Netherlands Electronic Chemicals Market Size, Share, By Type (Atmospheric & Specialty Gases, Photoresist Chemicals, Wet Chemicals and Solvents, Others), By Application (Integrated Circuits and Semiconductors, Flat Panel Displays & Light Emitting Diodes, Photovoltaic, Printed Circuit Boards, Others), Netherlands Electronic Chemicals Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsNetherlands Electronic Chemicals Market Insights Forecasts to 2035

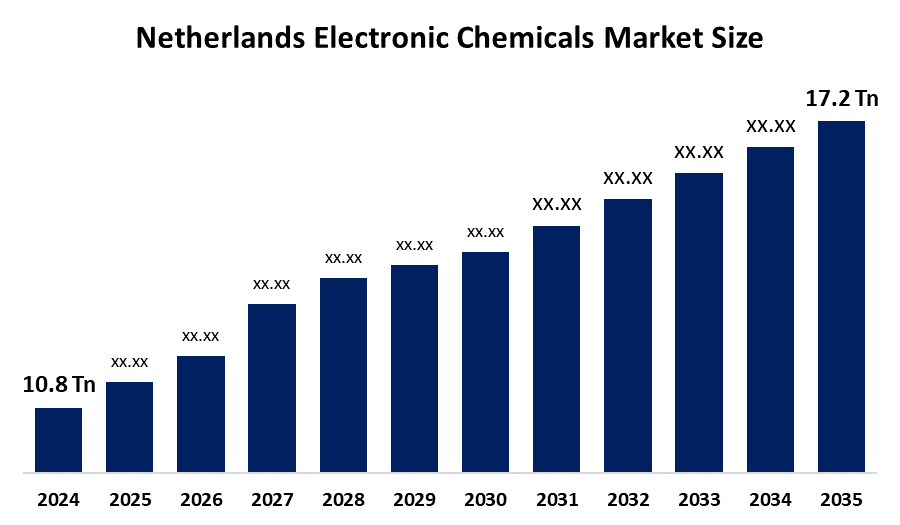

- Netherlands Electronic Chemicals Market Size 2024: 10.8 thousand tonnes

- Netherlands Electronic Chemicals Market Size 2035: 17.2 thousand tonnes

- Netherlands Electronic Chemicals Market CAGR 2024: 4.32%

- Netherlands Electronic Chemicals Market Segments: Type and Application

Get more details on this report -

The electronic chemicals market of the Netherlands includes high-purity chemicals that manufacturers use to produce semiconductors, PCBs, display technology and advanced electronic devices. The Netherlands semiconductor and photonics industry, together with its advanced manufacturing sector, works as an ecosystem that depends on these high-purity chemicals.

In late 2025, Pegasus Materials introduced two new bio-based specialty materials designed for electronics and aerospace and 3D printing applications, which enable the development of slimmer USB-C connectors and high-speed memory module components used in data-centre servers. The materials serve as sustainable alternatives to traditional methods used in advanced electronic component manufacturing.

The Dutch government dedicated about €2.5 billion through 'Project Beethoven' to develop the chip industry ecosystem, especially in the Brainport Eindhoven high-tech region.

The semiconductor manufacturing market expansion, together with EU Chips Act funding and the rising demand for sustainable chemicals and the development of advanced lithography technology, will generate significant growth prospects for high-purity electronic chemicals and eco-friendly electronic chemicals.

Netherlands Electronic Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | .10.8 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.32% |

| 2035 Value Projection: | 17.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 163 |

| Segments covered: | By Type,By Application |

| Companies covered:: | Nouryon LyondellBasell Industries AkzoNobel BASF SE Shin-Etsu Chemical SABIC Evonik Industries Caldic IMCD Biesterfe Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Netherlands Electronic Chemicals Market:

The Netherlands electronic chemicals market is driven by the combination of strong semiconductor manufacturing presence with ASML-led lithography advancements, EU Chips Act funding and increasing need for high-purity materials and advanced packaging expansion, and development of sustainable PFAS-free chemical solutions with minimal defects.

The Netherlands electronic chemicals market is restrained by the combination of high production costs with strict EU chemical regulations and PFAS restrictions, and supply chain dependency on imports and limited domestic large-scale chemical manufacturing capacity for advanced electronic-grade materials creates the current market challenges.

The future of Netherlands electronic chemicals market is bright and promising, with the industry expansion driven by semiconductor investments, EU Chips Act support, advanced lithography leadership and increasing demand for sustainable chemicals and ongoing technological advancements in high-purity electronic material development.

Market Segmentation

The Netherlands electronic chemicals market share is classified into type and application.

By Type:

The Netherlands electronic chemicals market is divided by type into atmospheric & specialty gases, photoresist chemicals, wet chemicals and solvents, and others. Among these, the atmospheric & specialty gases segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their essential role in semiconductor fabrication, high consumption volumes, and continuous demand from advanced lithography and wafer processing.

By Application:

The Netherlands electronic chemicals market is divided by application into integrated circuits and semiconductors, flat panel displays & light emitting diodes, photovoltaic, printed circuit boards, and others. Among these, the integrated circuits and semiconductors segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Integrated Circuits and Semiconductors dominate owing to strong chip manufacturing presence, advanced R&D activities, and rising demand for high-purity electronic chemicals.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Netherlands electronic chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Netherlands Electronic Chemicals Market:

- Nouryon

- LyondellBasell Industries

- AkzoNobel

- BASF SE

- Shin-Etsu Chemical

- SABIC

- Evonik Industries

- Caldic

- IMCD

- Biesterfe

- Others

Key Target Audience

- Market Players

- Investors

- Applicationrs

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Netherlands, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Netherlands electronic chemicals market based on the below-mentioned segments:

Netherlands Electronic Chemicals Market, By Type

- Atmospheric & Specialty Gases,

- Photoresist Chemicals,

- Wet Chemicals and Solvents,

- Others

Netherlands Electronic Chemicals Market, By Application

- Integrated Circuits and Semiconductors,

- Flat Panel Displays & Light Emitting Diodes,

- Photovoltaic,

- Printed Circuit Boards,

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Netherlands electronic chemicals market size?A: Netherlands electronic chemicals market is expected to grow from 10.8 thousand tonnes in 2024 to 17.2 thousand tonnes by 2035, growing at a CAGR of 4.32% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the combination of strong semiconductor manufacturing presence with ASML-led lithography advancements, EU Chips Act funding and increasing need for high-purity materials and advanced packaging expansion, and development of sustainable PFAS-free chemical solutions with minimal defects.

-

Q: What factors restrain the Netherlands electronic chemicals market?A: Constraints include the combination of high production costs with strict EU chemical regulations and PFAS restrictions, and supply chain dependency on imports and limited domestic large-scale chemical manufacturing capacity for advanced electronic-grade materials creates the current market challenges.

-

Q: How is the market segmented by type?A: The market is segmented into atmospheric & specialty gases, photoresist chemicals, wet chemicals and solvents, and others.

-

Q: Who are the key players in the Netherlands electronic chemicals market?A: Key companies include Nouryon, LyondellBasell Industries, AkzoNobel, BASF SE, Shin-Etsu Chemical, SABIC, Evonik Industries, Caldic, IMCD, Biesterfeld and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, Applicationrs, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?