North America Clinical Trial Supply and Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Logistics & Distribution, Storage & Retention, Packaging, Labelling & Blinding, Manufacturing, and Others), By Therapeutic Area (Oncology, Cardiovascular Diseases, Respiratory Diseases, CNS and Mental Disorders, and Others), By End User (Pharmaceuticals, Biologics, and Medical Devices), and North America Clinical Trial Supply and Logistics Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareNorth America Clinical Trial Supply and Logistics Market Insights Forecasts to 2035

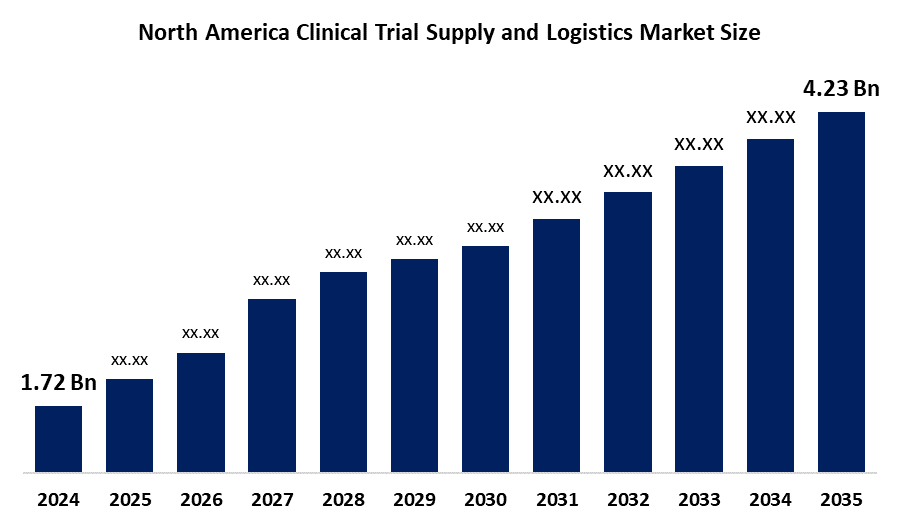

- The North America Clinical Trial Supply and Logistics Market Size Was Estimated at USD 1.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.52% from 2025 to 2035

- The North America Clinical Trial Supply and Logistics Market Size is Expected to Reach USD 4.23 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Clinical Trial Supply and Logistics Market Size is Anticipated to Reach USD 4.23 Billion by 2035, Growing at a CAGR of 8.52% from 2025 to 2035. The market is driven the increasing complexity of clinical trials and the growing emphasis on precision medicine, the need for specialized and compliant supply chain solutions has become paramount.

Market Overview

The clinical trial supply and logistics market is described as a systematic approach that guarantees supply, equipment, and drug delivery for clinical research in the region to be on time, at a reasonable cost and in compliance with regulations. It includes the strategic planning and transportation of investigational medicinal products, patient samples, and ancillary supplies between manufacturing sites, central labs, clinical trial locations, and patients' houses.

In April 2025, DHL Group spend €2 billion in the next 5 years to improve its logistics capabilities in the life sciences and healthcare sectors. North America is going to get 40% of the total investment.

In October 2025, Citius Oncology, Inc., which is the oncology-focused subsidiary of Citius Pharmaceuticals, Inc., made public the fact that it has concluded a distribution services agreement with McKesson Corporation, a company that is among the biggest pharmaceutical distributors and healthcare services providers in North America.

The use of AI-powered predictive analytics for inventory control across the board along with IoT-based sensors for constant measuring of temperature-sensitive pharmaceuticals takes real-time advice. The biopharmaceutical sector is progressively transferring its dependence on internal logistics to functional service provider (FSP) models in order to cut expenses and take advantage of the vendors' expertise. Moreover, these applications will be used more for complete traceability and to keep the data legitimate for the strict FDA and Health Canada regulations that need to be met.

Report Coverage

This research report categorizes the market for the North America clinical trial supply and logistics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America clinical trial supply and logistics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America clinical trial supply and logistics market.

North America Clinical Trial Supply and Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.72 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.52% |

| 2035 Value Projection: | USD 4.23 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service, By Therapeutic Area, By End User |

| Companies covered:: | Movianto, UPS, Piramal Pharma Solutions, PAREXEL, Catalent Inc, FedEx Corp, Thermo Fisher Scientific Inc, Almac Group, UPS Healthcare, DHL, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The clinical trial supply and logistics market in North America is driven by the transition to precision medicine and personalized therapies, which has raised the need for small-batch logistics solutions that are highly specialised. The linchpin of these cutting-edge treatments is ultra-cold chain and cryogenic storage that can meet very high standards, which, in turn, results in larger margins for the logistics sector. The widespread application of IoT-based sensors, AI-powered predictive analytics, and blockchain technology is improving real-time visibility, demand forecasting and data integrity. The steady rise of clinical research in new medicines in North America is mainly due to the prevalence of cancer, heart and lung disease conditions.

Restraining Factors

The clinical trial supply and logistics market in North America is restrained by the total costs concerning cold chain management, specific packaging, and complicated international logistics are often more than the planned budget. The emergence of biologics and cell/gene therapies is demanding high-standard cold chain facilities. Cybersecurity threats are increasing with the growing digitalization and adoption of IoT for real-time monitoring.

Market Segmentation

The North America clinical trial supply and logistics market share is categorised into service, therapeutic area, and end user.

- The logistics & distribution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America clinical trial supply and logistics market is segmented by service into logistics & distribution, storage & retention, packaging, labelling & blinding, manufacturing, and others. Among these, the logistics & distribution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, logistics and distribution continued to lead the market with a revenue share of 27.27%. The pharmaceutical industry is gradually taking the route for clinical trials to have a mixed patient population and fast recruitment. Therefore, the large-scale trials mean that the logistics and distribution network has to be strong to transport the investigational drugs, medical devices, and other trial materials across borders without a hitch and at the same time, follow the different regulatory requirements.

- The oncology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on therapeutic area, the North America clinical trial supply and logistics market is segmented into oncology, cardiovascular diseases, respiratory diseases, CNS and mental disorders and others. Among these, the oncology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the high rates of various cancer types, namely breast cancer, lung cancer, and colorectal cancer, have caused the number of clinical trials aimed at discovering new and innovative oncology treatments to increase significantly. The direct correlation between the growing activity in the oncology sector and the higher need for clinical trial supply and logistics services is pretty clear.

- The pharmaceuticals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America clinical trial supply and logistics market is segmented by end user into pharmaceuticals, biologics and medical devices. Among these, the pharmaceuticals segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the heavy investment in R&D, the large number of drugs coming to the market, and the complex requirements of the supply chain. investing heavily in developing new drugs, from generics to novel compounds, creating enormous demand for clinical trial supplies and complex logistics. The sheer volume of trials for these therapies keeps the sector leading.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America clinical trial supply and logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Movianto

- UPS

- Piramal Pharma Solutions

- PAREXEL

- Catalent Inc

- FedEx Corp

- Thermo Fisher Scientific Inc

- Almac Group

- UPS Healthcare

- DHL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2024, Noramco announced its launch of the Noramco Group, a newly created comprehensive North American-based supply chain solution, including subsidiaries Purisys, Noramco, and the newly acquired drug product CDMO, Halo Pharma.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America clinical trial supply and logistics market based on the below-mentioned segments:

North America Clinical Trial Supply and Logistics Market, By Service

- Logistics & Distribution

- Storage & Retention

- Packaging

- Labelling & Blinding

- Manufacturing

- Others

North America Clinical Trial Supply and Logistics Market, By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Respiratory Diseases

- CNS and Mental Disorders

- Others

North America Clinical Trial Supply and Logistics Market, By End User

- Pharmaceuticals

- Biologics

- Medical Devices

Frequently Asked Questions (FAQ)

-

Q: What is the North America clinical trial supply and logistics market size?A: The North America clinical trial supply and logistics market size is expected to grow from USD 1.72 billion in 2024 to USD 4.23 billion by 2035, growing at a CAGR of 8.52% during the forecast period 2025-2035.

-

Q: What are clinical trial supply and logistics, and their primary use?A: The clinical trial supply and logistics market is described as a systematic approach that guarantees supply, equipment, and drug delivery for clinical research in the region to be in time, at a reasonable cost and in compliance with regulations.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the transition to precision medicine and personalized therapies, which has raised the need for small-batch logistics solutions that are highly specialized.

-

Q: What factors restrain the North America clinical trial supply and logistics market?A: The market is restrained by the total costs concerning cold chain management, specific packaging, and complicated international logistics, which are often more than the planned budget.

-

Q: How is the market segmented by service?A: The market is segmented into logistics & distribution, storage & retention, packaging, labelling & blinding, manufacturing, and others.

-

Q: Who are the key players in the North America clinical trial supply and logistics market?A: Key companies include Movianto, UPS, Piramal Pharma Solutions, PAREXEL, Catalent Inc, FedEx Corp, Thermo Fisher Scientific Inc, Almac Group, UPS Healthcare, and DHL.

Need help to buy this report?