North America Bisphenol S Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid, Powder), By Sales Channel (Direct Sales, Indirect Sales), By End User (Thermal Papers, Fine Chemicals, Epoxy Resins, Phenolic Resins, Others), and North America Bisphenol S Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsNorth America Bisphenol S Market Insights Forecasts to 2035

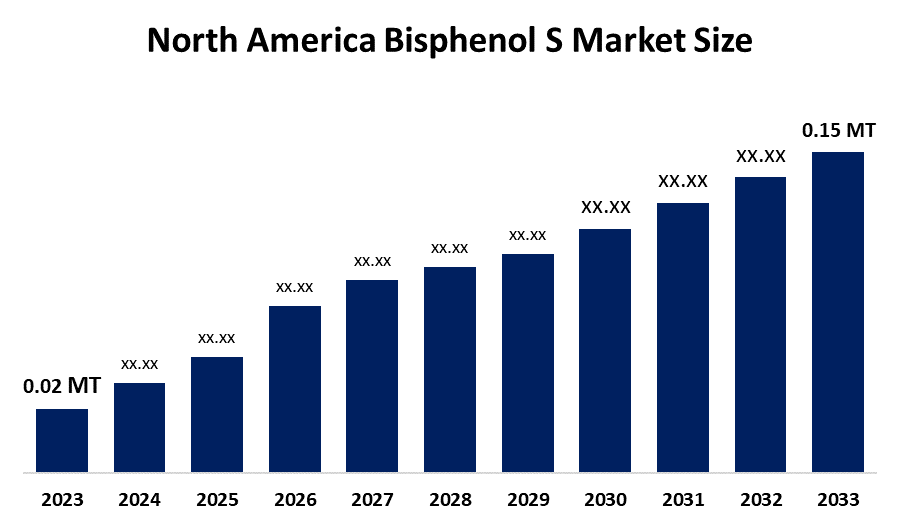

- The North America Bisphenol S Market Size Was Estimated at 0.02 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 20.1% from 2025 to 2035

- The North America Bisphenol S Market Size is Expected to Reach 0.15 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Bisphenol S Market Size Is Anticipated To Reach 0.15 Million Tonnes By 2035, Growing At A CAGR Of 20.1% From 2025 To 2035. The market is driven by a rising trend for online shopping, and an increase in related warehousing operations is expected to fuel the Bisphenol S demand, as the chemical is widely used in the packaging industry

Market Overview

The bisphenol s (BPS) market refers to the production and use of BPS, a chemical compound commonly used as an alternative to bisphenol A in manufacturing. The production of polyethersulfone (PES) plastic requires bisphenol S (BPS) because manufacturers use this plastic to create hard plastic products and synthetic fibers found in clothing and various textile items. The regulatory organizations raised health concerns about BPA, which led to increased use of BPS because it shares chemical characteristics with BPA, but people consider it less dangerous.

In May 2023, Akzo Nobel introduced Accelshield 700, their first BPA-NI (Bisphenol A non-intent) internal coating solution for beverage can lids assists metal can production facilities and roll coating plants in achieving their bisphenol-free operational objectives.

The state of Washington implemented a new regulation in January 2026 that prohibits all bisphenols from being used in receipt paper because it protects people's health and demands safer alternatives. Washington becomes the first state in the United States to implement this particular measure. The Office of Environmental Health Hazard Assessment (OEHHA) added the developmental toxicity endpoint to the reproductive toxicity listing of bisphenol S (BPS) under Proposition 65 in December 2025.

Report Coverage

This research report categorizes the market for the North America bisphenol S market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America bisphenol S market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America bisphenol S market.

North America Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.02 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 20.1% |

| 2035 Value Projection: | 0.15 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Sales Channel |

| Companies covered:: | Addivant Corporation, Huntsman Corporation, SI Group, Connect Chemicals, Kessler Chemical, Solvay S.A., Changzhou Changyu Chemical Co., Ltd., Honshu Chemical Industry Co., Ltd, Jiangsu Aolunda High-Tech Industry Co., Ltd, Nantong Volant -Chem Corp., Others, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bisphenol S market in North America is driven by the rising demand for products that do not contain BPA, which has pushed companies to choose BPS as their packaging material for food and personal care items. The main market share of more than 42% for thermal paper shows that it is the most important product category used for receipts and labels. The California OEHHA recently classified BPS under Proposition 65 as a reproductive toxicant, which is ironically driving demand for labeled, "safer" alternatives or strictly regulated formulations.

Restraining Factors

The bisphenol S market in North America is hindered by the increasing health and environmental issues with enhanced governmental inspections, potential toxic dangers, expensive manufacturing costs and the rising demand from industries for safer or bio-based substitute materials.

Market Segmentation

The North America bisphenol S market share is categorised into product type, sales channel and end user.

- The liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Bisphenol S Market Size is segmented by product type into liquid, powder. Among these, the liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the product, which experiences high demand because it can handle tasks with high efficiency while requiring short processing times. Liquid BPS provides manufacturers with improved solvent compatibility, which increases its usage in production processes. The industry adopts the product because it enables them to achieve stable quality results throughout their operations.

- The direct sales segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sales channel, the North America Bisphenol S Market Size is segmented into direct sales, indirect sales. Among these, the direct sales segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the channel, which ensures cost control and customized solutions for bulk buyers. It fosters trust through direct negotiations. Direct sales decrease intermediary involvement, which leads to faster product delivery. The current method enables companies to handle their industrial operations through large-scale processes.

- The thermal papers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Bisphenol S Market Size is segmented by end user into thermal papers, fine chemicals, epoxy resins, phenolic resins, others. Among these, the thermal papers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the BPS improves thermal coating heat detection and serves essential functions for POS systems. Its usage surges in retail and logistics. Moreover, thermal papers benefit from BPS’s stability. The e-commerce industry expansion leads to an increasing demand for services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Bisphenol S Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Addivant Corporation

- Huntsman Corporation

- SI Group

- Connect Chemicals

- Kessler Chemical

- Solvay S.A.

- Changzhou Changyu Chemical Co., Ltd.

- Honshu Chemical Industry Co., Ltd

- Jiangsu Aolunda High-Tech Industry Co., Ltd

- Nantong Volant -Chem Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America bisphenol s market based on the below-mentioned segments:

North America Bisphenol S Market, By Product Type

- Liquid

- Powder

North America Bisphenol S Market, By Sales Channel

- Direct Sales

- Indirect Sales

North America Bisphenol S Market, By End User

- Thermal Papers

- Fine Chemicals

- Epoxy Resins

- Phenolic Resins

- Others

Frequently Asked Questions (FAQ)

-

What is the North America bisphenol S market size?The North America bisphenol S market size is expected to grow from USD 0.02 million in 2024 to USD 0.15 million by 2035, growing at a CAGR of 20.1% during the forecast period 2025-2035

-

What is bisphenol S, and its primary use?The Bisphenol S (BPS) market refers to the production and use of BPS, a chemical compound commonly used as an alternative to bisphenol A in manufacturing. The production of polyether sulfone (PES) plastic requires bisphenol S (BPS) because manufacturers use this plastic to create hard plastic products and synthetic fibers found in clothing and various textile items

-

What are the key growth drivers of the market?Market growth is driven by the rising demand for products that do not contain BPA, which has pushed companies to choose BPS as their packaging material for food and personal care items.

-

What factors restrain the North America bisphenol S market?The market is restrained by the increasing health and environmental issues, with enhanced governmental inspections, potential toxic dangers, and expensive manufacturing costs.

-

How is the market segmented by product type?The market is segmented into liquid and powder.

-

Who are the key players in the North America bisphenol S market?Key companies include Addivant Corporation, Huntsman Corporation, SI Group, Connect Chemicals, Kessler Chemical, Solvay S.A., Changzhou Changyu Chemical Co., Ltd., Honshu Chemical Industry Co., Ltd, Jiangsu Aolunda High-Tech Industry Co., Ltd, and Nantong Volant -Chem Corp.

Need help to buy this report?