Global Next Generation Sequence Market Size, Share, and COVID-19 Impact Analysis, By Technology (WGS, Whole Exome Sequencing, Targeted Sequencing & Resequencing, and Others), By Product (Platform and Consumables), By Application (Oncology, Clinical Investigation, Reproductive Health, HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics, and Consumer Genomics), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Next Generation Sequence Market Insights Forecasts to 2035

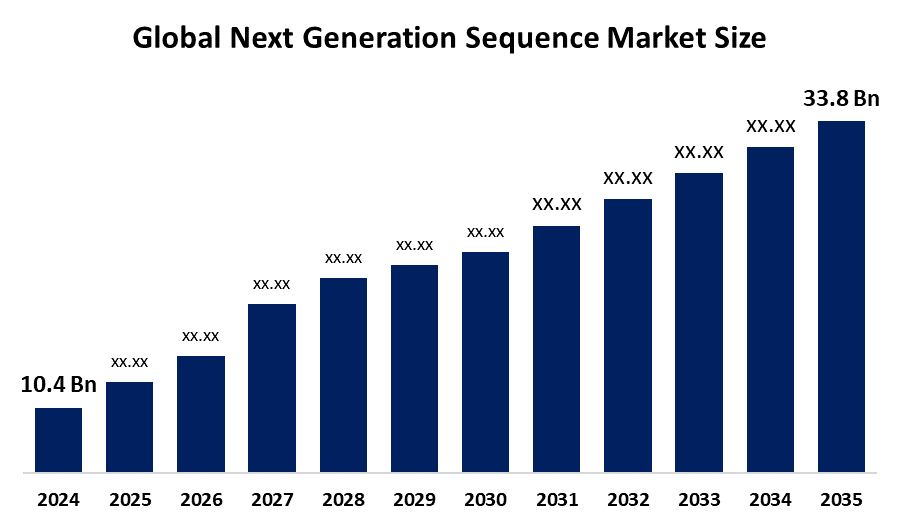

- The Global Next Generation Sequence Market Size Was Estimated at USD 10.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.31% from 2025 to 2035

- The Worldwide Next Generation Sequence Market Size is Expected to Reach USD 33.8 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Next Generation Sequence Market Size was worth around USD 10.4 Billion in 2024 and is predicted to grow to around USD 33.8 Billion by 2035 with a compound annual growth rate (CAGR) of 11.31% from 2025 and 2035. The next generation sequencing (NGS) market offers future opportunities through personalized medicine, oncology diagnostics, infectious disease detection, agricultural genomics, and AI-driven data analytics, driven by falling sequencing costs and expanding clinical and research applications worldwide.

Market Overview

Next-generation sequencing (NGS) refers to high-throughput DNA/RNA sequencing technologies that allow rapid, parallel sequencing of large volumes of genetic material for diagnostics, research, agriculture, and public health. Key growth drivers include escalating demand for precision medicine, cancer profiling, rare disease diagnostics, and infectious disease surveillance; in addition, falling sequencing costs and advances in bioinformatics and AI are making the technology more accessible. Governments globally are funding large-scale genomics programs for instant, Genome India Initiative aims to sequence tens of thousands of individuals; Korea and Canada have launched precision health or public-genomics data infrastructure initiatives. Recent launches include more affordable NGS panels, AI-augmented variant calling tools, and faster “sample-to-answer” instruments. Regulatory approvals and reimbursement policies are improving, spurring clinical adoption.

Key Market Insights

- North America is expected to account for the largest share in the next generation sequence market during the forecast period.

- In terms of technology, the targeted sequencing & resequencing segment is projected to lead the next generation sequence market throughout the forecast period

- In terms of product, the consumables segment captured the largest portion of the market

- In terms of application, the oncology segment is projected to lead the next generation sequence market throughout the forecast period

Next Generation Sequence Market Trends

- Rapid Growth in Clinical Applications – Expanding use in oncology, rare disease diagnosis, reproductive health, and infectious disease testing.

- Shift Toward Precision Medicine – NGS enables tailored therapies based on genetic profiling.

- Technological Advancements – Emergence of long-read sequencing, single-cell sequencing, and nanopore technologies improving accuracy and speed.

- Declining Sequencing Costs – Making genomic testing more accessible for research and clinical adoption.

- Integration with AI & Bioinformatics – Advanced analytics to handle large-scale genomic data for faster insights.

- Rise in Liquid Biopsy Testing – Non-invasive cancer detection through circulating tumor DNA (ctDNA) sequencing.

Report Coverage

This research report categorizes the next generation sequence market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the next generation sequence market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the next generation sequence market.

Global Next Generation Sequence Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 10.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.31% |

| 2035 Value Projection: | USD 33.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Technology, By Product, By Application and by Region |

| Companies covered:: | Illumina, F. Hoffman La Roche Ltd., QIAGEN, Thermo Fisher Scientific, Inc., Bio Rad Laboratories, Inc., Oxford Nanopore Technologies, PierianDx, Genomatix GmbH, DNASTAR, Inc., Perkin Elmer, Inc., Eurofins GATC Biotech GmbH, and BGI. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The next generation sequencing (NGS) market is driven by several key factors. The rising prevalence of cancer, genetic disorders, and infectious diseases has created strong demand for advanced genomic solutions. Technological innovations, including single-cell sequencing, long-read platforms, and reduced sequencing costs, are making NGS more accessible and efficient. The growing emphasis on precision medicine and personalized therapies further fuels adoption in clinical settings. Expanding applications in drug discovery, biomarker development, and reproductive health also contribute to market growth. Additionally, supportive government initiatives, increasing investments in genomics research, and favourable reimbursement policies are accelerating the global uptake of NGS technologies.

Restraining Factor

The next generation sequencing (NGS) market faces restraints such as high initial equipment costs, complex data interpretation requiring advanced bioinformatics, regulatory hurdles, and limited skilled professionals. Data privacy concerns and reimbursement challenges further slow widespread clinical adoption, especially in developing regions.

Market Segmentation

The global next generation sequence market is divided into technology, product, and application.

Global Next Generation Sequence Market, By Technology:

- The targeted sequencing & resequencing segment dominated the market in 2024 and is projected to grow at approximately 22.6% CAGR during the forecast period.

Based on technology, the global next generation sequence market is segmented into, WGS, whole exome sequencing, targeted sequencing & resequencing, and others. Among these, the targeted sequencing & resequencing segment dominated the market in 2024 and is projected to grow at approximately 22.6% CAGR during the forecast period. Targeted sequencing & resequencing dominated the 2024 NGS market due to its cost-effectiveness, faster turnaround, and higher accuracy for specific genes. Its broad clinical utility in oncology, genetic disease testing, and biomarker discovery further drives adoption, ensuring strong future growth.

Whole genome sequencing (WGS) is the fastest-growing segment due to its comprehensive genomic coverage, ability to detect novel mutations, increasing demand in precision medicine, and rising adoption in research, oncology, and rare disease diagnostics, despite higher costs and complexity.

Global Next Generation Sequence Market, By Product:

- The Consumables segment accounted for the largest share in 2024 and is anticipated to grow at a 22.47% CAGR during the forecast period.

Based on product, the global next generation sequence market is segmented into platform and consumables. Among these, the consumables segment accounted for the largest share in 2024 and is anticipated to grow at a 22.47% CAGR during the forecast period. The substantial market share and rapid growth of the consumables segment are primarily attributed to the recurrent usage and high demand for consumables in both commercial and research applications of NGS. These consumables include sample preparation kits and target enrichment kits, which are essential for the sequencing process

Get more details on this report -

platforms are high-cost, one-time investments but essential for NGS operations. Growth is driven by technological advancements (long-read, high-throughput systems), increasing adoption in clinical and research labs, and rising demand for faster, more accurate sequencing.

Global Next Generation Sequence Market, By Application:

- The oncology segment accounted for the largest share in 2024 and is anticipated to grow at a 16.1% CAGR during the forecast period.

Based on application, the global next generation sequence market is segmented into oncology, clinical investigation, reproductive health, HLA typing/immune system monitoring, metagenomics, epidemiology & drug development, agrigenomics & forensics, and consumer genomics. Among these, the oncology segment accounted for the largest share in 2024 and is anticipated to grow at a 16.1% CAGR during the forecast period. This dominance is attributed to the increasing prevalence of cancer and the growing adoption of NGS technologies in cancer research and diagnostics.

the consumer genomics segment is anticipated to exhibit the fastest growth. This is driven by advancements in sequencing technologies, decreasing costs, and increasing consumer interest in personalized health information.

Regional Segment Analysis of the Global Next Generation Sequence Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Next Generation Sequence Market Trends

North America is expected to hold the largest share of the global next generation sequence market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global next generation sequence market over the forecast period. North America’s dominance in the next generation sequencing market is driven by advanced healthcare infrastructure, high R&D investment, widespread adoption of NGS technologies, strong presence of key market players, and increasing prevalence of genetic disorders and cancer research initiatives.

U.S. Next Generation Sequencing Market Trends:

The U.S. NGS market is driven by rising cancer prevalence, extensive government funding, advanced genomic research facilities, growing adoption in clinical diagnostics, precision medicine initiatives, and collaborations between biotech companies and research institutes to expand sequencing applications.

Canada Next Generation Sequencing Market Trends:

Canada’s NGS market growth is fueled by government-backed genomics programs, increasing investments in healthcare R&D, adoption of NGS in oncology and rare disease research, expansion of personalized medicine, and partnerships between academic institutions, hospitals, and biotechnology companies.

Asia Pacific is expected to grow at the fastest CAGR in the Next Generation Sequence market during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR in the next generation sequence market during the forecast period. Asia Pacific’s NGS market is projected to grow fastest due to rising healthcare expenditure, increasing prevalence of genetic disorders and cancer, expanding research infrastructure, growing awareness of personalized medicine, and supportive government initiatives promoting genomics and biotechnology advancements.

India Next Generation Sequencing Market Trends:

India’s NGS market is driven by rising government initiatives in genomics, increasing investment in healthcare and biotech research, growing awareness of precision medicine, expanding adoption in oncology and reproductive health, and collaborations between hospitals, research institutes, and NGS providers.

China Next Generation Sequencing Market Trends:

China’s NGS market growth is fuelled by significant government funding for genomic research, rising prevalence of cancer and genetic disorders, rapid adoption of advanced sequencing technologies, expansion of precision medicine programs, and strategic partnerships between biotech companies and healthcare institutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global next generation sequence market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Next Generation Sequence Market Include

- Illumina

- F. Hoffman La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- December 2023: Oxford Nanopore introduced TurBOT beta access in collaboration with Tecan. Customers are expected to receive the products in Q1 2024. TurBOT is a benchtop instrument enabling efficient basecalling, data analysis, automated extraction, and library preparation for multiple samples in a single unit.

- December 2023: Illumina signed a memorandum of understanding with the African Society for Laboratory Medicine to enhance access to genomics across Africa, aiming to strengthen efforts against infectious diseases.

- December 2023: Illumina partnered with HaploX to supply locally manufactured sequencing instruments in China, supporting regional genomics development.

- November 2023: MedGenome and PacBio announced the De Novo Genome Assembly and Annotation grant, expected to boost research and development initiatives within the genomics industry.

- November 2023: Yourgene Health and PacBio collaborated to optimize long-read sequencing workflows. PacBio approved Yourgene Health’s LightBench instrument for size selection of long DNA fragments.

- September 2023: Integrated DNA Technologies (IDT) launched its xGen NGS product line, including primers, adapters, and universal blockers, specifically for the Ultima Genomics UG100 platform.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the next generation sequence market based on the following segments:

Global Next Generation Sequence Market, By Technology

- WGS

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- Others

Global Next Generation Sequence Market, By Product

- Platform

- Consumables

Global Next Generation Sequence Market, By Application

- Oncology

- Clinical Investigation

- Reproductive Health

- HLA Typing/Immune System Monitoring

- Metagenomics

- Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

Global Next Generation Sequence Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the next generation sequence market over the forecast period?The global next generation sequence market is projected to expand at a CAGR of 11.31% during the forecast period.

-

2. What is the market size of the next generation sequence market?The global next generation sequence market size is expected to grow from USD 10.4 billion in 2024 to USD 33.8 billion by 2035, at a CAGR 11.31% of during the forecast period 2025-2035.

-

3.Wh ich region holds the largest share of the next generation sequence market?North America is anticipated to hold the largest share of the next generation sequence market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global next generation sequence market?Illumina, F. Hoffman-La Roche Ltd., QIAGEN, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, PierianDx, Genomatix GmbH, DNASTAR, Inc., Perkin Elmer, Inc., Eurofins GATC Biotech GmbH, and BGI.

-

5. What factors are driving the growth of the next generation sequence market?The next generation sequencing market is driven by rising prevalence of genetic disorders and cancer, increasing adoption in clinical diagnostics and research, advancements in sequencing technologies, and growing demand for personalized medicine.

-

6. What are market trends in the next generation sequence market?Market trends include expanding use in oncology and reproductive health, collaborations between companies and research institutes, government genomics initiatives, and the development of benchtop and portable sequencing instruments.

-

7. What are the main challenges restricting wider adoption of the next generation sequence market?Key challenges restricting adoption are high costs of sequencing, data analysis complexity, lack of skilled professionals, and regulatory and privacy concerns related to genomic data.

Need help to buy this report?