Global Mobile Device Materials Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Metals & Metal Alloys (Aluminum Alloys, Stainless Steel, Magnesium Alloys, Titanium & Premium Alloys), Plastics & Polymers (Polycarbonate (PC), Reinforced PC (Glass-Fiber, Nano-Fiber), High-Performance Engineering Plastics, Bio-Based & Recycled Polymers), Glass & Transparent Materials (Aluminosilicate Glass, Ultra-Thin Strengthened Glass, Hybrid Glass-Polymer Materials), Composites & Hybrid Materials (Fiber-Reinforced Composites, Metal-Plastic Hybrid Materials, Multi-Layer Structural Composites) ), By Manufacturing & Processing Technology (Bonding & Joining Technologies (Metal-Plastic Bonding, Transparent PC-Metal Bonding, Adhesive Bonding, Laser-Assisted Joining), Surface Treatment & Finishing (Anodizing, Coatings & Protective Layers, Decorative And Aesthetic Surface Treatments), Structural Optimization Technologies (Ultra-Thin Materials (≤0.2T), High Stiffness-To-Weight Solutions, Lightweight Structural Reinforcements), Sustainable Material & Process Technologies (Recyclable Materials, Low-Carbon Manufacturing Processes)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Mobile Device Materials Market Insights Forecasts to 2035

- The Global Mobile Device Materials Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Worldwide Mobile Device Materials Market Size is expected to hold a significant share by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global mobile device materials market size is expected to hold a significant share by 2035, at a CAGR of 6.5% during the forecast period 2025-2035. Growing smartphone use, improvements in lightweight and sustainable materials, increased demand for durability, improved performance, and innovation in flexible and recyclable components all present exciting opportunities in the mobile device materials market.

Market Overview

The mobile device materials market defines the worldwide sector that is concerned with the development, production, supply, and sale of materials used in the making of mobile devices like smartphones, tablets, wearables, and their accessories. This sector comprises an extensive list of materials, which are metals, plastics, glass, ceramics, polymers, and advanced composites that are used in various electronic structural parts such as screens, housings, batteries, chips, and circuit boards. The European Union’s regulation, coming into effect in June 2025, which will demand stronger devices, more efficient use of energy, and more friendly repairability, is a typical example of the regulatory forces working towards circular economies. The change results in a 20% decrease in e-waste and a €20 billion saving in consumer costs by 2030. The recent developments comprise the Samsung Circular Battery Supply Chain, which can use the recycled cobalt in the Galaxy S25 devices, and also winning the 2025 Rema Design for Recycling Award. Growing digital connection, increased internet penetration, and consumers' increasing reliance on mobile technology for communication, entertainment, and productivity are some of the main causes of the sharp rise in smartphone and mobile device usage worldwide.

Report Coverage

This research report categorizes the mobile device materials market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mobile device materials market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the mobile device materials market.

Mobile Device Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material Type |

| Companies covered:: | Corning Incorporated, SCHOTT AG, AGC Inc., Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Group, SABIC, Covestro AG, BASF SE, LG Chem, Toray Industries, Teijin Limited, Solvay S.A., SGL Carbon, Mitsubishi Chemical Group, Hexcel Corporation, Victrex plc, Evonik Industries, RTP Company, And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for increased battery life and faster charging times is considered the main driver of the development of new materials for batteries, thermal management systems, and energy-efficient components. Another important factor is the need for materials that are not only lightweight but also strong enough and possessing high tensile strength so that the overall device portability is not affected while still being able to endure and resist the wear and weather conditions. In addition, the use of specialized materials such as flexible glass, polymers, and advanced coatings is also increasing at a high rate due to new developments in display technologies such as OLED, AMOLED, and foldable screens.

Restraining Factors

High material costs, intricate manufacturing procedures, supply chain interruptions, strict environmental regulations, a lack of advanced raw materials, and issues with recycling, scalability, and technological compatibility across device designs are some of the factors restricting the mobile device materials market.

Market Segmentation

The mobile device materials market share is classified into material type and manufacturing & processing technology.

- The metals & metal alloys segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material type, the mobile device materials market is divided into metals & metal alloys (aluminum alloys, stainless steel, magnesium alloys, titanium & premium alloys), plastics & polymers (polycarbonate (PC), reinforced PC (glass-fiber, nano-fiber), high-performance engineering plastics, bio-based & recycled polymers), glass & transparent materials (aluminosilicate glass, ultra-thin strengthened glass, hybrid glass–polymer materials), composites & hybrid materials (fiber-reinforced composites, metal–plastic hybrid materials, multi-layer structural composites). Among these, the metals & metal alloys segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for metals and metal alloys is a result of their extensive use in device internal frameworks, casings, and structural parts. Global need for robust, lightweight, and high-performing gadgets is driving the metals and metal alloys market.

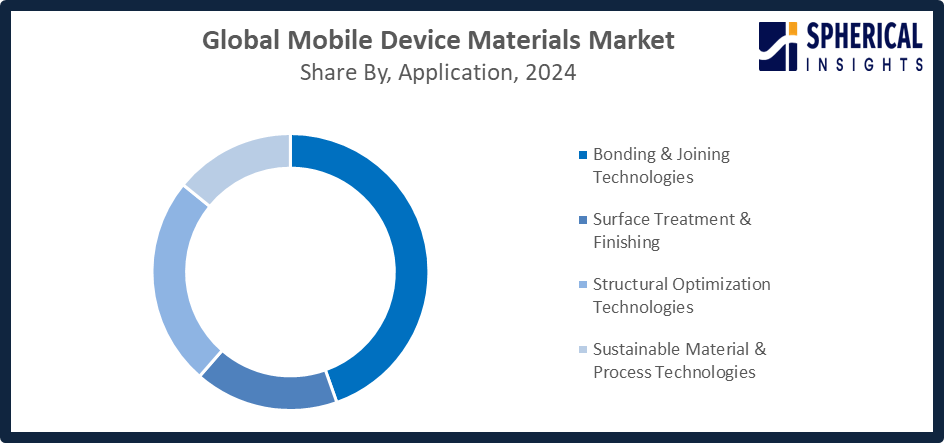

- The bonding & joining technologies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the manufacturing & processing technology, the mobile device materials market is divided into bonding & joining technologies (metal–plastic bonding, transparent PC–metal bonding, adhesive bonding, laser-assisted joining), surface treatment & finishing (anodizing, coatings & protective layers, decorative and aesthetic surface treatments), structural optimization technologies (ultra-thin materials (≤0.2T), high stiffness-to-weight solutions, lightweight structural reinforcements), sustainable material & process technologies (recyclable materials, low-carbon manufacturing processes). Among these, the bonding & joining technologies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for sophisticated assembly methods that improve device durability, miniaturization, and manufacturing efficiency, such as metal–plastic bonding, transparent PC–metal bonding, adhesive bonding, and laser-assisted joining, drives the bonding & joining technologies market.

Get more details on this report -

Regional Segment Analysis of the Mobile Device Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the mobile device materials market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the mobile device materials market over the predicted timeframe. Asia Pacific's robust manufacturing ecosystem and large concentration of mobile device production facilities are the main causes. the region's unmatched manufacturing ecosystem, which includes growing assembly hubs in China and India as well as semiconductor foundries like TSMC in Taiwan and Samsung in South Korea. The Asia Pacific Cross-Sector Anti-Scam Taskforce (ACAST), established by the GSMA in July 2025 across 16 countries, promotes safe digital supply chains, reduces fraud risks in the sourcing of commodities, and boosts investor confidence. According to the ASEAN Digital Masterplan 2025, India's rise as an assembly hub speeds up local testing and packaging innovations, lowering reliance on imports.

North America is expected to grow at a rapid CAGR in the mobile device materials market during the forecast period. The primary drivers in North America are robust technical innovation and high consumer expenditure on state-of-the-art devices. The region's early adoption of next-generation technologies, including 5G, artificial intelligence, and advanced semiconductor solutions, has increased demand for high-performance and specialty materials. The General Services Administration's August 2025 launch of the USAi platform, which enables safe AI prototyping with low-emission materials and reduces procurement delays for federal device updates by 40%, is one of the innovations. Google's Made by Google 2025 announcement advanced sustainable sourcing standards by revealing the Pixel 10 series with Tensor G5 chips that use 100% recycled rare earths.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mobile device materials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corning Incorporated

- SCHOTT AG

- AGC Inc.

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Group

- SABIC

- Covestro AG

- BASF SE

- LG Chem

- Toray Industries

- Teijin Limited

- Solvay S.A.

- SGL Carbon

- Mitsubishi Chemical Group

- Hexcel Corporation

- Victrex plc

- Evonik Industries

- RTP Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, India’s telecoms ministry launched a directive requiring smartphone manufacturers to pre-install the government-run Sanchar Saathi app on all new devices, raising privacy concerns over bonding, coatings, and metal–plastic components in mobile devices.

- In September 2025, Arm Holdings launched its next-generation Lumex chip designs, optimized for AI on smartphones and watches, enabling offline performance while integrating efficiently with aluminum alloys, plastics, glass, and composite materials in mobile device construction.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the mobile device materials market based on the below-mentioned segments:

Global Mobile Device Materials Market, By Material Type

- Metals & Metal Alloys

- Aluminum Alloys

- Stainless Steel

- Magnesium Alloys

- Titanium & Premium Alloys

- Plastics & Polymers

- Polycarbonate (PC)

- Reinforced PC (Glass-Fiber, Nano-Fiber)

- High-Performance Engineering Plastics

- Bio-Based & Recycled Polymers

- Glass & Transparent Materials

- Aluminosilicate Glass

- Ultra-Thin Strengthened Glass

- Hybrid Glass–Polymer Materials

- Composites & Hybrid Materials

- Fiber-Reinforced Composites

- Metal–Plastic Hybrid Materials

- Multi-Layer Structural Composites

Global Mobile Device Materials Market, By Manufacturing & Processing Technology

- Bonding & Joining Technologies

- Metal–Plastic Bonding

- Transparent PC–Metal Bonding

- Adhesive Bonding

- Laser-Assisted Joining

- Surface Treatment & Finishing

- Anodizing

- Coatings & Protective Layers

- Decorative And Aesthetic Surface Treatments

- Structural Optimization Technologies

- Ultra-Thin Materials (≤0.2T)

- High Stiffness-To-Weight Solutions

- Lightweight Structural Reinforcements

- Sustainable Material & Process Technologies

- Recyclable Materials

- Low-Carbon Manufacturing Processes

Global Mobile Device Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the mobile device materials market over the forecast period?The global mobile device materials market is projected to expand at a CAGR of 6.5% during the forecast period.

-

2. What is the market size of the mobile device materials market?The global mobile device materials market size is expected to hold a significant share by 2035, at a CAGR of 6.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the mobile device materials market?Asia Pacific is anticipated to hold the largest share of the mobile device materials market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global mobile device materials market?Corning Incorporated, SCHOTT AG, AGC Inc., Toray Industries, Teijin Limited, Mitsubishi Chemical Group, SABIC, Covestro AG, BASF SE, LG Chem, Solvay S.A., SGL Carbon, Hexcel Corporation, Victrex plc, Evonik Industries, RTP Company, and Others.

-

5. What factors are driving the growth of the mobile device materials market?The market for mobile device materials is expanding due to a number of factors, including growing smartphone penetration, technological improvements, the need for lightweight and durable materials, innovations in displays and batteries, and sustainability programs.

-

6. What are the market trends in the mobile device materials market?Adoption of flexible and foldable displays, the creation of recyclable and environmentally friendly materials, the growing usage of sophisticated composites, component miniaturization, and the incorporation of high-performance, energy-efficient materials are some of the trends.

-

7. What are the main challenges restricting the wider adoption of the mobile device materials market?Broader acceptance in the mobile device materials market is hampered by high material costs, intricate production procedures, a lack of innovative raw materials, difficulties with regulatory compliance, supply chain interruptions, and problems with recycling and scalability.

Need help to buy this report?