North America Bacon Market Size, Share, and COVID-19 Impact Analysis, By Type (Regular and Ready-to-Eat), By Distribution Channel (Foodservice, Retail, Online, Hypermarkets and Supermarkets and Others), and North America Bacon Market Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesNorth America Bacon Market Size Insights Forecasts to 2035

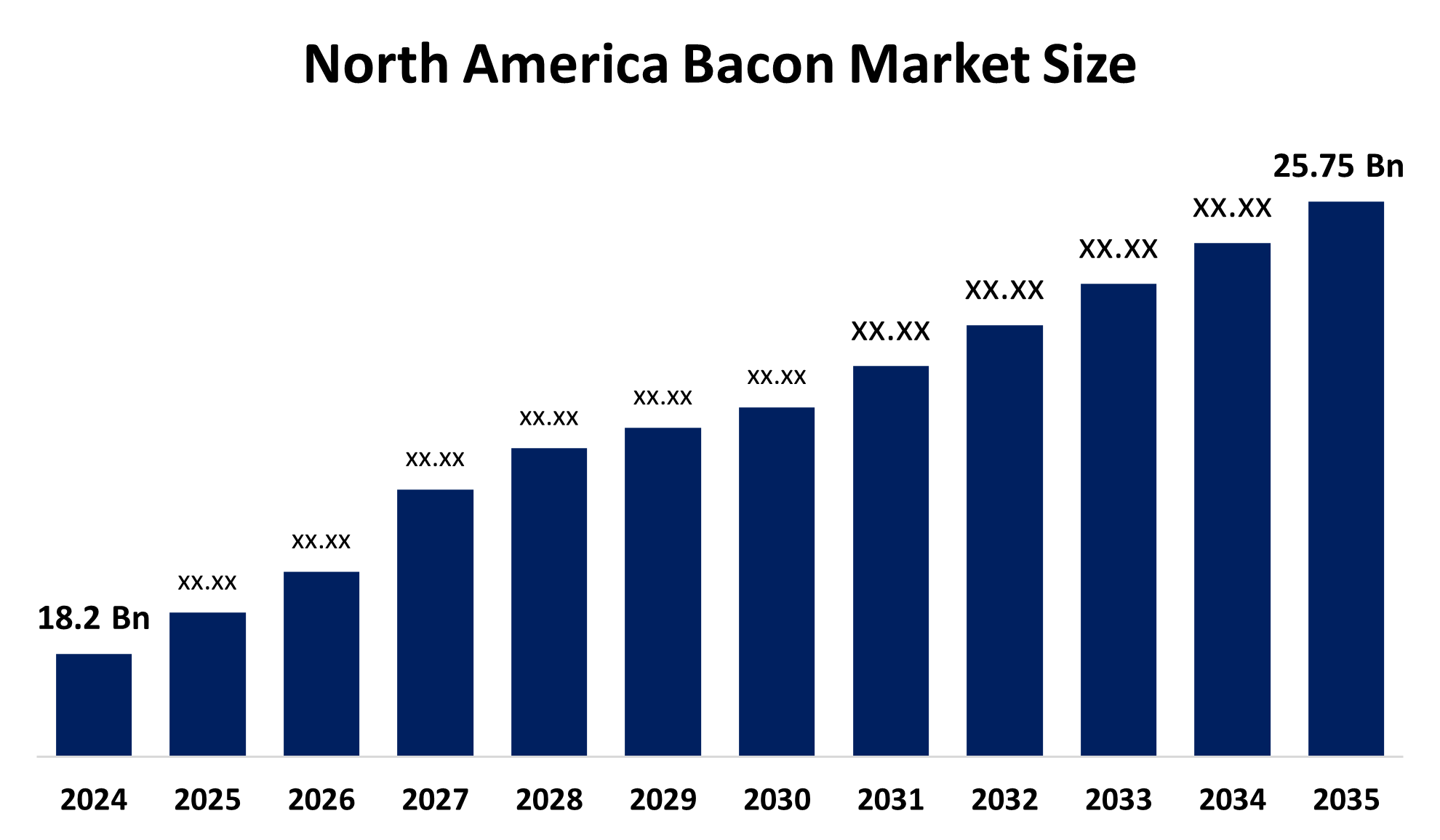

- The North America Bacon Market Size Was Estimated at USD 18.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.2% from 2025 to 2035

- The North America Bacon Market Size is Expected to Reach USD 25.75 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Bacon Market Size is Anticipated to Reach USD 25.75 Billion by 2035, Growing at a CAGR of 3.2% from 2025 to 2035. The market is driven by the increase in consumer demand for bacon products, which is due to the growing emphasis on premiumization of bacon offerings and the emergence of bacon as a versatile ingredient in various culinary applications.

Market Overview

Bacon is a meat product undergone a process and is made from the curing of different parts of the pig, primarily the belly and the loin. Bacon is cured pork, and among the various products of pork, bacon has the strongest taste and is therefore the most widely used as an ingredient. It is for this reason that bacon is added to and at the same time acts as a texture enhancer in many dishes, such as salads, baked potatoes, soups, and pizzas, to mention just a few.

In January 2025, North Country Smokehouse presents its novel Reduced Sodium, Organic Applewood Smoked Bacon, which is available now at Whole Foods Market all over the country. This handcrafted bacon boasts rich flavors with lower salt, and it is made from pork bellies that are marinated in genuine maple syrup and then very gradually smoked in small quantities.

Regulatory changes in the USA have highlighted the area of food safety, especially meat processing, along with bacon production, among others. The new laws stress the need for better traceability and visibility in the supply chain, thereby allowing the bacon products to be under stringent safety and quality rules regularly. The market for plant-based meat is predicted to be $74 billion, with bacon substitutes being the first to catch up. This is happening because people are gradually getting more health-conscious and environmentally friendly predispositions.

Report Coverage

This research report categorizes the market for the North America bacon market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America bacon market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Bacon Market Size.

North America Bacon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.2 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.2% |

| 2035 Value Projection: | USD 25.75 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Niman Ranch Rewiews, Oscar Mayer, Farmland LP, Hormel Foods Corp, The Kraft Heinz Co, Tyson Foods Inc., Smithfield Foods, Maple Leaf Foods, JBS S.A., Fresh Mark Inc., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The bacon market in North America is driven by busy lifestyles and urbanization have raised the demand for rapid and convenient meal solutions, resulting in the booming of the ready-to-eat and ready-to-cook bacon segments. The flexibility of bacon as a component in different meals, literally from breakfast to burgers and salads, has led this meat to become a necessary item in the menus of North American fast-food and casual dining restaurants. In addition, the increase in knowledge of protein consumption, which is at times associated with diets like keto and paleo, has made bacon a high-protein food choice that is consumed more often.

Restraining Factors

The bacon market in North America is hindered by consumer awareness regarding the health risks of high saturated fat, sodium, and preservatives in processed meats. The rise of vegan diets and the available meat alternatives present a serious challenge for traditional pork bacon producers.

Market Segmentation

The North America bacon market share is categorised into type and distribution channel.

- The regular segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Bacon Market Size is segmented by type into regular and ready-to-eat. Among these, the regular segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. With a revenue share of 59.06%, Regular was the largest segment in 2023. Regular bacon generally costs less than pre-cooked, ready-to-eat varieties, the latter of which usually include a price for the processing and special packaging. Regular bacon that is freshly cooked allows the consumer to obtain their desired crispness and texture, something that is not easy to achieve with the pre-cooked bacon versions.

- The retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the North America Bacon Market Size foodservice, retail, online, hypermarkets and supermarkets and others. Among these, the retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the growing status of bacon in home-made dishes, breakfast food, and ready-to-eat goods. The foodservice industry is also a big player, as doing so restaurants and cafes are including bacon in their wide range of dishes, thereby making them tastier and more attractive in terms of the menu.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Bacon Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Niman Ranch Rewiews

- Oscar Mayer

- Farmland LP

- Hormel Foods Corp

- The Kraft Heinz Co

- Tyson Foods Inc.

- Smithfield Foods

- Maple Leaf Foods

- JBS S.A.

- Fresh Mark Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Godshall’s Quality Meats launched a new chicken bacon product. Godshall’s Quality Meats, a third-generation family operation that produces smoked meats, confirmed it would be launching its newest product: Chicken Bacon

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Bacon Market Size based on the below-mentioned segments:

North America Bacon Market, By Type

- Regular

- Ready-to-Eat

North America Bacon Market, By Distribution Channel

- Foodservice

- Retail

- Online

- Hypermarkets and Supermarkets

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America bacon market size?A: The North America bacon market size is expected to grow from USD 18.2 billion in 2024 to USD 25.75 billion by 2035, growing at a CAGR of 3.2% during the forecast period 2025-2035.

-

Q: What is bacon, and its primary use?A: Bacon is a meat product that undergoes a process and is made mostly from the curing of the different parts of the pig, primarily the belly and the loin.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by busy lifestyles and urbanization have raised the demand for rapid and convenient meal solutions, resulting in the booming of the Ready-to-eat and Ready-to-cook bacon segments.

-

Q: What factors restrain the North America bacon market?A: The market is restrained by consumer awareness regarding the health risks of high saturated fat, sodium, and preservatives in processed meats.

-

Q: How is the market segmented by type?A: The market is segmented into regular and ready-to-eat.

-

Q: Who are the key players in the North America bacon market?A: Key companies include Niman Ranch Rewiews, Oscar Mayer, Farmland LP, Hormel Foods Corp, The Kraft Heinz Co, Tyson Foods Inc., Smithfield Foods, Maple Leaf Foods, JBS S.A., and Fresh Mark Inc.

Need help to buy this report?