North America Aircraft MRO Market Size, Share, and COVID-19 Impact Analysis, By Type (Airframe, Engine, Component), By Application (Line Maintenance and Base Maintenance), By Aircraft Type (Commercial Aircraft, Military Aircraft, Business and General Aviation), and North America Aircraft MRO Market Size Insights, Industry Trends, Forecast to 2035

Industry: Aerospace & DefenseNorth America Aircraft MRO Market Size Insights Forecasts to 2035

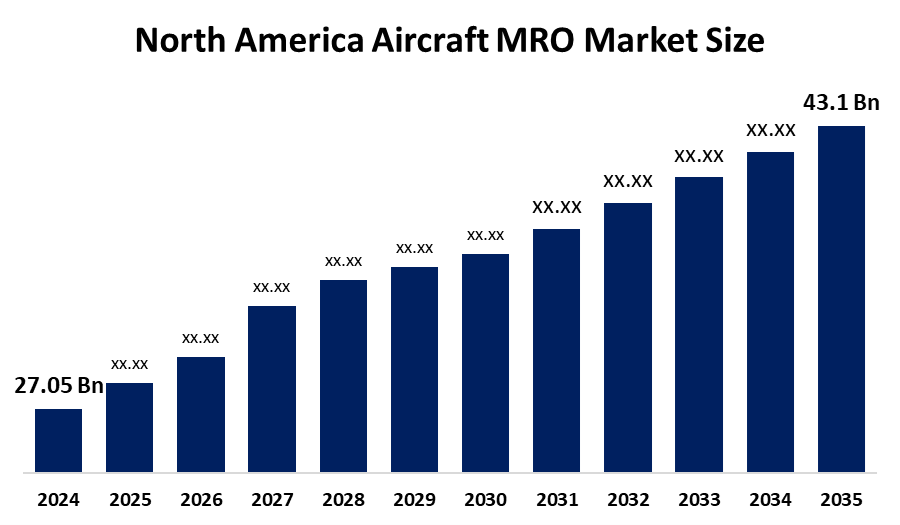

- The North America Aircraft MRO Market Size Was Estimated at USD 27.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.33% from 2025 to 2035

- The North America Aircraft MRO Market Size is Expected to Reach USD 43.1 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Aircraft MRO Market Size is anticipated to reach USD 43.1 Billion by 2035, growing at a CAGR of 4.33% from 2025 to 2035. The market is driven by factors such as a large and aging aircraft fleet, increasing air travel demand, and stringent safety regulations

Market Overview

The aircraft maintenance, repair, and overhaul (MRO) market is a solid and developing sector, powered by a complicated combination of economic, operational, and technological factors. The airlines are recovering from the pandemic and are facing new challenges, but the demand for MRO services keeps growing. These services are considered to be crucial in the safety and efficiency of flying as they involve carrying out routine inspections and conducting complex overhauls of both turbine and piston engines to meet the standards set by the FAA and ICAO. Core structural inspections and control of corrosion and structural repairs, which usually take place inside the hangars, are usually done.

In February 2025, Air France Industries KLM Engineering & Maintenance and Air Canada entered into a 10-year Component Support agreement concerning 58 B787 Dreamliners, thus creating a new pool stock in Toronto aimed at providing better support for Air Canada’s growing operations.

The Canadian government, through its Strategic Innovation Fund, is encouraging the growth of MRO, which is also the case with the planned new CAD 120 million LEAP-1B shop in Calgary that is going to be opened in 2027. The IAP and FAP are still not done with their emission and hazardous waste standard tightening, and this has forced MRO suppliers to set up more complicated waste disposal systems just to keep their operating licenses.

Report Coverage

This research report categorizes the market for the North America Aircraft MRO Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Aircraft MRO Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Aircraft MRO Market Size.

North America Aircraft MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 27.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.33% |

| 2035 Value Projection: | 43.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Delta TechOps, AAR CORP., StandardAero, GE Aerospace, Lufthansa Technik, Pratt & Whitney, ST Engineering Aerospace, General MRO Aerospace, AeroRepair Corp, Turbine Controls MRO, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aircraft MRO market in North America is driven by a greater need for both scheduled and unscheduled maintenance is a direct result of the higher operational tempo. The period of routine checks and service intervals is shortened and the likelihood of unexpected repairs is heightened. This causes a steady and substantial flow of work for MRO providers. Not only are airlines renewing their fleets, but they are also taking in new aircraft, especially narrow-body and regional jets, to meet the demand for an increasing number of routes and passengers. The MRO workload has increased directly as a result of this expansion, especially in the low-cost carrier and regional sectors.

Restraining Factors

The aircraft MRO market in North America is restrained by a high number of skilled technicians nearing retirement age. The situation of demand being greater than supply not only results in increased labor costs due to wage inflation, which has surpassed 20%, but also causes delays in performing necessary maintenance, repair, and overhaul tasks. Consequently, the overall operational expenses are rising, which are impacting profit margins and preventing the companies from growing. Among the various factors contributing to high expenses in MRO, labor costs hold a significant position.

Market Segmentation

The North America Aircraft MRO Market Size share is categorised into type, application and aircraft type.

- The engine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Aircraft MRO Market Size is segmented by type into airframe, engine, component. Among these, the engine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. 42.43% of the total revenue for 2024 came from engine activity as 18,000 active commercial turbofans caused the first-run removals to occur in a steady manner. The combination of the critical factors is what makes this segment the largest revenue contributor. The complexity and high cost of modern aircraft engines, along with the stringent regulatory supervision and high demand for engine shop visits, are the factors that contribute to this segment being the largest revenue generator.

- The line maintenance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America Aircraft MRO Market Size is segmented into line maintenance and base maintenance. Among these, the line maintenance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the use to foster the security of an aircraft, launched daily and routine transits or mainly on pre-arrival, daily, or weeklong scales.

- The commercial aircraft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Aircraft MRO Market Size is segmented by aircraft type into commercial aircraft, military aircraft, business and general aviation. Among these, the commercial aircraft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The commercial aircraft, with a share of 40.14% in 2024. The enormous amount and the degree of utilization of the North American commercial fleet, which is one of the biggest and most frequently used globally. Besides, the air passenger travel has a strong rebound post-pandemic, and hence the demand for regular maintenance to keep on ensuring flight safety and efficiency is huge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Aircraft MRO Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Delta TechOps

- AAR CORP.

- StandardAero

- GE Aerospace

- Lufthansa Technik

- Pratt & Whitney

- ST Engineering Aerospace

- General MRO Aerospace

- AeroRepair Corp

- Turbine Controls MRO

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, AAR CORP., a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced it had acquired HAECO Americas from HAECO Group for $78 million in an all-cash transaction, subject to customary adjustments.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Aircraft MRO Market Size based on the below-mentioned segments:

North America Aircraft MRO Market Size, By Type

- Airframe

- Engine

- Component

North America Aircraft MRO Market Size, By Application

- Line Maintenance

- Base Maintenance

North America Aircraft MRO Market Size, By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Business and General Aviation

Frequently Asked Questions (FAQ)

-

What is the North America Aircraft MRO Market Size?The North America Aircraft MRO Market Size is expected to grow from USD 27.05 billion in 2024 to USD 43.1 billion by 2035, growing at a CAGR of 4.33% during the forecast period 2025-2035.

-

What is aircraft MRO, and its primary use?The North American aircraft maintenance, repair, and overhaul (MRO) market is a solid and developing sector, powered by a complicated combination of economic, operational, and technological factors. The airlines are recovering from the pandemic and are facing new challenges, but the demand for MRO services keeps growing.

-

What are the key growth drivers of the market?Market growth is driven by greater need for both scheduled and unscheduled maintenance is a direct result of the higher operational tempo. The period of routine checks and service intervals is shortened and the likelihood of unexpected repairs is heightened.

-

What factors restrain the North America Aircraft MRO Market Size?The market is restrained by high number of skilled technicians nearing retirement age. The situation of demand being greater than supply not only results in increased labor costs due to wage inflation which has already surpassed 20%.

-

How is the market segmented by type?The market is segmented into airframe, engine, component

-

Who are the key players in the North America Aircraft MRO Market Size?Key companies include Delta TechOps, AAR CORP., StandardAero, GE Aerospace, Lufthansa Technik, Pratt & Whitney, ST Engineering Aerospace, General MRO Aerospace, AeroRepair Corp, and Turbine Controls MRO.

Need help to buy this report?