North America Acetic Acid Market Size, Share, and COVID-19 Impact Analysis, By Derivatives (Vinyl Acetate Monomer, Purified Terephthalic Acid, Ethyl Acetate, Acetic Anhydride, and Others), By Application (Polymers, Food and Beverages, Adhesives, Paints and Coatings, and Others), and North America Acetic Acid Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Acetic Acid Market Insights Forecasts to 2035

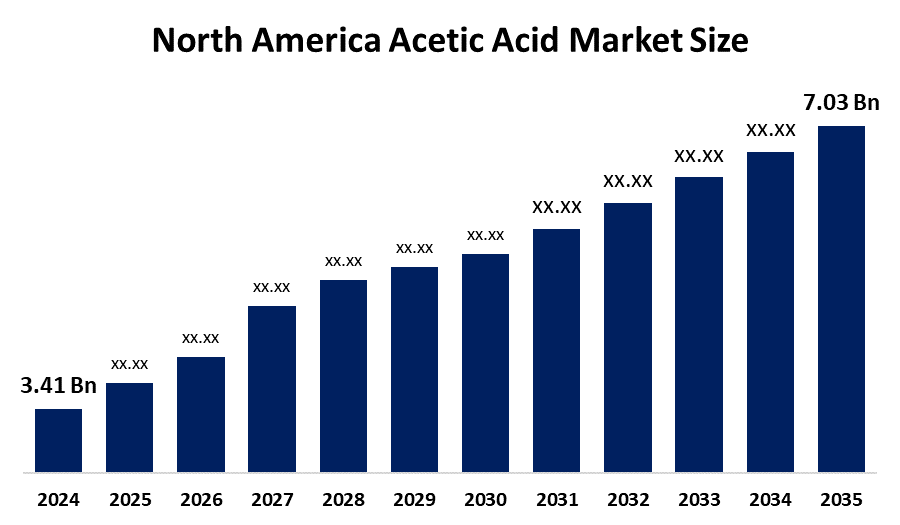

- The North America Acetic Acid Market Size Was Estimated at USD 3.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.8% from 2025 to 2035

- The North America Acetic Acid Market Size is Expected to Reach USD 7.03 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Acetic Acid Market size is anticipated to reach USD 7.03 Billion by 2035, growing at a CAGR of 6.8% from 2025 to 2035. The market is driven by the demand from vinyl acetate monomer, purified terephthalic acid and food preservation industries. Growing focus on capacity expansion, process optimization and strategic partnerships to enhance competitiveness.

Market Overview

The acetic acid market shows continuous growth due to vinyl acetate monomer VAM finds increasing use in adhesives, paints and coatings. The construction and automotive industries require VAM for their emulsions and resins, which drives demand for VAM. Acetic acid serves multiple purposes in food preservation as an acidulant and flavoring agent and as a substance to prevent microbial spoilage in pickled products and meat processing. Acetic acid functions as a raw material and solvent in the pharmaceutical industry for producing different medications and vitamins, antibiotics and hormones.

Celanese Corporation announced a force majeure declaration, which led to sales control of acetic acid and vinyl acetate monomer products throughout the Western Hemisphere. INEOS disclosed its acquisition agreement with Eastman Chemical Company to purchase the Eastman Texas City site, which includes the 600kt Acetic Acid plant and all associated third party activities on the site for approximately 500 million.

The Canadian economy receives 6 of its total economic output from this sector, which employs more than 1.26 million workers who contribute to an annual revenue exceeding 90 billion USD. The U.S. government supports bio based sustainable acetic acid production through the USDA bio preferred program which provides both certification and financial assistance to businesses.

Report Coverage

This research report categorizes the market for the North America acetic acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America acetic acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America acetic acid market.

North America Acetic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.41 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.8% |

| 2035 Value Projection: | USD 7.03 Bilion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Derivatives , By Application |

| Companies covered:: | Celanese Co,INEOS,Eastman Chemical Company,Lyondell Basell Industries Holding BV,SABIC,Quimica Delta,Acid League,Brainerd Chemicals Co,ChemCeed,Altiras Chemicals And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The acetic acid market in North America is driven by the increasing need for processed meats and packaged foods stems from the changing consumer habits that accompany urban development. The chemical functions as a reagent and solvent that manufacturers use to create organic chemicals, pharmaceuticals, and acetate rayon synthetic fibers. The environmental regulations that government departments enforce with U.S. Department of Energy programs, create financial benefits that companies use to implement sustainable bio-based acetic acid production methods.

Restraining Factors

The acetic acid market in North America is hindered by the U.S. Environmental Protection Agency EPA imposing strict environmental regulations through its restrictions on volatile organic compound VOC emissions. The growing demand for bio-based and environmentally friendly solvents drives businesses to investigate new solutions that will reduce their usage of traditional acetic acid production methods.

Market Segmentation

The North America acetic acid market share is categorised into derivatives and application.

- The vinyl acetate monomer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America acetic acid market is segmented by derivative into vinyl acetate monomer, purified terephthalic acid, ethyl acetate, acetic anhydride, and others. Among these, the vinyl acetate monomer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market accounted for the acetic acid production holds a 42.8 market share through vinyl acetate monomer. The North America acetic acid market identifies vinyl acetate monomer (VAM) as its main application segment which produces substantial market share through its extensive use in adhesives and coatings and packaging materials. The demand for VAM is increasing with the construction and automotive industries and is supported by rising infrastructure projects and the increasing preference for eco-friendly adhesives.

- The paints and coatings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America acetic acid market is segmented into polymers, food and beverages, adhesives, paints and coatings, and others. Among these, the paints and coatings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the production of vinyl acetate monomer (VAM), and ethyl acetate depends on this process because it serves as a fundamental production method for these essential industrial chemicals. The compounds serve as essential components for creating advanced coatings which are used in automotive, construction and industrial applications. The market experiences additional expansion through infrastructure development and rising demand for protective coatings that can withstand extreme environmental conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America acetic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Celanese Co.

- INEOS

- Eastman Chemical Company

- Lyondell Basell Industries Holding B.V.

- SABIC

- Quimica Delta

- Acid League

- Brainerd Chemicals Co.

- ChemCeed

- Altiras Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Acetic Acid Market based on the below-mentioned segments:

North America Acetic Acid Market, By Derivatives

- Vinyl Acetate Monomer

- Purified Terephthalic Acid

- Ethyl Acetate

- Acetic Anhydride

- Others

North America Acetic Acid Market, By Application

- Polymers

- Food and Beverages

- Adhesives

- Paints and Coatings

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America acetic acid market size?A: The North America Acetic Acid Market size is expected to grow from USD 3.41 billion in 2024 to USD 7.03 billion by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

Q: What is acetic acid, and its primary use?A: The acetic acid market shows continuous growth because vinyl acetate monomer (VAM) finds increasing use in adhesives, paints and coatings. The construction and automotive industries require VAM for their emulsions and resins, which drives demand for VAM.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing need for processed meats and packaged foods stems from the changing consumer habits that accompany urban development.

-

Q: What factors restrain the North America acetic acid market?A: The market is restrained by the U.S. Environmental Protection Agency (EPA) imposes strict environmental regulations through its restrictions on volatile organic compound (VOC) emissions.

-

Q: How is the market segmented by derivatives?A: The market is segmented into vinyl acetate monomer, purified terephthalic acid, ethyl acetate, acetic anhydride, and others.

-

Q: Who are the key players in the North America acetic acid market?A: Key companies include Celanese Co., INEOS, Eastman Chemical Company, Lyondell Basell Industries Holding B.V., SABIC, Quimica Delta, Acid League, Brainerd Chemicals Co., ChemCeed, and Altiras Chemicals.

Need help to buy this report?