North America Avocado Market Size, Share, and COVID-19 Impact Analysis, By Form (Fresh, Processed, Pulp, Guacamole, and Others), By Distribution Channel (B2B, Processing Industry, Foodservice Industry, and B2C), and North America Avocado Market Size Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesNorth America Avocado Market Size Insights Forecasts to 2035

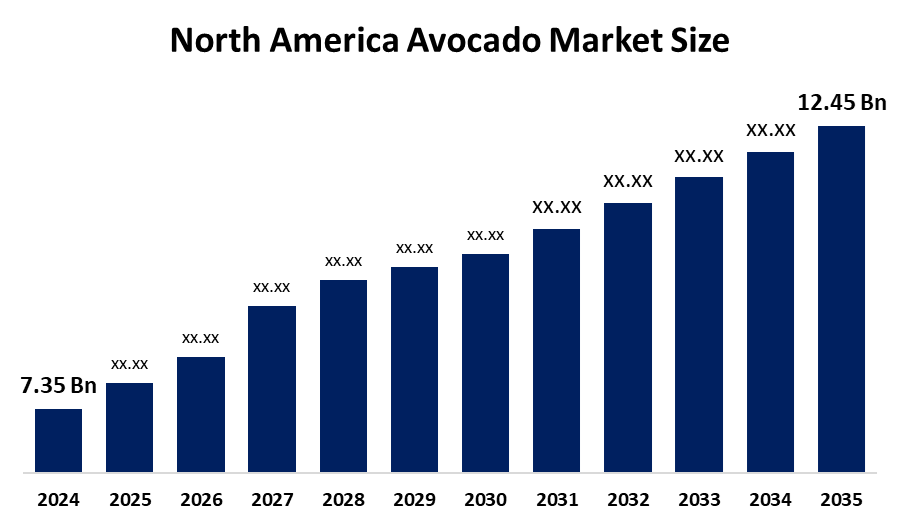

- The North America Avocado Market Size Was Estimated at USD 7.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.91% from 2025 to 2035

- The North America Avocado Market Size is Expected to Reach USD 12.45 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Avocado Market Size is Anticipated to Reach USD 12.45 Billion by 2035, Growing at a CAGR of 4.91% from 2025 to 2035. The market is driven by the increasing recognition of avocados' health benefits, with their rich nutritional content fueling consumer demand.

Market Overview

The avocado market refers to the overall production, consumption, and trade of avocado fruit, along with all kinds of its derived products. Avocados are loaded with the most important vitamins such as C, E, K, and B-6, as well as minerals like riboflavin, niacin, vitamin B-12 and pantothenic acid, and others. The antioxidant benefits of the avocado along with its use in food, are some of the factors driving its market growth. The cosmetic and personal care industry is faced with a rising demand for avocado oil and extracts due to their premium nutrient composition and skin benefits.

The United States remains the main market for avocados in North America. In 2024, it took in more than 80% of Mexico's avocado exports, which were measured in tons. The U.S. always depends on Mexico, which provides around 88% of its entire avocado imports, with the highest shipments happening from December to February.

California is the number one state for avocado production in the US. This is due to its over 3,000 avocado growers covering more than 50,000 acres altogether. In August 2025, Fresh Del Monte Produce announced a new joint venture with Managro Group, an agricultural company based in Colombia, and a major exporter of limes and avocados. The recent sales of organic avocados increased by 13%, which is an indication of the consumers' preference for sustainable and chemical-free products.

Report Coverage

This research report categorizes the market for the North America Avocado Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Avocado Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Avocado Market Size.

North America Avocado Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 7.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.91% |

| 2035 Value Projection: | 12.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Distribution Channel |

| Companies covered:: | EMPACADORA DE AGUACATES SAN LORENZO S.A, West Pak Avocado, Mission Produce Inc, Simpson Manufacturing Co Inc, Calavo Growers, Inc, Mission Produce, Inc., Henry Avocado Corporation, AvoAmerica Exporters, Del Monte Fresh Produce N.A, Del Rey Avocado Co., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The avocado market in North America is driven by the process of elevating personal well-being through food and lifestyle choices. Hass avocados are the main ones exported owing to their long shelf life, great taste, and also strong character during transportation. According to the USDA, organic avocado sales have gone up by 13% in 2023, which mirrors customers' inclination towards sustainable and healthier choices. this trend is seen in the middle-class population in the developing countries, where the demand for healthy and nutrient-rich diets is fueled by higher income and health awareness. Over time, the popularity of processed and ready-to-eat avocado products like guacamole, oil, and slices has been rapidly increasing.

Restraining Factors

The avocado market in North America is restrained by the perishable nature of avocados, which heralds the use of modern technologies to improve their shelf life. the use of avocado oil is still limited compared to other edible oils. Seasonal supply fluctuations refer to the ups and downs in avocado availability caused by changing production cycles and the weather.

Market Segmentation

The North America Avocado Market Size share is categorised into form and distribution channel.

- The fresh segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Avocado Market Size is segmented by form into fresh, processed, pulp, guacamole, and others. Among these, the fresh segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2023, the Fresh segment accounted for a remarkable 77.64% of the revenue share. The demand for fresh fruits has increased so much that suppliers are introducing technological innovations in their production processes. The customers' taste for fresh avocados can be associated with the rising trend of fresh meals and the easy availability of the product. The fresh form's high fiber content fosters healthy bowel function, prevents constipation, facilitates digestion, and reduces the risk of getting colon cancer.

- The B2C segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the North America Avocado Market Size is segmented into B2B, processing industry, foodservice industry, and B2C. Among these, the B2C segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the B2C channel consists of e-commerce, supermarkets and hypermarkets, convenience stores, speciality stores, and other retail outlets. Due to changing eating habits, consumers are willing to pay extra for a variety of goods that are high-quality, fresh, safe, and convenient.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Avocado Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EMPACADORA DE AGUACATES SAN LORENZO S.A

- West Pak Avocado

- Mission Produce Inc

- Simpson Manufacturing Co Inc

- Calavo Growers, Inc

- Mission Produce, Inc.

- Henry Avocado Corporation

- AvoAmerica Exporters

- Del Monte Fresh Produce N.A

- Del Rey Avocado Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Mexico launched a program to export avocados without contributing to deforestation. Mexican avocados are produced and exported without deforestation, meet phytosanitary standards, and provide fair, safe working conditions for workers, excluding child labour.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Avocado Market Size based on the below-mentioned segments:

North America Avocado Market Size, By Form

- Fresh

- Processed

- Pulp

- Guacamole

- Others

North America Avocado Market Size, By Distribution Channel

- B2B

- Processing Industry

- Foodservice Industry

- B2C

Frequently Asked Questions (FAQ)

-

What is the North America Avocado Market Size?The North America Avocado Market Size is expected to grow from USD 7.35 billion in 2024 to USD 12.45 billion by 2035, growing at a CAGR of 4.91% during the forecast period 2025-2035.

-

What is avocado, and its primary use?The avocado market refers to the overall production, consumption, and trade of avocado fruit, along with all kinds of its derived products. Avocados are loaded with the most important vitamins such as C, E, K, and B-6, as well as minerals like riboflavin, niacin, vitamin B-12 and pantothenic acid, and others.

-

What are the key growth drivers of the market?Market growth is driven by the process of elevating personal well-being has been through food and lifestyle choices. Hass avocados are the main ones exported owing to their long shelf life, great taste, and also strong character during transportation

-

What factors restrain the North America Avocado Market Size?The market is restrained by the perishable nature of avocados heralds the use of modern technologies to improve their shelf life. the use of avocado oil is still limited compared to other edible oils

-

How is the market segmented by form?The market is segmented into fresh, processed, pulp, guacamole, and others

-

Who are the key players in the North America Avocado Market Size?Key companies include EMPACADORA DE AGUACATES SAN LORENZO S.A, West Pak Avocado, Mission Produce Inc., Simpson Manufacturing Co. Inc., Calavo Growers, Inc., Mission Produce, Inc., Henry Avocado Corporation, AvoAmerica Exporters, Del Monte Fresh Produce N.A., and Del Rey Avocado Co.

Need help to buy this report?