Global Mixed Xylene Market Size, Share, and COVID-19 Impact Analysis, By Grade (Isomer Grade, and Solvent Grade), By Application (Fuel Blending, Solvents, Thinners, and Raw Material), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Mixed Xylene Market Insights Forecasts to 2035

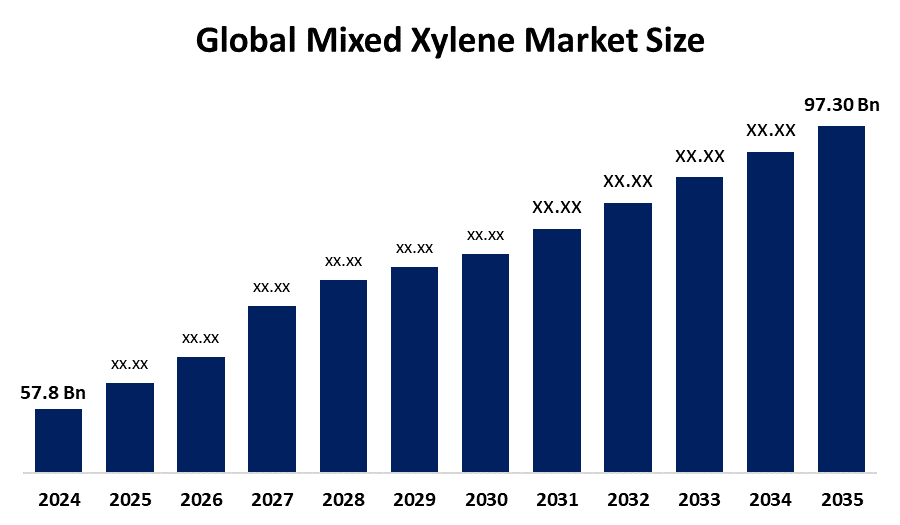

- The Global Mixed Xylene Market Size Was Estimated at USD 57.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.85% from 2025 to 2035

- The Worldwide Mixed Xylene Market Size is Expected to Reach USD 97.30 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Mixed Xylene Market size was worth around USD 57.8 Billion in 2024 and is predicted to Grow to around USD 97.30 Billion by 2035 with a compound annual growth rate (CAGR) of 4.85% from 2025 to 2035. The opportunities for petrochemical growth, environmentally friendly packaging, automotive coatings, industrial solvents, infrastructure development in emerging nations, technological advancement, and a rise in the need for specialized chemicals in the manufacturing and construction industries are all presented by the mixed xylene market.

Global Mixed Xylene Market Forecast and Revenue Outlook

- 2024 Market Size: USD 57.8 Billion

- 2035 Projected Market Size: USD 97.30 Billion

- CAGR (2025-2035): 4.85%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The production, refining, distribution, and consumption of mixed xylenes (MX), a volatile aromatic hydrocarbon blend consisting of ortho, meta-, and para-xylene isomers (C6H1), which are mainly obtained from petroleum naphtha reforming and coal carbonization processes, are all included in the global commercial ecosystem known as the mixed xylene market. The mixed xylene market includes downstream uses in a variety of industries, including textiles, automotive, packaging, and construction, as well as operations pertaining to the extraction, purification, distribution, and commercialization of mixed xylenes. The need for mixed xylene, especially isomer type, as a crucial raw material is being driven by the growing consumer and industrial demand for premium plastics, polyesters, and coatings. The demand for mixed xylene in solvent and raw material applications is rising due to the growth of sectors like automotive, packaging, and textiles, particularly in the Asia-Pacific. The use of mixed xylene to create eco-friendly and energy-efficient products is being accelerated by the growth of lightweight materials and sustainable packaging in the production of electric vehicles.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the mixed xylene market during the forecast period.

- In terms of grade, the isomer grade segment is projected to lead the mixed xylene market throughout the forecast period

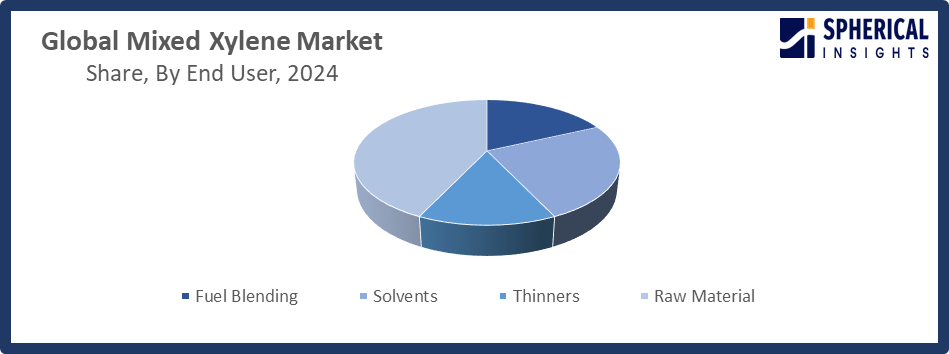

- In terms of application, the raw material segment captured the largest portion of the market

Mixed Xylene Market Trends

- Isomer-grade mixed xylene is becoming more popular due to its usage in the production of para-xylene for the production of polyester and PET resin.

- Technological developments that increase yields and lower energy intensity in the manufacturing of mixed xylene include catalytic reforming and better isomer separation.

- Cleaner production methods and bio-based substitutes are becoming more popular due to growing environmental and regulatory demands (VOCs, sustainable solvents).

- growth in solvent grade applications (paints, coatings, adhesives) as a result of emerging economies' expanding automotive and infrastructure sectors.

Report Coverage

This research report categorizes the mixed xylene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the mixed xylene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the mixed xylene market.

Global Mixed Xylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 57.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.85% |

| 2035 Value Projection: | USD 97.30 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | BASF SE, Braskem, Merck KGaA, MP Biomedicals, Flint Hills Resources, SK geo centric Co., Ltd, Exxon Mobil Corporation, Reliance Industries Limited, Honeywell International Inc., Huntsman International LLC, LOTTE Chemical CORPORATION, Formosa Chemicals & Fibre Corp., Tokyo Chemical Industry Pvt. Ltd., And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

Growing demand for mixed xylene as a feedstock in the manufacturing of gasoline additives, solvents, and ethylbenzene is driving the mixed xylene market expansion. It is anticipated that the growing application of mixed xylene in paints, coatings, and as an octane enhancer in gasoline will increase usage in both the consumer and industrial markets. The increasing use of para-xylene, a by-product of mixed xylene and a crucial feedstock for the manufacturing of polyester fibers, polyethylene terephthalate (PET) resins, and other synthetic polymers, is one of the main causes. Technological developments in chemical processing, industrialization, growing demand for polyester products, and changes in the price of crude oil are driving factors in the mixed xylene market.

Restraining Factor

The market for mixed xylene is restricted by a number of factors, including fluctuating crude oil prices, stringent environmental and safety laws, expensive production and operating costs, exposure-related health risks, and erratic downstream demand.

Market Segmentation

The global mixed xylene market is divided into grade and application.

Global Mixed Xylene Market, By Grade:

- The isomer grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on grade, the global mixed xylene market is segmented into base isomer grade and solvent grade. Among these, the isomer grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its widespread use in the manufacturing of para-xylene, a crucial precursor for polyethylene terephthalate (PET) polymers used in packaging and textiles, is what propels the isomer grade market. Because of its high purity and compatibility with petrochemical processes, isomer grade mixed xylene is used, especially when producing terephthalic acid (PTA). The growing need for PET resins and polyester fibers in clothing, packaging, and industrial uses is driving global consumption.

The solvent grade segment in the mixed xylene market is expected to grow at the fastest CAGR over the forecast period. Solvent grade mixed xylene is prized for its superior solvency qualities and capacity to lower drying times, which makes it perfect for creating high-performance paints and coatings used in the industrial, construction, and automotive industries.

Global Mixed Xylene Market, By Application:

- The raw material segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global mixed xylene market is segmented into fuel blending, solvents, thinners, and raw materials. Among these, the raw material segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The raw material segment is mostly due to the growing global demand for polyester fibers and polymers, especially in textiles and packaging. Its vital significance as a feedstock in the synthesis of para-xylene, ortho-xylene, and meta-xylene isomers, which are necessary for the production of PET, phthalic anhydride, and other chemicals, drives the raw material segment.

Get more details on this report -

The solvent segment in the mixed xylene market is expected to grow at the fastest CAGR over the forecast period. The demand for high-performance solvents and the swift rise of the automotive and construction sectors drive the solvent market's progress, especially in developing nations that are becoming more industrialized.

Regional Segment Analysis of the Global Mixed Xylene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Mixed Xylene Market Trends

Asia Pacific is expected to hold the largest share of the global mixed xylene market over the forecast period.

Rapid industrialization, extensive chemical production, and strong demand from the paints and coatings industry, especially in nations like China and India, are all linked to the Asia-Pacific. Mixed xylene is becoming more accessible and affordable thanks to government programs that support industrial growth and the availability of reasonably priced raw ingredients. The market is expanding due to the region's dominance in polyester production as well as the growing need for paints, coatings, and adhesives. ExxonMobil launched a 1.2 billion-tonne MX facility in Singapore with AI-optimized reforming for 20% efficiency, while Reliance Industries launched a bio-xylene pilot in Jamnagar, supporting ESG, EV, and sustainable packaging growth.

China Mixed Xylene Market Trends

One major growth driver is the increasing need for polyester fibers, resins, and solvents in the construction, automotive, and textile industries. Large-scale infrastructure projects, rising paraxylene consumption, and expanding polyester production are the main drivers of growth. Large-scale production is made possible by integrated petrochemical districts and refinery complexes. The market is being driven by China's focus on creating smart cities and its robust domestic petrochemical manufacturing base.

Japan Mixed Xylene Market Trends

Japan's sophisticated chemical industry and strong demand for polyester-based products are driving the country's mixed xylene market. Industry differentiation is fueled by an increasing focus on green chemical manufacturing and high-value isomer separation. In general, industry success is supported by steady production and export buoyancy. Growth is being driven by the use of mixed xylene in the manufacturing of high-performance coatings and adhesives, especially in the automotive and electronics industries.

North America Mixed Xylene Market Trends

North America is expected to grow at the fastest CAGR in the mixed xylene market during the forecast period.

Increasing industrialization, strong expansion in the automotive, packaging, and textile industries, and growing demand for polyester fibers and polyethylene terephthalate (PET) resins are the main factors driving North America. The region's production and supply capacities are further improved by its robust chemical manufacturing infrastructure and continuous investments in cutting-edge petrochemical plants. In February 2025, the U.S. DOE launched the "Advanced Petrochemical Resilience Initiative," providing USD 8 billion in grants for carbon-capture-integrated MX facilities, boosting energy independence and reducing emissions under the Bipartisan Infrastructure Law.

U.S Mixed Xylene Market Trends

The construction and automotive sectors, which significantly depend on mixed xylene as a solvent, are important drivers of market expansion. The market is being favorably determined by the use of novel production methods to comply with environmental standards. Additionally, investments in shale gas development and the United States' robust chemical manufacturing base are guaranteeing a steady supply of raw materials, which is encouraging industry expansion.

Canada Mixed Xylene Market Trends

Growing demand from downstream sectors like polyester fiber, paints, coatings, adhesives, and polyethylene terephthalate (PET) resin is what propels Canada. Growing use of mixed xylene as a feedstock and solvent is supported by industrial growth, especially in the chemical and automotive industries. While regulatory compliance guarantees ecologically responsible operations, technological developments in refining and separation processes have improved production efficiency and product quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mixed xylene market, along with a comparative evaluation primarily based on their Grade of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Grade development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Mixed Xylene Market Include

- BASF SE

- Braskem

- Merck KGaA

- MP Biomedicals

- Flint Hills Resources

- SK geo centric Co., Ltd

- Exxon Mobil Corporation

- Reliance Industries Limited

- Honeywell International Inc.

- Huntsman International LLC

- LOTTE Chemical CORPORATION

- Formosa Chemicals & Fibre Corp.

- Tokyo Chemical Industry Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In January 2023, Reliance Industries Limited (RIL) launched a steady pricing strategy, keeping Mixed Xylene at INR 78/kg (USD 1/kg) to sustain PET and solvent demand, strengthen its Asia-Pacific market position, and promote global price stability.

- In September 2021, Mitsubishi Gas Chemical (MGC) launched an expansion of meta-xylenediamine (MXDA) production in Europe with a 25,000 MTA plant in Rotterdam, meeting rising epoxy and polyamide demand while enhancing global supply and reinforcing its international market presence.

- In April 2021, Indian Oil Corporation Limited (IOCL) launched a million-dollar EPCC contract with Tecnimont Private Limited to build an integrated PX-PTA facility in Paradip, Odisha, producing 800 kilotons annually to boost mixed xylene utilization, PET demand, and India’s petrochemical growth.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the mixed xylene market based on the following segments:

Global Mixed Xylene Market, By Grade

- Isomer Grade

- Solvent Grade

Global Mixed Xylene Market, By Application

- Fuel Blending

- Solvents

- Thinners

- Raw Material

Global Mixed Xylene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the mixed xylene market over the forecast period?The global mixed xylene market is projected to expand at a CAGR of 4.85% during the forecast period.

-

2. What is the market size of the mixed xylene market?The global mixed xylene market size is expected to grow from USD 57.8 billion in 2024 to USD 97.30 billion by 2035, at a CAGR 4.85% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the mixed xylene market?Asia Pacific is anticipated to hold the largest share of the Mixed Xylene market over the predicted timeframe.

-

4. Who are the top companies operating in the global mixed xylene market?BASF SE, Braskem, Merck KGaA, MP Biomedicals, Flint Hills Resources, SK Geocentric Co., Ltd, ExxonMobil, Reliance Industries Limited, Honeywell International Inc., Huntsman International LLC, LOTTE Chemical Corporation, Formosa Chemicals & Fibre Corp., Tokyo Chemical Industry Pvt. Ltd., and others.

-

5. What factors are driving the growth of the mixed xylene market?The growth of the Mixed Xylene market is driven by rising demand for polyester, PET resins, industrial solvents, paints, coatings, adhesives, technological advancements, industrialization, and expanding downstream applications globally.

-

6. What are market trends in the mixed xylene market?The Market trends include AI‑optimized production, bio-xylene initiatives, sustainability focus, regional consumption shifts, technological innovations in refining, regulatory compliance, and increased integration of petrochemical and manufacturing processes across key industries.

-

7. What are the main challenges restricting wider adoption of the mixed xylene market?Volatile crude oil prices, severe environmental laws, high production costs, health and safety concerns, erratic downstream demand, and competition from other solvents or bio-based compounds are some of the main challenges preventing wider implementation.

Need help to buy this report?