Netherlands Hydrogen Market Size, Share, By Technology (Alkaline Electrolyzers, Proton Exchange Membrane Electrolyzers, Solid Oxide Electrolyzers, And Others), By Distribution (Pipeline, Shipping & Liquid Hydrogen, Compressed Hydrogen, And Others), And Netherlands Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNetherlands Hydrogen Market Insights Forecasts to 2035

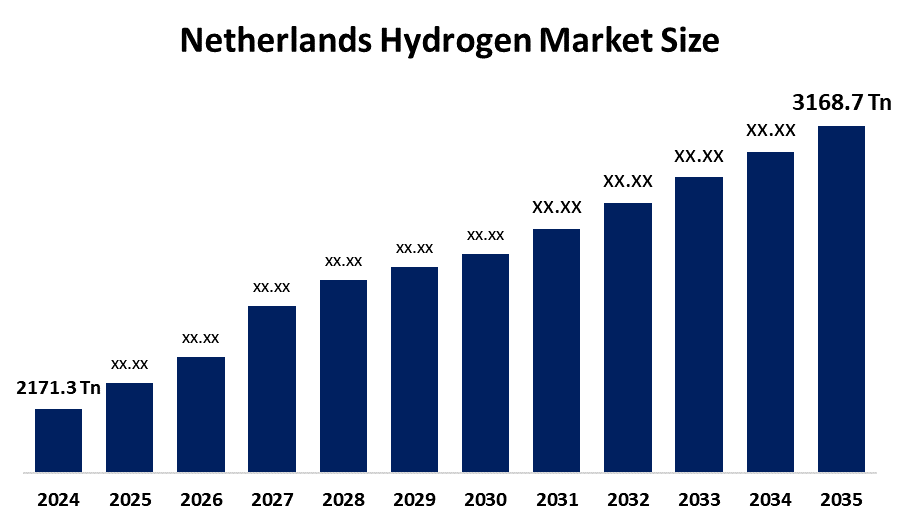

- Netherlands Hydrogen Market Size 2024: 2171.3 Thousand Tonnes

- Netherlands Hydrogen Market Size 2035: 3168.7 Thousand Tonnes

- Netherlands Hydrogen Market CAGR 2024: 3.5%

- Netherlands Hydrogen Market Segments: Technology and Distribution

Get more details on this report -

The country's hydrogen sector encompasses the entire national ecosystem and emerging industry of developing hydrogen especially renewable as an energy vector to decarbonise major industries such as transport, heavy industry and electricity generation. This requires developing methods of producing, storing, transporting and using hydrogen. With the strategic port location, vast amounts of port infrastructure, and available gas infrastructure in place already, the Netherlands is establishing itself as a hydrogen hub within Northwestern Europe to enable both domestic consumption and pathways to support the larger European energy transition through importing and exporting hydrogen.

The hydrogen in Netherlands are backed by government support, including the Dutch National Hydrogen Strategy, supported by the Climate Fund and other policy frameworks, which aims to scale up hydrogen production and infrastructure while integrating hydrogen into the national energy system. The allocation of approximately €9 billion by the Dutch government to support green hydrogen projects and infrastructure development as part of its national strategy, significantly boosting investment in production capacity and enabling technologies while stimulating economic growth and job creation.

As technology advances, Netherlands’s hydrogen providers are now using electrolysis technology and other new production technologies intended to increase efficiency and decrease costs and industry partners - including overseas energy companies who will build large-GW-scale electrophoresis machines to use to create hydrogen as there are also virtually no large-scale hydrogen supply-capacity expansion efforts underway to expand supply capacity. The development of advanced hydrogen storage, transport solutions and their integration into renewable energy systems continues to bolster the foundation of our technology for industry in Netherlands.

Netherlands Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2171.3 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.5% |

| 2035 Value Projection: | 3168.7 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Technology,By Distribution |

| Companies covered:: | Shell Gasunie Air Liquide VoltH2 Uniper Hydrogen Netherlands Eneco Battolyser Systems HyCC Air Products Vattenfall HyET Hydrogen Statkraft Renewables H2Eron HyGear SoluForce Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Netherlands Hydrogen Market:

The Netherlands hydrogen market is driven by the urgent need to decarbonise sectors such as petrochemicals, heavy transport, and industry, national and European climate goals that prioritise hydrogen as a clean energy vector, the country’s geographical position, well established infrastructure to serve as a hydrogen gateway, increased additional investments and partnerships, and advances in technology for hydrogen production.

The Netherlands hydrogen market is restrained by the high cost of hydrogen production, infrastructure deployment, challenges in establishing a fully integrated transport and storage network, technical uncertainties, market readiness issues, and the need for continued policy clarity and economic incentives.

The future of Netherlands hydrogen market is bright and promising, with versatile opportunities emerging from the potential exists to create significant export and import markets through the major ports while simultaneously establishing an international market for hydrogen technology through foreign investment and developing new economic value chains. With the right policy framework, increased capacity for renewable energy, and cooperation from other countries, the hydrogen market will be positioned to help meet wider European decarbonisation objectives and create the foundation for a significant clean energy industry.

Market Segmentation

The Netherlands Hydrogen Market share is classified into technology and distribution.

By Technology:

The Netherlands hydrogen market is divided by technology into alkaline electrolyzers, proton exchange membrane electrolyzers, solid oxide electrolyzers, and others. Among these, the alkaline electrolyzers segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Proven maturity, low capital costs, superior scalability for large scale industrial applications, low maintainance required, and favours reliability and economic viability all contribute to the alkaline electrolyzers segment's largest share and higher spending on hydrogen when compared to other technology.

By Distribution:

The Netherlands hydrogen market is divided by distribution into pipeline, shipping & liquid hydrogen, compressed hydrogen, and others. Among these, the pipeline segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The ammonia segment dominates because of providing cost effective and efficient method for large scale transportation, extensive natural gas infrastructure, and allows high volume and continuous transport between industrial clusters and neighbouring countries.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Netherlands hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Netherlands Hydrogen Market:

- Shell

- Gasunie

- Air Liquide

- VoltH2

- Uniper Hydrogen Netherlands

- Eneco

- Battolyser Systems

- HyCC

- Air Products

- Vattenfall

- HyET Hydrogen

- Statkraft Renewables

- H2Eron

- HyGear

- SoluForce

- Others

Recent Developments in Netherlands Hydrogen Market:

In August 2025, Hynetwork completed the final weld on the first section of the 32-km Rotterdam pipeline, marking a key, tangible move towards commissioning.

In August 2025, Thyssengas and Hynetwork launched the conversion of a 53-km pipeline between Vlighuis and Ochtrup to carry hydrogen, with operations planned for 2027.

In October 2024, a 100 MW electrolyser was officially inaugurated in Nieuwegein by Hysolar. This facility produces 300,000 kg of green hydrogen annually, intended for heavy-duty transportation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Netherlands, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Netherlands hydrogen market based on the below-mentioned segments:

Netherlands Hydrogen Market, By Technology

- Alkaline Electrolyzers

- Proton Exchange Membrane Electrolyzers

- Solid Oxide Electrolyzers

- Others

Netherlands Hydrogen Market, By Distribution

- Pipeline

- Shipping & Liquid Hydrogen

- Compressed Hydrogen

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Netherlands hydrogen market size?A: Netherlands hydrogen market is expected to grow from 2171.3 thousand tonnes in 2024 to 3168.7 thousand tonnes by 2035, growing at a CAGR of 3.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the urgent need to decarbonise sectors such as petrochemicals, heavy transport, and industry, national and European climate goals that prioritise hydrogen as a clean energy vector, the country’s geographical position, well established infrastructure to serve as a hydrogen gateway, increased additional investments and partnerships, and advances in technology for hydrogen production.

-

Q: What factors restrain the Netherlands hydrogen market?A: Constraints include the high cost of hydrogen production, infrastructure deployment, challenges in establishing a fully integrated transport and storage network, technical uncertainties, market readiness issues, and the need for continued policy clarity and economic incentives.

-

Q: How is the market segmented by technology?A: The market is segmented into alkaline electrolyzers, proton exchange membrane electrolyzers, solid oxide electrolyzers, and others.

-

Q: Who are the key players in the Netherlands hydrogen market?A: Key companies include Shell, Gasunie, Air Liquide, VoltH2, Uniper Hydrogen Netherlands, Eneco, Battolyser Systems, HyCC, Air Products, Vattenfall, HyET Hydrogen, Statkraft Renewables, H2Eron, HyGear, SoluForce, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?