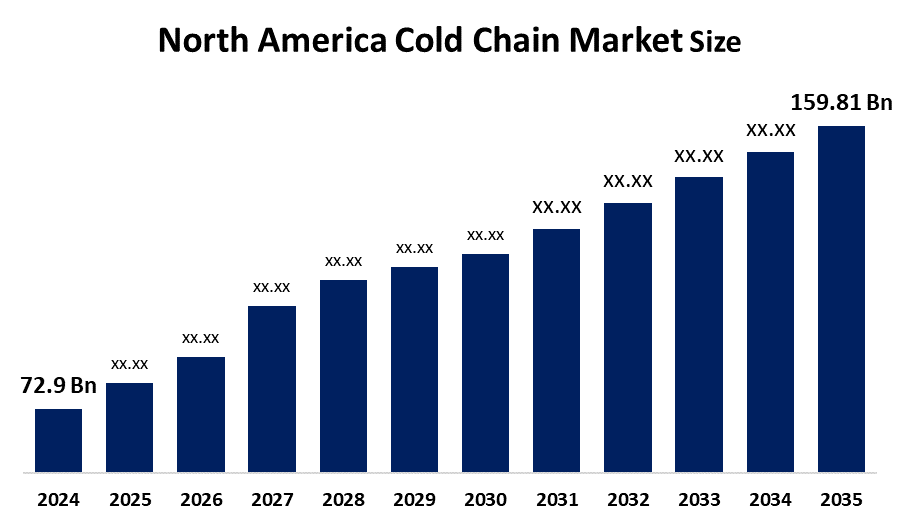

- The North America Cold Chain Market Size Was Estimated at USD 72.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.4% from 2025 to 2035

- The North America Cold Chain Market Size is Expected to Reach USD 159.81 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Cold Chain Market size is anticipated to reach USD 159.81 billion by 2035, growing at a CAGR of 7.4% from 2025 to 2035. The market is driven by the growth of temperature-sensitive product trade, the increasing demand of the pharmaceutical and healthcare sectors, and the spread of e-commerce and online grocery delivery services.

Market Overview

Cold chain indicates a regulated temperature environment system during transportation, storage, and handling of temperature-sensitive items, including food, drugs, and vaccines, until they reach the consumer. Statistics Canada reveals that the total inventory of frozen and chilled meats in the first two quarters of 2024 was 128,080 and 131,778 units, respectively, which contributed to the growth of the North America cold chain market size.

According to the USDA, the red meat frozen stocks amounted to 96% in the U.S., which were in cold storage at the beginning of January 2024. This fortifies the meat sector. the significant increase in frozen and chilled meat stocks during the first half of 2024 played a major role in the growth of the meat industry.

In June 2024, CJ Logistics America declared a new cold storage facility close to Kansas City. Among the other changes, Lineage Logistics' cross-border transport service that links the US and Canadian markets is one of them, as well as the $45.9 million facility of Agile Cold Storage in St. Tammany Parish. United States Cold Storage Inc. will finish a large refrigerated extension in Tulare by February 2025.

The Mexican government has recently presented the Mexico Plan, a six-year plan developed in collaboration with the federal government and the private sector, which aims to stimulate the economy of Mexico. The pharmaceutical industry is expected to hit $700 billion in the future, with cold chain logistics being a key factor in keeping temperature-sensitive drugs safe.

Report Coverage

This research report categorizes the market for the North America cold chain market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America cold chain market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America cold chain market.

North America Cold Chain Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.9 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.4% |

| 2035 Value Projection: | USD 159.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | Americold Logistics LLC, Lineage Logistics Holding, LLC, United States Cold Storage Inc., VersaCold Logistics Services, AGRO Merchants Group, Interstate Warehousing Inc., Tippmann Group, NewSold, Pensker, Wabash National Corporation, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Cold Chain Market Size in North America is driven by the U.S. grocery market, is anticipated to hit the $1.2 trillion mark, with around 30% of the sales about perishables. The increase in demand calls for better cold chain solutions to keep the products safe and of high quality, thus making the market bigger. In the future, the North American e-commerce market will be worth $1.5 trillion, and online grocery sales will be $120 billion. The major reason for this growth is the shift in consumer preferences towards convenience and home delivery. It is estimated that the food safety compliance costs will rise to more than $12 billion throughout the industry. These rules make companies allocate money for the modern cold chain system.

Restraining Factors

The Cold Chain Market Size in North America is restrained by operational costs, with forecasts suggesting that travel and storage costs may take up to 30% of total logistics expenses. The USDA reports that nearly 25% of rural areas do not have adequate cold storage facilities. This restriction is a major hurdle in the distribution of perishable products and thus limits market growth and accessibility for consumers in such areas.

Market Segmentation

The North America cold chain market share is categorised into service type, temperature, and end user.

- The refrigerated storage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Cold Chain Market Size is segmented by service type into refrigerated storage, refrigerated transport. Among these, the refrigerated storage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is expected to grow the storage portion responsible for the major part of 60.0% in 2024. It is the cold chain storage service which is gradually growing as companies are more and more investing in new temperature-controlled buildings that are automated and have digital monitoring systems.

- The chilled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on temperature, the North America Cold Chain Market Size is segmented into chilled, frozen. Among these, the chilled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Market growth in chilled storage is identified as the storage of items under controlled conditions at a temperature which is between the freezing point and room temperature. It is a solution for those goods that need a constant but cool temperature supply, for example, fruits, vegetables, milk products, and soft drinks.

- The meat and seafood segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Cold Chain Market is segmented by end user into meat and seafood, fruits and vegetables, bakery and confectionery, dairy and frozen products, pharmaceuticals, and others. Among these, the meat and seafood segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The very high demand for these perishable products and the requirement for specific temperatures is expected to result in a very serious situation. One of the most important aspects of the cold chain system is that it provides the meat and seafood industries with the ability to maintain the proper standards of the products, increase their lifespan, and ensure that the food is safe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America cold chain market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Americold Logistics LLC

- Lineage Logistics Holding, LLC

- United States Cold Storage Inc.

- VersaCold Logistics Services

- AGRO Merchants Group

- Interstate Warehousing Inc.

- Tippmann Group

- NewSold

- Pensker

- Wabash National Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Sonoco Products Company, a global leader in high-value sustainable packaging, announced it had signed a definitive agreement to sell its ThermoSafe business unit, which is one of the leading providers of temperature-assured packaging, to Arsenal Capital Partners.

- In March 2025, Brenntag, the market leader in chemicals and ingredients distribution, announced a distribution agreement for the U.S., Canada and Mexico with Pure Tech Scientific, a global leader in organic synthesis of ultra-high purity glycolic acid for the life sciences and speciality chemical industry.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Cold Chain Market based on the below-mentioned segments:

North America Cold Chain Market, By Service Type

- Refrigerated Storage

- Refrigerated Transport

North America Cold Chain Market, By Temperature

- Chilled

- Frozen

North America Cold Chain Market, By End User

- Meat and Seafood

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy and Frozen Products

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

What is the North America cold chain market size?The North America Cold Chain Market size is expected to grow from USD 72.9 billion in 2024 to USD 159.81 billion by 2035, growing at a CAGR of 7.4% during the forecast period 2025-2035

-

What is a cold chain, and its primary use?Cold chain indicates a regulated temperature environment system during transportation, storage, and handling of temperature-sensitive items, including food, drugs, and vaccines, until they reach the consumer

-

What are the key growth drivers of the market?Market growth is driven by the U.S. grocery market is anticipated to hit the $1.2 trillion mark, with around 30% of the sales about perishables. The increase in demand calls for better cold chain solutions to keep the products safe and of high quality, thus making the market bigger. In the future, the North American e-commerce market will be worth $1.5 trillion, and online grocery sales will be $120 billion

-

What factors restrain the North America cold chain market?The market is restrained by the operational costs, with forecasts suggesting that travel and storage costs may take up to 30% of total logistics expenses. The USDA reports that nearly 25% of rural areas do not have adequate cold storage facilities. This restriction is a major hurdle in the distribution of perishable products and thus limits market growth and accessibility for consumers in such areas.

-

How is the market segmented by service type?The market is segmented into refrigerated storage, refrigerated transport

-

Who are the key players in the North America cold chain market?Key companies include Americold Logistics LLC, Lineage Logistics Holding, LLC, United States Cold Storage Inc., VersaCold Logistics Services, AGRO Merchants Group, Interstate Warehousing Inc., Tippmann Group, NewSold, Pensker, and Wabash National Corporation

Need help to buy this report?