Global Multichannel Order Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Deployment (On-premises and Cloud), By Enterprise Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Application (Healthcare, Manufacturing, Food & Beverages, Automotive, Retail & E-commerce, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Multichannel Order Management Market Size Forecasts to 2035

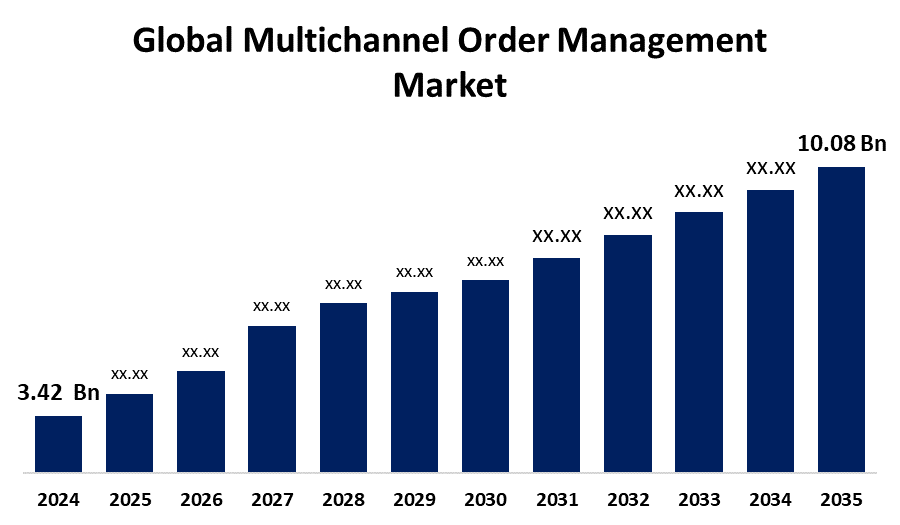

- The Global Multichannel Order Management Market Size Was Estimated at USD 3.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.33% from 2025 to 2035

- The Worldwide Multichannel Order Management Market Size is Expected to Reach USD 10.08 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Multichannel Order Management Market sSze was worth around USD 3.42 billion in 2024 and is predicted to Grow to around USD 10.08 Billion by 2035 with a compound annual growth rate (CAGR) of 10.33% from 2025 to 2035. The rise of multichannel strategies has fueled demand for efficient order management solutions that ensure accuracy and customer satisfaction. Despite data security concerns, the market continues to grow as businesses prioritize streamlined, compliant operations.

Market Overview

The multichannel order management market refers to the methodical process of accepting, monitoring, and completing consumer orders across a range of sales channels, including social media, physical retail locations, internet retailers, and third-party marketplaces like Amazon and eBay. To provide a uniform and effective consumer experience regardless of the location of the purchase, it entails centralizing and coordinating critical operational functions such as inventory management, order routing, shipping, and returns.

The market for multichannel order management is expected to increase significantly as a result of growing e-commerce penetration, cloud and artificial intelligence technological advancements, and the growing need for seamless customer experiences. Considering obstacles such as a lack of technological expertise and worries about data security, the business has a lot of promise. Companies are spending more money on systems that provide uniform data access and real-time inventory visibility. This improves operational efficiency and guarantees consistent service across all channels. Adoption is further accelerated across sectors by scalability and flexible deployment choices. The market is therefore anticipated to grow quickly throughout the course of the forecast period.

Report Coverage

This research report categorizes the multichannel order management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the multichannel order management market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the multichannel order management market.

Global Multichannel Order Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.42 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.33% |

| 2035 Value Projection: | USD 10.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Component, By Deployment, By Enterprise Size, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | NetSuite, VTEX, Magento (Adobe Commerce), Delhivery Pvt. Ltd., IBM Corporation, Shopify Plus, SAP SE, Newfold Digital Inc., Salesforce.com, Inc., Oracle Corporation, Zoho Corporation, HCL Tech, Etail Solutions, SellerActive, Appian, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The need for multichannel order management solutions has increased due to the rise in internet shopping and retail expansion. Managing orders and inventory across several platforms becomes essential as companies implement multichannel strategies. By offering real-time inventory visibility, these systems aid in avoiding overstocking and stockouts. Timely fulfillment and increased customer satisfaction are guaranteed by effective order processing. Ongoing difficulties, however, are brought on by growing worries about data protection and legal compliance. Nevertheless, as companies look for more efficient, legal operations across a variety of sales channels, the industry is expanding.

Restraining Factors

The market growth is hindered by the cloud and IoT technologies develop quickly, protecting company data has become crucial. Greater exposure to privacy issues and cyberthreats results from increased connectedness. The use of handheld devices makes secure data access even more important. Thus, effective adoption of digital technology requires robust information security measures.

Market Segmentation

The multichannel order management market share is classified into component, deployment, enterprise size, and application.

- The solution segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the component, the multichannel order management market is categorized into solutions and services. Among these, the solution segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the scalable and adaptable software solutions are crucial for managing increasing order volumes and new sales channels as firms grow. These systems offer centralized control over inventory and fulfillment as well as real-time visibility. Businesses such as Zoho Corp provide solutions that improve multichannel businesses' productivity. These technologies are essential for maintaining growth and satisfying changing consumer demands.

- The on-premises segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment, the multichannel order management market is categorized into on-premises and cloud. Among these, the on-premises segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the businesses have more control, customisation, and system integration with on-premises solutions. They guarantee adherence to internal and regulatory requirements and improve data security. They provide intricate operational requirements with consistent network performance and long-term cost advantages. These benefits make them perfect for companies that value control and flexibility in order processing.

- The large enterprises segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the enterprise size, the multichannel order management market is categorized into small & medium enterprises (SMEs) and large enterprises. Among these, the large enterprises segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to its ability to manage intricate processes and enormous order volumes across numerous channels, Large businesses require robust order management systems. Scalability, automation, and performance are provided by MOM systems to effectively satisfy these needs. They provide dependable, seamless order processing free from system interruptions. They are, therefore, a wise option for extensive corporate operations.

- The retail and e-commerce segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the multichannel order management market is classified into healthcare, manufacturing, food & beverages, automotive, retail & e-commerce, and others. Among these, the retail and e-commerce segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the growing global demand from customers for internet purchasing. For example, Insider Intelligence estimates that 41.8 million people between the ages of 25 and 34 made purchases online in 2022, with millennials making up the largest group of these buyers. Additionally, MOM solutions offer a consolidated platform to optimize order management procedures, such as fulfillment, inventory control, and order processing. Retailers and e-commerce companies may effectively handle orders across several channels with the aid of this consolidated strategy.

Regional Segment Analysis of the Multichannel Order Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the multichannel order management market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the multichannel order management market over the predicted timeframe. The regional growth can be attributed to the region which digital transformation and technology breakthroughs. MOM systems optimize order management procedures by utilizing cutting-edge technology like data analytics, machine learning, and artificial intelligence. Businesses can improve operational efficiency and competitive advantage by using these technologies to automate repetitive operations, make data-driven choices, and obtain insightful information.

Asia Pacific is expected to grow at a rapid CAGR in the multichannel order management market during the forecast period. The region's growth is being driven by the primary goal of the digital improvements being made to grocery stores, shopping malls, supermarkets, hypermarkets, and convenience stores in the Asia-Pacific area is to keep them competitive in the future of shopping. These developments have transformed the whole in-person retail experience by fusing the speed and ease of internet shopping with the physical presence and dependability of brick-and-mortar establishments. Over the forecast period, these factors are expected to increase the region's need for order management solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the multichannel order management market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NetSuite

- VTEX

- Magento (Adobe Commerce)

- Delhivery Pvt. Ltd.

- IBM Corporation

- Shopify Plus

- SAP SE

- Newfold Digital Inc.

- Salesforce.com, Inc.

- Oracle Corporation

- Zoho Corporation

- HCL Tech

- Etail Solutions

- SellerActive

- Appian

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Oracle announced new features for the Oracle Fusion Cloud Applications Suite, which are intended to help businesses accelerate supply chain planning, improve operational efficiency, and increase financial accuracy. These updates included new planning tools, usage-based pricing, rebate management capabilities in Oracle Fusion Cloud Supply Chain & Manufacturing (SCM), and improvements to the quote-to-cash processes in Oracle Fusion Applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the multichannel order management market based on the below-mentioned segments:

Global Multichannel Order Management Market, By Component

- Solutions

- Services

Global Multichannel Order Management Market, By Deployment

- On-premises

- Cloud

Global Multichannel Order Management Market, By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Global Multichannel Order Management Market, By Application

- Healthcare

- Manufacturing

- Food & Beverages

- Automotive

- Retail & E-commerce

- Others

Global Multichannel Order Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the multichannel order management market over the forecast period?The global multichannel order management market is projected to expand at a CAGR of 10.33% during the forecast period.

-

2. What is the market size of the multichannel order management market?The global multichannel order management market size is expected to grow from USD 3.42 Billion in 2024 to USD 10.08 Billion by 2035, at a CAGR of 10.33% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the multichannel order management market?North America is anticipated to hold the largest share of the multichannel order management market over the predicted timeframe.

Need help to buy this report?