Global Military Aircraft and Aerospace Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product/Service (Aircraft Parts, Avionics & Electronic Systems, Maintenance, Repair & Overhaul (MRO) & Other Services, and Missiles & Space Systems), By Aircraft Type (Fixed-Wing Aircraft, Rotocraft, and Unmanned Aerial Vehicles (UAVs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Military Aircraft & Aerospace Manufacturing Market Insights Forecasts to 2035

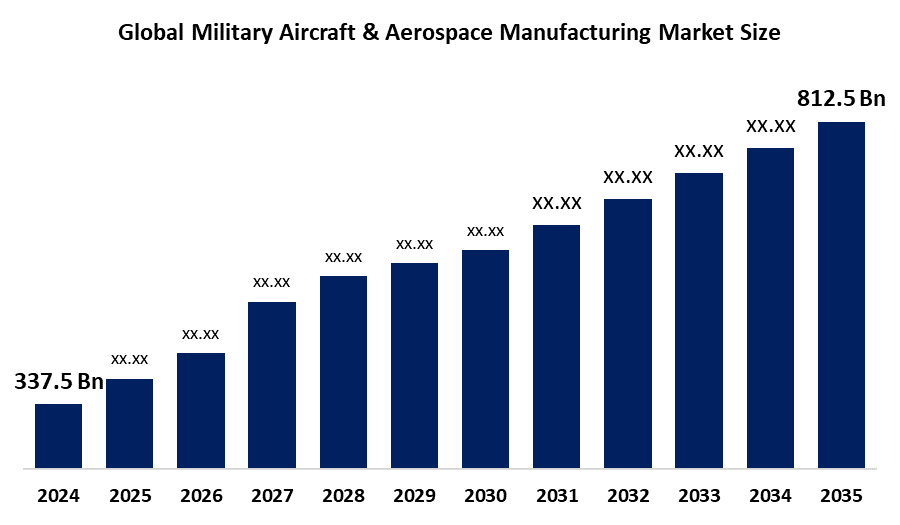

- The Global Military Aircraft & Aerospace Manufacturing Market Size Was Estimated at USD 337.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.31% from 2025 to 2035

- The Worldwide Military Aircraft & Aerospace Manufacturing Market Size is Expected to Reach USD 812.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Global Military Aircraft & Aerospace Manufacturing Market Size was worth around USD 337.5 Billion in 2024 and is Predicted to Grow to around USD 812.5 Billion by 2035 with a compound annual growth rate (CAGR) of 8.31% from 2025 to 2035. With the evolving threats, increasing investment in defense modernization is driving the global military aircraft & aerospace manufacturing market.

Market Overview

The military aircraft & aerospace manufacturing market refers to the industry that encompasses the designing, development, production, and maintenance of aircraft, spacecraft, and related systems specifically for military applications. Military aircraft & aerospace manufacturing refers to designing, building, testing, and maintaining aircraft, aircraft parts, missiles, rockets, or spacecraft. Aerospace is a high-technology industry, supporting aviation by building aircraft and manufacturing aircraft parts for their maintenance. Advanced air mobility (AAM) in military aircraft and aerospace manufacturing emphasizes innovative aircraft designs and technologies. Further, the introduction of unmanned systems, especially unmanned aerial vehicles (UAVs) or drone manufacturing, aids in propelling the market growth. AI aids in accelerating progress in various areas, such as aftermarket services and optimization of the supply chain. The increasing investment in the development of advanced military aircraft by the national defense authorities, along with the rising security concerns, is creating new growth opportunities in the military aircraft & aerospace manufacturing market.

Report Coverage

This research report categorizes the military aircraft & aerospace manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the military aircraft & aerospace manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the military aircraft & aerospace manufacturing market.

Global Military Aircraft and Aerospace Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 337.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.31% |

| 2035 Value Projection: | USD 812.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Service, By Aircraft Type, By Region. |

| Companies covered:: | Airbus SAS, The Boeing Company, Saab AB, Bell Texton Inc., Sukhoi Corporation, Korea Aerospace Industries, Embraer SA, Hindustan Aeronautics Limited, GE Aviation, Lockheed Martin Corporation, Raytheon Technologies Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Evolving threats and geopolitical tensions, including Eastern Europe and the South China Sea, are expected to drive the demand for advanced military capabilities, which is anticipated to propel the market demand. Further, increasing defense spending, with the increasing modernization of aging aircraft fleets that not only gain a competitive edge over adversaries but also aid in strengthening national interests, is propelling market growth. Advanced military aviation, including drones that provide intelligence, surveillance, and reconnaissance capabilities, serving as a cost-effective alternative to traditional manned aircraft, is driving the market growth.

Restraining Factors

Cyberthreats and high investment required for manufacturing are limiting the military aircraft & aerospace manufacturing market. Increased raw material costs and stringent regulatory standards are increasing overall production costs, thereby challenging market growth.

Market Segmentation

The military aircraft & aerospace manufacturing market share is classified into product/service and aircraft type.

- The aircraft parts segment dominated the military aircraft & aerospace manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product/service, the military aircraft & aerospace manufacturing market is divided into aircraft parts, avionics & electronic systems, maintenance, repair & overhaul (MRO) & other services, and missiles & space systems. Among these, the aircraft parts segment dominated the military aircraft & aerospace manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period. There is increasing emphasis on innovative technologies and efficient production processes, with the consistent demand for aircraft parts. Further, an increasing demand for replacement parts and maintenance is contributing to propel the market in the aircraft parts segment.

- The fixed-wing aircraft segment accounted for a major market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the aircraft type, the military aircraft & aerospace manufacturing market is divided into fixed-wing aircraft, rotocraft, and unmanned aerial vehicles (UAVs). Among these, the fixed-wing aircraft segment accounted for a major market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. A fixed-wing aircraft is heavier and capable of flight using aerodynamic lift. The growing investment in modernizing the fixed-wing military aircraft fleet, along with the procurement of next-generation aircraft for enhancing aerial combat capabilities and maintaining air superiority, is propelling the market growth.

Regional Segment Analysis of the Military Aircraft & Aerospace Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the military aircraft & aerospace manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the military aircraft & aerospace manufacturing market over the predicted timeframe. The increasing need for military aircraft, both manned and unmanned, which is predicted to come from the US, is driving the market demand in the region. Further, the substantial defense investments and technological advancement initiatives, along with the region’s commitment to military modernization, are driving the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the military aircraft & aerospace manufacturing market during the forecast period. The growing defense budget due to the increasing need for modernizing armed forces and strengthening the position for better managing foreign affairs strain is driving the market for military aircraft & aerospace manufacturing. Countries seeking to strengthen their military capabilities and strategic partnerships are enhancing the regional market for military aircraft & aerospace manufacturing.

Europe is expected to hold a significant share of the military aircraft & aerospace manufacturing market during the predicted timeframe. The increased security risks and geopolitical tensions are contributing to driving the military aircraft & aerospace manufacturing market. Further, the companies' growing investments in cutting-edge innovations spanning AI, advanced materials, 3D printing, and autonomous systems are propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the military aircraft & aerospace manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SAS

- The Boeing Company

- Saab AB

- Bell Texton Inc.

- Sukhoi Corporation

- Korea Aerospace Industries

- Embraer SA

- Hindustan Aeronautics Limited

- GE Aviation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Rolls-Royce announced a significant partnership with Hyderabad-based Azad Engineering to manufacture complex components for military aircraft engines. The collaboration aligns with India’s push for defence indigenisation and aims to strengthen the country’s aerospace manufacturing capabilities.

- In March 2024, Korea Aerospace Industries Ltd. (KAI), the country’s sole military aircraft manufacturer, plans to develop future aerial mobility to secure a new growth driver.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the military aircraft & aerospace manufacturing market based on the below-mentioned segments:

Global Military Aircraft & Aerospace Manufacturing Market, By Product/Service

- Aircraft Parts

- Avionics & Electronic Systems

- Maintenance

- Repair & Overhaul (MRO) & Other Services

- Missiles & Space Systems

Global Military Aircraft & Aerospace Manufacturing Market, By Aircraft Type

- Fixed-Wing Aircraft

- Rotocraft

- Unmanned Aerial Vehicles (UAVs)

Global Military Aircraft & Aerospace Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the military aircraft & aerospace manufacturing market over the forecast period?The global military aircraft & aerospace manufacturing market is projected to expand at a CAGR of 8.31% during the forecast period.

-

2. What is the market size of the military aircraft & aerospace manufacturing market?The global military aircraft & aerospace manufacturing market size is expected to grow from USD 337.5 Billion in 2024 to USD 812.5 Billion by 2035, at a CAGR of 8.31% during the forecast period 2025-2035.

-

3. Who are the top 10 companies operating in the Global Military Aircraft & Aerospace Manufacturing Market?Key players include Airbus SAS, The Boeing Company, Saab AB, Bell Texton Inc., Sukhoi Corporation, Korea Aerospace Industries, Embraer SA, Hindustan Aeronautics Limited, Lockheed Martin Corporation, and Raytheon Technologies Corporation.

-

4. Can you provide company profiles for the leading Military Aircraft & Aerospace Manufacturing companies?Yes. For example, Airbus SAS is a leading aircraft manufacturer, designs, manufactures, and supplies commercial military aircraft, and complements its product offering with an extensive service network. The Boeing Company designs, manufactures, and sells airplanes, rotocraft, rockets, satellites, and missiles worldwide.

-

5. What are the main drivers of growth in the military aircraft & aerospace manufacturing market?Demand for advanced military aircraft and ongoing geopolitical tensions and conflicts around the world are major factors responsible for driving market growth.

-

6. How do Asia–Pacific and North America compare in terms of market growth?Asia–Pacific is expected to show a higher CAGR due to growing defense budgets and demand for strengthening their military capabilities and strategic partnerships, while North America currently holds a higher market share.

-

7. What are the latest trends in the military aircraft & aerospace manufacturing market?Integration of artificial intelligence (AI) and advanced air mobility (AAM) with unmanned systems is are key emerging trend in the military aircraft & aerospace manufacturing market.

-

8. What are the top investment opportunities in the Global Military Aircraft & Aerospace Manufacturing Market?Investments in the development of advanced military aircraft by national defense authorities provide attractive opportunities in the military aircraft & aerospace manufacturing market.

-

9. What is the long-term outlook (2025–2035) for the military aircraft & aerospace manufacturing market?The market is expected to remain in a growth phase, supported by modernization in the aircraft industry and geopolitical tensions.

Need help to buy this report?