Global Nifedipine Market Size, Share, and COVID-19 Impact Analysis, By Type (Nifedipine Controlled-Release Tablets and Nifedipine Extended Action Tablets), By Application (HBP, Heart Attack, Chilblain, Preterm Labor, and Others), By Distribution Channel (Hospital Pharmacy, Medical Center, and Retail Pharmacy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Nifedipine Market Size Insights Forecasts to 2035

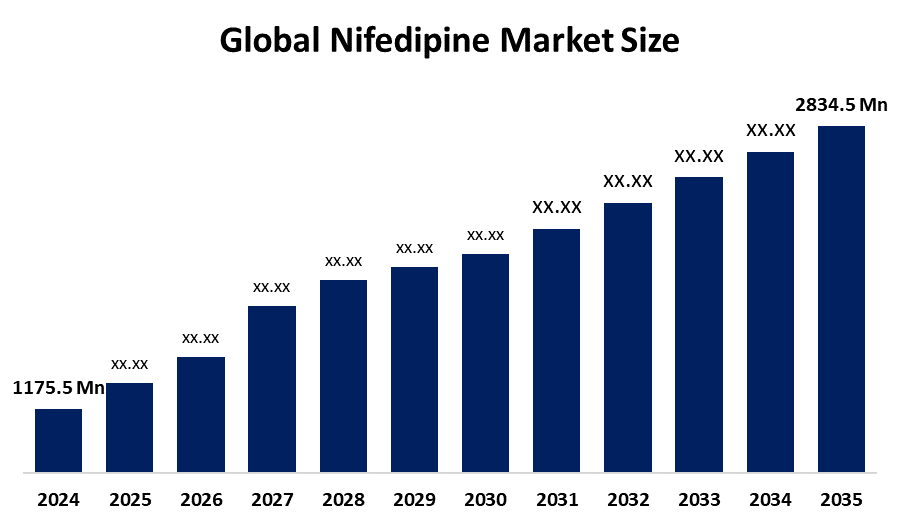

- The Global Nifedipine Market Size Was Estimated at USD 1175.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.33% from 2025 to 2035

- The Worldwide Nifedipine Market Size is Expected to Reach USD 2834.5 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Nifedipine Market Size was worth around USD 1175.5 Million in 2024 and is predicted to Grow to around USD 2834.5 Million by 2035 with a compound annual growth rate (CAGR) of 8.33% from 2025 and 2035. The market for nifedipine has a number of opportunities to grow due to increasing advancements in the drug delivery system of nifedipine.

Market Overview

The global nifedipine industry is the commercial ecosystem for the drug nifedipine, a dihydropyridine calcium channel blocker used primarily to treat hypertension (high blood pressure) and angina (chest pain). Nifedipine is a class of medications called calcium channel blockers that lowers blood pressure by relaxing the blood vessels, controlling chest pain by increasing the supply of blood and oxygen to the heart. Its long-acting formulation is used in pregnancy, especially for preterm labour, to temporarily delay labour, while the short-acting formulation aids in the rapid treatment of severe hypertension.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures, the expanding partnerships, and generic pharmaceutical companies' increased focus on strategic approvals. The quick development of combination therapies, research into new formulations with enhanced efficacy, digital health integration for improved patient management, and emphasis on patient education & awareness campaigns are driving a huge surge in the global nifedipine market.

Report Coverage

This research report categorizes the nifedipine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Nifedipine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nifedipine market.

Global Nifedipine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1175.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.33% |

| 2035 Value Projection: | USD 2834.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Pfizer Inc., Novartis International AG, AstraZeneca PLC, Bayer AG, Johnson & Johnson, GlaxoSmithKline plc, Merck & Co., Inc., Abbott Laboratories, Boehringer Ingelheim GmbH, Hoffmann-La Roche AG, Teva Pharmaceutical Industries Ltd., Vectura Group plc, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of hypertensive heart diseases is responsible for driving the nifedipine market. It was estimated that hypertension affects approximately 75 million adults, which is 1 in 3 adults in the United States, and prolonged hypertension is a known risk factor for the development of heart failure, as per a study. An increasing technological innovations in the field of nanomedicine for enhancing the delivery of sparingly water-soluble nifedipine is propelling the market growth.

Restraining Factors

The nifedipine market is restricted by factors, including side effects associated with nifedipine and tolerability issues that impact patient adherence. The strict regulations associated with the approval of new formulations and changes in healthcare policies & reimbursement issues are negatively impacting the market growth.

Market Segmentation

The nifedipine market share is classified into type, application, and distribution channel.

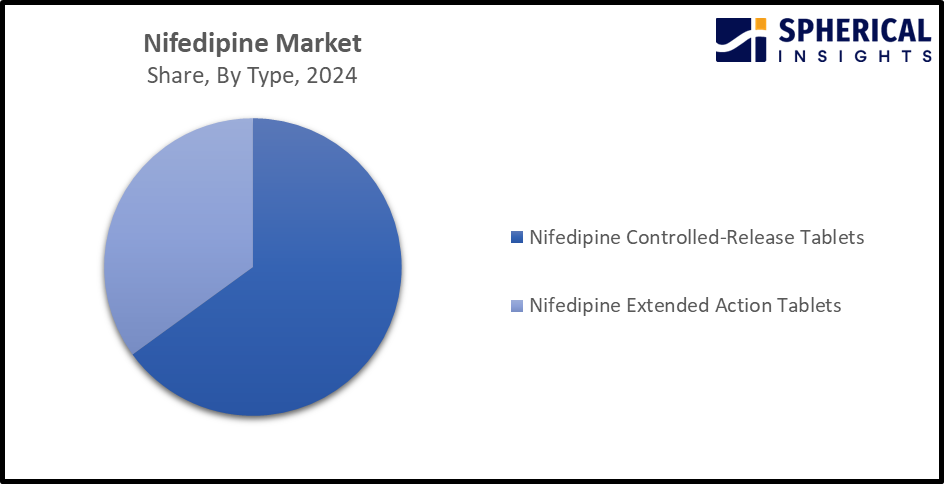

- The nifedipine controlled-release tablets segment held the largest share between 45% - 65% of the nifedipine market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the nifedipine market is divided into nifedipine controlled-release tablets and nifedipine extended action tablets. Among these, the nifedipine controlled-release tablets segment held the largest share between 45% - 65% of the nifedipine market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Controlled release technology involves the drug release as per a predictable and rational programmed rate for achieving optimal serum drug concentration, which enhances the safety, efficacy, reliability, and convenience of drug therapy. An increasing prioritization towards controlled-release drug delivery is driving the market as it aids in enhancing patient convenience and adherence by lowering daily dosage frequency.

Get more details on this report -

- The preterm labor segment dominated the market with the largest share of about 35% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the nifedipine market is divided into HBP, heart attack, chilblain, preterm labor, and others. Among these, the preterm labor segment dominated the market with the largest share of about 35% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Nifedipine is considered a first-line tocolytic agent for managing preterm labor. According to the World Health Organization's estimate, 12.9 million births, representing 9.6% of all births worldwide, were preterm in 2005. An increasing use of tocolytics as a part of preterm birth prevention efforts for delaying labor and improving fetal outcomes contributes to driving the market demand.

- The hospital pharmacy segment accounted for the largest share of about 40%-50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the nifedipine market is divided into hospital pharmacy, medical center, and retail pharmacy. Among these, the hospital pharmacy segment accounted for the largest share of about 40%-50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. An increasing focus on formulary optimization for cardiovascular medications, along with the growing prevalence of heart failure, aids in driving the market growth.

Regional Segment Analysis of the Nifedipine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the nifedipine market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 32.8% of the nifedipine market over the predicted timeframe. The market ecosystem in North America is strong, with leading pharmaceutical companies emphasizing innovation and development in the area of controlled release formulations, with fixed dose combinations. For instance, PROCARDIA XL extended release tablet developed by Pfizer laboratories Div Pfizer Inc., designed for providing nifedipine at an approximately constant rate over 24 hours. The demand for nifedipine has been driven by the consumers’ changing lifestyles and the increased prevalence of chronic long-term illness. The United States is dominating the North America nifedipine market, accounting for 85-95% of regional share, attributed to the country’s well-established healthcare infrastructure and advanced medical research and development.

Asia Pacific is expected to grow at a rapid CAGR of about 8-9% in the nifedipine market during the forecast period. The Asia Pacific area has a thriving market for nifedipine due to a growing senior population in countries like China & India, increased healthcare spending, and enhanced healthcare infrastructure. Further, increased investment in healthcare infrastructure, along with government's increased investment for development. China is leading the Asia Pacific nifedipine market with about 30% share in the year 2024, attributed to the country’s increasing ageing population and supportive government policies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nifedipine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Novartis International AG

- AstraZeneca PLC

- Bayer AG

- Johnson & Johnson

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Abbott Laboratories

- Boehringer Ingelheim GmbH

- Hoffmann-La Roche AG

- Teva Pharmaceutical Industries Ltd.

- Vectura Group plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Bayer Canada announced a new partnership with Mint Pharmaceutical Inc. for the distribution of ADALAT XL 30mg tablets in Canada. ADALAT XL (nifedipine extended-release tablets) is indicated for the management of chronic stable angina and the management of mild to moderate essential hypertension.

- In June 2022, India set a target of a 25% relative reduction in the prevalence of hypertension (raised blood pressure) by 20253. To achieve this, it is important to fast-track access to treatment services by strengthening interventions such as the India Hypertension Control Initiative (IHCI).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nifedipine market based on the below-mentioned segments:

Global Nifedipine Market, By Type

- Nifedipine Controlled-Release Tablets

- Nifedipine Extended Action Tablets

Global Nifedipine Market, By Application

- HBP

- Heart Attack

- Chilblain

- Preterm Labor

- Others

Global Nifedipine Market, By Distribution Channel

- Hospital Pharmacy

- Medical Center

- Retail Pharmacy

Global Nifedipine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the nifedipine market?The global nifedipine market size is expected to grow from USD 1175.5 Million in 2024 to USD 2834.5 Million by 2035, at a CAGR of 8.33% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the nifedipine market?North America is anticipated to hold the largest share of the nifedipine market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Nifedipine Market from 2024 to 2035?The market is expected to grow at a CAGR of around 8.33% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Nifedipine Market?Key players include Pfizer Inc., Novartis International AG, AstraZeneca PLC, Bayer AG, Johnson & Johnson, GlaxoSmithKline plc, Merck & Co., Inc., Abbott Laboratories, Boehringer Ingelheim GmbH, Hoffmann-La Roche AG, Teva Pharmaceutical Industries Ltd., and Vectura Group plc.

-

5. Can you provide company profiles for the leading nifedipine manufacturers?Yes. For example, Pfizer Inc. is a research-based biopharmaceutical company that discovers, develops, manufactures, markets, sells, and distributes medicines and vaccines, addressing a wide range of therapeutic areas like cardiovascular diseases. Novartis International AG is a pharmaceutical company that is engaged in the research, development, manufacturing, distribution, marketing, and sale of innovative medicines.

-

6. What are the main drivers of growth in the nifedipine market?The increasing prevalence of hypertensive heart diseases and technological innovations for enhancing drug delivery are major market growth drivers of the nifedipine market.

-

7. What challenges are limiting the nifedipine market?The side effects & tolerability issues of nifedipine and the strict regulatory approval process remain key restraints in the nifedipine market.

Need help to buy this report?