North America Agricultural Biotechnology Market Size, Share, and COVID-19 Impact Analysis, By Organism (Plants, Animals, Microbes, and Others), By Application (Vaccine Development, Transgenic Crops and Animals, Antibiotic Development, Nutritional Supplements, Flower Culturing, and Biofuels), and North America Agricultural Biotechnology Market Insights Forecasts to 2035

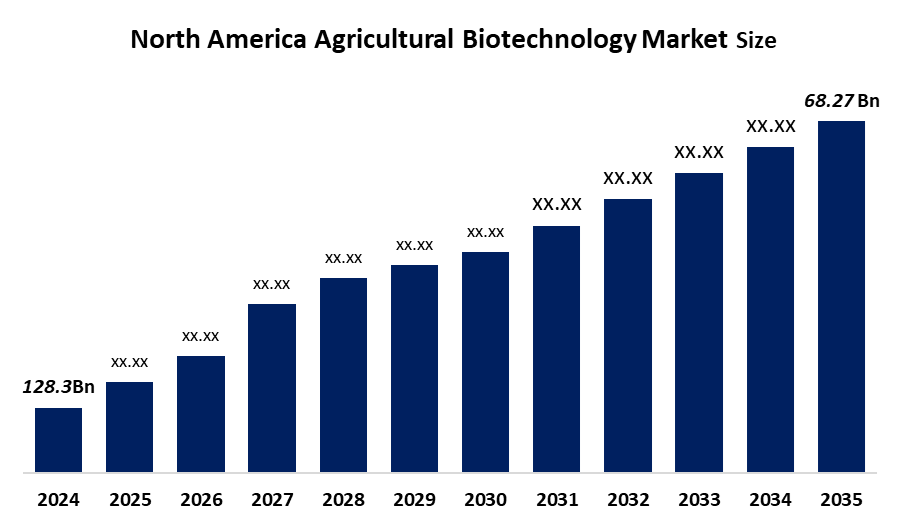

Industry: Agriculture- The North America Agricultural Biotechnology Market Size Was Estimated at USD 68.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The North America Agricultural Biotechnology Market Size is Expected to Reach USD 128.3 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, he North America Agricultural Biotechnology Market size is anticipated to reach USD 128.3 Billion by 2035, growing at a CAGR of 5.9% from 2025 to 2035. The market is driven by the increasing demand for high-yield crops, efficient nutrient management, and improved pest resistance are the main factors that drive the market for agricultural biotechnology. Genetically modified seeds, soil microbial enhancers, and modern molecular diagnostic tools are gradually taking a strong position in this market.

Market Overview

Agricultural biotechnology refers to the application of science-based tools along with biological processes to increase the productivity of crops, enhance their resistance, and fine-tune the farming systems. Biotechnology, through its various methods like genetic engineering, molecular markers, microbial biotechnology, genome editing, and tissue culture etc., can find answers to the issues of food scarcity, climate change, and the ever-growing population, such as GM crops, precision farming technologies, and breeding innovations.

Evogene Ltd., the foremost organization in the domain of computational biology, with the objective of revolutionizing the discovery and development of life-science products in different market segments, announced in July 2023 a remarkable technology launch for its ChemPass AI tech-engine, which is a target-protein discovery transforming technology

The forming of strategic collaborations and partnerships among the biotechnology companies with industry peers as well as research institutions, continues to be the trend that is gaining more and more momentum. By combining their resources and talents, the partners aim at not only fast-tracking the innovativeness of the agricultural biotechnological products but also speeding up their market availability. The companies are fully committed to developing and marketing biotech products that are in line with the sustainable farming practices, i.e. lower chemical inputs and more efficient use of resources.

Report Coverage

This research report categorizes the market for the North America agricultural biotechnology market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America agricultural biotechnology market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America agricultural biotechnology market.

North America Agricultural Biotechnology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 128.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.9% |

| 2035 Value Projection: | USD 68.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Organism |

| Companies covered:: | Dow Agro Sciences, • Syngenta Biotechnology, • Ag Growth International, • Biofabrica Siglo XXI, • Aevus Biotechnologia, • Agri Technovation USA, • Oerth Bio, • AgriBusiness Global, • Genective, • Formunica, •, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The agricultural biotechnology market in the National Oceanic and Atmospheric Administration (NOAA) has declared that North America is undergoing more intense weather events, including droughts, floods, and heat waves, which in turn pushed the biotechnological industry to develop new plant varieties with the ability to withstand these extreme conditions through breeding. Sustainable developments such as biofertilizers, biopesticides, and microbial solutions, which lessen dependence on chemicals, are also taking place and reflecting positively on nature. There is a growing demand as governments’ actions to promote organic farming and sustainable agriculture continue to support this industry.

Restraining Factors

The agricultural biotechnology market in North America is restrained by the intricate and ever-changing legal structures governing genetically modified organisms (GMOs), along with other biotechnological products. Heavy regulations, mandatory labelling, and constant public scrutiny can make it more difficult to bring biotech crops to market and on top of all that, limited farmers' knowledge about the benefits of biotech. It takes extensive research, testing, and validation in the field to develop biotech crops and bio-inputs.

Market Segmentation

The North America agricultural biotechnology market share is categorised into organism and application.

- The plants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America agricultural biotechnology market is segmented by organism into plants, animals, microbes, and others. Among these, the plants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, plants accounted for the highest revenue share among all segments at 45.34%. This was mainly due to the large-scale cultivation of genetically modified crops that provide the advantages of higher yields, pest resistance, and resilience to climate change. The increasing adoption of CRISPR-edited and biofortified crops is another factor that enhances the market penetration in developing countries, particularly

- The transgenic crops and animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America agricultural biotechnology market is segmented into vaccine development, transgenic crops and animals, antibiotic development, nutritional supplements, flower culturing, and biofuels. Among these, the transgenic crops and animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment held 30% of the market share. It involves the development and marketing of genetically modified plants and animals for agricultural purposes. Genetically modified crops are largely used in North American agriculture as they have increased the yields and for their advantages of reduced pesticide use and better resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America agricultural biotechnology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Agro Sciences

- Syngenta Biotechnology

- Ag Growth International

- Biofabrica Siglo XXI

- Aevus Biotechnologia

- Agri Technovation USA

- Oerth Bio

- AgriBusiness Global

- Genective

- Formunica

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, Corteva, Inc. and Hexagon Bio announced a multi-million-dollar joint venture aimed at accelerating the discovery and development of new nature-inspired crop protection solutions.

In June 2024, Bayer launched ten blockbuster products in the next ten years to support farmers worldwide, the company announced at its 2024 Crop Science innovation update in Chicago.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Agricultural Biotechnology Market based on the below-mentioned segments:

North America Agricultural Biotechnology Market, By Organism

- Plants

- Animals

- Microbes

- Others

North America Agricultural Biotechnology Market, By Application

- Vaccine Development

- Transgenic Crops and Animals

- Antibiotic Development

- Nutritional Supplements

- Flower Culturing

- Biofuels

Frequently Asked Questions (FAQ)

-

What is the North America agricultural biotechnology market size?The North America Agricultural Biotechnology Market size is expected to grow from USD 68.27 billion in 2024 to USD 128.3 billion by 2035, growing at a CAGR of 5.9% during the forecast period 2025-2035.

-

What is agricultural biotechnology, and its primary use?Agricultural biotechnology refers to the application of science-based tools along with biological processes to increase the productivity of crops, enhance their resistance, and fine-tune the farming systems. Biotechnology, through its various methods like genetic engineering, molecular markers, microbial biotechnology, genome editing, and tissue culture.

-

What are the key growth drivers of the market?Market growth is driven by the National Oceanic and Atmospheric Administration (NOAA) has declared that North America is undergoing more intense weather events, including droughts, floods, and heat waves, which in turn pushed the biotechnological industry to develop new plant varieties with the ability to withstand these extreme conditions through breeding.

-

What factors restrain the North America agricultural biotechnology market?The market is restrained by the intricate and ever-changing legal structures governing genetically modified organisms along with other biotechnological products. Heavy regulations, mandatory labelling, and constant public scrutiny can make it more difficult to bring biotech crops to market and on top of all that, limited farmers' knowledge about the benefits of biotech.

-

How is the market segmented by organism?The market is segmented into plants, animals, microbes, and others.

-

Who are the key players in the North America agricultural biotechnology market?Key companies include Dow Agro Sciences, Syngenta Biotechnology, Ag Growth International, Biofabrica Siglo XXI, Aevus Biotechnologia, Agri Technovation USA, Oerth Bio, AgriBusiness Global, Genective, and Formunica.

Need help to buy this report?