Global Monochloroacetic Acid Market Size, Share, and COVID-19 Impact Analysis, By Form (Crystalline and Liquid), By Application (Intermediates, Agrochemicals, Thickening Agent, and Surfactants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Monochloroacetic Acid Market Insights Forecasts to 2035

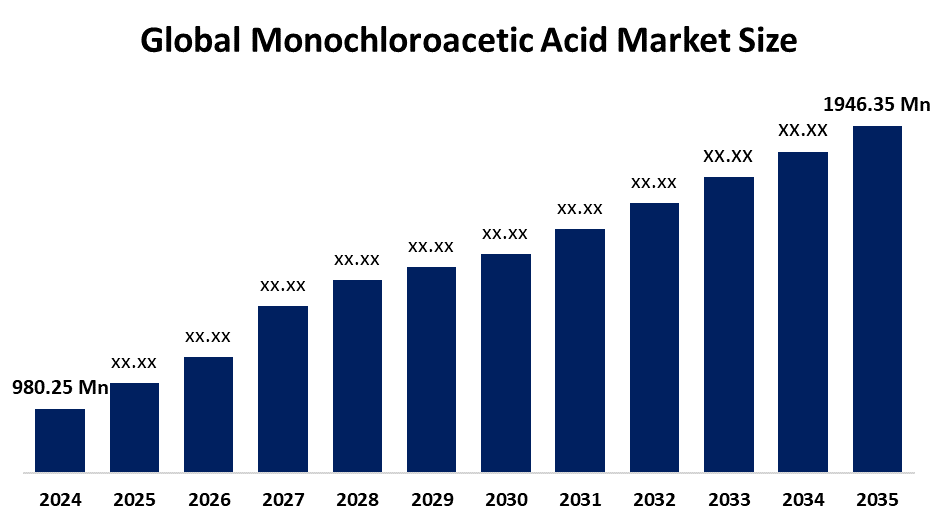

- The Global Monochloroacetic Acid Market Size Was Estimated at USD 980.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.43% from 2025 to 2035

- The Worldwide Monochloroacetic Acid Market Size is Expected to Reach USD 1946.35 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Monochloroacetic Acid Market Size was worth around USD 980.25 Million in 2024 and is predicted to grow to around USD 1946.35 Million by 2035 with a compound annual growth rate (CAGR) of 6.43 % from 2025 to 2035. Growing demand in the agrochemical, pharmaceutical, and personal care industries, as well as developments in green chemistry and sustainable production techniques, especially in emerging economies with growing industrial and agricultural activities, are factors driving the monochloroacetic acid market.

Global Monochloroacetic Acid Market Forecast and Revenue Outlook

- 2024 Market Size: USD 980.25 Million

- 2035 Projected Market Size: USD 1946.35 Million

- CAGR (2025-2035): 6.43%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The manufacturing, sale, and distribution of this multipurpose crystalline chemical compound, which is produced by directly chlorinating acetic acid as a crucial step in organic synthesis, are all included in the monochloroacetic acid (MCA) market. The monochloroacetic acid market is mostly used to produce glycine, carboxymethylcellulose, thioglycolic acid, and derivatives for agrochemicals, food processing, personal care, and pharmaceuticals. The monochloroacetic acid market offers MCA in three different forms: flakes, molten, and solid. These forms serve a variety of industrial uses, including the production of herbicides, thioglycolic acid, and carboxymethyl cellulose (CMC). Growing agricultural demand and the increased use of MCA derivatives in a variety of industries, most notably in the manufacturing of carboxymethyl cellulose (CMC), are the main drivers of the rise. Monochloroacetic acid is still mostly used as an intermediate component in the production of other chemicals; hence, the chemical industry continues to be the main source of demand for it. The monochloroacetic acid market growth prospects are significantly bolstered and driven by the pharmaceutical industry.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the monochloroacetic acid market during the forecast period.

- In terms of form, the crystalline segment is projected to lead the monochloroacetic acid market throughout the forecast period

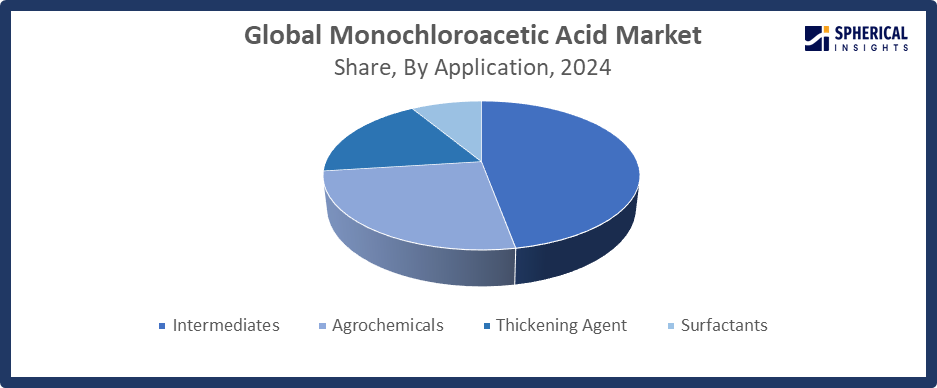

- In terms of application, the intermediates segment captured the largest portion of the market

Monochloroacetic Acid Market Trends

- The expansion of production capabilities by major international chemical corporations.

- The increasing demand from the personal care, textile, pharmaceutical, and agrochemical sectors.

- Strict environmental laws have an impact on the quality of products and industrial methods.

- The growing application as an intermediary in specialized chemicals, carboxymethyl cellulose, and pesticides.

- Regional market expansion is being driven by rapid urbanization and industrialization, particularly in Asia-Pacific region.

Report Coverage

This research report categorizes the monochloroacetic acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the monochloroacetic acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the monochloroacetic acid market.

Global Monochloroacetic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 980.25 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.43% |

| 2035 Value Projection: | USD 1946.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Form, By Application), and By Region |

| Companies covered:: | PCC SE, Niacet, Merck KGaA, CABB GmbH, Denak Co., Ltd, Abhishek Impex, Akzo Nobel N.V., Daicel Corporation, Shiv Chem Industries, The Dow Chemical Company, Shandong Minji Chemical Co., Ltd., Xuchang Dongfang Chemical Co. Ltd., Others, and |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving factors

The demand for monochloroacetic acid in the market is largely driven by the expansion of the pharmaceutical sector, which is fueled by changing healthcare demands, technological breakthroughs, and growing international markets. The growing rate of innovation in the preservative and packaging categories is one of the main factors driving the monochloroacetic acid market. The global monochloroacetic acid market is anticipated to be driven by the growing need for food packaging as well as the nutrition and health sectors. Due to its numerous uses in agrochemicals, medications, and personal care items, monochloroacetic acid is expected to see strong development in demand worldwide.

Restraining Factor

The market for monochloroacetic acid is constrained by a number of issues, including strict environmental laws, high production costs, toxicity concerns, and variations in the availability of raw materials. These limitations come together to prevent the monochloroacetic acid market from expanding and from being widely adopted across a range of end-use sectors.

Market Segmentation

The global monochloroacetic acid market is divided into form and application.

Global Monochloroacetic Acid Market, By Form:

- The crystalline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on form, the global monochloroacetic acid market is segmented into crystalline and liquid. Among these, the crystalline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The production of herbicides, pharmaceutical intermediates, and carboxymethyl cellulose (CMC) are among the many sectors that utilize extensive use of the crystalline structure. Crystalline monochloroacetic acid, a crucial raw ingredient, is used to make CMC. CMC serves as a thickener, stabilizer, and binder in a variety of industries.

The liquid segment in the monochloroacetic acid market is expected to grow at the fastest CAGR over the forecast period. The liquid market is fueled by its ease of handling, effective mixing in industrial processes, and growing demand in pharmaceutical and agrochemical applications, especially in areas with sophisticated chemical manufacturing infrastructure.

Global Monochloroacetic Acid Market, By Application:

- The intermediates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global monochloroacetic acid market is segmented into intermediates, agrochemicals, thickening agents, and surfactants. Among these, the intermediates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The main cause of the intermediates segment is the extensive usage of MCAA as a crucial component in the manufacturing of numerous downstream products, including thioglycolic acid, carboxymethyl cellulose (CMC), and other specialty chemicals. These intermediates are essential to several sectors, such as personal care, textiles, and pharmaceuticals, which fuel the steady need for monochloroacetic acid.

Get more details on this report -

The agrochemicals segment in the monochloroacetic acid market is expected to grow at the fastest CAGR over the forecast period. The demand agrochemicals are efficient crop protection techniques is being driven by the world's increased emphasis on food security, population growth, and the loss of arable land. An essential step in the production of insecticides and herbicides is MCAA.

Regional Segment Analysis of the Global Monochloroacetic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Monochloroacetic Acid Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global monochloroacetic acid market over the forecast period.

The market in the region is mostly driven by rapid industrialization, growing agricultural activity, and rising demand from end-use sectors like textiles, agrochemicals, medicines, and personal care goods. In the agricultural sectors of countries like China, Japan, and India, monochloroacetic acid is being exported. Recent developments highlight market momentum: Akzo Nobel completed a 25% capacity expansion at its MCA facility in 2024, while FMC Corporation launched advanced crop protection products in India, boosting agrochemical applications and strengthening the Monochloroacetic Acid market in Asia-Pacific.

China Monochloroacetic Acid Market Trends

China is propelled by growing industrialization and rising demand from important industries, including textiles, agrochemicals, and pharmaceuticals. The industry is gaining momentum due to government programs that boost chemical manufacturing and rapid urbanization. China's cost-effective industrial capability and plentiful supply of raw materials boost its competitive edge internationally. Environmental compliance and efficiency are also being improved by investments in sustainable production processes and technological breakthroughs.

Japan Monochloroacetic Acid Market Trends

The demand from the specialty chemical, pharmaceutical, and cosmetics sectors propels the monochloroacetic acid (MCAA) market in Japan. The usage of MCAA in cutting-edge applications, including personal care and medical formulations, is supported by Japan's emphasis on producing innovative and premium products. Strong R&D efforts and strict regulatory requirements guaranteeing product safety and environmental compliance help the market.

North America Monochloroacetic Acid Market Trends

North America is expected to grow at the fastest CAGR in the monochloroacetic acid market during the forecast period.

The region's major end-use sectors, including agrochemicals, pharmaceuticals, and personal care items, are driving demand in North America. The need for MCAA-based agrochemicals in North America is further driven by the increased focus on crop protection and agricultural production. Improvements in chemical production, increased demand for medicines, agrochemicals, and surfactants, as well as strong infrastructure and innovation hubs in the US, Canada, and Mexico, are driving the industry. In July 2025, the U.S. executive order on Regulatory Relief enhances chemical manufacturing security by easing emissions controls, while Canada’s backing of the USMCA framework strengthens cross-border trade and innovation, driving growth in the North American Monochloroacetic Acid market.

U.S Monochloroacetic Acid Market Trends

The growing demand for agrochemicals, personal care products, and pharmaceuticals is driving the U.S. Market expansion is supported by increased expenditures in chemical manufacturing facilities and a focus on cutting-edge crop protection technologies. Regulations that support emissions reduction and environmental sustainability affect industrial methods and spur the development of environmentally friendly technologies. Furthermore, supply chain resilience is improved by the U.S. government's attempts to boost domestic chemical production.

Canada Monochloroacetic Acid Market Trends

The demand from the pharmaceutical, personal care, and agrochemical industries propels Canada. Government initiatives to promote cross-border cooperation and improve market accessibility include membership in trade agreements such as the USMCA. Adoption of green production technology is encouraged by stringent environmental restrictions and a focus on sustainable manufacturing. Stable raw material supplies and investments in cutting-edge infrastructure support Canada's chemical industry and increase production capacity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global monochloroacetic acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Monochloroacetic Acid Market Include

- PCC SE

- Niacet

- Merck KGaA

- CABB GmbH

- Denak Co., Ltd

- Abhishek Impex

- Akzo Nobel N.V.

- Daicel Corporation

- Shiv Chem Industries

- The Dow Chemical Company

- Shandong Minji Chemical Co., Ltd.

- Xuchang Dongfang Chemical Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In October 2023, CABB Group launched a new high-purity monochloroacetic acid product line, designed to enhance performance in specialty chemical and pharmaceutical production, delivering improved quality, consistency, and meeting growing industry demands for advanced and reliable chemical intermediates.

- In September 2023, AkzoNobel announced the expansion of its monochloroacetic acid production capacity at its German facility, aiming to meet rising demand from pharmaceutical and agrochemical industries, strengthening its market position and supporting growth in key end-use sectors.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the monochloroacetic acid market based on the following segments:

Global Monochloroacetic Acid Market, By Form

- Crystalline

- Liquid

Global Monochloroacetic Acid Market, By Application

- Intermediates

- Agrochemicals

- Thickening Agent

- Surfactants

Global Monochloroacetic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the monochloroacetic acid market over the forecast period?The global monochloroacetic acid market is projected to expand at a CAGR of 6.43% during the forecast period.

-

2. What is the market size of the monochloroacetic acid market?The global monochloroacetic acid market size is expected to grow from USD 980.25 million in 2024 to USD 1946.35 million by 2035, at a CAGR 6.43% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the monochloroacetic acid market?Asia Pacific is anticipated to hold the largest share of the monochloroacetic acid market over the predicted timeframe.

-

4. Who are the top companies operating in the global monochloroacetic acid market?PCC SE, Niacet, Merck KGaA, CABB GmbH, Denak Co., Ltd., Abhishek Impex, Akzo Nobel N.V., Daicel Corporation, Shiv Chem Industries, The Dow Chemical Company, Shandong Minji Chemical Co., Ltd., Xuchang Dongfang Chemical Co., Ltd., and others.

-

5. What factors are driving the growth of the monochloroacetic acid market?The growth of the monochloroacetic acid market is driven by rising demand in agrochemicals, pharmaceuticals, and personal care industries, along with technological advancements and increasing agricultural activities in emerging economies.

-

6. What are market trends in the monochloroacetic acid market?The market trends include a shift toward sustainable production methods, increased capacity expansions, rising R&D investments, and growing use of MCAA in high-value applications across various industrial sectors.

-

7. What are the main challenges restricting wider adoption of the monochloroacetic acid market?The major challenges include stringent environmental regulations, high production costs, toxicity concerns, and fluctuations in raw material supply, all of which hinder broader adoption and market expansion of monochloroacetic acid.

Need help to buy this report?