Netherlands Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Chemical Form (Anhydrous Ammonia, and Aqueous Ammonia), By End Use (Agriculture & Fertilizers, Textiles & Pharmaceuticals, Explosives, Refrigeration, and Others), and Netherlands Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNetherlands Ammonia Market Insights Forecasts To 2035

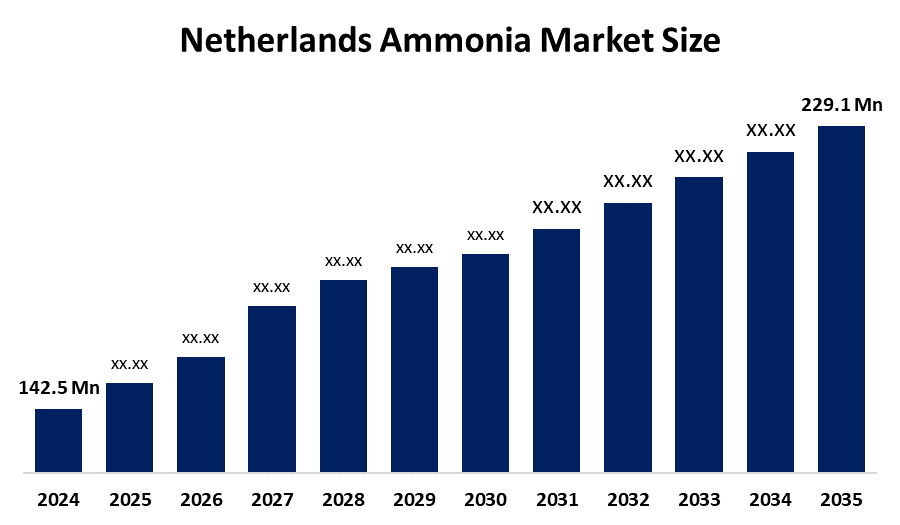

- The Netherlands Ammonia Market Size Was Estimated At USD 142.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 4.41% From 2025 To 2035

- The Netherlands Ammonia Market Size Is Expected To Reach USD 229.1 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Netherlands Ammonia Market Size Is Anticipated To Reach USD 229.1 Million By 2035, Growing At A CAGR Of 4.41% From 2025 To 2035. The ammonia market size in the Netherlands is driven by strong fertilizer demand, sophisticated chemical and petrochemical industries, port-based ammonia trade, growing wastewater treatment requirements, and growing investments in green ammonia and hydrogen transition projects.

Market Overview

The Netherlands ammonia market size encompasses all activities related to ammonia, including production and importation, storage and distribution, and industrial and agricultural consumption. Ammonia functions as a basic component in nitrogen-based fertilizers, chemical and petrochemical production, refrigeration systems, wastewater treatment, pharmaceutical manufacturing, and hydrogen transportation for clean energy purposes. Market development in the Netherlands receives strong support from its extensive port infrastructure, advanced chemical sector, and its position as a leader in sustainable hydrogen and ammonia technologies.

The Dutch government supports the ammonia market size through programs aimed at decarbonizing industrial operations and reducing nitrogen emissions. These initiatives provide €78 million in subsidies for emission-reduction technologies, while the IMKE program has received €148 million to support climate-neutral manufacturing. In addition, the government offers grants for green hydrogen and ammonia projects. Investments at the Port of Rotterdam further establish the Netherlands as a central hub for green ammonia production.

In 2025, the Port of Rotterdam and AM Green signed an agreement to build a green fuel corridor capable of handling up to 1 million tons of green ammonia annually, increasing both trade activities and clean fuel production. The Netherlands is expected to see increased sustainable ammonia production capacity through green hydrogen-to-ammonia cracking projects and electrolyzer investments, which will strengthen essential production and distribution systems.

Report Coverage

This research report categorizes the market size for the Netherlands ammonia market size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Netherlands ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Netherlands ammonia market.

Netherlands Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 142.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.41% |

| 2023 Value Projection: | USD 229.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Chemical, By End Use |

| Companies covered:: | OCI N.V., Yara International ASA, Royal Vopak N.V., Euro Heat Pipes, SHV Holdings, Mekog, Local chemical distributors and terminals in the Port of Rotterdam, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammonia market size in Netherlands is driven by the strong demand from the fertilizer and agricultural sectors, while the established chemical and petrochemical industry and the country's main European trade route through the Port of Rotterdam drive market demand. The ammonia market experiences growth because of government support for green ammonia and hydrogen projects, modern industrial facilities, and the rising use of ammonia in wastewater treatment and environmentally friendly energy production.

Restraining Factors

The ammonia market size in Netherlands is mostly constrained by the expensive production and operational expenses, the enforcement of strict environmental and nitrogen emission regulations, insufficient domestic feedstock resources, market dependency on imported materials, and unpredictable international ammonia and natural gas price movements.

Market Segmentation

The Netherlands ammonia market share is classified into chemical form and end use.

- The anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Netherlands ammonia market size is segmented by chemical form into anhydrous ammonia, and aqueous ammonia. Among these, the anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that anhydrous ammonia is more effective for industrial applications, chemical synthesis, and fertilizer manufacture due to its increased nitrogen content. Large-scale operations are supported by its ease of handling, storage, and bulk transportation, which leads to the highest revenue share and consistent market growth over aqueous ammonia.

- The agriculture & fertilizers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Netherlands ammonia market size is segmented by end use into agriculture & fertilizers, textiles & pharmaceuticals, explosives, refrigeration, and others. Among these, the agriculture & fertilizers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Ammonia's vital function as a nitrogen source in fertilizer production, which sustains the Netherlands' intense agricultural sector and food export economy, is the reason for this dominance. This sector has the biggest market share and is expected to develop steadily due to government incentives for sustainable agriculture, sophisticated agricultural techniques, and steady fertilizer consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Netherlands ammonia market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OCI N.V.

- Yara International ASA

- Royal Vopak N.V.

- Euro Heat Pipes

- SHV Holdings

- Mekog

- Local chemical distributors and terminals in the Port of Rotterdam

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, to improve clean fuel infrastructure, OCI Global and VICTROL signed a Memorandum of Understanding to create a supply chain for chilled clean ammonia bunkering in the Netherlands and Belgium.

- In May 2025, an agreement is signed between AM Green and the Port of Rotterdam Authority to establish a green fuels supply chain between India and Europe, including the export of green ammonia through Rotterdam.

- In April 2025, the Port of Rotterdam completes a test of ammonia bunkering, moving 800 m³ of liquid ammonia between ships and increasing ammonia's suitability as a maritime fuel.

Market Segment

This study forecasts revenue at the Netherlands, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Netherlands ammonia market based on the below-mentioned segments:

Netherlands Ammonia Market, By Chemical Form

- Anhydrous Ammonia

- Aqueous Ammonia

Netherlands Ammonia Market, By End Use

- Agriculture & Fertilizers

- Textiles & Pharmaceuticals

- Explosives

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

What is the Netherlands ammonia market size?Netherlands ammonia market size is expected to grow from USD 142.5 million in 2024 to USD 229.1 million by 2035, growing at a CAGR of 4.41% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by strong demand from the fertilizer and agricultural sectors, while the established chemical and petrochemical industry and the country's main European trade route through the Port of Rotterdam drive market demand.

-

What factors restrain the Netherlands ammonia market?Constraints include the expensive production and operational expenses, and the enforcement of strict environmental and nitrogen emission regulations.

-

How is the market segmented by chemical form?The market is segmented into anhydrous ammonia, and aqueous ammonia.

-

Who are the key players in the Netherlands ammonia market?Key companies include OCI N.V., Yara International ASA, Royal Vopak N.V., Euro Heat Pipes, SHV Holdings, Mekog, Local chemical distributors and terminals in the Port of Rotterdam, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?