Global Milk & Cream Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product & Service (Fluid Milk, Milk Powder, and Cream), By Major Market (Wholesalers & Supermarkets, Food Service Operators, Convenience Stores, and Discount Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Milk & Cream Manufacturing Market Insights Forecasts to 2035

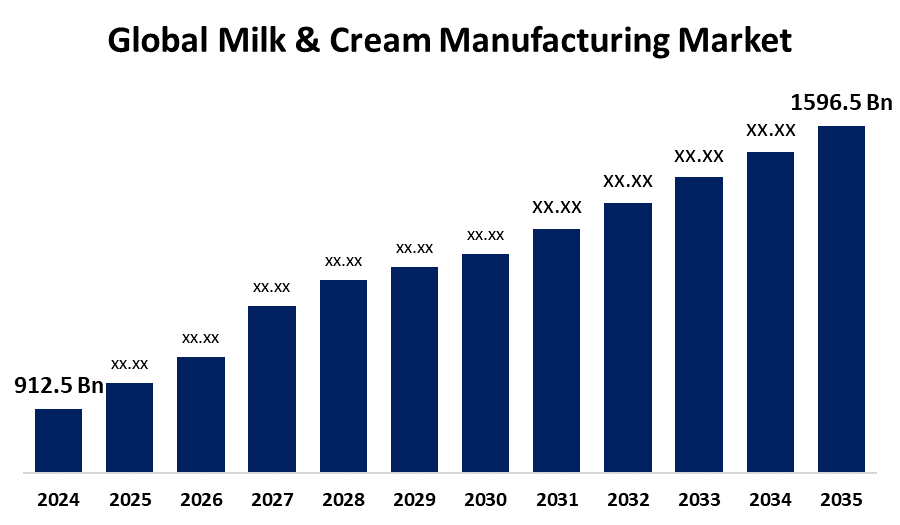

- The Global Milk & Cream Manufacturing Market Size Was Estimated at USD 912.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.12% from 2025 to 2035

- The Worldwide Milk & Cream Manufacturing Market Size is Expected to Reach USD 1596.5 Billion by 2035

- Asia Pacific is Expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the global Milk & Cream Manufacturing market size was worth around USD 912.5 billion in 2024 and is predicted to grow to around USD 1596.5 billion by 2035 with a compound annual growth rate (CAGR) of 5.12% from 2025 to 2035. An increasing consumer health consciousness and milk product consumption are driving the global milk & cream manufacturing market.

Market Overview

The milk & cream manufacturing market is the industry that involves the production, processing, and distribution of milk and cream products. Milk & cream manufacturing steps include receiving and processing raw milk, separating cream from milk, pasteurization, homogenization (if required), and packaging. Cream is produced by the separation of the higher-fat layer from milk by using centrifugation, while milk is standardized and pasteurized. Milk and cream are increasingly used among foodservice operators and food & beverage producers. There is an increasing spending on R&D activities by the manufacturers for introducing novel products due to environmental concerns and sustainability goals. The presence of a highly skilled and tech-savvy workforce and the adoption of digital tools and systems in the milk & cream manufacturing are propelling the market growth. Inclination towards organic products owing to the consumers' increasing health consciousness provides lucrative opportunities for dairy cream manufacturers, thereby escalating the market growth for milk & cream manufacturing.

Report Coverage

This research report categorizes the milk & cream manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the milk & cream manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the milk & cream manufacturing market.

Milk & Cream Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 912.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.12% |

| 2035 Value Projection: | USD 1596.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product & Service, By Major Market and By Region |

| Companies covered:: | Arla Foods, Groupe Danone, Nestle SA, Dairy Farmers of America, Amul Industries Private Limited, Kraft Foods, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A significant demand for functional dairy products, including vitamins and mineral-fortified milk, is contributing to driving the market growth. As per the report of OECD-FAO, the world milk production is anticipated to increase by 1.6% annually between 2020 and 2029, reaching 997 million tons in 2029. Further, the increasing consumption of milk and milk products, especially in India, Pakistan, and Africa, is anticipated to propel the market demand. The increasing consumer health awareness of dairy products positively affects the purchase intention and purchase proportion of dairy products, which contributes to propelling the market. Advancements in technology and production processes for reducing waste and optimizing resource usage are contributing to promoting market growth of milk & cream manufacturing.

Restraining Factors

The poor quality of animal feed is negatively affecting milk production and milk product consumption, thereby challenging the market. Further, the fluctuation in raw material prices and supply chain disruptions are hampering the milk & cream manufacturing market.

Market Segmentation

The milk & cream manufacturing market share is classified into product & service and major market.

- The fluid milk segment dominated the milk & cream manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product & service, the milk & cream manufacturing market is divided into fluid milk, milk powder, and cream. Among these, the fluid milk segment dominated the milk & cream manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Fluid milk has versatile applications in dairy beverages, yogurt, and cheese production, and is significantly used in the bakery and confectionery industry. The popularity of fluid milk, along with the growing preference for sustainable products, with a priority on sourcing from local and organic dairy farms, is propelling the market growth in the fluid milk segment.

- The wholesalers & supermarkets segment accounted for a significant share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the major market, the milk & cream manufacturing market is divided into wholesalers & supermarkets, food service operators, convenience stores, and discount stores. Among these, the wholesalers & supermarkets segment accounted for a significant share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Wholesalers quickly adapt to the demand, with diversifying product lines and adjusting their supply chains. The strategic investment in a broad assortment of dairy items to cater to diverse customer needs, ensuring the availability of fresh dairy, is propelling the market growth in the wholesalers & supermarkets segment.

Regional Segment Analysis of the Milk & Cream Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the milk & cream manufacturing market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the milk & cream manufacturing market over the predicted timeframe. The European region has a traditional market for cream products, with the presence of several cream product customers. The region’s food industry, reflecting the rich tradition of dairy consumption and a diverse range of products, is driving the milk & cream manufacturing market in the Europe region.

Asia Pacific is expected to grow at a rapid CAGR in the milk & cream manufacturing market during the forecast period. The increasing foodservice sector and number of cream-consuming customers are contributing to driving the market. Further, organic dairy food products, due to their various advantages, are promoting the market. With the growing urbanization, the adoption of the Western diet is driving the demand for milk and cream products, thereby propelling the market demand.

North America is anticipated to hold a significant share of the milk & cream manufacturing market during the predicted timeframe. Evolving consumer behaviour with a notable shift towards out-of-home consumption patterns contributes to driving the milk and cream manufacturing market. An increasing food and drink products, such as chocolate, pastries, fresh dairy products, broth, and others that make use of cream, is propelling the market demand for milk & cream manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the milk & cream manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods

- Groupe Danone

- Nestle SA

- Dairy Farmers of America

- Amul Industries Private Limited

- Kraft Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Fonterra and Nourish Ingredients joined forces to develop innovative new products. Fonterra has started working with Nourish Ingredients, a leader in specialty fats and precision fermentation, to accelerate the development of dairy products with innovative fats.

- In July 2024, Governor Hochul celebrated Wells Enterprises' significantly expanded $425 million investment at its Dunkirk Ice cream manufacturing facility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the milk & cream manufacturing market based on the below-mentioned segments:

Global Milk & Cream Manufacturing Market, By Product & Service

- Fluid Milk

- Milk Powder

- Cream

Global Milk & Cream Manufacturing Market, By Major Market

- Wholesalers & Supermarkets

- Food Service Operators

- Convenience Stores

- Discount Stores

Global Milk & Cream Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Milk & Cream Manufacturing market?The global Milk & Cream Manufacturing market size is expected to grow from USD 912.5 Billion in 2024 to USD 1596.5 Billion by 2035, at a CAGR of 51.2% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the Milk & Cream Manufacturing market?Europe is anticipated to hold the largest share of the Milk & Cream Manufacturing market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Milk & Cream Manufacturing Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.12% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Milk & Cream Manufacturing Market?Key players include Arla Foods, Groupe Danone, Nestle SA, Dairy Farmers of America, Amul Industries Private Limited, and Kraft Foods.

-

5. Can you provide company profiles for the leading milk & cream manufacturing companies?Yes. For example, Arla Foods is a dairy company, works continuously on the farms, at the dairies, and in administration to reduce its carbon footprint and environmental impact. Dairy Farmers of America is a farmer-owned dairy cooperative, with dairy farmers focused on making high-quality milk.

-

6. What are the main drivers of growth in the milk & cream manufacturing market?An increasing consumer health consciousness and milk product consumption are major market growth drivers.

-

7. What challenges are limiting the milk & cream manufacturing market?Poor animal feed quality, supply chain fluctuations, high production costs, and stringent regulatory standards remain key restraints.

Need help to buy this report?