Global Military Shipbuilding and Submarines Market Size, Share, and COVID-19 Impact Analysis, By Type of Ships (Surface Ships, Corvettes, Frigates, Destroyers, Cruisers, and Aircraft Carriers), By Purpose (Offensive Operations, Defensive Operations, Patrol & Surveillance, and Special Operations), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Military Shipbuilding & Submarines Market Insights Forecasts to 2035

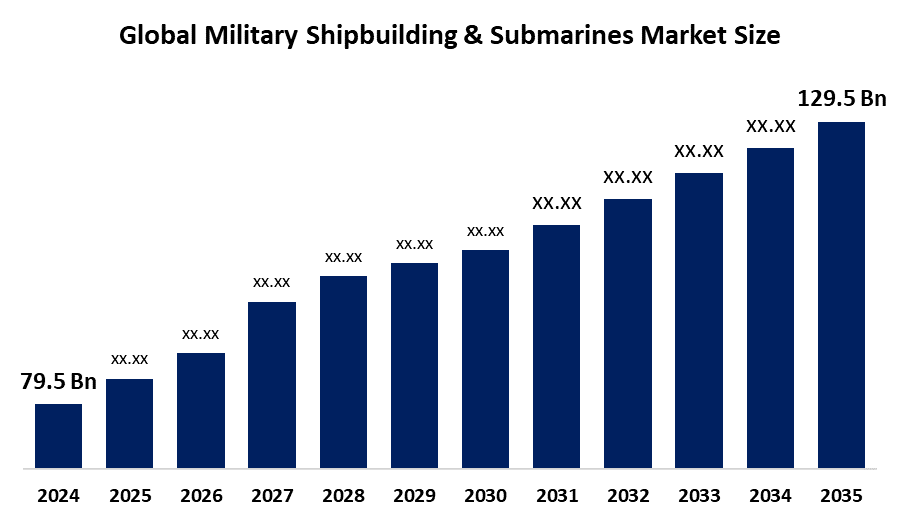

- The Global Military Shipbuilding & Submarines Market Size Was Estimated at USD 79.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.54% from 2025 to 2035

- The Worldwide Military Shipbuilding & Submarines Market Size is Expected to Reach USD 129.5 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Global Military Shipbuilding & Submarines Market Size was worth around USD 79.5 Billion in 2024 and is Predicted to Grow to around USD 129.5 Billion by 2035 with a compound annual growth rate (CAGR) of 4.54% from 2025 to 2035. With the evolving threats and geopolitical instability, increasing defense budgets, and the need for advanced naval capabilities are driving the global military shipbuilding & submarines market.

Market Overview

The military shipbuilding & submarines market refers to the market encompassing the designing, construction, maintenance, and modernization of naval vessels, like surface ships and submarines, for military purposes. Shipbuilding refers to the designing, construction, and maintenance of surface vessels such as warships and aircraft carriers, while submarine construction deals with the unique engineering challenges of building submersible vessels for underwater operations. Introduction of advanced propulsion systems, like AIP (air-independent propulsion) technology, has driven the endurance and operation efficiency of military shipbuilding & submarines. Further, advanced composite materials and powerful sonar systems in modern navy boats are used to increase efficacy in maritime operations and oceanic research. Cloud based research platforms in the military shipbuilding and submarine development, facilitating the collaborative processes and seamlessly interacting with CRM and BI systems, enabling streamlined design, construction, and lifecycle management by connecting various stakeholders and systems. Retrofitting, repairs, and technical support for surface vessels are some of the services that are creating growth opportunities, positively impacting the military shipbuilding and submarines market.

Report Coverage

This research report categorizes the military shipbuilding & submarines market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the military shipbuilding & submarines market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the military shipbuilding & submarines market.

Global Military Shipbuilding and Submarines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 79.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.54% |

| 2035 Value Projection: | USD 129.5 Billio |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type of Ships, By Purpose, By Region. |

| Companies covered:: | General Dynamics Corporation, Huntington Ingalls Industries Inc., BAE Systems PLC, Northrop Gruman Corporation, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Leonardo SpA, Singapore Technologies Engineering, DCNS S.A (Naval Group), Singapore Technologies Engineering, Daewoo Shipbuilding and Marine Engineering and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The evolving threats and geopolitical instability, including the Russia-Ukraine war, shadowing fleets, and fluctuating trade relationships, are prompting nations to bolster their defense capabilities, which aids in propelling the military shipbuilding & submarines market. With the changing global security context, shifting government defense budgets, shipbuilders could adjust their offerings in response to navies seeking to improve fleet capabilities and readiness. For instance, Japan has increased its defense budget by 27% from 2022 to 2023 after the revision of its national security strategy, which now aims to spend 2% of its GDP on defense by 2027. The emergence of advanced naval capabilities influenced by several initiatives is bolstering the market growth.

Restraining Factors

The increased cost of naval construction and complexity in integrating advanced technologies are challenging the market. Further, the strict regulations and compliance standards delaying project approvals are hampering the market growth.

Market Segmentation

The military shipbuilding & submarines market share is classified into type of ships and purpose.

- The surface ships segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type of ships, the military shipbuilding & submarines market is divided into surface ships, corvettes, frigates, destroyers, cruisers, and aircraft carriers. Among these, the surface ships segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Surface ships are designed for warfare on the water surface, equipped with their own weapons and armed forces. The increasing demand for advanced and stealthy surface ships for enhancing the naval capabilities and ensuring maritime security is propelling the market growth.

- The offensive operations segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the purpose, the military shipbuilding & submarines market is divided into offensive operations, defensive operations, patrol & surveillance, and special operations. Among these, the offensive operations segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Military shipbuilding and submarines enable power projection, sea control, and sea denial, playing an important role in offensive naval operations. The growing demand for advanced and lethal warships for offensive operations is driving the market growth of military shipbuilding & submarines.

Regional Segment Analysis of the Military Shipbuilding & Submarines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the military shipbuilding & submarines market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the military shipbuilding & submarines market over the predicted timeframe. An increasing need for naval and commercial vessels, government defense budgets, and shipbuilding advanced technologies are driving the region’s military shipbuilding & submarines market. For instance, the department of defense allocated $30 billion towards building new destroyers, submarines, and support vessels by the US government.

Asia Pacific is expected to grow at a rapid CAGR in the military shipbuilding & submarines market during the forecast period. The increasing defense spending and budget allocation for naval forces, along with growing emphasis on modernizing naval vessel fleets, are driving the military shipbuilding & submarines market. The growing significance of advanced shipbuilding technologies, along with the high demand for robust submarine fleets, contributes to promoting market growth.

Europe is anticipated to hold a significant share of the military shipbuilding & submarines market during the predicted timeframe. Increased focus on the impact of the Ukraine conflict affecting the naval shipbuilding is contributing to propel the military shipbuilding & submarines market. An increasing investment in robotics and other digital technologies by the local naval shipbuilders is supporting the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the military shipbuilding & submarines market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Dynamics Corporation

- Huntington Ingalls Industries Inc.

- BAE Systems PLC

- Northrop Gruman Corporation

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Leonardo SpA

- Singapore Technologies Engineering

- DCNS S.A (Naval Group)

- Singapore Technologies Engineering

- Daewoo Shipbuilding and Marine Engineering

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, the Submarine Force’s newest attack submarine, the future USS Oregon (SSN 793), was delivered to the U.S. Navy. PCU Oregon is the twentieth Virginia Class submarine that is co-produced at General Dynamics Electric Boat and Huntington Ingalls Industries – Newport News Shipbuilding (HII-NNS) through a long-standing teaming agreement.

- In February 2022, Naval Group and PT PAL signed a Memorandum of Understanding seeking to leverage the capabilities of both partners to meet the growing requirements of the Indonesian Navy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the military shipbuilding & submarines market based on the below-mentioned segments:

Global Military Shipbuilding & Submarines Market, By Type of Ships

- Surface Ships

- Corvettes

- Frigates

- Destroyers

- Cruisers

- Aircraft Carriers

Global Military Shipbuilding & Submarines Market, By Purpose

- Offensive Operations

- Defensive Operations

- Patrol & Surveillance

- Special Operations

Global Military Shipbuilding & Submarines Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the military shipbuilding & submarines market?The global military shipbuilding & submarines market size is expected to grow from USD 79.5 Billion in 2024 to USD 129.5 Billion by 2035, at a CAGR of 4.54% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the military shipbuilding & submarines market?North America is anticipated to hold the largest share of the military shipbuilding & submarines market over the predicted timeframe.

-

3. What is the market size of the Global Military Shipbuilding & Submarines Market in 2025?The Global Military Shipbuilding & Submarines Market size was estimated USD 4.54% billion in 2025.

-

4. What is the forecasted CAGR of the Global Military Shipbuilding & Submarines Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.54% during the period 2024–2030.

-

5. Who are the top 10 companies operating in the Global Military Shipbuilding & Submarines Market?Key players include General Dynamics Corporation, Huntington Ingalls Industries Inc., BAE Systems PLC, Northrop Gruman Corporation, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Leonardo SpA, Singapore Technologies Engineering, DCNS S.A (Naval Group), and Singapore Technologies Engineering.

-

6. Can you provide company profiles for the leading Military Shipbuilding & Submarines manufacturers?Yes. For example, General Dynamics Corporation, a global aerospace and defense company, is a producer of nuclear submarines, main battle tanks, and armoured fighting vehicles. Huntington Ingalls Industries Inc. delivers the world’s most powerful ships and all-domain solutions, engages in the design, construction, repair, and maintenance of both nuclear and non-nuclear ships for the U.S. Navy and Coast Guard.

-

7. What are the main drivers of growth in the military shipbuilding & submarines market?Geopolitical instability, government defense budgets, and advanced naval capabilities are major market growth drivers.

-

8. What challenges are limiting the Military Shipbuilding & Submarines Market?Increased cost of naval construction and complexity in integrating advanced technologies as well as stringent regulations and compliance standards, are limiting the military shipbuilding & submarines market.

Need help to buy this report?