Middle East Potash Market Size, Share, By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate, Other Products), By End Use (Agriculture and Other End-Uses), Middle East Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsMiddle East Potash Market Insights Forecasts to 2035

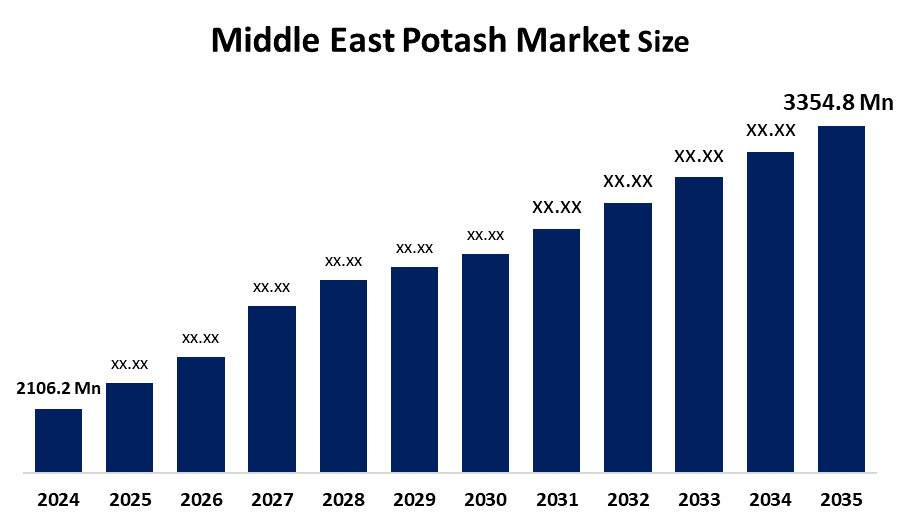

- Middle East Potash Market Size 2024: USD 2106.2 Mn

- Middle East Potash Market Size 2035: USD 3354.8 Mn

- Middle East Potash Market CAGR 2024: 4.32%

- Middle East Potash Market Segments: Product and End use

Get more details on this report -

The Middle East potash Market Size encompasses the entire cycle of potash (potassium-based minerals) production, distribution, and trade, with the primary use being as a key nutrient in fertilisers. The area is the world's leading supplier thanks to the extensive deposits, particularly those around the Dead Sea. The application of potash in agriculture is aimed at the fertilisers that increase the yield of crops, add to the quality of plants, and make them more resistant to drought and diseases. Besides, it is an important ingredient in industrial chemicals, animal feed, and water treatment processes.

The Arab Potash Company in Jordan started the Southern Expansion Project in 2025 which was intended to increase the annual output by almost 740,000 tonnes and thus the total capacity of the plant would reach about 3.7 million tonnes by 2029. This development will not only augment the potash production of the area but also strengthen the Jordan's position as the major global supplier of potash through exporting.

The Jordanian government, following the commands of the king, has notably given orders to the concerned parties to make the Arab Potash Company (APC) projects, particularly the ones related to water, energy and industrial expansion aimed at improving competitiveness and production capacity in the global markets, faster and easier to complete. In a bid to enhance agricultural sustainability, the UAE government revamped its regulations to include among others, the provision of potash products as a part of the environmentally friendly fertilizers to be promoted for soil health. This policy facilitates the use of efficient fertilizers by farmers and also aids in the improvement of soil fertility.

In the coming years, the Middle East potash market is expected to grow significantly due to the continuous food security initiatives, the increase in irrigated and greenhouse farming, the rising demand for speciality fertilisers, and the capacity expansion of major manufacturers.

Market Dynamics of the Middle East Potash Market:

The Middle East potash market is driven by the food security initiatives, modern agricultural practices being adopted more and more, and the demand for high-efficiency fertilizers rising. In addition to these factors, the market growth is also supported by the continuation of greenhouse farming, the government's backing for eco-friendly farming, and the robust demand for exports from Asia and Europe.

The Middle East potash market is restrained by the high production and energy costs, water scarcity, environmental regulations, and the dependency on global fertiliser price fluctuations that can also impact profitability and thus become a factor in the investment decision process.

The Middle East potash market is bright and promising, very much alive and represents a good opportunity, backed by government support, growing production capacity, the overall demand for fertiliser getting higher, and more concern about food security and eco-friendly agriculture.

Market Segmentation

The Middle East Potash Market share is classified into product and end use.

By Product:

The Middle East potash market is divided by product into potassium chloride, potassium sulphate, potassium nitrate, and other products. Among these, the potassium chloride dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Potassium Chloride reigns because it is the most cost-effective and the most common potash fertiliser, which can be used for a variety of crops. The Middle East has a powerful production capacity and a good export infrastructure for potassium chloride, and its high potassium content makes it the number one choice for large-scale agriculture.

By End Use:

The Middle East potash market is divided by service into agriculture and other end-uses. Among these, the agriculture segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Agriculture prevails as potash is an indispensable nutrient for plants, and the governments of the Middle East are very much in favour of fertilisers as they consider it a way to increase the productivity of the land, ensure food supply, and further take up modern farming methods like irrigated and greenhouse agriculture.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Middle East potash market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Middle East Potash Market:

- Arabpotash

- Icl

- Uralkali

- Nutrien

- K+S Aktiengesellschaft

- Mosaic

- Bhp

- Jordan Phosphate Mines Co. Plc

- Intrepid Potash

- Encanto Potash Corp. (Ep

- Others

Recent Developments in the Middle East Potash Market:

-

October 2025: The Arab Potash Company (APC) signed an engineering services agreement with the German firm CAC Engineering GmbH (formerly CEC) for the planning and design of a new production facility.

-

May 2025: APC inaugurated its USD 1.1 billion Southern Expansion Project, aimed at increasing annual potash production capacity to approximately 3.7 million tonnes. The project is expected to strengthen export capabilities and support global food security initiatives.

-

June 2025: APC entered into a new potash supply agreement with Indian Potash Limited, securing exports through 2025 and reinforcing trade relations with key importing markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Middle East, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Middle East potash market based on the below-mentioned segments:

Middle East Potash Market, By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

- Other Products

Middle East Potash Market, By End Use

- Agriculture

- Other End-Uses

Frequently Asked Questions (FAQ)

-

What is the Middle East potash market size?Middle East potash market is expected to grow from USD 2106.2 million in 2024 to USD 3354.8 million by 2035, growing at a CAGR of 4.32% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the food security initiatives, modern agricultural practices being adopted more and more, and the demand for high-efficiency fertilisers rising. In addition to these factors, the market growth is also supported by the continuation of greenhouse farming, the government's backing for eco-friendly farming, and the robust demand for exports from Asia and Europe.

-

What factors restrain the Middle East potash market?Constraints include the high production and energy costs, water scarcity, environmental regulations, and the dependency on global fertiliser price fluctuations that can also impact profitability and thus become a factor in the investment decision process.

-

How is the market segmented by product?The market is segmented into potassium chloride, potassium sulphate, potassium nitrate, and other products

-

Who are the key players in the Middle East potash market?Key companies include Arabpotash, ICL, Uralkali, Nutrien, K+S Aktiengesellschaft, Mosaic, BHP, Jordan Phosphate Mines Co. Plc, Intrepid Potash, Encanto Potash Corp. (EP), and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?