North America Arthroscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Arthroscopy Fluid Management Systems, Arthroscopy Visualization Systems, Arthroscopy Implants, Arthroscopy Shavers, Arthroscopy RF Ablation Systems, Arthroscopy RF Wands, and Others), By End User (Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, Community Hospitals, and Others), and North America Arthroscopy Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareNorth America Arthroscopy Devices Market Insights Forecasts to 2035

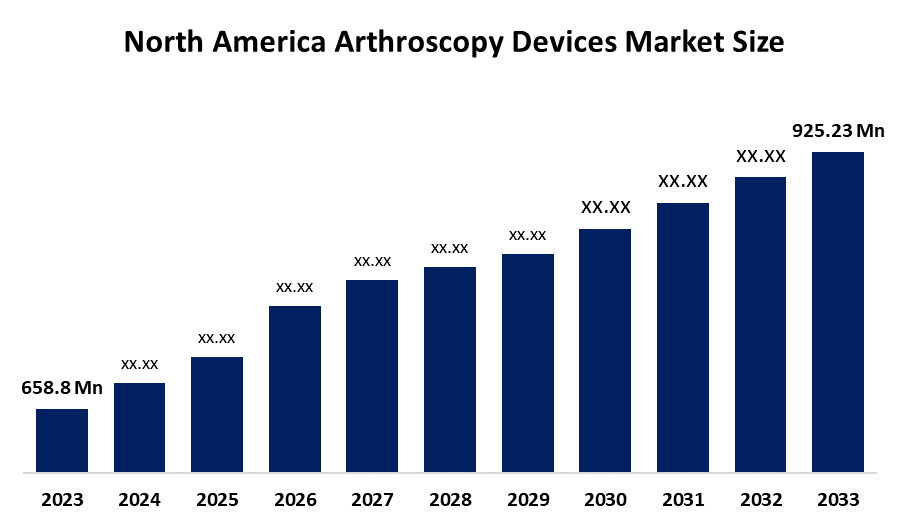

- The North America Arthroscopy Devices Market Size Was Estimated at USD 658.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.16% from 2025 to 2035

- The North America Arthroscopy Devices Market Size is Expected to Reach USD 925.23 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Arthroscopy Devices Market is anticipated to reach USD 925.23 million by 2035, growing at a CAGR of 3.16% from 2025 to 2035. The primary drivers of the market are the rising sports injuries, growing prevalence of osteoarthritis and joint disorders, technological advancements in minimally invasive surgery, and an aging population that is more prone to musculoskeletal conditions.

Market Overview

The North America Arthroscopy Devices Market Size refers to the segment of the medical device industry that focuses on instruments and equipment used in arthroscopic procedures; minimally invasive surgeries performed to diagnose and treat joint-related conditions such as ligament tears, cartilage damage, and arthritis. Arthroscopy devices are specialized instruments such as arthroscopes, implants, fluid management systems, RF systems, and visualization equipment that enable surgeons to perform minimally invasive joint surgeries by inserting a small camera and tools into the joint, resulting in faster recovery times than traditional open procedures. The North American market is divided into applications such as knee, hip, spine, shoulder, elbow, and other joints, and product types, including arthroscopes, implants, fluid management systems, RF systems, visualization systems, and accessories. Moreover, the North American arthroscopy devices market is significant because of its growing healthcare demand, which is being driven by an increase in sports injuries, osteoarthritis, and other joint disorders, as well as continuous technological advancements in imaging and surgical tools that improve precision and patient outcomes. So, the most significant drop in knee surgeries happened early in the pandemic. This had a further impact on the expansion of the arthroscopic device industry during the epidemic. However, the sector has been doing well since the restrictions were eased. Over the last two years, the industry has recovered due to an increase in orthopedic procedures and marketing methods used to sell arthroscopy gadgets.

In January 2023, Zimmer Biomet bought Embodiment, Inc. For USD 155 million upfront plus up to USD 120 million in milestones, with a focus on soft tissue healing technology related to arthroscopy. Lazurite's arthrofree wireless surgical camera system was approved by the FDA.

In November 2022, as part of a collaboration with the Hospital for Special Surgery, to improve arthroscopic endoscopic procedures. Miach Orthopaedics won a USD 20 million series B extension in Q2 2024 for its bear implant, which is utilized in ACL repairs and will enable us to commercialize.

Report Coverage

This research report categorises the market for the North America arthroscopy devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America arthroscopy devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America arthroscopy devices market.

North America Arthroscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 658.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.16% |

| 2035 Value Projection: | USD 925.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type.By End User |

| Companies covered:: | Stryker Corporation, Arthrex, Inc., Smith & Nephew plc, ConMed Corporation, Medtronic plc, Johnson & Johnson, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American arthroscopy devices market is driven by increased sports injuries, an increase in osteoarthritis and other orthopedic problems, technological advancements that improve minimally invasive procedures, and an aging population that is more susceptible to joint ailments. These technologies aid in faster healing and shorter hospital stays, harmonizing with the healthcare system's push toward outpatient care. Moreover, the market is additionally being influenced by an increase in arthroscopic treatments performed as outpatients in ambulatory surgery centers (ASCs) due to lower costs and increased patient convenience. Additionally, attractive reimbursement policies in industrialized economies are encouraging more patients to choose arthroscopic operations. Another key driving element is the increased use of biodegradable implants and absorbable sutures, which improve post-operative recovery and reduce the need for revision surgeries.

Restraining Factors

The North America arthroscopy devices market faces key restraints such as high device costs, reimbursement challenges, regulatory hurdles, and limited access in smaller healthcare facilities.

Market segmentation

The North America arthroscopy devices market share is classified into product type and end user.

- The arthroscopy fluid management systems segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America arthroscopy devices market is divided by product type into arthroscopy fluid management systems, arthroscopy visualization systems, arthroscopy implants, arthroscopy shavers, arthroscopy RF ablation systems, arthroscopy RF wands, and others. Among these, the arthroscopy fluid management systems segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by playing a crucial role in maintaining clear visibility during procedures by regulating irrigation and suction, and it accounts for a significant market share since they are indispensable in almost all arthroscopic surgeries.

- The hospitals segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America arthroscopy devices market is segmented by end user into hospitals, ambulatory surgical centers, orthopedic clinics, community hospitals, and others. Among these, the hospitals segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment driven by their comprehensive infrastructure, which includes cutting-edge arthroscopy devices, imaging technology, and specialized orthopedic departments, allowing them to handle large patient volumes and complex surgical procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America arthroscopy devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stryker Corporation

- Arthrex, Inc.

- Smith & Nephew plc

- ConMed Corporation

- Medtronic plc

- Johnson & Johnson

- Others

Recent Developments:

- In June 2025, Arthrex launched Synergy Power, a battery-powered orthopedic system for sports medicine and arthroscopy, offering versatile attachments for procedures like knee and shoulder repairs. Offering Features like Versatile attachments for procedures like knee and shoulder repairs, designed to improve mobility and reduce reliance on external power sources.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America arthroscopy devices market based on the below-mentioned segments:

North America Arthroscopy Devices Market, By Product Type

- Arthroscopy Fluid Management Systems

- Arthroscopy Visualization Systems

- Arthroscopy Implants

- Arthroscopy Shavers

- Arthroscopy Rf Ablation Systems

- Arthroscopy Rf Wands

- Others

North America Arthroscopy Devices Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Clinics

- Community Hospitals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current and forecasted size of the North America arthroscopy devices market?A: The market was valued at approximately USD 658.8 million in 2024 and is projected to grow at a CAGR of 3.16%, reaching around USD 925.23 million by 2035.

-

What are the primary product types in the North America arthroscopy devices market?A: The primary product types are arthroscopy fluid management systems, arthroscopy visualization systems, arthroscopy implants, arthroscopy shavers, arthroscopy RF ablation systems, arthroscopy RF wands, and others.

-

Q: What is the main end user in the market?A: The main end user is hospitals, ambulatory surgical centers, orthopedic clinics, community hospitals, and others.

-

Q: What are the key driving factors for market growth?A: Growth is driven by the rising sports injuries, growing prevalence of osteoarthritis and joint disorders, technological advancements in minimally invasive surgery, and an aging population that is more prone to musculoskeletal conditions.

-

Q: What challenges does the market face?A: Challenges include high device costs, reimbursement challenges, regulatory hurdles, and limited access in smaller healthcare facilities.

-

Q: Who are some key players in the market?A: Key companies include Stryker Corporation, Arthrex, Inc., Smith & Nephew plc, ConMed Corporation, Medtronic plc, Johnson & Johnson, and others.

Need help to buy this report?