Global Naproxen Market Size, Share, and COVID-19 Impact Analysis, By Type (Tablets, Capsules, and Liquid Form), By Application (Pain Relief, Inflammation, Arthritis Treatment, and Fever Reduction), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Naproxen Market Insights Forecasts To 2035

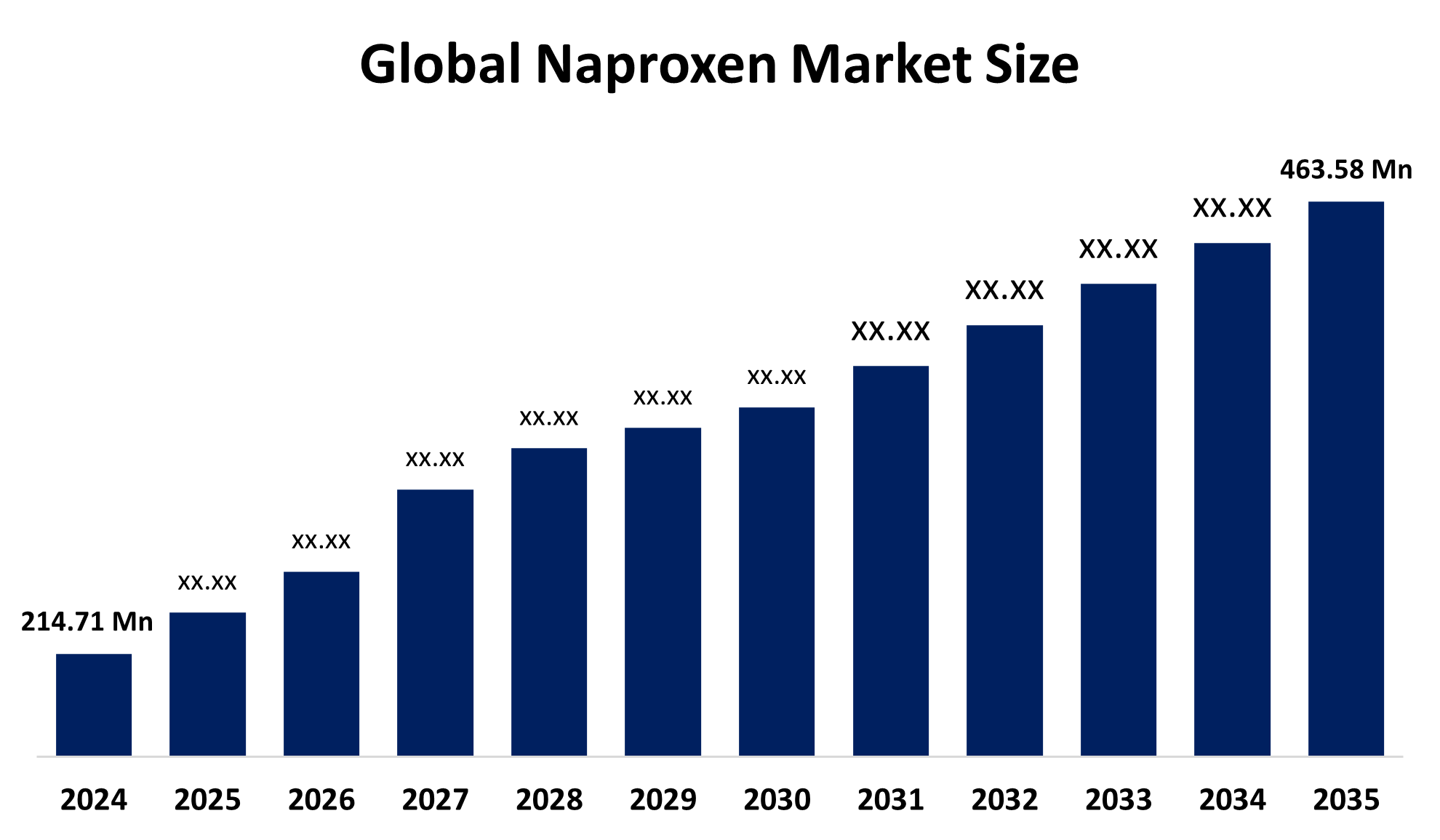

- The Global Naproxen Market Size Was Estimated at USD 214.71 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.25% from 2025 to 2035

- The Worldwide Naproxen Market Size is Expected to Reach USD 463.58 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Naproxen Market Size was worth Around USD 214.71 Million in 2024, Growing to USD 230.71 Million in 2025, and is Predicted to Grow to around USD 463.58 Million by 2035 with a compound annual growth rate (CAGR) of 7.25% from 2025 to 2035. The market for naproxen is growing due to the increasing prevalence of chronic pain, arthritis, and inflammatory conditions. Growing awareness of over-the-counter pain relief, an aging population, and increasing access to healthcare in developing economies further fuel demand. Moreover, continued R&D efforts and the availability of products in generic forms aid market growth.

Global Naproxen Market Forecast and Revenue Outlook

- 2024 Market Size: USD 214.71 Million

- 2025 Market Size: USD 230.71 Million

- 2035 Projected Market Size: USD 463.58 Million

- CAGR (2025-2035): 7.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The naproxen market refers to the production, supply, and distribution of naproxen, an over-the-counter (OTC) nonsteroidal anti-inflammatory drug (NSAID) that is used for the relief of inflammation, pain, and fever. It is normally prescribed for conditions such as arthritis, menstrual cramps, muscle spasms, and other musculoskeletal disorders. Prescription and OTC versions of naproxen can be found. With its widespread use in therapy, it is an integral component of pain relief management. Growth is largely triggered by the rising prevalence of chronic pain disorders, the growing geriatric population, and increased awareness of self-medication. The increasing need for affordable generic drugs also drives growth, especially in emerging economies.

Opportunities lie in enhanced market access through e-pharmacies, deeper healthcare penetration in rural areas, and strategic collaborations of pharma companies. Market leaders are Bayer AG, Dr. Reddy's Laboratories, Teva Pharmaceutical Industries, Sun Pharmaceutical Industries, and Roche. The firms are investing in research and development to enhance the strength of the drugs and reduce side effects. Moreover, the new government policies launched in order to establish healthcare infrastructure and enable the utilization of generics, particularly in nations such as India, China, and Brazil, will be the key drivers that will enable enhanced market growth. In 2024, the FDA approved marketing of ANI Pharmaceuticals' ANDA for generic Naproxen Delayed Release Tablets to enable the launch of a cost-saving alternative to EC Naprosyn, enhancing access to anti-inflammatory therapy in the United States.

Key Market Insights

- North America is expected to account for the largest share in the naproxen market during the forecast period.

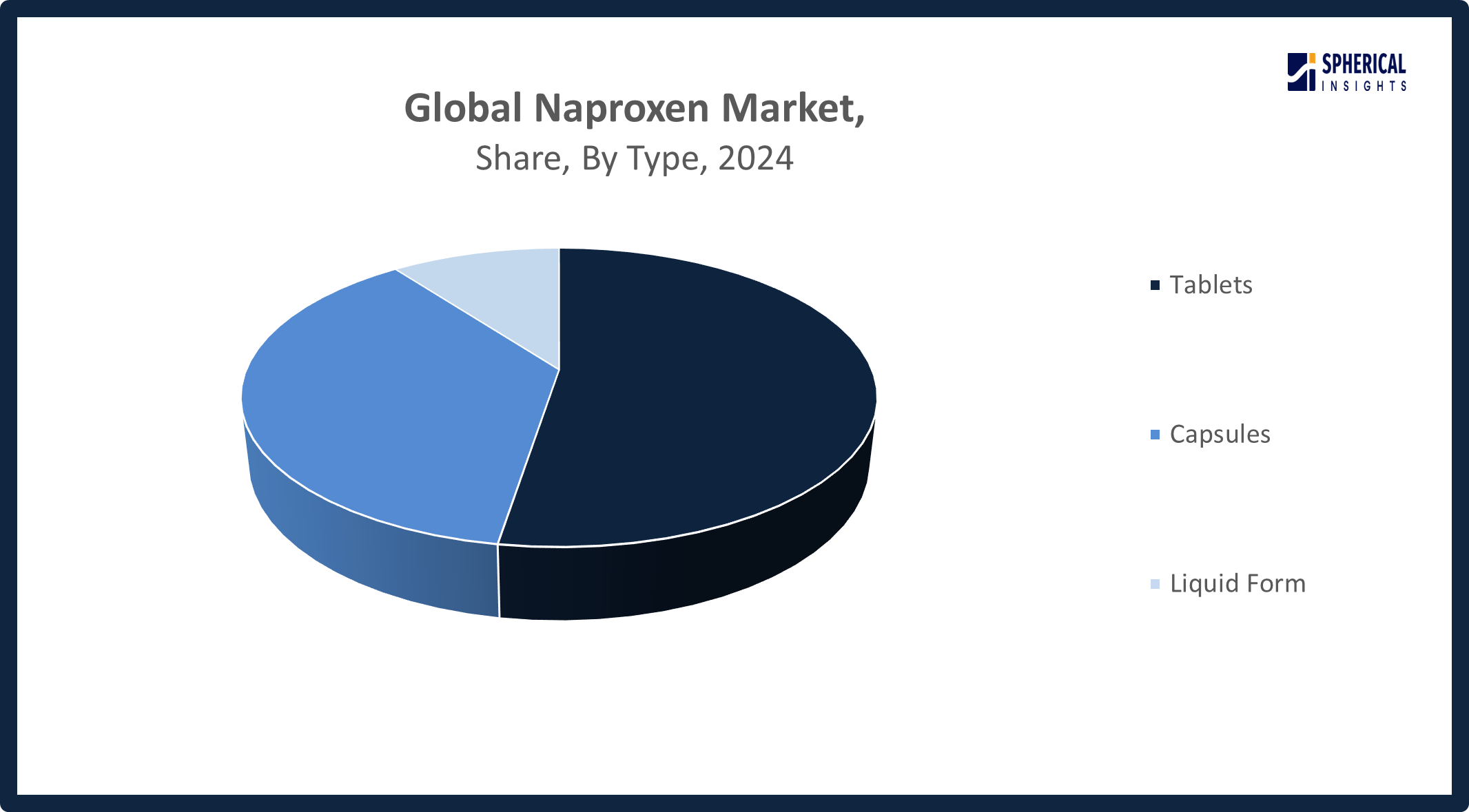

- In terms of type, the tablets segment is projected to lead the naproxen market throughout the forecast period

- In terms of application, the arthritis treatment segment captured the largest portion of the market

Naproxen Market Trends

- The naproxen market is experiencing steady growth due to rising cases of arthritis and chronic pain.

- Generic drug availability is expanding market access, especially in developing countries.

- Increased awareness of over-the-counter pain relief options boosts consumer demand.

- Aging global populations continue to drive the need for long-term anti-inflammatory medications.

- Online pharmacies and e-commerce are streamlining naproxen distribution channels.

Report Coverage

This research report categorizes the naproxen market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the naproxen market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the naproxen market.

Global Naproxen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 214.71 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.25% |

| 2035 Value Projection: | USD 463.58 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Bayer AG, Roche, Dr. Reddy’s Laboratories, Aurobindo Pharma Ltd., Pfizer Inc., Strides Pharma, ANI Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, GlaxoSmithKline plc, Johnson & Johnson Consumer Inc., Novartis AG, Camber Pharmaceuticals Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

Increased cases of arthritis, an aging population, the availability of generic drugs, and growing self-medication awareness contribute to the growth of the naproxen market. Increased cases of arthritis around the world increase the demand for naproxen exponentially, as it responds well to pain and inflammation in arthritis. Growth is further led by an aging population, as chronic pain is more prevalent in older people. The presence of cheap generic forms enhances accessibility, particularly in the developing world, while increased awareness of self-medication leads to more people using naproxen to relieve mild to moderate pain.

Restraining Factor

Side effects, government regulations, drug interactions, and market competition restrain the growth of the naproxen market. Side effects such as gastrointestinal issues discourage patients from taking naproxen. Government regulations restrict some of the forms. Drug interactions are safety threats, while significant competition from other NSAIDs and analgesics constricts market growth.

In 2024, India’s Health Ministry restricted the manufacture, sale, and distribution of two Naproxen fixed-dose combinations: Naproxen with Esomeprazole and Naproxen with Pantoprazole, citing safety and regulatory concerns.

Market Segmentation

The global naproxen market is divided into type and application.

Global Naproxen Market, By Type:

What made tablets the dominant segment in the naproxen market?

Tablets are the most used oral drug formulation, representing 65% of the market. Both immediate-release (220mg, 250mg, 375mg, 500mg) and enteric-coated tablets decrease stomach irritation. Innovations feature scored tablets for variable dosing and combinations with stomach shields, with smaller, more easily swallowed 275mg tablets becoming increasingly popular, particularly with older patients. Generics predominate, representing 85% of sales.

Get more details on this report -

The capsules segment in the naproxen market is expected to grow at the fastest CAGR over the forecast period. The capsules segment of the naproxen market is rapidly growing, with 25% of revenue, owing to its quicker absorption rate, the launch of delayed-release technology, rising demand in sports medicine, and growing preference for easy, efficient pain relief among young and active consumers.

Global Naproxen Market, By Application:

Why did the arthritis treatment segment account for the largest share in 2024?

The arthritis treatment segment occupied the majority share in 2024, with about 45% of the total naproxen market. This is attributed to the rising incidence of arthritis globally, particularly among the elderly, which fuels demand for long-term anti-inflammatory and pain relief medication. Increased awareness and improved diagnosis also drive its market leadership.

The pain relief segment in the naproxen market is expected to grow at the fastest CAGR over the forecast period. The pain relief segment accounted for about 30% of the naproxen market in 2024 and is forecast to register the highest CAGR due to increasing demand for over-the-counter analgesics, growing self-medication awareness, and the requirement for an effective cure for acute and chronic pain syndromes.

Regional Segment Analysis of the Global Naproxen Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Naproxen Market Trends

What factors contribute to North America's dominance in the global naproxen market?

The largest portion of the worldwide naproxen market is in North America, at around 38% in 2024. The dominance is due to a highly developed healthcare infrastructure, high spending on healthcare, and widespread coverage of prescription and over-the-counter naproxen products, together with the high incidence of an aging population in growing cases of arthritis and chronic pain. Combined with robust regulatory support and top pharmaceutical companies, North America is the market leader, and its growth in the naproxen segment is consistent.

Why are certain trends driving growth in the U.S. naproxen market?

Growth drivers for the U.S. naproxen market are the growing prevalence of arthritis, heightened self-medication awareness, increased over-the-counter availability, new drug formulation developments, and an enhanced aging population seeking efficient and effective pain relief methods.

Asia Pacific Naproxen Market Trends

Why is the Asia Pacific region expected to grow at the fastest CAGR in the naproxen market?

The Asia Pacific region, which controls about 23% of the overall naproxen market in 2024, will grow at the highest CAGR, owing to the growing incidence of arthritis and musculoskeletal disorders, particularly in the aging population in India and China, which is fueling demand. Developing health infrastructure and improved access to low-priced generic drugs also contribute to growth. Furthermore, growing awareness of over-the-counter medication and self-medication also stimulates consumption demand. Growing economic development and increased disposable incomes within the region also fuel the fast growth of the naproxen market.

What factors influence the growth of the naproxen market in India?

Growth of the naproxen market in India is influenced by rising arthritis cases, increasing healthcare awareness, expanding access to affordable generic drugs, growing geriatric population, and improved healthcare infrastructure supporting over-the-counter and prescription pain management solutions.

What are the major trends shaping the naproxen market in China?

Some major trends in the Naproxen market in China are increased prevalence of arthritis, increased demand for low-cost generics, rising awareness of self-medication, greater access to healthcare, use of innovative drug formulation, and higher interest in pain management among the elderly.

Why is the naproxen market growing or changing in Japan?

The Japanese naproxen market is expanding due to the country's aging population and rising chronic pain, increasing demand for efficient pain relief, drug formulation improvements, and increasing awareness of over-the-counter and self-medication treatment.

Europe Naproxen Market Trends

What factors are driving demand for naproxen in the European market?

Naproxen demand in the European market, with 20% of the worldwide market share, is stimulated by a high incidence rate of arthritis and chronic pain disorders, a growing population of older people, higher over-the-counter pain relief preferences, and innovative drug formulations. Favorable healthcare policies and increasing awareness of self-medication are other growth drivers for the market.

What are the main trends influencing the naproxen market in Germany?

Key trends in Germany's naproxen market are swelling cases of arthritis, growing adoption of generics, enhanced preference for easy to swallow oral forms, technological improvements in delayed release formulas, and increased patient awareness of self-medication and pain control choices.

Why is the naproxen market evolving in the U.K.?

The U.K. naproxen market is changing because of the rising prevalence of chronic pain, heightened demand for over-the-counter solutions, rising awareness of self-medication, and improvements in drug formulations, enhancing safety and efficacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global naproxen market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Naproxen Market Include

- Bayer AG

- Roche

- Dr. Reddy's Laboratories

- Aurobindo Pharma Ltd.

- Pfizer Inc.

- Strides Pharma

- ANI Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd

- GlaxoSmithKline plc

- Johnson & Johnson Consumer Inc.

- Novartis AG

- Camber Pharmaceuticals Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In July 2024, ANI Pharmaceuticals announced FDA approval of its Abbreviated New Drug Application (ANDA) and launched Naproxen Delayed-Release Tablets, USP, a generic version of the reference drug EC-Naprosyn, expanding affordable options for pain and inflammation treatment in the U.S. market.

- In May 2023, Camber Consumer Care launched Naproxen Sodium Tablets, adding an affordable, high-quality option to its OTC portfolio. Used for pain relief and inflammation from conditions such as arthritis and menstrual cramps, Camber offers 220 mg tablets in various bottle sizes with private labeling and bulk order options.

- In November 2022, Camber Pharmaceuticals launched its generic Naprosyn Naproxen Oral Suspension, offering 125 mg/5 mL strength in 500 mL bottles. It is indicated for pain relief and treatment of arthritis, tendonitis, bursitis, acute gout, and primary dysmenorrhea.

- In August 2022, Strides Pharma’s subsidiary, Strides Pharma Global Pte, received FDA approval for generic naproxen sodium 220 mg softgel capsules, an over-the-counter product bioequivalent to Bionpharma’s reference drug. The capsules will be manufactured at Strides’ Bengaluru facility, enhancing their market presence.

- In August 2021, Dr. Reddy’s Laboratories re-launched OTC Naproxen Sodium Tablets USP, 220 mg, the store brand equivalent of Aleve, in the US market. Approved by the FDA, it serves as a pain reliever and fever reducer, available in multiple pack sizes for consumer convenience.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the naproxen market based on the following segments:

Global Naproxen Market, By Type

- Tablets

- Capsules

- Liquid Form

Global Naproxen Market, By Application

- Pain Relief

- Inflammation

- Arthritis Treatment

- Fever Reduction

Global Naproxen Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Naproxens market over the forecast period?The global naproxen market is projected to expand at a CAGR of 7.25% during the forecast period.

-

2. What is the naproxen market?The naproxen market refers to the industry surrounding naproxen, a nonsteroidal anti-inflammatory drug (NSAID) used for pain, inflammation, and fever, available both over-the-counter (OTC) and by prescription

-

3. What is the market size of the naproxen market?The global naproxen market size is expected to grow from USD 214.71 million in 2024 to USD 463.58 million by 2035, at a CAGR 7.25% of during the forecast period 2025-2035.

-

4. What are the market trends in the naproxen market?Key trends include the dominance of over-the-counter (OTC) sales, growth opportunities in emerging markets, and the need for innovative formulations and improved safety profiles to stay competitive.

-

5. Which region holds the largest share of the naproxen market?North America is anticipated to hold the largest share of the naproxen market over the predicted timeframe.

-

6. What factors are driving the growth of the naproxen market?Growth in the Naproxen market is driven by rising arthritis cases, aging populations, increasing self-medication awareness, availability of affordable generics, and expanding healthcare infrastructure globally.

-

7. What are the main challenges restricting wider adoption of the naproxen market?Challenges include side effects, strict regulations, drug interactions, availability of alternative pain relievers, and intense market competition.

-

8. Who are the top 10 companies operating in the global naproxen market?The major players operating in the naproxen market are Bayer AG, Roche, Dr. Reddy's Laboratories, Aurobindo Pharma Ltd., Pfizer Inc., Strides Pharma, ANI Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, GlaxoSmithKline plc, Johnson & Johnson Consumer Inc., Novartis AG, Camber Pharmaceuticals Inc., and Others.

Need help to buy this report?