Global Mobile Payments Market Size, Share, and COVID-19 Impact Analysis, By Technology (NFC, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, Others), By Type (B2B, B2C, and B2G), By Location (Remote, and Proximity), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Electronics, ICT & MediaGlobal Mobile Payments Market Insights Forecasts to 2032

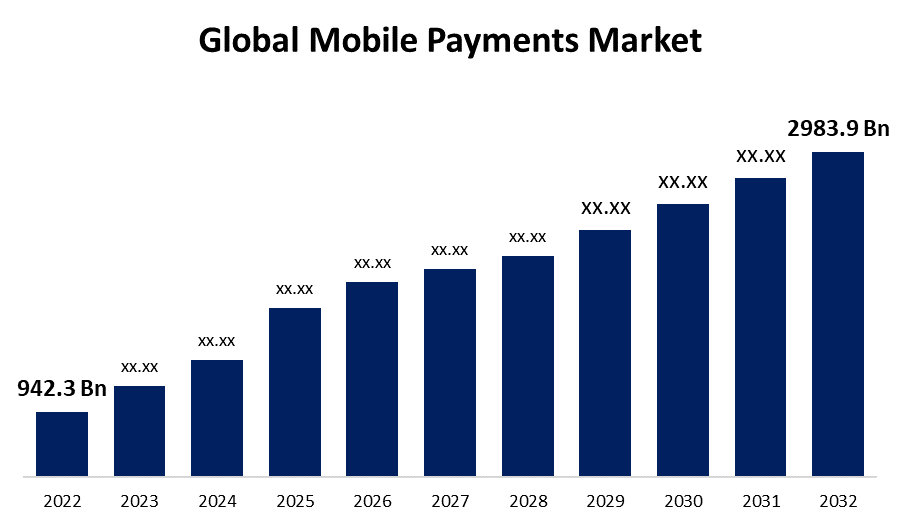

- The Global Mobile Payments Market Size was Valued at USD 942.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 12.22% from 2022 to 2032

- The Worldwide Mobile Payments Market Size is Expected to Reach USD 2983.9 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Mobile Payments Market Size is Anticipated to Exceed USD 2983.9 Billion by 2032, Growing at a CAGR of 12.22% from 2022 to 2032.

Market Overview

A mobile payment is any financial transaction done using a portable electronic device, like a tablet or cell phone, to purchase a good or service. Using apps like PayPal and Venmo, mobile payment technologies can also be utilized to send money to friends and family. Customers can check out on mobile e-commerce sites with their credit card or through mobile payment apps. Since most consumers always carry a smartphone or tablet with them, using them for payment is even more convenient than using cash or a credit card. Therefore, incorporating a mobile payment option in addition to standard credit card processing methods is essential for providing consumers with a seamless online or in-store buying experience, regardless of the way of offering goods or services. Furthermore, the market is anticipated to benefit from an increase in the need for rapid and simple transaction services as well as a surge in the use of host card emulation, NFC, and RFID technologies in mobile payments. Aside from this, the market is being positively impacted by small enterprises' increasing use of mobile payments to draw in customers who prefer cashless purchases. In addition, the growing popularity of subscription-based services for software, entertainment, and other goods is boosting the demand for easy, recurring payment options like mobile payments.

Report Coverage

This research report categorizes the market for the global mobile payments market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global mobile payments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global mobile payments market.

Global Mobile Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 942.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.22% |

| 2032 Value Projection: | USD 2983.9 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Technology, By Type, By Location, By Region |

| Companies covered:: | Google (Alphabet Inc.), Samsung Electronics Co. Ltd., Visa Inc., WeChat (Tencent Holdings Limited), Apple Inc., Alibaba Group Holdings Limited, Amazon.com Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

There is a quite minimal hassle involved in using a mobile phone to make payments. The platform's features will contribute to the market's expansion in the upcoming years. Expanding the customer base will result from improving the current technologies. The world's population is becoming more and more reliant on sophisticated technology and gadgets. Due to multiple payment service providers investing in their businesses, there is fierce competition in the consumer market. Payment app firms, including Google Pay, Alipay, Amazon Pay, and others, are employing innovative tactics to retain their existing customer base and attract new ones. For example, Google Pay provides scratch cards with a maximum value that can be obtained with few transactions. By encouraging smartphone payments, these programs are preserving consumer loyalty. The market's expansion will be greatly influenced by each of these elements. Additional elements that will be crucial to the market's expansion include the technology's dependability, security, and speed of service.

Restraining Factors

The bulk of end users are still entirely dependent on cash for their everyday operations, even though mobile payment solutions provide various advantages like improved operability, dependability, and flexibility. People are hesitant to adopt new technologies because they have been using the conventional payment method for several years. Because of their routines, customers feel more comfortable making large purchases via the traditional method of payment. The broad acceptance of mobile payment technology is contingent upon the presence of a strong and dependable telecommunications infrastructure. Mobile payments may not expand as quickly in areas with poor network coverage or slow internet. Mobile payments depend heavily on security since users must have confidence that their financial information is safe. The adoption of mobile payment technology may be hindered by consumer confidence being undermined by security breaches or fraud incidents.

Market Segmentation

The Global Mobile Payments Market share is classified into technology, type, and location.

- The mobile web payment segment is expected to hold the largest share of the global mobile payments market during the forecast period.

Based on technology, the global mobile payment market is bifurcated into NFC, direct mobile billing, mobile web payment, SMS, interactive voice response systems, mobile apps, and others. Among these, the mobile web payment segment accounted for the largest market share and is expected to continue this pattern over the forecast period. The reason for the growth of this market segment is the security and flexibility that mobile web payment solutions provide. The growing acceptance of m-commerce fosters the segment's growth as well. The mobile web payment platforms' URLs and accurate bookmarking make it easier for users to visit or recommend the website.

- The B2B segment is expected to grow at the highest pace in the global mobile payments market during the forecast period.

Based on the type, the global mobile payments market is divided into B2B, B2C, and B2G. Among these, the B2B segment is expected to grow at the highest pace in the mobile payments market during the forecast period. This is because there is room for growth, as seen by the large investments that venture capital and investment firms are making in B2B payments. Rupifi, a provider of business-to-business payment applications, raised $25 million in January 2022 through a series-A funding round led by Bessemer Venture Partners and Tiger Global Management, LLC. With the funds, Rupifi intends to develop a comprehensive B2B checkout product as well as multichannel, mobile-first B2B payment solutions for merchants, sellers, and sellers.

- The remote segment is expected to hold the largest share of the global mobile payments market during the forecast period.

Based on the location, the global mobile payments market is divided into remote, and proximity. Among these, the remote segment is expected to hold the largest share of the global mobile payments market during the forecast period. This is because the flexibility to pay and transact at any time and from any location satisfies customers' desire for convenient financial transactions. Online purchasing, bill paying, and service transactions are all made easier by the ability to complete transactions without being physically present.

Regional Segment Analysis of the Global Mobile Payments Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global mobile payments market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global mobile payments market over the predicted years. Throughout the forecast period, rising smartphone penetration, evolving online shopping practices, and shifting lifestyles are anticipated to propel regional market expansion. It is anticipated that the growing number of government initiatives in the Asia Pacific area to adopt cashless payment systems would generate growth prospects for the local market. Fintech companies and banks now have a new avenue to reach underserved and unbanked customers in rural places with mobile banking solutions because of the increased adoption of mobile technology in emerging nations.

North America is expected to grow at the fastest pace in the global Mobile Payments market during the forecast period. This is due to the area has embraced cutting-edge technologies early on. The acceptance of mobile payments is also being fueled by the rise in unmanned retail locations in the United States. In North America, mobile payment solutions are widely used due to the expansion of the e-commerce sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mobile payments along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Google (Alphabet Inc.)

- Samsung Electronics Co. Ltd.

- Visa Inc.

- WeChat (Tencent Holdings Limited)

- Apple Inc.

- Alibaba Group Holdings Limited

- Amazon.com Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, In India, Samsung unveiled the Galaxy Watch 6 series, which is now capable of NFC payments using Samsung Wallet. The Tap & Pay feature allows users to make mobile payments. For Indian customers, the launch of near-field communication payments through Samsung Wallet is a game-changing feature that would likely accelerate the uptake of mobile payments in the nation.

- In April 2023, Visa has announced a collaboration with Venmo and PayPal to test their new Visa+ program. The goal of this new service is to facilitate quick and secure money transfers between various person-to-person (P2P) digital payment apps.

- In March 2023, JPMorgan Chase is testing a novel approach to utilize face recognition technology to pay for goods and services. When compared to conventional payment methods, the system is both more convenient and safer. Though it's only in the experimental stage, the biometric checkout system has the potential to completely change how consumers pay for goods. It also saves cash and credit card usage, making it more convenient.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Mobile Payments Market based on the below-mentioned segments:

Global Mobile Payments Market, By Technology

- NFC

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- others

Global Mobile Payments Market, By Type

- B2B

- B2C

- B2G

Global Mobile Payments Market, By Location

- Remote

- Proximity

Global Mobile Payments Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within market?Google (Alphabet Inc.), Samsung Electronics Co. Ltd., Visa Inc., WeChat (Tencent Holdings Limited), Apple Inc., Alibaba Group Holdings Limited, Amazon.com Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., and others.

-

2. Which region is holding largest share of market?Asia-Pacific is anticipated to hold the largest share of the global mobile payments market over the predicted timeframe.

Need help to buy this report?