North America B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments and Cross-Border Payments), By Payment Mode (Traditional, Digital), By Enterprise Size (Large Enterprise, Small and Medium Sized Enterprise), By End User (BFSI, Manufacturing, IT and Telecom, Metals and Mining and Others), and North America B2B Payments Market Insights, Industry Trends, Forecast to 2035

Industry: Banking & FinancialNorth America B2B Payments Market Insights Forecasts to 2035

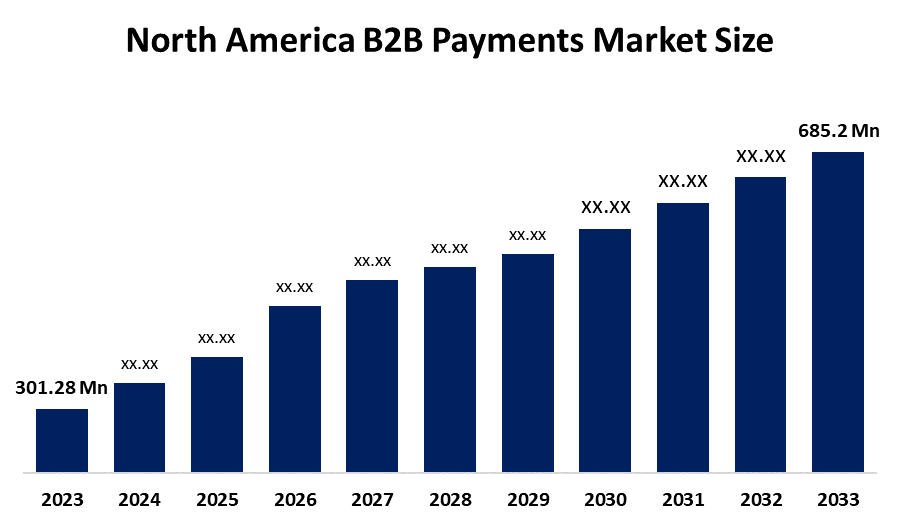

- The North America B2B Payments Market Size Was Estimated at USD 301.28 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.76% from 2025 to 2035

- The North America B2B Payments Market Size is Expected to Reach USD 685.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America B2B payments market size is anticipated to reach USD 685.2 Million by 2035, growing at a CAGR of 7.76% from 2025 to 2035. The market is driven by an increase in B2B payments due to growing trade volume between the parties involved in cross-border transactions. Nevertheless, businesses are still able to improve their performance through enhanced data analysis and the use of novel tools and platforms.

Market Overview

Business-to-business (B2B) payment systems allow merchants involved in ongoing and repetitive transactions to have more secure transactions, and also offer a variety of functions for users, such as accounts receivable, accounts payable, payroll and acquisition departments. Business-to-business (B2B) transactions are more complicated than business-to-consumer (B2C) transactions since B2B processing takes longer to get the approval and settlement of the transaction.

The total funding has come to €13 million, headed by Idekapital and Shine Capital, with contributions from new investor Investinor and previous ones Antler, Sequoia Capital, Alliance Ventures, Arkwright, and Local Globe. In 2022, research on digital payments performed by the Association of Financial Professionals (AFP), North American firms pointed out payment speed (48%), payment certainty (42%), and fraud risk (41%) as the main issues concerning them. 48% of US & Canadian companies hold the view that the speed of payments does not affect their company at all.

AI is changing the B2B payment transaction market by allowing automation, predictive analytics, and fraud detection all at once. Every B2B payment will still be made and even left unprocessed thanks to AI agents' intervention. In October 2025, BILL introduced AI agents into its platform for automating financial functions, thus facilitating completely paperless B2B payment transactions for corporations.

Report Coverage

This research report categorizes the market for the North America B2B payments market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America B2B payments market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America B2B payments market.

North America B2B Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 301.28 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.76% |

| 2035 Value Projection: | USD 685.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Payment Type, By Payment Mode, By End User |

| Companies covered:: | Visa, Mastercard, American Express, PayPal, Stripe, Fiserv, Global Payments, JPMorgan Chase, Elavon, Fiserv,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The B2B payments market in North America is driven by the market, 64% of B2B sales are performed on credit, which indicates that businesses are relying more and more on trade credit in order to compete effectively. By facilitating the process and using automation for B2B payments, people can avoid cash flow issues, and the outcome of the business can be more reliable and profitable. One of the prominent shifting patterns in the North America B2B payments market is the rapid uptake of digital payment methods by business entities. As the payment industry continues to make technological advancements and innovatively develop its services, digital payments have become much more secure and faster compared to traditional methods.

Restraining Factors

The B2B payments market in North America is restrained by digital payments signify the transfer of delicate financial information, which is why they need to be well protected against cyber-attacks and fraud. Business-to-business (B2B) payments, which are the money transfers between companies, are extremely important for keeping the operations running without any interruptions and for the companies' growth.

Market Segmentation

The North America B2B Payments market share is categorised into payment type, payment mode, enterprise size and end user.

- The domestic payments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America B2B payments market is segmented by payment type into domestic payments and cross-border payments. Among these, the domestic payments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by transacting domestically helps companies take advantage of the current banking partners and payment systems, which need very little cost for setting up and fast-tracking approvals. The infrastructure already in place and developed over time makes domestic transactions less complicated than the new foreign market arrangements.

- The traditional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on payment mode, the North America B2B payments market is segmented into traditional, digital. Among these, the traditional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the established familiarity, adherence to legal norms, and alignment with existing government regulations. In fact, the prevalent techniques are coming from such reasons as their being recognized and compliance with regulations and therefore fewer risks associated with them.

- The large enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America B2B payments market is segmented by enterprise size into large enterprise, small and medium sized enterprise. Among these, the large enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the priority to optimized payment platforms. To coordinate complex supply chains and thousands of vendor relationships using outdated manual methods. The high fixed costs are justifiable in merging partnerships onto platforms that are moving approval workflows, payments, and remittance among divisions and vendors.

- The manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America B2B payments market is segmented into BFSI, manufacturing, IT and telecom, metals and mining and others. Among these, the manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by a large number of suppliers, hence a large number of purchases, and a huge number of high-value transactions. Manufacturing is the sector that has the largest impact on total B2B transaction value, as it is the one with the highest number of payment flows, e.g., continuous sourcing of raw materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America B2B payments market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Visa

- Mastercard

- American Express

- PayPal

- Stripe

- Fiserv

- Global Payments

- JPMorgan Chase

- Elavon

- Fiserv

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2025, Prometeo, a leading fintech infrastructure company connecting global corporations with financial institutions in Latin America and the United States, announced the launch of its Borderless Banking offering to support business-to-business (B2B) financial operations between the U.S. and LatAm markets.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America B2B payments market based on the below-mentioned segments:

North America B2B Payments Market, By Payment Type

- Domestic Payments

- Cross-Border Payments

North America B2B Payments Market, By Payment Mode

- Traditional

- Digital

North America B2B Payments Market, By Enterprise size

- Large Enterprises

- Small and Medium-Sized Enterprises

North America B2B Payments Market, By End User

- BFSI

- Manufacturing

- IT and Telecom

- Metals and Mining

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America B2B payments market size?A: The North America B2B payments market size is expected to grow from USD 301.28 million in 2024 to USD 685.2 million by 2035, growing at a CAGR of 7.76% during the forecast period 2025- 2035

-

Q: What is B2B payments, and its primary use?A: Business-to-business (B2B) payment systems enable merchants engaging in periodic and recurring transactions to have safer transactions while they also provide a wide range of tasks for the end users, like accounts receivable, accounts payable, payroll, and acquisition departments.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the market, 64% of B2B sales are already performed on credit, which indicates that businesses are relying more and more on trade credit in order to compete effectively and rapid uptake of digital payment methods by business entities.

-

Q: What factors restrain the North America B2B payments market?A: The market is restrained by the digital payments signify the transfer of delicate financial information, which is why they need to be well protected against cyber-attacks and fraud. B2B, which are the money transfers between companies, are important for keeping the operations running without any interruptions and for the companies' growth.

-

Q: How is the market segmented by payment type?A: The market is segmented into domestic payments and cross-border payments.

-

Q: Who are the key players in the North America B2B payments market?A: Key companies include Visa, Mastercard, American Express, PayPal, Stripe, Fiserv, Global Payments, JPMorgan Chase, Elavon, and Fiserv.

Need help to buy this report?