Global Non-Destructive Testing Market Size, Share, and COVID-19 Impact Analysis, By Offering (Services, Equipment), By Technique (Traditional NDT Method, Digital/Advanced NDT Method), By End-User (Manufacturing, Oil & Gas, Energy & Power Generation, Aerospace, Defense, Automotive & Transportation, Health Care, Construction, Public Infrastructure, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Non-Destructive Testing Market Insights Forecasts to 2032

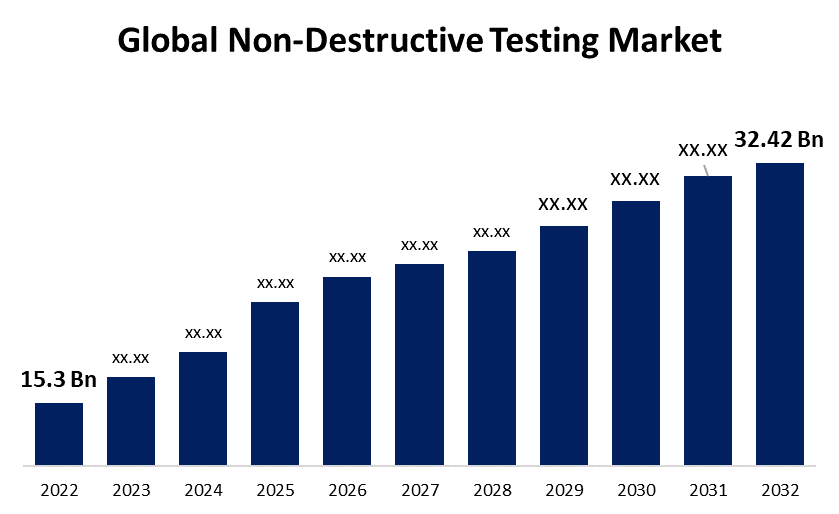

- The Non-Destructive Testing Market Size was valued at USD 15.3 Billion in 2022.

- The Market is Growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide Non-Destructive Testing Market Size is expected to reach USD 32.42 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Non-Destructive Testing Market Size is expected to reach USD 32.42 Billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

Non-destructive testing, also known as NDT, is a testing and evaluation process used in manufacturing to assess the functionality of a component, system, material, or structure for typical differences, welding errors, and gaps without inflicting collateral harm to the original component. Non-destructive testing (NDT) is also known as non-destructive examination (NDE), non-destructive inspection (NDI), and non-destructive evaluation (NDE). NDT is widely utilized in the sectors of forensic engineering, mechanical engineering, energy engineering, electrical engineering, civil engineering, systems engineering, aeronautical engineering, medical science, and design. Non-destructive testing (NDT) techniques incorporate the utilization of electromagnetic radiation, sound, and various other signal conversions to analyze a wide range of contents for authenticity, structure, or condition while resulting in no alterations to the content under assessment.

NDT is frequently used in the field as an umbrella term that includes non-destructive inspection techniques, evaluation tools, or even the entire field of non-destructive examinations. The most widely applied NDT technique, visual inspection (VT), is frequently enhanced through the use of magnification, borescopes, cameras, or other optical arrangements for either in-person or distant observation. NDT testing methods are primarily used in manufacturing industries where component failure would result in considerable financial damages or a potentially dangerous occurrence, such as transportation, pressure vessels, building structures, piping systems, and hoisting machinery. Comprehensive government rules concerning public security and the integrity of goods, as well as ever-changing developments in technological devices, digital transformation, and robotics applications, are some of the primary drivers influencing the tremendous demand for the Non-destructive Testing and Inspection market.

Global Non-Destructive Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 15.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 32.42 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Offering, By Technique, By End-User, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | MISTRAS Group , Ashtead Technology, General Electric, Nikon Metrology NV, Bosello High Technology Srl, MME Group, TWI Ltd., Bureau Veritas S.A., Fprimec Solutions Inc., Intertek Group PLC, YXLON International GmbH, T.D. Williamson, Inc., Eddyfi, NDT Global, Sonatest, Yxlon International, Zetec, Inc, Fischer Technologies Inc., Labquip NDT Limited, LynX Inspection, Acuren Inspection Inc., SGS SA, Olympus Corporation |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The growing demand from aviation and aerospace companies for higher material, framework, and durability standards, as well as expanding implementation lists, such as identifying fractures, errors, and leaks, will drive the non-destructive testing, or NDT, market expansion. Furthermore, the corresponding rise in production processes in developed as well as developing nations will contribute to the growth of the NDT market throughout the forecast period. Furthermore, raising manufacturers recognition of NDT's advantages will help further enhance the accessibility of Non-destructive Testing techniques in future years.

In addition, partly because of its simplicity, technological advancements over the anticipated time frame are expected to increase the traction of this evaluation process. Given the ease of identifying faults in complex spaces and erratic surfaces, a growing variety of initiatives utilizing non-destructive testing techniques are being completed in less time. As a result, the demand from several end-use industries such as manufacturing, oil & gas, aerospace, and among others is increasing rapidly. Furthermore, emerging urbanization and industrialization in developing economies, as well as increasing IIoT (Industrial Internet of Things) penetration and the advancement of Industrial 4.0, as well as the requirement for regulatory requirements for security and quality assurance, are contributing to market development.

Restraining Factors

However, the high initial investment capital and high equipment costs as well as technologies, such as infrared thermography, computed tomography, radiography technologies, and others, may restrain the market growth. The high cost of equipment may make it difficult for developing and underdeveloped countries to adopt NDT processes and technologies. This may result in less adoption of NDT equipment by these countries, resulting in a drop in equipment being adopted.

Market Segmentation

By Offering Insights

The services segment is dominating the market with the largest revenue share over the forecast period.

On the basis of offering, the global non-destructive testing market is segmented into services and equipment. Among these, the services segment is dominating the market with the largest revenue share of 67.3% over the forecast period. This is due to the high initial cost of non-destructive testing equipment, as well as the technical complexities involved in their deployment/installation, which is one of the main factors boosting end-users to delegate their non-destructive testing operations. Furthermore, demanding governmental rules which regulate workplace safety is pushing end-users to assign non-destructive testing to independent service companies. However, A shortage of skilled workers capable of undertaking non-destructive testing is restricting new non-destructive testing equipment installations globally.

By Technique Insights

The traditional NDT method segment accounted for the largest market share over the forecast period.

On the basis of technique, the global non-destructive testing market is segmented into traditional NDT methods, digital or advanced NDT methods, and others. Among these, the traditional NDT method segment accounted for the largest market share over the forecast period. This is owing to traditional NDT methods like visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing are becoming more popular. Ultrasonic testing is projected to grow in this sector because it is lightweight, simple to operate, and provides reliable outcomes in comparison with various standard non-destructive testing techniques. NDT ultrasonic testing is further subdivided into angle beam testing, immersion testing, straight beam testing, and others. Thus, the widespread use of ultrasonic testing is increasing rapidly and is expected to increase further in the coming years. As a result, the traditional NDT testing methods are expected to increase during the forecast period.

By End-User Insights

The manufacturing segment accounted the largest revenue share of more than 37.5% over the forecast period.

On the basis of end-user, the global non-destructive testing market is segmented into manufacturing, oil & gas, energy & power generation, aerospace, defense, automotive & transportation, health care, construction, public infrastructure, and others. Among these, manufacturing is dominating the market with the largest revenue share of 37.5% over the forecast period. The increase in manufacturing activity worldwide is expected to boost the non-destructive testing market growth. The manufacturing sector will likely adopt numerous NDT processes, resulting in an upsurge in the worldwide market for non-destructive testing and inspection services. Moreover, rising investment from leading companies and increasing government initiatives concerning the workforce safety are expected to propel the demand for the non-destructive testing market over the forecast period.

Furthermore, the energy and power generation segment includes a variety of commercial sectors such as power grids and hydroelectric power plants. The never-ending rise in demand for electrical power in developing countries is the primary reason for the rapid deployment of non-destructive testing and inspection methods in electricity generation, as non-destructive testing techniques ensure greater output rates.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 43.7% market share over the forecast period. This is due to the widespread implementation of non-destructive testing techniques in a wide range of applications, the accessibility of a skilled workforce, and a large number of non-destructive testing training facilities in the region. In addition, power production from shale oil reserves in the United States, Canada, and Mexico is expected to have an advantageous effect on the region's expansion rate. Furthermore, rising defense and aerospace spending, as well as significant demand for NDT methods from the power generation industry, will contribute to market revenue growth. Furthermore, Mexico is expected to have the highest growth rate in the North American NDT and inspection market during the forecast period, as a result of an increased emphasis on urban mobility, expanding natural gas pipeline networks, an expanding economy, and a rapidly expanding population.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. This is owing to the rapid growth of the construction, nuclear power generation, and manufacturing industries in this region's newly industrialized nations. According to the World Nuclear Association, China and India, for example, have plans for 43 and 14 nuclear reactors, respectively. As a result, the need for maintenance of those power plants will rise, creating a demand for the non-destructive testing market. Though skilled labor is currently scarce in the region, this is expected to improve as the understanding and utilization of non-destructive testing techniques grow in the coming years.

List of Key Market Players

- MISTRAS Group

- Ashtead Technology

- General Electric

- Nikon Metrology NV

- Bosello High Technology Srl

- MME Group

- TWI Ltd.

- Bureau Veritas S.A.

- Fprimec Solutions Inc.

- Intertek Group PLC

- YXLON International GmbH

- T.D. Williamson, Inc.

- Eddyfi

- NDT Global

- Sonatest

- Yxlon International

- Zetec, Inc

- Fischer Technologies Inc.

- Labquip NDT Limited

- LynX Inspection

- Acuren Inspection Inc.

- SGS SA

- Olympus Corporation

Key Market Developments

- On February 2023, Ashtead Technology introduced its new standard drop camera system, which is part of a line of systems designed for high-resolution seabed visual inspection in water depths of up to 4000 meters. In addition to its established WROV deployed winched borehole drop camera, Ashtead Technology is currently developing a range of advanced drop camera solutions for shallow and deep-water use.

- On September 2022, Intertek, a leading Total Quality Assurance provider to industries worldwide, announced today the signing of a Memorandum of Understanding with FEDS Drone-powered Solutions (Falcon Eye Drones), a leading Middle Eastern supplier of cutting-edge drone technology. Intertek is constantly improving the assurance, testing, inspection, and certification solutions that are available to customers worldwide. Intertek's collaboration with FEDS will enable it to provide the innovative and cost-effective drone and data technology that businesses require to support their operational project requirements.

- On September 2022, NDT Global has introduced PROTON™, a highly configurable phased array inspection platform.

- On March 2022, Olympus Corporation has introduced the 72DL PLUS ultrasonic thickness gauge. It provides precision thickness measurements at high speeds in a portable, user-friendly device. The gauge can measure the thickness of very thin layers for challenging applications across industries thanks to its fast scanning, advanced algorithms, and Olympus' lowest-ever minimum thickness capability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Non-Destructive Testing Market based on the below-mentioned segments:

Non-Destructive Testing Market, Offering Analysis

- Services

- Equipment

Non-Destructive Testing Market, Technique Analysis

- Traditional NDT Method

- Visual Testing

- General visual inspection

- Aided visual inspection

- Ultrasonic Testing

- Angle beam testing

- Immersion testing

- Straight beam testing

- Radiographic Testing

- Computed radiography

- Gamma ray testing

- X-ray testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Digital/Advanced NDT Method

- Digital Radiography

- Phased Array Ultrasonic Testing

- Pulsed Eddy Current

- Time-Of-Flight Diffraction

- Alternating Current Field Measurement

- Automated Ultrasonic Testing

Non-Destructive Testing Market, End-User Analysis

- Manufacturing

- Oil & Gas

- Energy & Power Generation

- Aerospace

- Defense

- Automotive & Transportation

- Health Care

- Construction

- Public Infrastructure

- Others

Non-Destructive Testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Non-Destructive Testing market?The Global Non-Destructive Testing Market is expected to grow from USD 15.3 billion in 2022 to USD 32.42 billion by 2032, at a CAGR of 7.8% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?MISTRAS Group, Ashtead Technology, General Electric, Nikon Metrology NV, Bosello High Technology Srl, MME Group, TWI Ltd., Bureau Veritas S.A., Fprimec Solutions Inc., Intertek Group PLC, YXLON International GmbH, T.D. Williamson, Inc., Eddyfi, NDT Global, Sonatest

-

3. Which segment dominated the Non-Destructive Testing market share?The manufacturing segment in end-user type dominated the Non-Destructive Testing market in 2022 and accounted for a revenue share of over 37.5%.

-

4. What are the elements driving the growth of the Non-Destructive Testing market?Stringent government regulations governing public safety and product quality, as well as continuous advancements in electronics, automation, and robotics applications, are driving the Non-Destructive Testing market's growth.

-

5. Which region is dominating the Non-Destructive Testing market?North America is dominating the Non-Destructive Testing market with more than 43.7% market share.

-

6. Which segment holds the largest market share of the Non-Destructive Testing market?The services segment based on offering type holds the maximum market share of the Non-Destructive Testing market.

Need help to buy this report?