North America Aniline Market Size, Share, and COVID-19 Impact Analysis, By Application (MDI/Polyurethanes, Rubber Chemicals, Dyes & Pigments, Agrochemicals, Pharma, and Others), By End-Use Industry (Automotive, Construction, Textiles, Agriculture, and Others), and North America Aniline Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Aniline Market Insights Forecasts to 2035

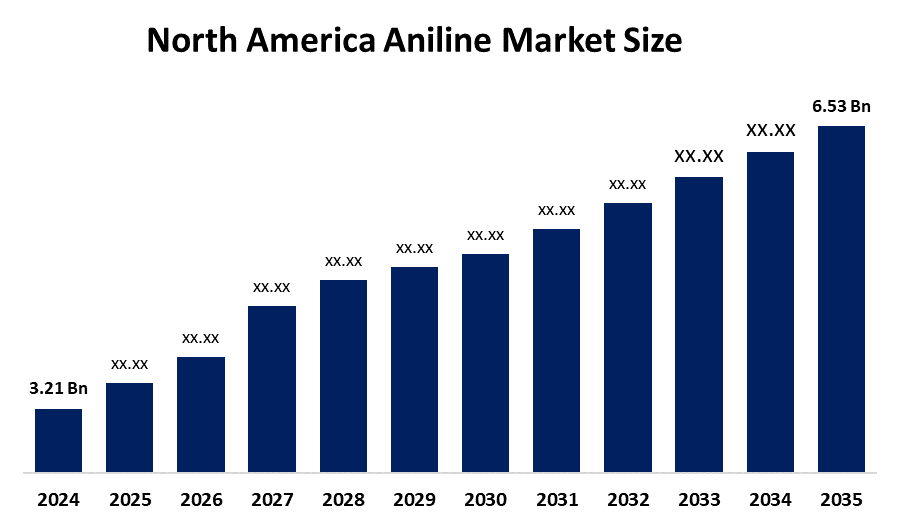

- The North America Aniline Market Size Was Estimated at USD 3.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.67% from 2025 to 2035

- The North America Aniline Market Size is Expected to Reach USD 6.53 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Aniline Market Size is anticipated to reach USD 6.53 billion by 2035, growing at a CAGR of 6.67% from 2025 to 2035. The primary drivers of the market are polyurethane demand in construction and automotive, growth in rubber-processing chemicals, and applications in pharmaceuticals, dyes, and agrochemicals.

Market Overview

The North America Aniline Market Size involves the manufacturing and usage of aniline (C6H5NH2), the most basic aromatic amine used as a chemical building block. It is essential for the production of methylene diphenyl diisocyanate (MDI), which is used in polyurethane foams for construction, automobiles, and appliances, as well as in rubber-processing chemicals, dyes, pigments, medicines, and agrochemicals. This market encompasses synthetic and emerging bio-based aniline, serving a range of sectors, including infrastructure, consumer goods, and agriculture. Aniline is mainly utilized to make a variety of industrial chemicals, including methylene diphenyl diisocyanate (MDI), which is essential in the creation of polyurethane foams. In agrochemicals, aniline derivatives are important components in pesticide and herbicide formulations, which boost agricultural output. Furthermore, dyes and pigments have numerous important applications, with aniline-based compounds being widely utilized in the textile industry for coloration purposes. Rubber processing also accounts for a significant portion, as aniline plays an important role in improving the qualities of rubber products, ensuring durability and performance. Emerging trends show a rising emphasis on sustainability and regulatory compliance. With increased scrutiny on chemical production and usage, there is a noticeable trend toward greener alternatives and improved safety measures in the manufacture of aniline-based goods. Additionally, as consumer behavior shifts toward more environmentally sensitive products, the North American aniline market positions itself at the confluence of innovation, regulatory adaptability, and consumer expectations.

In 2025, BASF plans to upgrade its nitrobenzene/aniline production facility through a capacity optimization project. The program aims to increase working hours and efficiency to fulfill the rising demand for methylene diphenyl diisocyanate (MDI), a vital precursor for polyurethane foams widely used in construction, automotive, and consumer goods.

Report Coverage

This research report categorises the market for the North America Aniline Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America aniline market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America aniline market.

North America Aniline Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.21 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.67% |

| 2035 Value Projection: | USD 6.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By End-Use Industry |

| Companies covered:: | BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group, Sumitomo Chemical Co., Narmada Chematur, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America Aniline Market Size is being driven by increased demand for methylene diphenyl diisocyanate (MDI), which is required for the production of polyurethane foams used in construction, automotive, and consumer goods. The growth of the automobile industry increases the demand for lightweight materials and rubber-processing chemicals, while the construction industry benefits from energy-efficient insulation solutions. Furthermore, medicines, agrochemicals, dyes, and pigments contribute to aniline's diverse applications, providing consistent demand across numerous industries, despite ongoing hurdles such as rigorous environmental laws and raw material price instability.

Restraining Factors

The North America aniline market faces key restraints such as strict environmental regulations, volatile benzene feedstock prices, health and safety concerns, and limited diversification.

Market segmentation

The North America Aniline Market share is classified into application and end-use industry.

- The MDI/polyurethanes segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America Aniline Market Size is divided by application into MDI/polyurethanes, rubber chemicals, dyes & pigments, agrochemicals, pharma, and others. Among these, the MDI/polyurethanes segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by Polyurethane foams, which are produced for usage as construction insulation in energy-efficient buildings, car seating and interiors, and domestic appliances such as refrigeration units, adhesives, and coatings. This leadership is driven by the growing need for sustainable, energy-efficient materials, as well as the automotive industry's desire for lightweight, long-lasting solutions.

- The construction segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America Aniline Market Size is segmented by end-use industry into automotive, construction, textiles, agriculture, and others. Among these, the construction segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment because MDI-derived polyurethane foams are vital for insulation in energy-efficient buildings, matching with higher sustainability regulations and increasing demand for green infrastructure. Automotive follows closely, since polyurethane is commonly utilized in seating, interiors, and lightweight components that improve fuel efficiency and comfort. These industries dominate consumption because they are the largest and most constant users of aniline, while other sectors, such as textiles, agriculture, and medicines, provide smaller, more specialized demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America aniline market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Wanhua Chemical Group

- Sumitomo Chemical Co.

- Narmada Chematur

- Others

Recent Developments:

- In February 2024, Covestro achieved a breakthrough in sustainable chemistry by launching a pilot plant in Leverkusen, Germany, dedicated to producing bio-based aniline from plant-derived biomass. Using a combination of fermentation and catalytic conversion, the project proved that aniline can be manufactured entirely from renewable sources. The bio-based aniline is intended mainly for MDI production, which is critical in polyurethane foams used across insulation, furniture, and automotive applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America aniline market based on the below-mentioned segments:

North America Aniline Market, By Application

- MDI/Polyurethanes

- Rubber Chemicals

- Dyes & Pigments

- Agrochemicals

- Pharma

- Others

North America Aniline Market, By End-Use Industry

- Automotive

- Construction

- Textiles

- Agriculture

- Others

Frequently Asked Questions (FAQ)

-

What is the current and forecasted size of the North America aniline market?The market was valued at approximately USD 3.21 billion in 2024 and is projected to grow at a CAGR of 6.67%, reaching around USD 6.53 billion by 2035.

-

What are the primary applications in the North America aniline market?The primary applications are MDI/polyurethanes, rubber chemicals, dyes & pigments, agrochemicals, pharma, and others. Among these, the mdi/polyurethanes segment held a substantial share in 2024. The segment is driven by Polyurethane foams, which are produced for usage as construction insulation in energy-efficient buildings, car seating and interiors, and domestic appliances such as refrigeration units, adhesives, and coatings.

-

What is the main end-use industry in the market?The main end-use industry is automotive, construction, textiles, agriculture, and others. Among these, the construction segment dominated the market in 2024. This is the dominant segment because MDI-derived polyurethane foams are vital for insulation in energy-efficient buildings, matching with higher sustainability regulations and increasing demand for green infrastructure.

-

What are the key driving factors for market growth?Growth is driven by the polyurethane demand in construction and automotive, growth in rubber-processing chemicals, and applications in pharmaceuticals, dyes, and agrochemicals.

-

What challenges does the market face?Challenges include strict environmental regulations, volatile benzene feedstock prices, health and safety concerns, and limited diversification.

-

Who are some key players in the market?Key companies include BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group, Sumitomo Chemical Co., Narmada Chematur, and others.

Need help to buy this report?