Global N-Heptane Market Size, Share, and COVID-19 Impact Analysis, By Purity (95%, 95 to 99%, and 99%), By Application (Pharmaceuticals, Paints & Coatings, Electronics, Adhesives & Sealants, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal N-Heptane Market Size Insights Forecasts to 2035

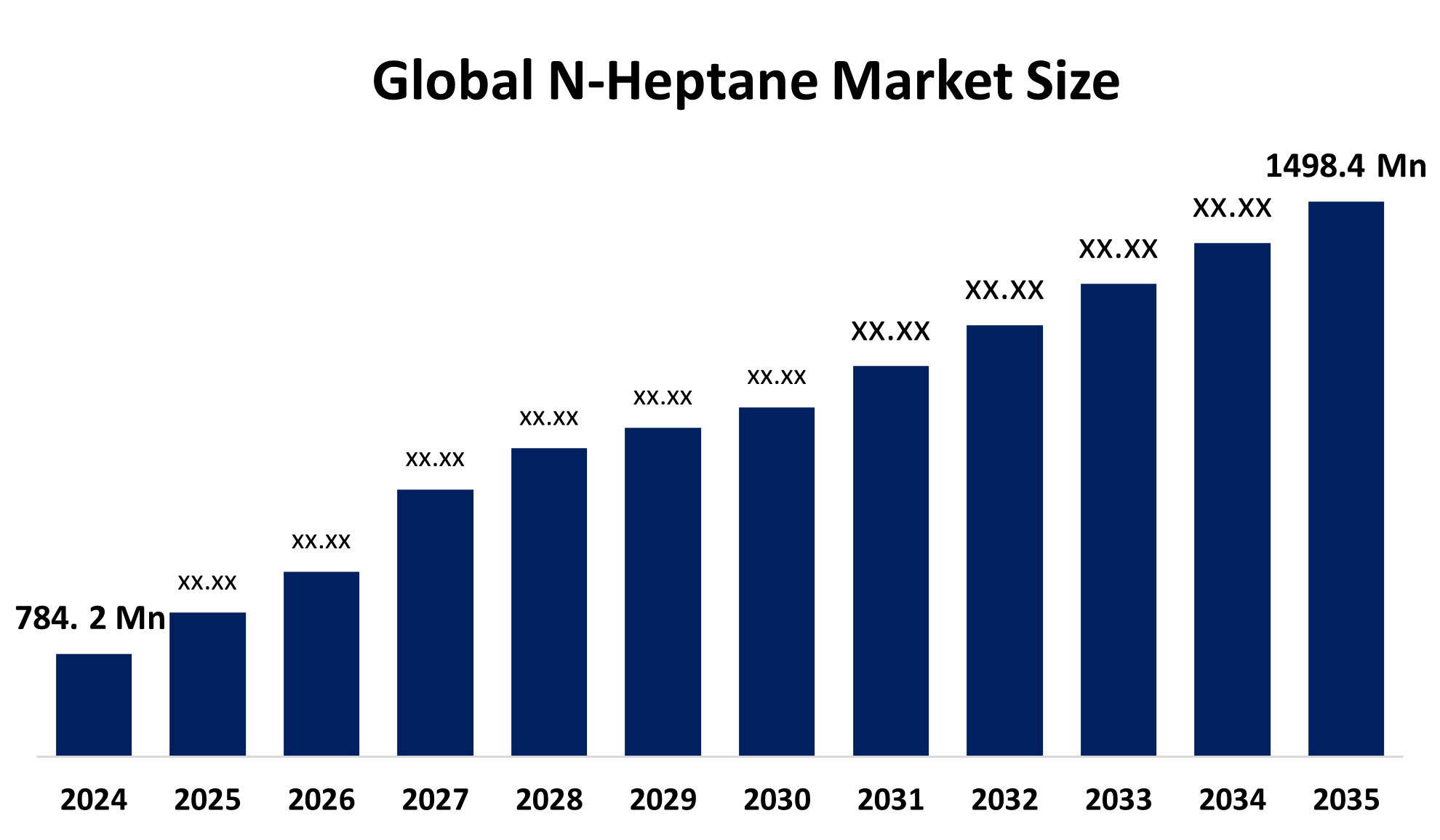

- The Global N-Heptane Market Size Was Estimated at USD 784.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.06 % from 2025 to 2035

- The Worldwide N-Heptane Market Size is Expected to Reach USD 1498.4 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global N-Heptane Market Size was worth around USD 784.2 Million in 2024 and is Predicted to Grow to around USD 1498.4 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 6.06% from 2025 to 2035. The opportunities include increased use in high-purity pharmaceutical and electronics solvents, rising demand for automotive coatings and adhesives, growth in specialty chemical manufacturing, and expansion in Asia-Pacific driven by industrialization and stringent quality standards.

Market Overview

The Global N-Heptane Market Size refers to the production and distribution of high-purity heptane used as a solvent in pharmaceuticals, paints, coatings, and chemical synthesis. Demand is rising due to expanding drug formulation, where N-heptane supports extraction and purification processes, especially in generic and API manufacturing. Growth is further propelled by increased automotive refinish coatings and adhesive consumption, supported by rising vehicle production. Government initiatives encouraging cleaner industrial practices, such as India’s solvent recovery policies and China’s green chemistry roadmap, are pushing industries toward low-aromatic, high-purity hydrocarbons. Manufacturers are increasing capacity to meet rising consumption across the Asia Pacific and North America. For Instance, in January 2025, Shell Chemicals announced a US$200 million joint venture with AkzoNobel to develop next-generation low-VOC coatings using high-purity n-Heptane, targeting the expanding sustainable coatings market across Europe and North America. The market for n-heptane is being driven by the increasing need for low-toxic solvents to comply with stringent environmental regulations, as well as the green solvent alternative qualities of n-heptane.

Report Coverage

This research report categorizes the Global N-Heptane Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the N-heptane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the N-heptane market.

Global N-Heptane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 784.2 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.06% |

| 2035 Value Projection: | USD 1498.4 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Purity, By Application |

| Companies covered:: | Chevron Phillips Chemical Company LLC, Chuzhou Runda Solvents Co., Ltd., SK Inc., DHC Solvent Chemie GmbH, Haltermann Carless Group GmbH, Liaoning Yufeng Chemical Co., Ltd., Royal Dutch Shell, Shenyang Huifeng Petrochemical Co., Ltd., Mehta Petro Refineries Limited, Gadiv Petrochemical Industries Ltd. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

Growth in the Global N-Heptane Market Size is driven by rising demand for high-purity solvents across pharmaceutical manufacturing, where the chemical is used in synthesis, extraction, and purification of APIs and intermediates. Expanding industrial coatings and automotive refinish sectors further increase consumption due to N-heptane’s volatility and clean evaporation properties. Regulatory pushes toward low-aromatic, cleaner hydrocarbons support substitution away from traditional aromatic solvents. Additionally, rapid industrialization in Asia-Pacific, paired with capacity expansion by petrochemical producers, strengthens long-term supply and market demand.

Restraining Factors

Stringent environmental regulations on volatile organic compound emissions, flammability concerns, costly purification processes, and availability of greener solvent alternatives limit broader adoption and create compliance burdens for manufacturers across developed markets.

Market Segmentation

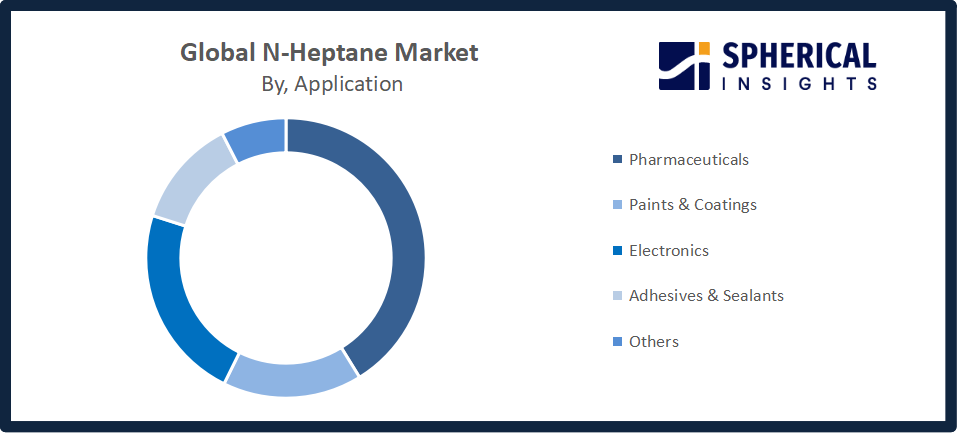

The N-heptane market share is classified into purity and application.

- The 99% segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the purity, the Global N-Heptane Market Size is divided into 95%, 95 to 99%, and 99%. Among these, the 99% segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The 99% purity grade dominated the market in 2024 due to its critical use in pharmaceutical manufacturing, electronic cleaning, analytical labs, and other precision applications requiring minimal impurities. High-purity N-heptane remains preferred in these industries because it meets stringent quality and performance standards, driving higher adoption and growth relative to lower-purity segments through the forecast period.

- The pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Global N-Heptane Market Size is divided into pharmaceuticals, paints & coatings, electronics, adhesives & sealants, and others. Among these, the pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceuticals segment captured the largest share of the N-heptane market in 2024 due to its extensive use as a high-purity solvent in drug synthesis, extraction, and purification of active pharmaceutical ingredients. Growing production of generics, expansion of contract manufacturing in India and China, and stricter purity standards continue to boost consumption. Rising investments in API capacity and government support for local drug manufacturing reinforce strong future demand.

Get more details on this report -

Regional Segment Analysis of the N-Heptane Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the N-heptane market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Global N-Heptane Market Size over the predicted timeframe. This region’s dominance is driven by rapid growth in pharmaceuticals, electronics, and industrial coatings industries, strong manufacturing expansion in China and India, and increasing demand for high-purity solvents. Additionally, rising investments in chemical infrastructure, favorable government policies supporting local production, and a growing base of contract manufacturers contribute to sustained market leadership for N-heptane in Asia Pacific. Growing demand for n-heptane in the chemical and pharmaceutical industries has made India a major player in the region. The use of n-heptane solvent in Indian businesses is being fueled by the growing energy industry and government measures to promote sustainable energy practices.

North America is expected to grow at a rapid CAGR in the Global N-Heptane Market Size during the forecast period. North America is projected to grow at a rapid CAGR due to rising demand for high-purity solvents in expanding pharmaceutical and biotechnology manufacturing, driven by API onshoring and increased R&D spending. The region’s strong automotive coatings industry and adoption of low-aromatic solvents further support consumption. Environmental policies favoring cleaner hydrocarbons and ongoing investments in specialty chemical production also accelerate N-heptane demand across the U.S. and Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global N-Heptane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Phillips Chemical Company LLC

- Chuzhou Runda Solvents Co., Ltd.

- SK Inc.

- DHC Solvent Chemie GmbH

- Haltermann Carless Group GmbH

- Liaoning Yufeng Chemical Co., Ltd.

- Royal Dutch Shell

- Shenyang Huifeng Petrochemical Co., Ltd.

- Mehta Petro Refineries Limited

- Gadiv Petrochemical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, ExxonMobil Chemical announced commissioning of a 50,000-tonnes-per-annum n-Heptane solvent purification facility in Baytown, Texas, using advanced membrane technology to achieve 99.8% purity and 25% lower energy consumption.

- In November 2024, Honeywell International announced HoneySolv Recovery System, a membrane-based n-Heptane reclamation technology achieving 97% recovery, first installed at Bayer Germany, reducing fresh solvent consumption by 35% significantly overall.

- In September 2024, SABIC launched a US$150 million expansion at its Jubail facility, boosting n-Heptane capacity by 30,000 tonnes annually to meet Asia Pacific pharmaceutical and agrochemical market demand growth.

- In February 2024, ExxonMobil announced the resumption of paraxylene production at its Beaumont, Texas facility, adding 315,000 tons annually and accounting for about 12% of total U.S. paraxylene production capacity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global N-Heptane Market Size based on the below-mentioned segments:

Global N-Heptane Market, By Purity

- 95%

- 95 to 99%

- 99%

Global N-Heptane Market, By Application

- Pharmaceuticals

- Paints & Coatings

- Electronics

- Adhesives & Sealants

- Others

Global N-Heptane Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the N-heptane market over the forecast period?The global N-heptane market is projected to expand at a CAGR of 6.06% during the forecast period.

-

2.What is the market size of the N-heptane market?The global N-heptane market size is expected to grow from USD 784.2 million in 2024 to USD 1498.4 million by 2035, at a CAGR of 6.06 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the N-heptane market?Asia Pacific is anticipated to hold the largest share of the N-heptane market over the predicted timeframe.

-

4.Who are the top companies operating in the global N-heptane market?Chevron Phillips Chemical Company LLC, Chuzhou Runda Solvents Co., Ltd., SK Inc., DHC Solvent Chemie GmbH, Haltermann Carless Group GmbH, Liaoning Yufeng Chemical Co., Ltd., Royal Dutch Shell, Shenyang Huifeng Petrochemical Co., Ltd., Mehta Petro Refineries Limited, and Gadiv Petrochemical Industries Ltd., and Others.

-

5.What factors are driving the growth of the N-heptane market?Rising pharmaceutical production, expanding electronics and coatings industries, demand for high-purity solvents, industrialization in Asia-Pacific, and regulatory push for cleaner hydrocarbons.

-

6.What are the market trends in the N-heptane market?Shift toward high‑purity grades, sustainable solvent alternatives, increased use in pharmaceuticals and electronics, regional manufacturing growth, and adoption of advanced refining technologies.

-

7.What are the main challenges restricting the wider adoption of the N-heptane market?Flammability and safety concerns, strict environmental regulations, high purification costs, and competition from greener, lowVOC solvent alternatives limit wider usage.

Need help to buy this report?