North America Charcoal Market Size, Share, and COVID-19 Impact Analysis, By Type (Charcoal Briquettes, Lump Charcoal, and Others), By Application (Fuel Feedstock, Filtration Agent, Medicines, and Others), By End User (Residential, Water Treatment, Pharmaceutical, and Others), and North America Charcoal Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Charcoal Market Insights Forecasts to 2035

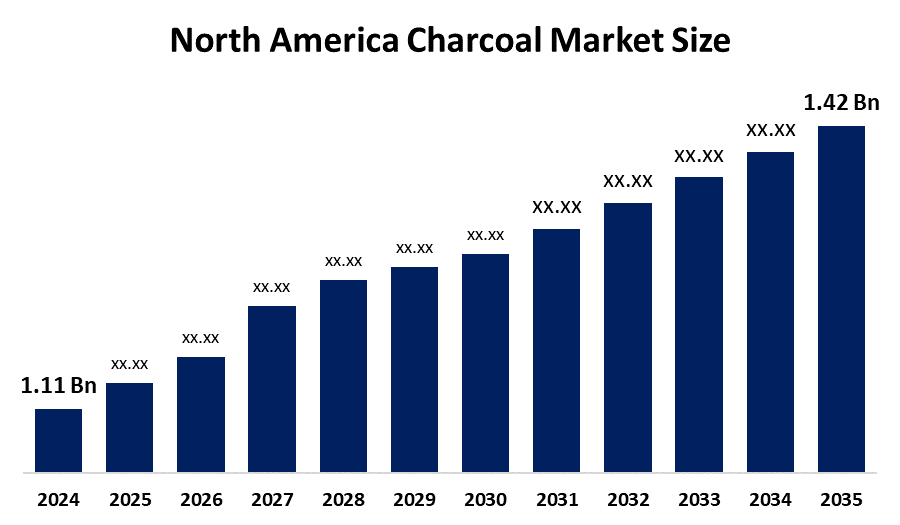

- The North America Charcoal Market Size Was Estimated at USD 1.11 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.26% from 2025 to 2035

- The North America Charcoal Market Size is Expected to Reach USD 1.42 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Charcoal Market Size Is Anticipated To Reach USD 1.42 Billion By 2035, Growing At A CAGR of 2.26% From 2025 to 2035. The market is driven by increasing BBQ culture, growing outdoor leisure activities, rising disposable income, and increased awareness of clean-burning fuels.

Market Overview

The Charcoal Market includes the process of charcoal product production, distribution, and consumption, used for industrial and recreational cooking. Charcoal is a black and light carbon product created when organic materials such as wood or plant waste are burned at very high temperatures without oxygen. Activated charcoal is used for the removal of chlorine, heavy metals, and volatile organic compounds (VOCs) from industrial effluent and drinking water. It has been a significant part of industrial gas masks and also in controlling the emission of mercury and other pollutants in the cement and power industries.

In the year 2024, the U.S. government made a declaration of a $6 billion investment for clean water infrastructure, with the Bipartisan Infrastructure Law offering a massive $50 billion in total. This large influx of money is what keeps activated charcoal as the main component in water filtration. The facilities that burn coal must use activated carbon according to the U.S. EPA's Mercury and Air Toxics Standards (MATS) for the removal of mercury from exhaust emissions.

There is an increasing consumer demand for high-quality natural lump charcoal, and also for products with sustainability certificates like FSC. Besides this, manufacturers are trying out different product flavors and environmentally friendly production methods. Charcoal has been extensively used in air and water purification processes because of government regulations and the public's increasing concern about water contamination.

Report Coverage

This research report categorizes the market for the North America Charcoal Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America charcoal market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America charcoal market.

North America Charcoal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.11 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 2.26% |

| 2035 Value Projection: | USD 1.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | The Clorox Company Royal Oak Enterprises, LLC Duraflame, Inc FOGO Charcoal B&B Charcoal Basques Hardwood Charcoal Calgon Carbon Corporation The Saint Louis Charcoal Company LLC Parker Charcoal Company Rancher Charcoal And Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Charcoal Market In North America is driven by the recent U.S. import duties on charcoal; market players have effectively built up local production and created export as well as sourcing networks. Charcoal, being the cheapest and the most efficient, is still the most widely used product in places lacking modern energy sources. The burning of charcoal, the grilling, smoking, and roasting methods, has ignited the wood again as a source of flavor in the trend of going back to cooking with raw materials. Activated carbon is an essential material in the business of wastewater treatment, air filtration, and water purification, among others, due to its high surface area and porosity

Restraining Factors

The Charcoal Market in North America is restrained by carbonisation of organic materials like wood and agricultural waste yields charcoal, the production of which has been linked to several environmental problems, including pollution, deforestation, and recalcitrant habitats. The most serious among them is the carbon footprint of charcoal production, where mainly, particulate matter and greenhouse gases are emitted, which are the core issues connected with charcoal making.

Market Segmentation

The North America charcoal market share is categorised into type, application and end user.

- The lump charcoal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Charcoal Market Size is segmented by type into charcoal briquettes, lump charcoal, and others. Among these, the lump charcoal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the ability to burn rapidly, reach a higher temperature rate, produce comparatively little carbon emissions, and have a high calorific value, making it superior to other forms of charcoal. Additionally, lump charcoal reacts favorably with oxygen to control heat through chimneys and vents. The most natural BBQ fuel is lump charcoal. It is anticipated that this aspect would sustain lump charcoal's supremacy.

- The fuel feedstock segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America Charcoal Market Size is segmented into fuel feedstock, filtration agent, medicines, and others. Among these, the fuel feedstock segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the need for heating and cooking in North America. In North America, it is the most preferred fuel for outdoor cooking. The market is increasing due to consumers' choice for grilled food. The market will continue to grow in the near future owing to the rapid growth of the hospitality sector.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Charcoal Market Size is segmented by end user into residential, water treatment, pharmaceutical, and others. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the growing appeal of barbecue grilling as a result of new cooking techniques and lifestyle shifts. The increasing intake of grilled food in a live cooking scenario was promoted by a lively atmosphere, a large buffet, and excellent music. Charcoal demand in North America will increase as a result.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Charcoal Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Clorox Company

- Royal Oak Enterprises, LLC

- Duraflame, Inc

- FOGO Charcoal

- B&B Charcoal

- Basques Hardwood Charcoal

- Calgon Carbon Corporation

- The Saint Louis Charcoal Company LLC

- Parker Charcoal Company

- Rancher Charcoal

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Drax and NGIS launched a new partnership to map carbon stocks of Drax’s North American biomass sourcing areas.

In January 2025, Weber LLC, the global leader in high-performance, high-quality outdoor cooking technology and products, unveiled its 2025 lineup of grills, smokers, griddles, and accessories. Designed to bring more flavor, versatility, and simplicity to every outdoor cooking experience, the new collection blends expert engineering, thoughtful craftsmanship, and quality construction to make Weber’s legendary performance.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America charcoal market based on the below-mentioned segments:

North America Charcoal Market, By Type

- Charcoal Briquettes

- Lump Charcoal

- Others

North America Charcoal Market, By Application

- Fuel Feedstock

- Filtration Agent

- Medicines

- Others

North America Charcoal Market, By End User

- Residential

- Water Treatment

- Pharmaceutical

- Others

Frequently Asked Questions (FAQ)

-

What is the North America charcoal market size?The North America charcoal market size is expected to grow from USD 1.11 billion in 2024 to USD 1.42 billion by 2035, growing at a CAGR of 2.26% during the forecast period 2025-2035.

-

What is charcoal, and its primary use?The charcoal market includes the process of charcoal products production, distribution, and consumption, with the use being for industrial and recreational cooking. Activated charcoal is used for the removal of chlorine, heavy metals, and volatile organic compounds (VOCs) from industrial effluent and drinking water

-

What are the key growth drivers of the market?Market growth is driven by the recent U.S. import duties on charcoal; market players have effectively built-up local production and created export as well as sourcing networks. Charcoal, being the cheapest and the most efficient, is still the most widely used product in places lacking modern energy sources

-

What factors restrain the North America charcoal market?The market is restrained by the carbonisation of organic materials like wood and agricultural waste yields charcoal, the production of which has been linked to several environmental problems, including pollution, deforestation, and recalcitrant habitats

-

How is the market segmented by type?The market is segmented into charcoal briquettes, lump charcoal, and others.

-

Who are the key players in the North America charcoal market?Key companies include The Clorox Company, Royal Oak Enterprises, LLC, Duraflame, Inc., FOGO Charcoal, B&B Charcoal, Basques Hardwood Charcoal, Calgon Carbon Corporation, The Saint Louis Charcoal Company, LLC, Parker Charcoal Company, and Rancher Charcoal.

Need help to buy this report?