Global Natural Steatite Market Size, Share, and COVID-19 Impact Analysis, By End Use (Polymer, Ceramic, Paint & Coatings, Paper, Electronics, and Others), By Sales Channel (Direct and Indirect), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Natural Steatite Market Size Insights Forecasts to 2035

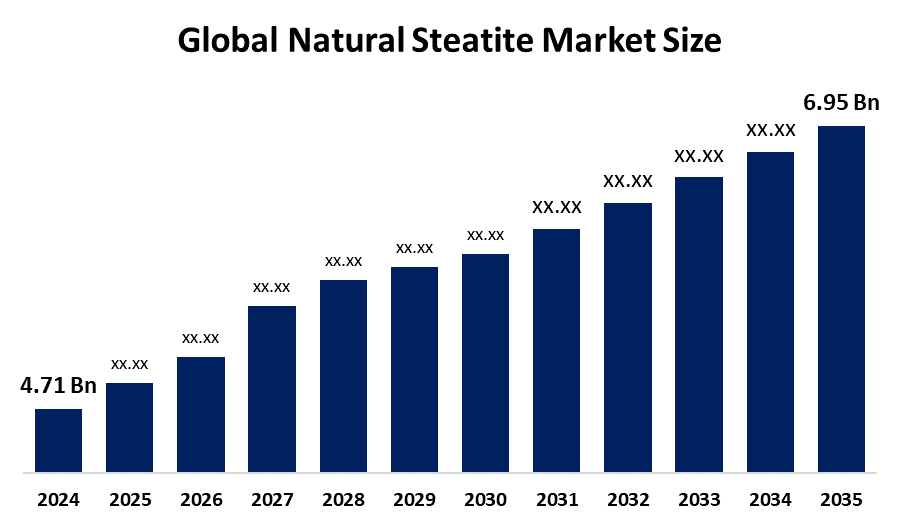

- The Global Natural Steatite Market Size Was Estimated at USD 4.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.6% from 2025 to 2035

- The Worldwide Natural Steatite Market Size is Expected to Reach USD 6.95 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Natural Steatite Market Size was worth around USD 4.71 Billion in 2024 and is predicted to Grow to around USD 6.95 Billion by 2035 with a compound annual growth rate (CAGR) of 3.6% from 2025 to 2035. The natural steatite market is expanding due to increasing requirements for advanced thermal and electrical insulation materials used in technical ceramics and automotive applications. The plastic industry growth results from steatite being used as a strengthening material, while its decorative properties make it suitable for building construction.

Market Overview

The worldwide natural steatite market encompasses commercial activities that involve extracting and utilizing steatite, a metamorphic rock that contains magnesium and is commonly called soapstone. Steatite functions as a material in electrical insulators, ceramics, refractories, cookware, countertops, and tiles, while also serving as a filler material in plastics, paints, rubber, and paper. The market experiences its main expansion because the electric and electronics sector demands more products, while both the ceramic and polymer industries continue to grow, and construction work and infrastructure development progress steadily. The rising demand for steatite in high-temperature applications and energy-efficient products drives market expansion.

In February 2026, Congresswoman Julie Fedorchak backed the Critical Mineral Dominance Act, aiming to boost U.S. production of critical and hardrock minerals. The legislation streamlines federal permitting while it prioritizes essential projects, decreases dependency on international supply networks, and enables energy security, advanced manufacturing, national defence, and local job development. Business opportunities exist in advanced ceramics, eco-friendly building materials, and emerging markets which industrialize their economies. The market includes producers and processors, which include IMI Fabi and Golcha Minerals, R.T. Vanderbilt and Mondo Minerals and regional mining companies, who work with global distributors and end-use manufacturers.

Report Coverage

This research report categorizes the natural steatite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the natural steatite market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the natural steatite market.

Global Natural Steatite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.6% |

| 2035 Value Projection: | USD 6.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 163 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End Use, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Mondo Minerals, R.T. Vanderbilt, Imerys, Golcha Minerals, IMI Fabi, Liaoning Aihai Talc Co., Ltd., Magris Talc, Minerals Technologies Inc., Harison Minerals and Marbles, Sudarshan Group, Liaoning Aihai talc Co., Ltd, Vasundhara Micron, Aravali Polyart Private Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide market for natural steatite soapstone products receives its main driving force from increasing industrial needs for ceramics and polymers and electrical insulation materials, which require soapstone's superior heat resistance and chemical stability. Construction demand increases in Asia-Pacific and Latin America because of rapid urban development, but the market needs technical ceramics for high-voltage insulators and electronic components to grow. The automotive and consumer electronics industries require steatite-reinforced plastics because these materials provide better product longevity. The construction industry experiences growth because of its shift toward sustainable construction materials, which include soapstone countertops and tiling products.

Restraining Factors

The global natural steatite market faces restraints from its dense nature, which results in high transportation and logistics expenses. Mining activities face environmental restrictions, while resource depletion and strict sustainability standards (ESG) create limits on operational capacity. The market experiences growth obstacles because of regional supply concentration and variable costs, and the possibility of industrial applications selecting different materials.

Market Segmentation

The natural steatite market share is classified into end use and sales channel.

- The ceramic segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the end use, the natural steatite market is divided into polymer, ceramic, paint & coatings, paper, electronics, and others. Among these, the ceramic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The ceramic segment dominated the natural steatite market because it possesses exceptional dielectric performance together with outstanding thermal stability and chemical resistance, which makes it suitable for use in electrical insulators, electronic components and advanced ceramic applications. The rising demand from electronics, automotive, and construction industries led to market expansion, which established ceramics as the primary end-use segment in the worldwide steatite market.

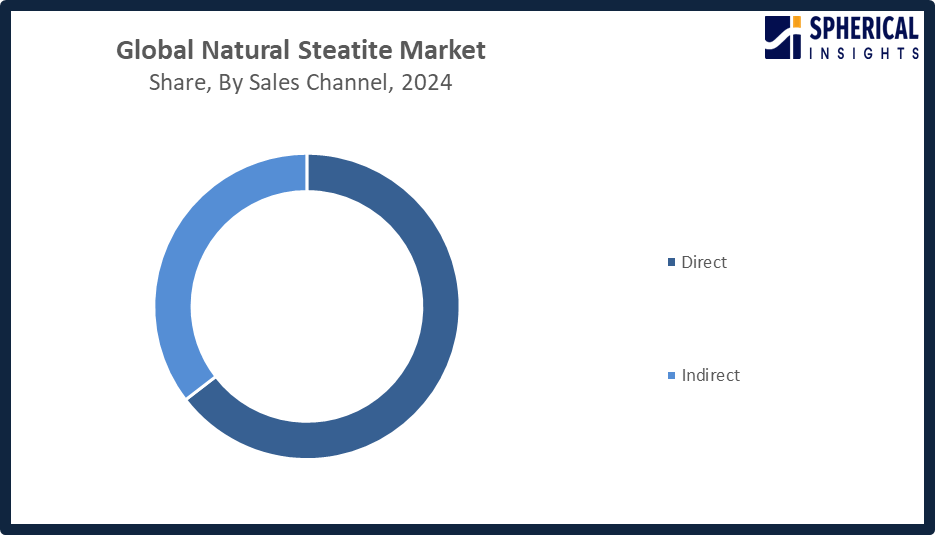

- The direct segment accounted for the highest market revenue in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the natural steatite market is divided into direct and indirect. Among these, the direct segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The direct sales segment growth in the natural steatite market is due to manufacturers and industrial buyers preferring bulk procurement directly from producers. The method provides consistent quality together with competitive pricing and dependable supply, which serves essential needs in ceramics, electronics, polymers and coatings. This combination drives its market leadership in the global steatite market.

Get more details on this report -

Regional Segment Analysis of the Natural Steatite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the natural steatite market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the natural steatite market over the predicted timeframe. The natural steatite market will reach its 42% share due to Asia-Pacific industrial growth, together with its electronics and ceramics, and construction industry development. China leads in electrical and ceramic component production and export activities, while India's steatite demand arises from its infrastructure and industrial development, and Japan currently uses advanced electronics technology to produce high-performance insulators. The Indian Union Budget 2026-27 established strategic self-reliance through its support of rare earth development, which created the Rare Earth Corridors system that connects mining with processing and research and manufacturing operations for import reduction purposes.

North America is expected to grow at a rapid CAGR in the natural steatite market during the forecast period. The North American natural steatite market will experience a 18% share of rapid expansion owing to increasing demand from the electronics, automotive and construction industries. The United States maintains its leading position because government programs support domestic mineral production needs from advanced manufacturing to high-tech applications. The electrical insulators market, heat-resistant component market and polymer composites market grow through steatite adoption together with supply chain investments. The DOE introduced its Mine of the Future program in September 2025, which dedicated $95 million to developing vital mineral strategies while decreasing foreign dependency and assisting advanced mining technologies such as talc through ore-sorting systems.

Europe experiences continuous expansion of its natural steatite market because the ceramics, electronics and construction industries show increasing demand for this mineral. Germany serves as an important market driver because its advanced manufacturing and automotive sectors need specialized insulating and heat-resistant materials. The natural steatite market in Europe expands because of three factors, which include the rising demand for sustainable industrial minerals, the implementation of new technologies and the development of alternative supply chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the natural steatite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mondo Minerals

- R.T. Vanderbilt

- Imerys

- Golcha Minerals

- IMI Fabi

- Liaoning Aihai Talc Co., Ltd.

- Magris Talc

- Minerals Technologies Inc.

- Harison Minerals and Marbles

- Sudarshan Group

- Liaoning Aihai talc Co., Ltd

- Vasundhara Micron

- Aravali Polyart Private Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, India continued to dominate global talc supply as manufacturers balanced industrial demand with environmental responsibility. Udaipur-based Vasundhara Micron highlighted selective mining practices, producing high-whiteness micron talc with superior MgO content and low impurities, reinforcing traceable sourcing, reduced environmental impact, and stronger buyer confidence across multiple industries.

- In August 2025, the USGS expanded its Critical Minerals List to 60, adding 10 new minerals like boron, copper, and phosphate due to supply risks and economic importance. Although talc wasn’t included, the framework’s investment incentives and streamlined permitting could indirectly benefit non-critical minerals such as steatite.

- In April 2024, French specialty minerals company Imerys showcased its sustainable cosmetic ingredient portfolio at in-Cosmetics Global in Paris. Responding to demand for natural, transparent, and multifunctional products, Imerys presented solutions based on minerals such as calcium carbonate, kaolin, mica, perlite, and talc, including two new product launches.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the natural steatite market based on the below-mentioned segments:

Global Natural Steatite Market, By End Use

- Polymer

- Ceramic

- Paint & Coatings

- Paper

- Electronics

- Others

Global Natural Steatite Market, By Sales Channel

- Direct

- Indirect

Global Natural Steatite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the natural steatite market over the forecast period?The global natural steatite market is projected to expand at a CAGR of 3.6% during the forecast period.

-

2. What is the market size of the natural steatite market?The global natural steatite market size is expected to grow from USD 4.71 billion in 2024 to USD 6.95 billion by 2035, at a CAGR of 3.6% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the natural steatite market?Asia Pacific is anticipated to hold the largest share of the natural steatite market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global natural steatite market?Mondo Minerals, R.T. Vanderbilt, Imerys, Golcha Minerals, IMI Fabi, Liaoning Aihai Talc Co., Ltd., Magris Talc, Minerals Technologies Inc., Harison Minerals and Marbles, Sudarshan Group, and Others.

-

5. What factors are driving the growth of the natural steatite market?Key drivers include rising demand in construction (tiles, countertops), technical ceramics, electrical insulation, and the polymer industry, alongside rapid industrialization in the Asia-Pacific and a preference for sustainable, high-performance materials.

-

6. What are the market trends in the natural steatite market?The market trends include rising electronics demand, industrial ceramics growth, direct supplier contracts, supply‑chain localization, and increased use in polymers and advanced materials.

-

7. What are the main challenges restricting wider adoption of the natural steatite market?Key challenges restricting the natural steatite market include high transportation/logistics costs, strict environmental regulations on mining, inconsistent product quality, limited supply chain infrastructure, and competition from alternative synthetic materials.

Need help to buy this report?