Global Monoisopropylamine Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, Pharmaceutical Grade, and Others), By End User (Agrochemicals, Pharmaceuticals, Rubber Industry, Water Treatment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Monoisopropylamine Market Insights Forecasts to 2035

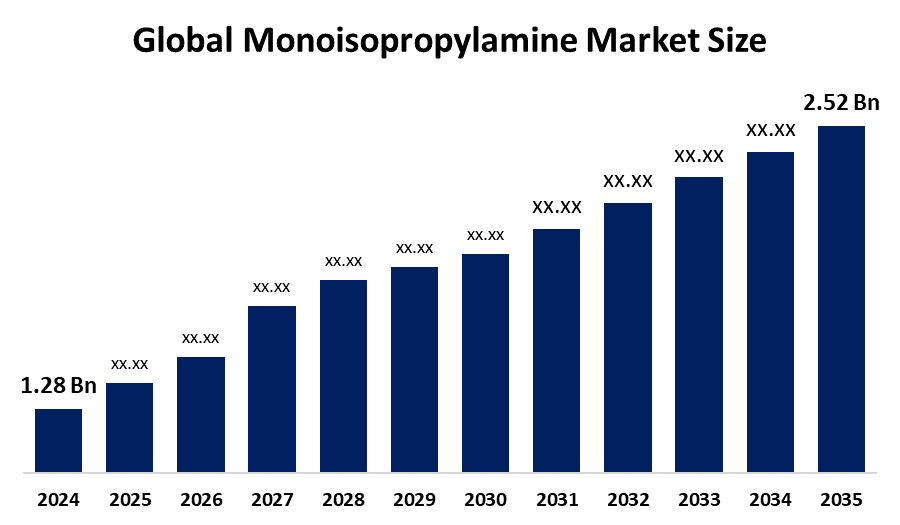

- The Global Monoisopropylamine Market Size Was Valued at USD 1.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.35 % from 2025 to 2035

- The Worldwide Monoisopropylamine Market Size is Expected to Reach USD 2.52 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Monoisopropylamine Market Size Was Worth Around USD 1.28 Billion In 2024 And Is Predicted To Grow To Around USD 2.52 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.35% From 2025 To 2035. The demand for specialty chemical intermediates, agrochemical production, pharmaceutical synthesis, capacity expansions in emerging economies, technological advancements in amination processes, and expanding applications across industrial manufacturing sectors are all factors contributing to the monoisopropylamine market.

Report Coverage

This research report categorizes the monoisopropylamine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the monoisopropylamine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the monoisopropylamine market.

Global Monoisopropylamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.28 Billio |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.35% |

| 2035 Value Projection: | USD 2.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Grade, By End User and By Region |

| Companies covered:: | Air Products and Chemicals, Inc., Akzo Nobel N.V., Alkyl Amines Chemicals Ltd., Arkema Group, Balaji Amines Ltd., BASF SE, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, INEOS Group Holdings S.A., Koei Chemical Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Solvay S.A., Taminco Corporation, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growing agriculture industry is one of the main drivers of the MIPA market's expansion. The expansion of the MIPA market is also being driven by environmental factors and agrochemical regulations. Furthermore, the need for effective agrochemical solutions is being driven by the growing emphasis on sustainable agricultural methods, which is another area where MIPA finds extensive use. MIPA's demand in agriculture is being further increased by the creation of novel herbicidal formulations that include it in order to address the growing resistance. The demand for agrochemical goods is further stimulated by rising population levels and the need for increased crop yields, which indirectly supports monoisopropylamine market expansion.

Restraining Factors

Strict environmental regulations, price volatility for raw materials, hazardous handling requirements, shifting end-use industry demand, supply chain interruptions, and rising compliance costs related to safety, transportation, and chemical manufacturing standards are all factors that are restricting the monoisopropylamine market.

Market Segmentation

The monoisopropylamine market share is classified into grade and end user.

- The industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the monoisopropylamine market is divided into industrial grade, pharmaceutical grade, and others. Among these, the industrial grade segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The industrial grade category owing to its widespread use in agrochemicals formulations, agrochemicals, chemicals used in rubber manufacturing, and other large-scale industrial applications. Due to its availability and affordability, industrial grade MIPA is frequently chosen, making it an essential part of large-scale production operations.

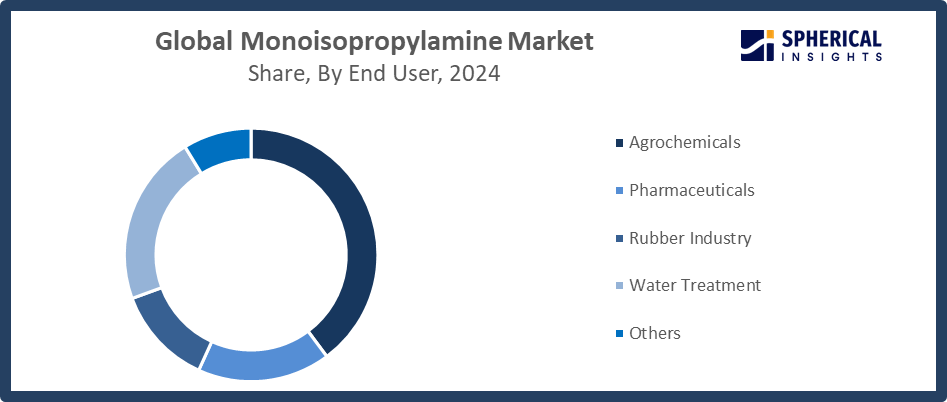

- The agrochemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the monoisopropylamine market is divided into agrochemicals, pharmaceuticals, rubber industry, water treatment, and others. Among these, the agrochemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. MIPA is a crucial component in the synthesis of pesticides and herbicides, which are essential for raising agricultural production in the agrochemical segment. MIPA is essential owing to the growing global population and the resulting need for food, which is driving the need for effective crop protection solutions.

Get more details on this report -

Regional Segment Analysis of the Monoisopropylamine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the monoisopropylamine market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the monoisopropylamine market over the predicted timeframe. The region's robust agricultural and pharmaceutical industries greatly support the ongoing need for monoisopropylamine as a crucial intermediate. This dominance is explained by the fast urbanization and industrialization taking place in nations like China and India, where there is a growing need for agrochemicals and pharmaceuticals. Supportive policies, like agricultural subsidies, chemical industry incentives under programs like "Make in India," and environmental regulations encouraging sustainable intermediates, are examples of policies that indirectly accelerate regional dominance by encouraging end-use sectors and infrastructure investments, even though government launches for MIPA are still limited.

North America is expected to grow at a rapid CAGR in the monoisopropylamine market during the forecast period. The adoption of efficient agrochemicals chemicals is encouraged by strict environmental rules and developments in the pharmaceutical and agrochemical industries in North America. Recent trends show consistent domestic production, large stocks, and continuous operations, which guarantee supply reliability and price stability in the face of feedstock dynamics. A region benefits from a strong healthcare system and rising demand for premium active pharmaceutical ingredients, of which monoisopropylamine is a crucial intermediary.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the monoisopropylamine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Products and Chemicals, Inc.

- Akzo Nobel N.V.

- Alkyl Amines Chemicals Ltd.

- Arkema Group

- Balaji Amines Ltd.

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Huntsman Corporation

- INEOS Group Holdings S.A.

- Koei Chemical Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Solvay S.A.

- Taminco Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Balaji Amines Ltd. announced commercial production of Monoisopropylamine at its Osmanabad facility, expanding specialty chemicals capacity and strengthening domestic supply while targeting emerging international market opportunities.

- In May 2025, BASF SE launched fully renewable electricity-based production of its European Monoisopropylamine portfolio, significantly reducing product carbon footprint and supporting sustainable supply for agriculture and pharmaceutical industries.

- In December 2024, India’s Directorate General of Trade Remedies announced an anti-dumping investigation into Monoisopropylamine imports from China, evaluating alleged injury to domestic manufacturers and potential trade defense measures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the monoisopropylamine market based on the below-mentioned segments:

Global Monoisopropylamine Market, By Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

Global Monoisopropylamine Market, By End User

- Agrochemicals

- Pharmaceuticals

- Rubber Industry

- Water Treatment

- Others

Global Monoisopropylamine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the monoisopropylamine market over the forecast period?The global monoisopropylamine market is projected to expand at a CAGR of 6.35% during the forecast period.

-

2. What is the market size of the monoisopropylamine market?The global monoisopropylamine market size is expected to grow from USD 1.28 Billion in 2024 to USD 2.52 Billion by 2035, at a CAGR of 6.35 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the monoisopropylamine market?Asia Pacific is anticipated to hold the largest share of the monoisopropylamine market over the predicted timeframe.

-

4. Who are the top companies operating in the global monoisopropylamine market?Air Products and Chemicals, Inc., Akzo Nobel N.V., Alkyl Amines Chemicals Ltd., Arkema Group, Balaji Amines Ltd., BASF SE, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, INEOS Group Holdings S.A., Koei Chemical Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Solvay S.A., Taminco Corporation., and Others.

-

5. What factors are driving the growth of the monoisopropylamine market?The increased demand for agrochemicals and pharmaceuticals, growing industrial uses, increased demands for agricultural productivity, fast industrialization in emerging nations, improvements in manufacturing process technology, and capacity expansions by major manufacturers are the main drivers of growth.

-

6. What are the market trends in the monoisopropylamine market?Technological advancements in catalytic amination, the growth of specialty chemical applications, capacity expansions and strategic alliances, a greater emphasis on sustainable production processes, and the increasing demand from developing Asia-Pacific markets are some of the major developments.

-

7. What are the main challenges restricting the wider adoption of the monoisopropylamine market?Strict environmental laws, volatile raw material prices, hazardous material handling specifications, high compliance costs, supply chain interruptions, and demand fluctuations from the end-use pharmaceutical and agrochemical sectors are some of the main challenges.

Need help to buy this report?