North America Blowing Agents Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydrochlorofluorocarbons, Hydrofluorocarbons, Hydrocarbons and Others), By Foam (Polyurethane Foam, Polystyrene Foam, Phenolic Foam, Polyolefin Foam and Others), and North America Blowing Agents Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Blowing Agents Market Insights Forecasts to 2035

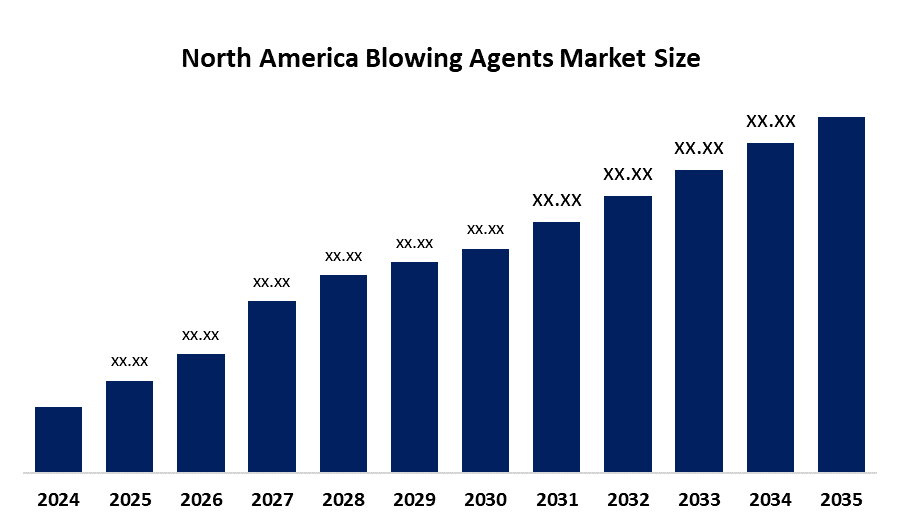

- The North America Blowing Agents Market Size Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The North America Blowing Agents Market Size is Expected to Reach a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Blowing Agents Market size is growing at a CAGR of 5.1% from 2025 to 2035. The market is driven by the growing demand from end-use industries, and the rapid expansion of the polymeric foams market creates a market demand for blowing agents. The industrialization process, with urban development and infrastructure construction activities currently taking place in various countries worldwide.

Market Overview

The blowing agents market is experiencing fast evolution due to three factors, including environmental demands, economic changes and industrial developments. A blowing agent is a substance that can create a cellular structure within materials through the foaming process. Blowing agents function as essential components that improve the thermal insulation capabilities of building foam materials, which leads to energy efficiency and compliance with ENERGY STAR and LEED certification standards.

Arkema has made a $60 million investment in its Calvert City manufacturing facility. The company now provides its 1233zd blowing agent for exclusive foam manufacturing needs in North American construction projects and appliance markets.

BASF Neopor uses graphite to develop expanded polystyrene, providing better thermal insulation through its ability to reflect heat radiation from inside the foam, resulting in lower energy needs for buildings because of its thinner insulation requirements.

The United States uses more blowing agents than any other country because its aerospace defense and energy companies need advanced core materials and repair technologies, which receive backing from government programs, defence spending, renewable energy targets and infrastructure development initiatives that are designed to enhance structural integrity, environmental sustainability and operational performance.

Report Coverage

This research report categorizes the market for the North America blowing agents market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America blowing agents market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America blowing agents market.

Driving Factors

The blowing agents market in North America is driven by the growing need for lightweight materials, which various industries use in construction, automotive and packaging applications serves as the main factor driving this trend. Manufacturers will continue this trend because it achieves better energy efficiency while lowering their material expenses. Production technology innovations currently improve both blowing agent efficiency and product quality. The implementation of stricter government regulations forces manufacturers to modify their products and processes so they can achieve safety and sustainability requirements.

Restraining Factors

The blowing agents market in North America is hindered by the fluctuations in the costs of feedstock, such as R-134a, which directly impact the pricing and availability of newer, eco-friendly blowing agents. The 2025 tariffs were established in the new tariffs after 2025 required companies to establish new sources, which createdextra difficulties and increased their 2026 operational expenses.

North America Blowing Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Honeywell International Inc., The Chemours Company, Arkema S.A., Solvay S.A., Exxon Mobil CO., Daikin Industries Ltd, Foam Supplies, Inc., Sinochem Group Co. Ltd, Nouryon, Dow, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The North America blowing agents market share is categorised into type and foam.

- The hydrocarbons segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America blowing agents market is segmented by type into hydrochlorofluorocarbons, hydrofluorocarbons, hydrocarbons and others. Among these, the hydrocarbons segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the zero-ozone depletion potential, low warming potential, and cost-effectiveness. The material serves as a primary insulation component in polyurethane foams used throughout the manufacturing process because it provides better performance and meets environmental standards while replacing banned HCFCs and HFCs.

- The polyurethane foam segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on foam, the North America blowing agents market is segmented into polyurethane foam, polystyrene foam, phenolic foam, polyolefin foam and others. Among these, the polyurethane foam segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the material getting extensive usage as insulation material for residential and commercial buildings and for appliances and automotive interiors because it provides exceptional thermal insulation and energy-efficient performance. The U.S. Department of Energy promotes building envelope upgrades that use PU foam-based insulation materials as a major element of their building envelope improvement program.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America blowing agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honeywell International Inc.

- The Chemours Company

- Arkema S.A.

- Solvay S.A.

- Exxon Mobil CO.

- Daikin Industries Ltd

- Foam Supplies, Inc.

- Sinochem Group Co. Ltd

- Nouryon

- Dow

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America blowing agents market based on the below-mentioned segments:

North America Blowing Agents Market, By Type

- Hydrochlorofluorocarbons

- Hydrofluorocarbons

- Hydrocarbons

- Others

North America Blowing Agents Market, By Foam

- Polyurethane Foam

- Polystyrene Foam

- Phenolic Foam

- Polyolefin Foam

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America blowing agents market size?A: The North America blowing agents market size is expected to grow at a CAGR of 5.1% during the forecast period 2025-2035.

-

Q: What are blowing agents, and their primary use?A: The blowing agents market is experiencing fast evolution due to three factors, including environmental demands, economic changes and industrial developments. A blowing agent is a substance that can create a cellular structure within materials through the foaming process.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing need for lightweight materials, which various industries use in construction, automotive and packaging applications serves as the main factor driving this trend.

-

Q: What factors restrain the North America blowing agents market?A: The market is restrained by the fluctuations in the costs of feedstock, such as R-134a, which directly impact the pricing and availability of newer, eco-friendly blowing agents.

-

Q: Who are the key players in the North America blowing agents market?A: Key companies include Honeywell International Inc., The Chemours Company, Arkema S.A., Solvay S.A., Exxon Mobil CO., Daikin Industries Ltd, Foam Supplies, Inc., Sinochem Group Co. Ltd, Nouryon, and Dow.

Need help to buy this report?