North America Biomass Power Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Solid Biofuel, Liquid Biofuel, Biogas), By Technology (Combustion, Anaerobic Digestion, Gasification), and North America Biomass Power Market Size Insights, Industry Trends, Forecast to 2035

Industry: Energy & PowerNorth America Biomass Power Market Size Insights Forecasts to 2035

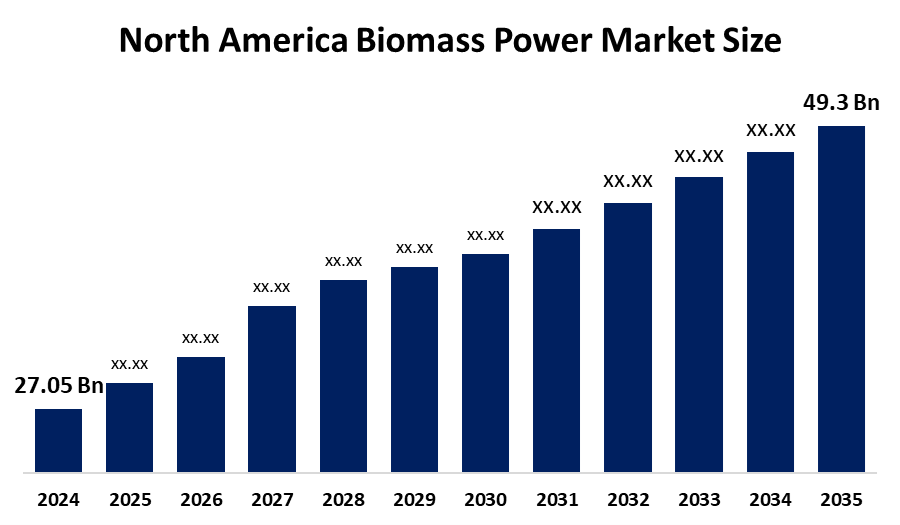

- The North America Biomass Power Market Size Was Estimated at USD 27.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.61% from 2025 to 2035

- The North America Biomass Power Market Size is Expected to Reach USD 49.3 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Biomass Power Market Size is anticipated to reach USD 49.3 Billion by 2035, growing at a CAGR of 5.61% from 2025 to 2035. The market is driven by the heightened awareness of environmental issues has led to trend where the renewable energy sector is gradually getting larger in the total electricity generation of various countries.

Market Overview

Biomass Power is the process that consists of generating electricity by using organic materials coming from plants and animals, such as wood, agricultural residues, animal manure, and certain parts of urban solid waste. The carbon emitted during combustion is believed to have been captured recently by the plants through photosynthesis. This energy source is called renewable since it is very close to carbon-neutral if managed properly. The primary method is direct combustion of biomass, which produces high-pressure steam that drives a turbine generator. Other methods are gasification and co-firing with coal in existing power stations.

In 2024, the company New Energy Blue, which specialises in clean energy and is the lowest-carbon developer of biofuels and biochemicals from crop residues, advances its Decarbonising America agenda by establishing New Energy Chemicals. In 2023, Allotrope Partners LLC, Axens North America, and Sumitomo Corporation of America teamed up to explore the commercial production of carbon biofuel from woody biomass sourced from forest thinning in California.

In November 2025, the U.S. Department of Energy declared an organisational restructuring. The existing Office of Energy Efficiency and Renewable Energy, alongside the Bioenergy Technologies Office, are to be included in the DOE units that will be affected.

Report Coverage

This research report categorizes the market for the North America Biomass Power Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Biomass Power Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Biomass Power Market Size.

North America Biomass Power Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 27.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.61% |

| 2035 Value Projection: | 49.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Feedstock, By Technology |

| Companies covered:: | Ameresco Inc., Xcel Energy Inc, Babcock & Wilcox Enterprises Inc, GE Aerospace, Drax Group, Enviva Partners, Covanta Energy, Veolia, Engie, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biomass power market in North America is driven by the increased focus and concern on the reduction of greenhouse gas (GHG) emissions and the transition towards renewable and clean power sources as a strategy to mitigate climate change, which has led to the classification of biomass as a renewable alternative to fossil fuels, thus resulting in the escalation of its demand. The government is promoting the financing and construction of biomass energy projects by supplying various incentives such as tax credits of the U.S. Inflation Reduction Act, the extension of the U.S. Renewable Fuel Standard, and Canada's Clean Fuel Standard. The technologies for converting biomass into electricity are making significant advances, with gasification and co-firing among the innovations, thus increasing the efficiency and decreasing the cost of biomass power generation, and making it more competitive.

Restraining Factors

The biomass power market in North America is restrained by the decrease in price of solar and wind energy has rendered them more desirable to investors and power companies. The biomass power plants are the most expensive among renewable energy power sources due to their high initial investment, and it is the U.S. Department of Energy that has estimated the initial investment to be between $2,000 and $4,500 for each installed kilowatt of capacity. The high initial costs and operating expenses make the project less financially appealing in comparison to other renewables.

Market Segmentation

The North America Biomass Power Market Size share is categorised into feedstock and technology.

- The solid biofuel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Biomass Power Market Size is segmented by feedstock into solid biofuel, liquid biofuel, biogas. Among these, the solid biofuel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2023, solid biofuel accounted for a major part of the total revenue, which was 78.01% share. Solid biofuel is made up of solid, organic, non-fossil-derived materials that are of biological origin. These materials are either used for the production of electricity or heat. The solid biofuel products that come under this category are wood pellets, animal waste, fuelwood, vegetable material, and wood residues.

- The combustion segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the North America Biomass Power Market Size is segmented into combustion, anaerobic digestion, gasification. Among these, the combustion segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by its established infrastructure and reliability in large-scale power generation. It is the source of more than 80%-90% of the worldwide energy produced from biomass. A great portion of this energy generated from biomass by burning technology is used for scoring and heating purposes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Biomass Power Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ameresco Inc.

- Xcel Energy Inc

- Babcock & Wilcox Enterprises Inc

- GE Aerospace

- Drax Group

- Enviva Partners

- Covanta Energy

- Veolia

- Engie

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Drax and NGIS launched a partnership to map carbon stocks of Drax’s North American biomass sourcing areas. Drax is a producer, user and seller of biomass pellets. It owns and operates Drax Power Station, which is the UK’s largest single source of renewable power.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Biomass Power Market Size based on the below-mentioned segments:

North America Biomass Power Market Size, By Feedstock

- Solid Biofuel

- Liquid Biofuel

- Biogas

North America Biomass Power Market Size, By Technology

- Combustion

- Anaerobic Digestion

- Gasification

Frequently Asked Questions (FAQ)

-

What is the North America Biomass Power Market Size?The North America Biomass Power Market Size is expected to grow from USD 27.05 billion in 2024 to USD 49.3 billion by 2035, growing at a CAGR of 5.61 % during the forecast period 2025-2035.

-

What is biomass power, and its primary use?Biomass power is the process that consists of generating electricity by using organic materials coming from plants and animals, such as wood, agricultural residues, animal manure, and certain parts of urban solid waste. The carbon emitted during combustion is believed to have been captured recently by the plants through photosynthesis.

-

What are the key growth drivers of the market?Market growth is driven by the increased focus and concern on the reduction of greenhouse gas emissions and the transition towards renewable and clean power sources as a strategy to mitigate climate change, which has led to the classification of biomass as a renewable alternative to fossil fuels, thus resulting in the escalation of its demand.

-

What factors restrain the North America Biomass Power Market Size?The market is restrained by the decrease in price of solar and wind energy has rendered them more desirable to investors and power companies. The biomass power plants are the most expensive among renewable energy power sources due to their high initial investment.

-

How is the market segmented by feedstock?The market is segmented into solid biofuel, liquid biofuel, biogas

-

Who are the key players in the North America Biomass Power Market Size?Key companies include Ameresco Inc., Xcel Energy Inc, Babcock & Wilcox Enterprises Inc, GE Aerospace, Drax Group, Enviva Partners, Covanta Energy, Veolia, and Engie.

Need help to buy this report?