Global Neuromorphic Hardware Market Size, Share, and COVID-19 Impact Analysis, By Type (Processor, Memory, Sensor, and Others), By Application (Image & Video Processing/Computer Vision, Natural Language Processing (NLP), Sensor Fusion, and Other Applications), By Vertical (Consumer Electronics, Aerospace & Defense, Automotive, Industrial, Medical, IT & Telecom, and Other Verticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Neuromorphic Hardware Market Insights Forecasts to 2035

- The Global Neuromorphic Hardware Market Size Was Estimated at USD 3.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.81% from 2025 to 2035

- The Worldwide Neuromorphic Hardware Market Size is Expected to Reach USD 40.56 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global neuromorphic hardware market size was worth around USD 3.87 billion in 2024 and is predicted to grow to around USD 40.56 billion by 2035 with a compound annual growth rate (CAGR) of 23.81% from 2025 to 2035. The neuromorphic hardware market is growing due to the rising demand for energy-efficient computing solutions and real-time data processing in AI and machine learning applications. The major factors that are driving the growth include the integration of these chips into edge computing devices, autonomous systems, and consumer electronics, among others, coupled with huge R&D investments.

Market Overview

Neuromorphic hardware refers to computing systems and chips that take inspiration from the structure and functionality of the human brain, mainly using spiking neural networks to mimic neurons and synapses. These brain-inspired processors power low-power, real-time AI applications in edge computing, robotics, autonomous vehicles, IoT, and pattern recognition. The demand for low-power, high-speed processing from smart devices and edge systems, along with the surge in AI adoption and the advances in neuromorphic R&D, is driving growth in the global market.

In April 2024, the Department of Energy (DOE) issued a Funding Opportunity Announcement for EXPRESS, with up to $65 million available, to advance ultra-energy-efficient neuromorphic computing based on engineering, neuroscience, and CS. EES2 expanded to double the efficiency of chips, while ARPA-E COOLERCHIPS funded innovations in cooling for neuromorphic data centers to drastically slash energy and water consumption. Additionally, a great growth opportunity is expected to come from automotive ADAS, medical imaging, and always-on sensory devices, wherein ultra-efficient event-driven intelligence will make a big difference. The players involved in the space include Intel, IBM, BrainChip Holdings Ltd., SynSense, Qualcomm, Samsung, GrAI Matter Labs, Applied Brain Research Inc., and Innatera Nanosystems.

Report Coverage

This research report categorizes the neuromorphic hardware market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the neuromorphic hardware market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the neuromorphic hardware market.

Global Neuromorphic Hardware Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.87 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 23.81% |

| 024 – 2035 Value Projection: | USD 40.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | IBM, Intel Corporation, SynSense AG, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., BrainChip Holdings Ltd., aiCTX AG, Hewlett Packard Enterprise, Advanced Micro Devices, Inc., SK Hynix Inc., Numenta, Inc., General Vision Inc., Applied Brain Research Inc., GrAI Matter Labs, Innatera Nanosystems B.V., And Other Players |

| Growth Drivers: | CAGR of 4.05% |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Driving the global neuromorphic hardware market are surging demands for ultra-low-power, brain-inspired computing, particularly in edge AI devices, as conventional architectures struggle to deliver real-time intelligence efficiently. Applications in autonomous vehicles, robotics, and consumer electronics create this demand. Breakthroughs in spiking neural networks and event-driven sensors let systems improve performance while increased R&D investment from governments and tech giants accelerates hardware innovation. Sustainability goals heighten interest in energy-efficient systems and make neuromorphic processors a preferable alternative to power-hungry conventional chips.

Restraining Factors

The main constraining factors for neuromorphic hardware are the high cost of R&D and production, and significant technical complications. These are further exacerbated by an immature software and toolchain ecosystem, a dearth of skilled professionals, and challenges relating to mass deployment and calibration of analogue devices.

Market Segmentation

The neuromorphic hardware market share is classified into type, application, and vertical.

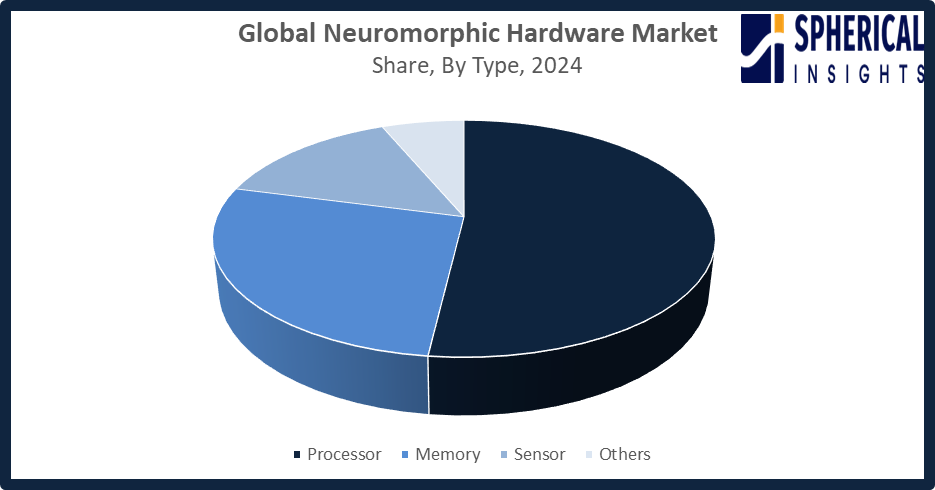

- The processor segment dominated the market in 2024, approximately 52% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the neuromorphic hardware market is divided into processor, memory, sensor, and others. Among these, the processor segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The processor segment dominated the neuromorphic hardware market due to high demand from AI and edge applications requiring energy-efficient and high-speed computing. Neuromorphic processors comprise spiking neural chips and dedicated accelerators that allow real-time data processing with very low power consumption. This makes neuromorphic processors highly critical to consumer electronics, autonomous vehicles, robotics, and IoT applications, hence driving fast growth in the market.

Get more details on this report -

- The image & video processing/computer vision segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the neuromorphic hardware market is divided into image & video processing/computer vision, natural language processing (NLP), sensor fusion, and other applications. Among these, the image & video processing/computer vision segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The image & video processing/computer vision segment dominates the market due to the growing demand for real-time, low-power visual computing in applications in sectors such as autonomous vehicles, drones, surveillance, and smart cameras. Neuromorphic chips can efficiently process high-volume sensory data for quicker recognition, pattern detection, and edge AI applications. This factor drives enormous adoption across various industries such as automotive, industrial, and consumer electronics.

- The consumer electronics segment accounted for the highest market revenue in 2024, approximately 25% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vertical, the neuromorphic hardware market is divided into consumer electronics, aerospace & defense, automotive, industrial, medical, IT & telecom, and other verticals. Among these, the consumer electronics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The consumer electronics segment market growth is due to an increased integration of smart, always-on AI devices such as smartphones, wearables, and smart home systems. Neuromorphic chips facilitate energy-efficient, real-time processing, elevate user experiences via low-latency interactions, improved pattern recognition, and extended battery life, and thus drive this wide-ranging adoption and expansion in market growth.

Regional Segment Analysis of the Neuromorphic Hardware Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the neuromorphic hardware market over the predicted timeframe.

North America is anticipated to hold the largest share of the neuromorphic hardware market over the predicted timeframe. North America is expected to have a 39% share of neuromorphic hardware during the forecast period owing to advanced AI research, robust semiconductor infrastructure, and strong government support. The United States is the leading contributor, driven by activities such as the DOE's EXPRESS funding, ARPA-E COOLERCHIPS, and the National AI Initiative, which altogether accelerate the R&D and commercialization of neuromorphic hardware. High adoption of edge AI, autonomous vehicles, robotics, and IoT devices in the region further fuels the demand. Additionally, the presence of key players such as Intel, IBM, Qualcomm, and BrainChip empowers technological leadership and maintains market dominance.

In FY2024, the U.S. National AI Initiative invested over USD 2 billion in neuromorphic chips across federal agencies. The NIH BRAIN Initiative advanced neuromorphic tools for brain research, highlighted by an October 2024 workshop demonstrating their use in modeling neural dynamics, further strengthening the country’s AI and neuroscience ecosystem.

Asia Pacific is expected to grow at a rapid CAGR in the neuromorphic hardware market during the forecast period. The neuromorphic hardware market in the Asia Pacific is rapidly growing, with an approximate 27% market share, driven by increasing AI adoption, government-backed semiconductor initiatives, and growing projects on smart cities and industrial automation. While China leads, powered by its China Brain Project and national AI strategies, neuromorphic research and chip development are well-funded. Rapid industrialization, growing demand for autonomous vehicles, robotics, and IoT applications, with strong investments by technology giants, has driven the deployment of energy-efficient, brain-inspired computing solutions, placing the region as the fastest-growing neuromorphic market in the world.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the neuromorphic hardware market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Intel Corporation

- SynSense AG

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- BrainChip Holdings Ltd.

- aiCTX AG

- Hewlett Packard Enterprise

- Advanced Micro Devices, Inc.

- SK Hynix Inc.

- Numenta, Inc.

- General Vision Inc.

- Applied Brain Research Inc.

- GrAI Matter Labs

- Innatera Nanosystems B.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, BrainChip Holdings unveiled the AKD1500, a neuromorphic Edge AI accelerator co-processor chip, at Embedded World North America, advancing ultra-low-power, fully digital, event-based neuromorphic AI for efficient edge computing applications.

- In August 2025, BrainChip Holdings launched the BrainChip Developer Akida Cloud, a cloud-based platform providing access to multiple generations of its Akida neuromorphic technology. The initial release features Akida 2, the company’s second-generation, fully digital, ultra-low-power, event-based AI platform, enabling developers to accelerate neuromorphic AI application development.

- In June 2025, Innatera launched Pulsar, its first commercial neuromorphic microcontroller for edge devices. Mimicking the brain’s neural networks, neuromorphic chips integrate memory and computation, unlike traditional von Neumann processors, enabling efficient, brain-inspired processing that reduces energy consumption and latency for advanced AI applications at the sensor edge.

- In August 2024, Intel unveiled Hala Point, the world’s largest neuromorphic system, deployed at Sandia National Laboratories. Powered by Loihi 2 processors, it supports research in brain-inspired AI, addressing challenges in efficiency and sustainability while advancing large-scale neuromorphic computing capabilities.

- In July 2024, Intel built the world’s largest neuromorphic computer, Hala Point, designed to mimic the human brain. It supports future AI research, performing workloads 50 times faster and using 100 times less energy than traditional CPU- and GPU-based systems, marking a breakthrough in efficient, brain-inspired computing.

- In September 2023, SynSense launched the Xylo IMU neuromorphic development kit, enabling IMU-based motion applications such as human movement analysis, HCI, and industrial monitoring. Its Rockpool open-source Python toolchain supports training and deploying spiking neural network (SNN) models, allowing developers to explore innovative use cases and advance neuromorphic research.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the neuromorphic hardware market based on the below-mentioned segments:

Global Neuromorphic Hardware Market, By Type

- Processor

- Memory

- Sensor

- Others

Global Neuromorphic Hardware Market, By Application

- Image & Video Processing/Computer Vision

- Natural Language Processing (NLP)

- Sensor Fusion

- Other Applications

Global Neuromorphic Hardware Market, By Vertical

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Industrial

- Medical

- IT & Telecom

- Other Verticals

Global Neuromorphic Hardware Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the neuromorphic hardware market over the forecast period?The global neuromorphic hardware market is projected to expand at a CAGR of 23.81% during the forecast period.

-

2. What is the market size of the neuromorphic hardware market?The global neuromorphic hardware market size is expected to grow from USD 3.87 billion in 2024 to USD 40.56 billion by 2035, at a CAGR of 23.81% during the forecast period 2025-2035.

-

3. What is the neuromorphic hardware market?The neuromorphic hardware market is an emerging sector focused on developing computing systems and specialized chips designed to mimic the structure and function of the human brain.

-

4. Which region holds the largest share of the neuromorphic hardware market?North America is anticipated to hold the largest share of the neuromorphic hardware market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global neuromorphic hardware market?IBM, Intel Corporation, SynSense AG, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., BrainChip Holdings Ltd., aiCTX AG, Hewlett Packard Enterprise, Advanced Micro Devices, Inc., SK Hynix Inc., Numenta, Inc., and Others.

-

6. What factors are driving the growth of the neuromorphic hardware market?The neuromorphic hardware market is driven by rising AI adoption, demand for energy-efficient edge computing, autonomous systems, IoT devices, real-time data processing, and government-backed R&D initiatives globally.

-

7. What are the market trends in the neuromorphic hardware market?Market trends in neuromorphic hardware include significant growth driven by AI applications, a shift toward edge computing, and increasing demand from the automotive and consumer electronics sectors.

-

8. What are the main challenges restricting wider adoption of the neuromorphic hardware market?The main challenges restricting the wider adoption of the neuromorphic hardware market are the high development and manufacturing costs, a significant lack of standardized software and programming tools, and a general limited awareness and understanding of the technology.

Need help to buy this report?