North America Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Form (Biofungicides, Bioherbicides, and Bioinsecticides), By Crop Type (Cash Crops, Horticultural Crops, and Row Crops), and North America Biopesticides Market Insights, Industry Trends, Forecast to 2035.

Industry: AgricultureNorth America Biopesticides Market Insights Forecasts to 2035

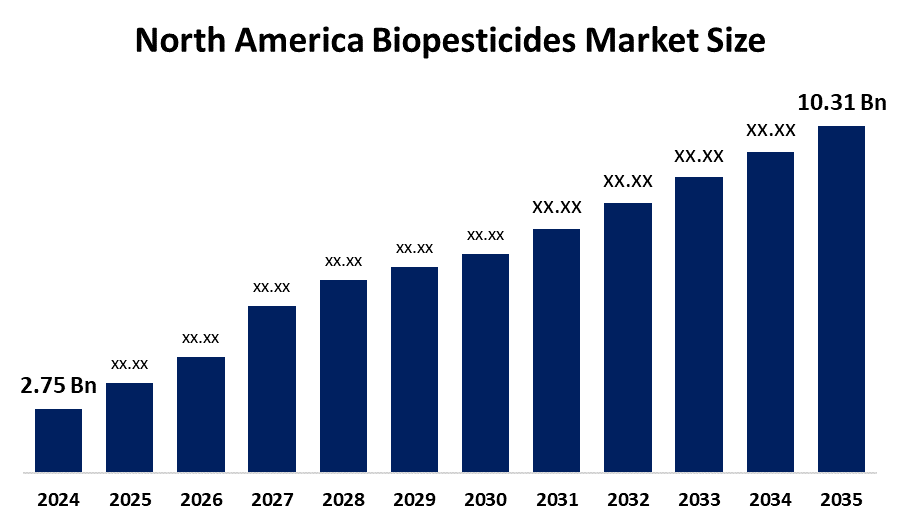

- The North America Biopesticides Market Size Was Estimated at USD 2.76 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.73% from 2025 to 2035

- The North America Biopesticides Market Size is Expected to Reach USD 10.31 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America biopesticides market size is anticipated to reach USD 10.31 Billion by 2035, growing at a CAGR of 12.73% from 2025 to 2035. The market is driven by growing concern about the environment among people who practice organic farming. The financial expansion is a sign of increased public understanding and the application of organic farming methods.

Market Overview

Biopesticides are natural and non-poisonous pest control agents obtained from microorganisms, plants, and biochemicals, and are liable to change the scenario of agriculture by taking their place automatically among field crops, horticulture, and turf management, controlling the organisms, and at the same time keeping the protection of soil and the meeting of EPA and USDA organic standards. to manage agricultural pests, diseases, and weeds without causing any significant harm to human beings, non-target organisms, and the ecosystem.

Regulatory authorities like the U.S. EPA and the PMRA in Canada back the growth of the biopesticide market by simplifying the approval processes and introducing regulations that favor the use of biopesticides. In 2024, Biobest, the world's leading company in biological control and pollination, revealed its completion of the purchase of BioWorks, Inc., a Victor, NY-based producer and seller of the most prominent biopesticides in the industry.

BASF SE brought the Texas purchase into the fold to introduce pioneering bionematicides thus gaining control over 30% of the corn protection contracts with 88% eco-friendly ratings and collaborations for precise spraying in Midwest states. Agriculture and Agri-Food Canada’s market report of December 2023 stated that the biopesticides used in the country had a 34% year-on-year increase, with British Columbia and Ontario being the top users. The provision of chemical pesticides has been made possible through the government's various incentive programs and consequently, the farmers have moved to biological alternatives.

Report Coverage

This research report categorizes the market for the North America biopesticides market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America biopesticides market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America biopesticides market.

North America Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.76 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.73% |

| 2035 Value Projection: | USD 10.31 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Crop Type |

| Companies covered:: | Certis Biologicals, Valent BioSciences LLC, Marrone Bio Innovations, BioWorks Inc., FMC Corporation, Lallemand Inc., Andermatt Group AG, UPL Ltd., Koppert B.V., Vestaron Corporation,and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biopesticides market in North America is driven by the increased demand for organic crop protection solutions, the implementation of integrated pest management (IPM) practices, and the development of new microbial fermentation technologies. In 2024, US crop protection sales surpassed USD 15 billion, which made more than 500 million acres of farmland treated annually and brought biopesticides closer to being a part of the whole farming system for better and more sustainable yield results. Environmental regulations were the main contributors to the USD 300 billion in green agriculture investments by 2025, and the primary focus was on microbial agents that would be certified by the EPA as biopesticides and would also meet the farmers’ needs for low-toxicity options.

Restraining Factors

The biopesticides market in North America is restrained by the regulatory framework that usually necessitates comprehensive testing and approval certification for biopesticide products has prevented the North American biopesticides market from growing. This is due to its delayed market entry and raises the costs for manufacturers as well.

Market Segmentation

The North America biopesticides market share is categorised into form and crop type.

- The biofungicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America biopesticides market is segmented by form into biofungicides, bioherbicides, and bioinsecticides. Among these, the biofungicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Biofungicides accounted for 46.0% of the biopesticides segment due to their ability to control soil and foliar pathogens, which usually threaten high-value crops in 2024. They are derived from natural organisms or their by-products, and the fungal pathogens are managed in a manner that neither harms the beneficial microbes nor the plants. The rise is attributed to the growing consumer preference for organic products, stricter regulations for residue-free produce, and the necessity to reduce the use of chemical fungicides.

- The row crops segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on crop type, the North America biopesticides market is segmented into cash crops, horticultural crops, and row crops. Among these, the row crops segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In the year 2024, row crops were responsible for the uptake of 92.6% of the total biopesticide volumes. Due to the extensive areas planted with corn, soybeans, and cotton in the Midwest and Southern Plains, which are the primary locations for these crops. The large-scale adoption of seed-treatment application methods also contributed to the high volume of biopesticides used in such crops.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America biopesticides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Certis Biologicals

- Valent BioSciences LLC

- Marrone Bio Innovations

- BioWorks Inc.

- FMC Corporation

- Lallemand Inc.

- Andermatt Group AG

- UPL Ltd.

- Koppert B.V.

- Vestaron Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2025, BioWorks launched PRINCIPLE WP bioinsecticide into the U.S. PRINCIPLE WP is a bioinsecticide based on the active ingredient Beauveria bassiana that delivers highly effective, resistance-free control on thrips, aphids, whiteflies, and more.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America biopesticides market based on the below-mentioned segments:

North America Biopesticides Market, By Form

- Biofungicides

- Bioherbicides

- Bioinsecticides

North America Biopesticides Market, By Crop Type

- Cash Crops

- Horticultural Crops

- Row Crops

Frequently Asked Questions (FAQ)

-

Q: What is the North America biopesticides market size?A: The North America biopesticides market size is expected to grow from USD 2.76 billion in 2024 to USD 10.31 billion by 2035, growing at a CAGR of 12.73% during the forecast period 2025-2035.

-

Q: What is Biopesticides, and its primary use?A: Biopesticides, which are natural and non-poisonous pest control agents obtained from microorganisms, plants, and biochemicals, are liable to change the scenario of agriculture by taking their place automatically among field crops, horticulture, and turf management, controlling the organisms.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rapid growth due to the increased demand for organic crop protection solutions, the implementation of integrated pest management (IPM) practices, and the development of new microbial fermentation technologies.

-

Q: What factors restrain the North America biopesticides market?A: The market is restrained by the regulatory framework that usually necessitates comprehensive testing and approval certification for biopesticide products has prevented the North American biopesticides market from growing.

-

Q: How is the market segmented by form?A: The market is segmented into biofungicides, bioherbicides, and bioinsecticides

-

Q: Who are the key players in the North America biopesticides market?A: Key companies include Certis Biologicals, Valent BioSciences LLC, Marrone Bio Innovations, BioWorks Inc., FMC Corporation, Lallemand Inc., Andermatt Group AG, UPL Ltd., Koppert B.V., and Vestaron Corporation.

Need help to buy this report?