Global Neem Oil Pesticides Market Size, Share, and COVID-19 Impact Analysis, Product Type (Concentrates, Ready-to-Use Sprays, Emulsifiable Neem Oil, and Others), By Application (Agriculture, Horticulture, Home & Garden, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Neem Oil Pesticides Market Insights Forecasts to 2035

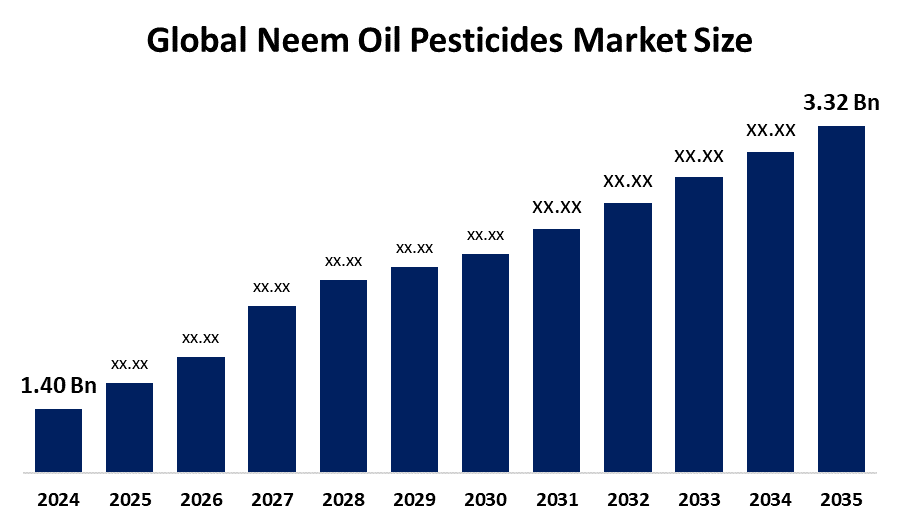

- The Global Neem Oil Pesticides Market Size Was Estimated at USD 1.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.17 % from 2025 to 2035

- The Worldwide Neem Oil Pesticides Market Size is Expected to Reach USD 3.32 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Tall Oil Rosin Market Size was Valued at around USD 1.12 Billion in 2024 and is Predicted to Grow to around USD 1.82 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.51 % from 2025 To 2035. Growing applications in adhesives, coatings, and bio-based chemicals, rising demand for sustainable products, and expansion in new regions propelled by green manufacturing trends are some of the potential opportunities in the tall oil rosin market.

Market Overview

The global market that results from the acquisition, processing, distribution, and application of biopesticides made from the seeds of the neem tree (Azadirachta indica) is known as the neem oil pesticides market. Due to their high azadirachtin concentration, these compounds are mostly employed as insecticides, fungicides, and repellents. They are safe for many beneficial animals, soil, and human health, in addition to being environmentally friendly. The Indian government reduced the tariff on 12 bio-pesticides, including neem-based formulations, from 7% to 5% in September 2025, a step toward the widespread use and affordability of neem-derived products. The growth industry is mainly founded on the increasing public knowledge of the adverse effects of synthetic pesticides and the worldwide conversion to organic farming practices. Moreover, the use of neem oil-derived treatments has been sped up by the widespread adoption of Integrated Pest Management (IPM) systems that put a higher focus on the use of bio-control agents.

Report Coverage

This research report categorizes the neem oil pesticides market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the neem oil pesticides market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the neem oil pesticides market.

Global Neem Oil Pesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.17% |

| 2035 Value Projection: | USD 3.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Regional Analysis |

| Companies covered:: | Agro Extracts Limited, AzaGuard (BioSafe Systems), BASF SE, Bharat Agro Industries, Certis USA LLC, Emami Agrotech Ltd., EID Parry (India) Limited, Fortune Biotech Ltd., Gramin India Agri BusiNest, Neeming Australia Pty Ltd., Nufarm Limited, P.J. Margo Pvt. Ltd., Parker India Group, Syngenta AG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Governments and international organizations imposing strict controls on chemical pesticides have created a positive environment for natural pesticides such as neem oil, which has, in turn, influenced the demand in the neem oil pesticide market. With the establishment of retail organic food stores and e-commerce platforms, farmers have become more accessible to and have a higher usage of neem oil-based remedies, which has hastened the growth of the neem oil pesticides market. Besides, the increasing need of consumers for organic and chemical-free food products is also motivating the farmers to adopt natural pest control methods.

Restraining Factors

The market for neem oil pesticides is restricted by a number of reasons, including high production costs, a short shelf life, poorer initial efficacy when compared to synthetic pesticides, uneven raw material quality, and farmers' ignorance of the benefits and proper usage.

Market Segmentation

The neem oil pesticides market share is classified into product type and application.

- The concentrates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the neem oil pesticides market is divided into concentrates, ready-to-use sprays, emulsifiable neem oil, and others. Among these, the concentrates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The most popular form is concentrates owing to their affordability and adaptability. The concentrate category is anticipated to hold a sizable portion of the neem oil pesticides market as demand for bulk and commercial applications increases, particularly among large farms and agricultural cooperatives.

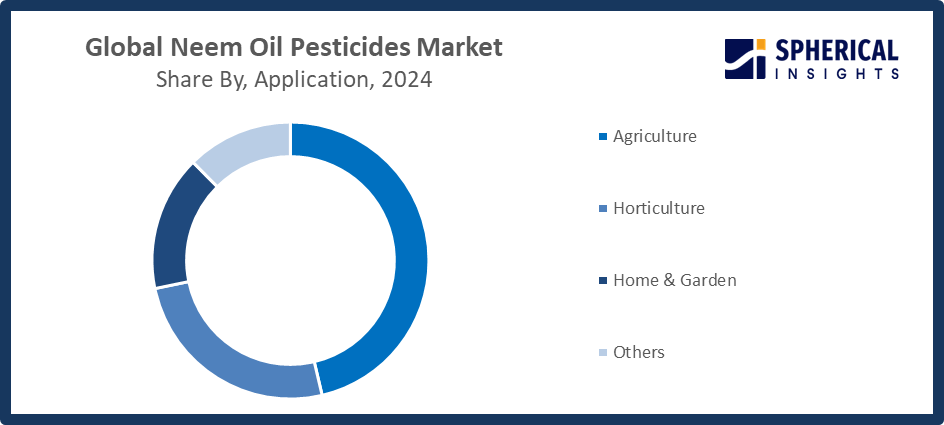

- The agriculture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the neem oil pesticides market is divided into agriculture, horticulture, home & garden, and others. Among these, the agriculture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. With the widespread application of neem oil insecticides for crop protection and pest control, the agriculture sector has the highest share. Government programs encouraging organic farming and the growing demand for agricultural products free of residues in both local and foreign markets contribute to the segment's expansion.

Get more details on this report -

Regional Segment Analysis of the Neem Oil Pesticides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the neem oil pesticides market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the neem oil pesticides market over the predicted timeframe. The Asia Pacific region's extensive agricultural operations and growing inclination towards eco-friendly farming practices essentially determine the region. In addition, the region's expansion is greatly influenced by government programs that promote eco-friendly agriculture, integrated pest management, and the use of organically cultivated commodities. HIL (India) Limited announced in December 2025 that a new neem biopesticide facility would be established as part of the GEF-UNIDO FARM project, which is anticipated to result in the conversion of 1.45Due to their varied crops, ongoing insect issues, and proactive government regulations supporting organic and environmentally friendly agricultural inputs, the nations of China, Japan, India, and others are the primary markets.

North America is expected to grow at a rapid CAGR in the neem oil pesticides market during the forecast period. Natural pest management methods are encouraged by the region's regulatory structure, which supports biopesticides and limits the use of some chemical pesticides. When it comes to organic farming, horticulture, and home gardening, the United States and Canada are leading the way in the use of neem oil pesticides. USDA Secretary Rollins announced the 2026 research objectives on December 30, 2025, with USD 500 million set aside for bio-input R&D and a focus on biopesticide innovation to increase farmer profitability and expand sustainable export markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the neem oil pesticides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agro Extracts Limited

- AzaGuard (BioSafe Systems)

- BASF SE

- Bharat Agro Industries

- Certis USA LLC

- Emami Agrotech Ltd.

- EID Parry (India) Limited

- Fortune Biotech Ltd.

- Gramin India Agri BusiNest

- Neeming Australia Pty Ltd.

- Nufarm Limited

- P.J. Margo Pvt. Ltd.

- Parker India Group

- Syngenta AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the neem oil pesticides market based on the below-mentioned segments:

Global Neem Oil Pesticides Market, By Product Type

- Concentrates

- Ready-to-Use Sprays

- Emulsifiable Neem Oil

- Others

Global Neem Oil Pesticides Market, By Application

- Agriculture

- Horticulture

- Home & Garden

- Others

Global Neem Oil Pesticides Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the neem oil pesticides market over the forecast period?The global neem oil pesticides market is projected to expand at a CAGR of 8.17% during the forecast period.

-

2. What is the market size of the neem oil pesticides market?The global Neem Oil Pesticides market size is expected to grow from USD 1.40 billion in 2024 to USD 3.32 billion by 2035, at a CAGR of 8.17 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the neem oil pesticides market?Asia Pacific is anticipated to hold the largest share of the neem oil pesticides market over the predicted timeframe.

-

4. Who are the top companies operating in the global neem oil pesticides market?Agro Extracts Limited, AzaGuard (BioSafe Systems), BASF SE, Bharat Agro Industries, Certis USA LLC, Emami Agrotech Ltd., EID Parry (India) Limited, Fortune Biotech Ltd., Gramin India Agri BusiNest, Neeming Australia Pty Ltd., Nufarm Limited, P.J. Margo Pvt. Ltd., Parker India Group, Syngenta AG, and others.

-

5. What factors are driving the growth of the neem oil pesticides market?The expanding consumer awareness of chemical-free products, government backing for biopesticides, expanding demand for organic farming, eco-friendly pest control, and technological improvements are driving the market for neem oil pesticides.

-

6. What are the market trends in the neem oil pesticides market?Increased usage of sustainable agriculture, innovative formulations, growing organic farming, integration with pest control techniques, expanding use in a variety of crops, and increased funding for biopesticide research and development are some of the current trends.

-

7. What are the main challenges restricting the wider adoption of the neem oil pesticides market?High production costs, less rapid effectiveness than chemical pesticides, a short shelf life, uneven raw material quality, low farmer awareness, and limited distribution in developing regions are some of the main challenges faced.

Need help to buy this report?