Global Naval Communication Market Size By Application (Command and Control, Intelligence Surveillance and Reconnaissance (ISR), Routine Operations, Others), By Platforms (Ships, Submarines, Unmanned System), By Technology (Naval Satcom System, Naval Radio Systems, Naval Security Systems and Communication Management Systems), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Naval Communication Market Insights Forecasts to 2033

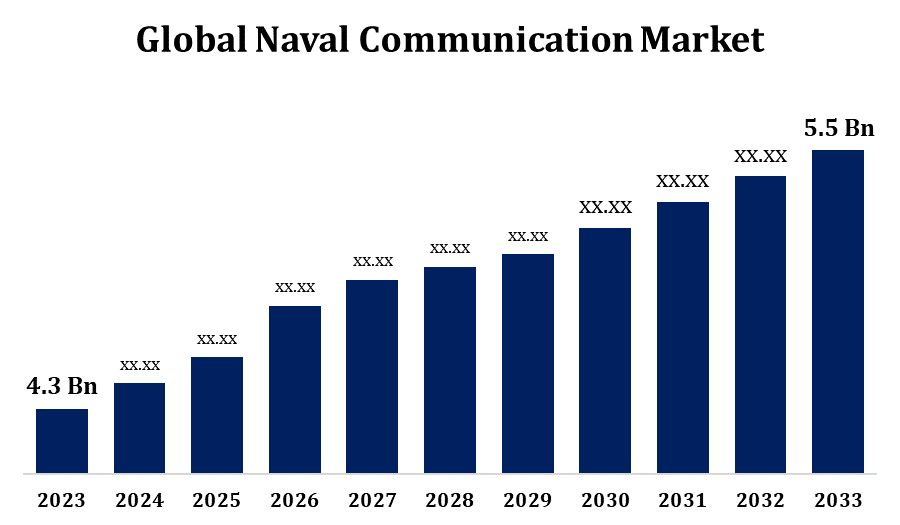

- The Naval Communication Market Size was valued at USD 4.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.49% from 2023 to 2033

- The Global Naval Communication Market is Expected to reach USD 5.5 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The global Naval Communication Market is expected to reach USD 5.5 billion by 2033, at a CAGR of 2.49% during the forecast period 2023 to 2033.

Numerous nations are allocating funds for the upgrading of their naval forces, encompassing communication infrastructure. Navy modernization involves replacing antiquated technologies with more sophisticated and interoperable communication platforms in order to stay ahead of the competition and respond to new threats. Naval forces are becoming increasingly concerned about cybersecurity as they depend more and more on networked naval communication systems. Investing in cybersecurity solutions designed for maritime environments is motivated by the high priority of ensuring the security and resilience of communication networks against cyber threats. For naval forces to have long-range and beyond-line-of-sight communication capabilities, satellite communication technologies are essential. High-bandwidth satellite communication technologies are becoming more and more in demand, allowing warships to maintain connectivity even during extended deployments and in remote locations.

Naval Communication Market Value Chain Analysis

In order to create new communication technologies and solutions specifically suited for naval applications, research institutes, defence contractors, and technology businesses invest in research and development, or R&D. The fundamental hardware and software components required for naval communication systems are supplied by component providers. This comprises networking hardware, antennas, sensors, semiconductors, radio frequency (RF) components, and encryption modules. Specialised manufacturers and commercial off-the-shelf (COTS) vendors are examples of suppliers. System integrators are in charge of putting together different parts to create whole naval communication systems. To guarantee compatibility, dependability, and performance, this entails integrating hardware, software, and firmware. Manufacturing facilities adhere to military standards and specifications while producing the tangible parts and subsystems of naval communication systems.

Naval Communication Market Opportunity Analysis

Numerous naval forces across the globe are undertaking modernization initiatives to enhance their communication systems in order to fulfil their operational requirements, both present and future. This gives suppliers the chance to offer cutting-edge communication solutions with improved resilience, interoperability, and capabilities. The naval communication market's satellite communication segment is seeing growth as a result of the rising demand for high-bandwidth communication capabilities. Suppliers of marine-specific satellite communication equipment and services might take advantage of this opening to give naval forces operating in far-flung locations dependable and secure connectivity. There's a growing need for cybersecurity solutions designed specifically for maritime environments as cyber threats keep evolving. Marine cybersecurity vendors can provide defences against cyberattacks on naval communication networks.

Global Naval Communication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.3 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.49% |

| 2033 Value Projection: | USD 5.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Platforms, By Technology, By Region |

| Companies covered:: | Acorn Science & Innovation, Inc., Airbus SAS, AIRtec Inc., Anduril Industries, Inc., Atlas Elektronik GmbH, BAE Systems, Bombardier Inc., Elbit Systems Ltd., General Dynamics Corporation, Hanwha Systems Co., Ltd., Harris Corporation, Huntington Ingalls Industries, Inmarsat Global Limited, L3 Harris Technologies, Leonardo DRS, Inc., Lockheed Martin Corporation, MAG Aerospace, Northrop Grumann Corporation, PAL Aerospace, Raytheon Technologies Corporation, Saildrone, Inc., Smartronix, LLC, Terma A/S, Textron Inc., Thales Group, Trillium Engineering LLC, Ultra Electronics Holdings, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Naval Communication Market Dynamics

Increasing naval fleets is propelling the market growth

To maintain efficient command, control, and coordination, nations must invest in growing their naval fleets and equip these ships with cutting-edge communication technology. Communication system suppliers have an opportunity to offer cutting-edge and effective solutions with the purchase of new ships and submarines. Numerous navies are implementing modernization initiatives to equip their current fleets with cutting-edge technologies. This involves combining new vessels with cutting-edge communication capabilities or equipping older ones with updated communication equipment. The need for communication services and equipment is fueled by these modernization initiatives. Strong communication networks are necessary for larger naval fleets to keep situational awareness among scattered assets. Real-time data interchange made possible by advanced communication systems enables naval commanders to efficiently monitor and react to threats.

Restraints & Challenges

Cyberattacks can jeopardise the availability, integrity, and secrecy of vital communications via naval communication systems. Robust cybersecurity procedures, such as encryption, authentication, intrusion detection, and constant monitoring, are necessary to safeguard communication networks against cyber attacks. Large data transmission volumes can be hampered by bandwidth limitations, especially in remote maritime areas. In order to prioritise critical communications, minimise delay, and guarantee timely information delivery, naval communication systems must optimise bandwidth utilisation. In hostile maritime settings including exposure to seawater, extreme temperatures, high humidity, and mechanical vibrations, naval communication systems need to function reliably. Particularly for navies with limited resources, budgetary restrictions may prevent investment in cutting-edge communication systems and infrastructure upgrades.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Naval Communication Market from 2023 to 2033. To sustain their operational dominance, the naval forces of North America make significant investments in cutting-edge communication technologies. This covers interoperable communication platforms, secure voice and data networks, satellite communication systems, and high-frequency radio systems. The North American naval forces prioritise cybersecurity in their communication systems due to the growing threats to cybersecurity. There are potential for vendors providing intrusion detection, encryption, and secure network architectures that are specifically designed for naval environments to cater to this market. The North American naval forces prioritise cybersecurity in their communication systems due to the growing threats to cybersecurity. There are potential for vendors providing intrusion detection, encryption, and secure network architectures that are specifically designed for naval environments to cater to this market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. There is a growing naval presence in the Asia-Pacific region, involving joint operations, patrols, and exercises. In order to enable command and control, coordination, and information exchange between naval vessels, aircraft, and shore-based command centres, dependable and secure communication technologies are required. With naval communication systems becoming increasingly digitally networked and dependent, cybersecurity risks present serious difficulties. Asia-Pacific nations are placing a greater emphasis on cybersecurity measures in order to safeguard sensitive data integrity and confidentiality and defend naval communication networks against cyberattacks. The Asia-Pacific region's economy is growing quickly, which has increased spending on defence and maritime security.

Segmentation Analysis

Insights by Application

The command and control segment accounted for the largest market share over the forecast period 2023 to 2033. In order to improve their command and control capabilities, many navies throughout the world are pursuing modernization programmes. The implementation of sophisticated communication systems facilitates instantaneous data sharing, aids in decision-making, and improves naval commanders' situational awareness. navy operations require efficient command and control between navy vessels, aeroplanes, submarines, and shore-based command centres. Interoperability standards-compliant command and control communication systems facilitate smooth coordination and communication across heterogeneous assets, hence augmenting operational efficacy. For the purpose of making choices during naval operations, commanders need to have immediate access to useful information. With the help of data fusion, analysis, and visualisation capabilities offered by command and control communication systems, commanders are able to keep an eye on the maritime environment, evaluate threats, and adapt quickly to changing circumstances.

Insights by Platforms

The ships segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The modernization of naval fleets is a global endeavour, with numerous navies making investments in new ship acquisitions and the installation of cutting-edge communication equipment on older ships. Vendors now have the chance to offer cutting-edge communication systems designed specifically for Navy vessels thanks to this modernization push. There is an increasing need for dependable and robust communication systems on board ships due to the increased number of naval deployments, which include patrols, exercises, and humanitarian missions. Strong communication capabilities are necessary for command and control operations, information sharing, and asset coordination on naval vessels. Shipboard communication systems are essential for giving naval crews and commanders situational awareness. Ships can observe their surroundings in the marine environment thanks to advanced communication solutions that provide real-time data sharing, sensor fusion, and tactical information distribution.

Insights by Technology

The naval satcom system segment accounted for the largest market share over the forecast period 2023 to 2033. Reliable communication systems with the ability to function over large marine regions are necessary due to the growing complexity and scope of maritime activities, which include disaster response, anti-piracy operations, surveillance, and reconnaissance. Naval SATCOM systems give naval forces the ability to communicate over great distances and beyond line of sight, keeping them connected even in isolated locations. Regardless of their location, naval warships may stay connected because to SATCOM systems' worldwide coverage. This is especially important for navies operating in locations with weak or nonexistent terrestrial communication infrastructure, or those on extended deployments. To supplement their current military SATCOM capabilities, many navies make use of commercial SATCOM services. In addition to military SATCOM assets, commercial SATCOM providers offer adaptable and reasonably priced solutions that provide extra capacity and redundancy for naval communication needs.

Recent Market Developments

- In November 2021, the DARPA Pheme project saw Collins Aerospace build a novel directional communication system designed for small aerial platforms like UAVs operating in contested territory, and it was on display.

Competitive Landscape

Major players in the market

- Acorn Science & Innovation, Inc.

- Airbus SAS

- AIRtec Inc.

- Anduril Industries, Inc.

- Atlas Elektronik GmbH

- BAE Systems

- Bombardier Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hanwha Systems Co., Ltd.

- Harris Corporation

- Huntington Ingalls Industries

- Inmarsat Global Limited

- L3 Harris Technologies

- Leonardo DRS, Inc.

- Lockheed Martin Corporation

- MAG Aerospace

- Northrop Grumann Corporation

- PAL Aerospace

- Raytheon Technologies Corporation

- Saildrone, Inc.

- Smartronix, LLC

- Terma A/S

- Textron Inc.

- Thales Group

- Trillium Engineering LLC

- Ultra Electronics Holdings

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Naval Communication Market, Application Analysis

- Command and Control

- Intelligence Surveillance and Reconnaissance (ISR)

- Routine Operations

- Others

Naval Communication Market, Platforms Analysis

- Ships

- Submarines

- Unmanned System

Naval Communication Market, Technology Analysis

- Naval Satcom System

- Naval Radio Systems

- Naval Security Systems

- Communication Management Systems

Naval Communication Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Naval Communication Market?The global Naval Communication Market is expected to grow from USD 4.3 billion in 2023 to USD 5.5 billion by 2033, at a CAGR of 2.49% during the forecast period 2023-2033.

-

2. Who are the key market players of the Naval Communication Market?Some of the key market players of the market are Acorn Science & Innovation, Inc., Airbus SAS, AIRtec Inc., Anduril Industries, Inc., Atlas Elektronik GmbH, BAE Systems, Bombardier Inc., Elbit Systems Ltd., General Dynamics Corporation, Hanwha Systems Co., Ltd., Harris Corporation, Huntington Ingalls Industries, Inmarsat Global Limited, L3 Harris Technologies, Leonardo DRS, Inc., Lockheed Martin Corporation, MAG Aerospace, Northrop Grumann Corporation, PAL Aerospace, Raytheon Technologies Corporation, Saildrone, Inc., Smartronix, LLC, Terma A/S, Textron Inc., Thales Group, Trillium Engineering LLC, and Ultra Electronics Holdings.

-

3. Which segment holds the largest market share?The command and control segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Naval Communication Market?North America is dominating the Naval Communication Market with the highest market share.

Need help to buy this report?