Global Mineral Turpentine Market Size, Share, and COVID-19 Impact Analysis, By Type (Type 1, Type 2, Type 3, and Type 0), By Application (Paint Thinner, Extraction Solvent, Cleaning Solvent, Degreasing Solvent, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Mineral Turpentine Market Insights Forecasts to 2035

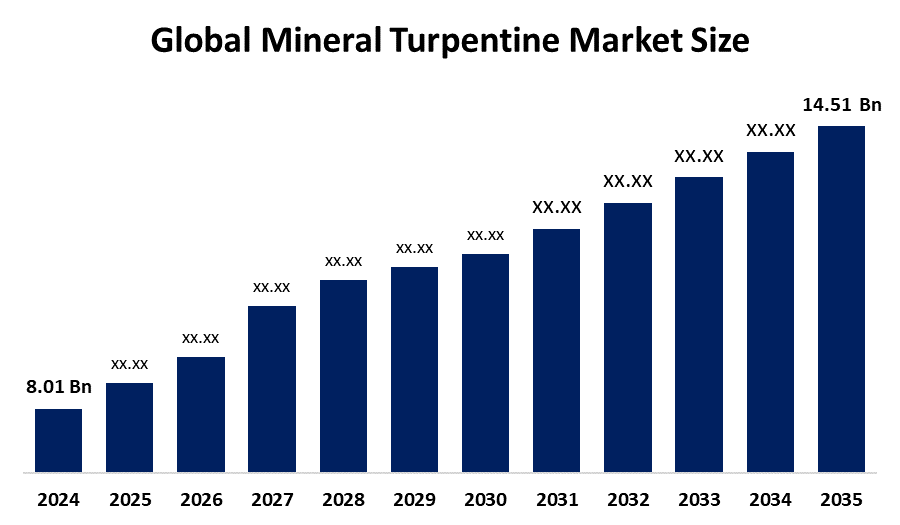

- The Global Mineral Turpentine Market Size Was Estimated at USD 8.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.55 % from 2025 to 2035

- The Worldwide Mineral Turpentine Market Size is Expected to Reach USD 14.51 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global mineral turpentine market size was worth around USD 8.01 billion in 2024 and is predicted to grow to around USD 14.51 billion by 2035 with a compound annual growth rate (CAGR) of 5.55 % from 2025 to 2035. Growing demand for low-VOC and environmentally friendly solvents, expansion in emerging economies, growth in the automotive and construction industries, and growing use in paints, coatings, adhesives, and industrial cleaning applications are all opportunities in the mineral turpentine market.

Market Overview

The production, distribution, and consumption of mineral turpentine oil (MTO), a refined petroleum distillate hydrocarbon solvent distinguished by its high solvency, low aromatic content, and volatility, are all included in the global ecosystem known as the mineral turpentine market. MTO, which is mostly made from naphtha cracking and distillation processes, is a crucial thinner in coatings and paints (38% market share), industrial cleaning agents (25.5%), chemically processed adhesives, and sealants, supporting industries like manufacturing, construction, and automobiles. The increased usage of mineral turpentine in end-use industries such as paints and coatings, adhesives, inks, and dyes has increased demand for the global mineral turpentine market. Due to its widespread use as a paint thinner and cleaning solution for paintbrushes, the paint industry is the biggest user of mineral turpentine. The mineral turpentine market for mineral turpentine is expanding due to all of these considerations.

Report Coverage

This research report categorizes the mineral turpentine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mineral turpentine market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the mineral turpentine market.

Global Mineral Turpentine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.01 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 5.55 % |

| 024 – 2035 Value Projection: | USD 14.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Al Sanea, Powerzone Oil, Sydney Solvents, Indian Oil Corporation Ltd, DHC Solvent Chemie GmbH, ALSHALL INTERNATIONAL CO., Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Global Petro, GSB Chemical Co. Pty. Ltd, And Other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of high-end paints and coatings in the automotive sector is expanding. Typically, the market structure consists of upstream producers, distributors, and downstream consumers. Growth is fueled by an increase in industrial activity, urbanization, and the need for high-performance solvents in a variety of industries. The automotive industry's increased need for mineral turpentine is anticipated to fuel the mineral turpentine market's expansion. Industrial, technological, and consumer-focused reasons are all contributing to the mineral turpentine market's consistent rise. The growing need for mineral turpentine as a flexible solvent in paints, coatings, varnishes, adhesives, and cleaning products is one of the main factors in the mineral turpentine market.

Restraining Factors

Strict environmental laws, health and safety issues brought on by volatile organic compounds, volatile crude oil prices, the availability of environmentally friendly substitutes, and high production costs are some of the factors restricting the mineral turpentine market's growth and adoption.

Market Segmentation

The mineral turpentine market share is classified into type and application.

- The Type 1 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the mineral turpentine market is divided into type 1, type 2, type 3, and type. Among these, the Type 1 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hydrodesulfurization technique is applied to type 1 mineral turpentine, which contains hydrocarbons with carbon numbers ranging from C7 to C12. Because type 1 mineral turpentine has a high boiling point (between 90 and 230°C), it is frequently used as an extraction and cleaning solution. The worldwide market is also driven by the use of type 1 mineral turpentine as an active solvent in aerosol and other wood preservative solutions.

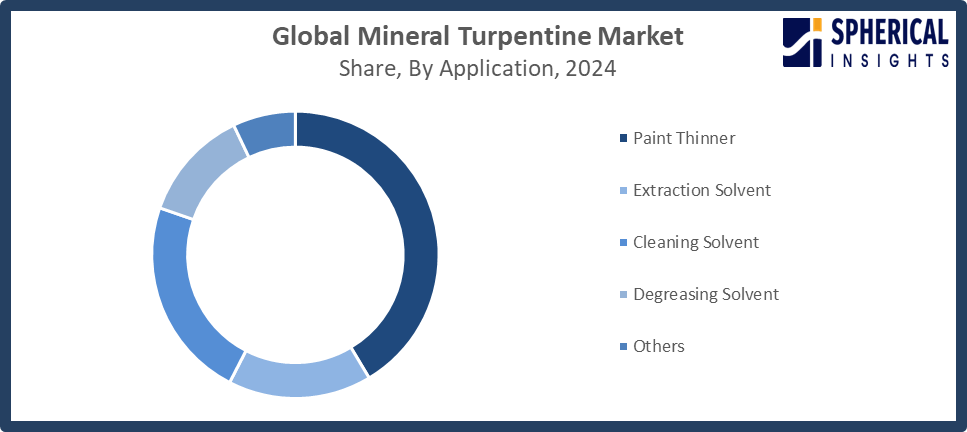

- The paint thinner segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the mineral turpentine market is divided into paint thinner, extraction solvent, cleaning solvent, degreasing solvent, and others. Among these, the paint thinner segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand for mineral turpentine in pain thinner applications is driven by its production from petroleum distillate, which makes it feasible to use as a solvent in paint thinner.

Get more details on this report -

Regional Segment Analysis of the Mineral Turpentine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the mineral turpentine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the mineral turpentine market over the predicted timeframe. Rapid urbanization, industrialization, and the growth of end-use industries like furniture, automobile, and construction are the main drivers of Asia Pacific. High-quality solvents are in high demand due to the significant infrastructural construction and industrial expansion occurring in nations like China, India, Japan, and South Korea. Paint viscosity is reduced and paint smoothness is enhanced with mineral turpentine. In addition, mineral turpentine's affordability and eco-friendliness make it appropriate for uses like paint thinners. The Asia-Pacific mineral turpentine market is also driven by the growing use of mineral turpentine in the construction and automotive end-use industries.

North America is expected to grow at a rapid CAGR in the mineral turpentine market during the forecast period. The need for mineral turpentine, a vital solvent in paints, varnishes, adhesives, and cleaning products, is growing in North America due to the construction, automotive, and furniture industries. Manufacturers are using mineral turpentine due to improvements in solvent quality and efficiency brought about by technological developments in production and refining processes. Adoption in the area is further supported by growing awareness of low-VOC and environmentally friendly chemical goods, as regulatory bodies place a strong emphasis on occupational health regulations and environmental sustainability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mineral turpentine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Al Sanea

- Powerzone Oil

- Sydney Solvents

- Indian Oil Corporation Ltd

- DHC Solvent Chemie GmbH

- ALSHALL INTERNATIONAL CO.

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Global Petro, GSB Chemical Co. Pty. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the mineral turpentine market based on the below-mentioned segments:

Global Mineral Turpentine Market, By Type

- Type 1

- Type 2

- Type 3

- Type 0

Global Mineral Turpentine Market, By Application

- Paint Thinner

- Extraction Solvent

- Cleaning Solvent

- Degreasing Solvent

- Others

Global Mineral Turpentine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the mineral turpentine market over the forecast period?The global mineral turpentine market is projected to expand at a CAGR of 5.55 % during the forecast period.

-

2. What is the market size of the mineral turpentine market?The global mineral turpentine market size is expected to grow from USD 8.01 billion in 2024 to USD 14.51 billion by 2035, at a CAGR of 5.55 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the mineral turpentine market?Asia Pacific is anticipated to hold the largest share of the mineral turpentine market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global mineral turpentine market?Al Sanea, Powerzone Oil, Sydney Solvents, Indian Oil Corporation Ltd, DHC, Solvent Chemie GmbH, ALSHALL International Co., Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Global Petro, GSB Chemical Co. Pty. Ltd, and others.

-

5. What factors are driving the growth of the mineral turpentine market?The growth of the mineral turpentine market is driven by rising industrialization, expanding construction and automotive sectors, increasing demand for paints and coatings, and advancements in solvent refining technologies.

-

6. What are the market trends in the mineral turpentine market?The trends in the mineral turpentine market include a shift toward eco-friendly, low-VOC solvents, technological innovations, sustainable manufacturing practices, and growing demand from emerging economies and industrial sectors.

-

7. What are the main challenges restricting wider adoption of the mineral turpentine market?The major challenges restricting the mineral turpentine market include stringent environmental regulations, health and safety concerns, fluctuating crude oil prices, and increasing availability of environmentally sustainable solvent alternatives.

Need help to buy this report?