Middle East Polyamide Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Aramid, Polyamide 6, Polyamide 66, and Polyphthalamide), By End User (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), and Middle East Polyamide Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsMiddle East Polyamide Market Insights Forecasts to 2035

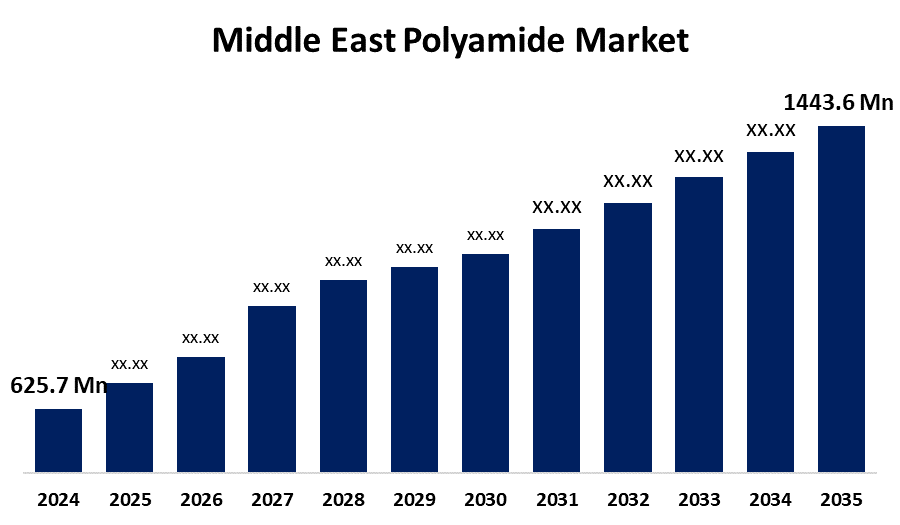

- The Middle East Polyamide Market Size Was Estimated at USD 625.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.45% from 2025 to 2035

- The Middle East Polyamide Market Size is Expected to Reach USD 1443.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Middle East Polyamide Market size is anticipated to reach USD 1443.6 Million by 2035, growing at a CAGR of 15.45% from 2025 to 2035. The market is driven by the increasing demand for lightweight and high-performance materials, governmental investments in infrastructure development and industrial diversification initiatives across the Middle East

Market Overview

Polyamide, also known as nylon. The polymer functions as a material because its chemical structure contains repeating units that are linked by amide bonds. The material is produced through a polymerization process involving the reaction of monomers commonly obtained from petroleum or coal. The flexible properties of polyamides combined with their ability to resist wear and their moisture absorption capacity make these materials suitable for use in multiple industries.

Aramco has developed its downstream expansion strategy through the purchase of a 22.5 stake in Rabigh Refining and Petrochemical Company from Sumitomo Chemical Corporation, which they acquired for 702 million.

Saudi Arabian Basic Industries Corporation (SABIC) announced a 27% increase in polyamide manufacturing capacity in 2023 alone, establishing the kingdom as the region's largest polyamide producer, which accounts for almost 65 of the Middle Eastern capacity. According to the UAE Defence Ministry, the country has set aside $25.4 billion for defence manufacturing capabilities through 2028, with approximately 17 allocated toward advanced materials production and acquisition.

Report Coverage

This research report categorizes the market for the Middle East polyamide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East polyamide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the Middle East polyamide market.

Middle East Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 625.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 15.45% |

| 2035 Value Projection: | USD 1443.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Resin Type, By End User |

| Companies covered:: | Jubail SPARK,KEZAD,NCS Resins,Hellermann Tyton,Kainotomia Polymers,CG Plastics,Spintellect Polymers,DaVinci Lab,Fiber Rope Solutions,Maizey Plastics Pty Ltd And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyamide market in Middle East is driven by the growing use of polyamides in electric vehicle EV production because these materials provide better performance than metal for manufacturing under hood components and fuel systems, and battery parts. The electronics manufacturing industry is expanding rapidly due to increasing demand for 5G technology components and consumer gadgets, which leads to higher consumption of polyamides in connectors and switches and cable insulation because they provide better electrical insulation and heat resistance.

Restraining Factors

The polyamide market in Middle East is hindered by the system exhibiting high sensitivity to three external factors, which include worldwide crude oil price changes and supply chain interruptions and geopolitical conflict situations. The Middle East region lacks sufficient local production facilities that can manufacture high-temperature speciality polyamide grades so the area depends on imports to meet its industrial needs, which results in extended delivery times.

Market Segmentation

The Middle East polyamide market share is categorised into resin type and end user.

- The polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East polyamide market is segmented by resin type into aramid, polyamide 6, polyamide 66, and polyphthalamide. Among these, the polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the Middle East market share reached 54.62 during 2025. The material exists as an ideal solution for automotive and construction applications because it possesses high tensile strength combined with abrasion resistance and chemical resistance. The compound retains its market dominance in the regional polyamide industry because of its flexible nature and its capacity to deliver various performance benefits.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Middle East polyamide market is segmented into aerospace, automotive, building and construction, electrical and electronics, industrial and machinery, packaging, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the automotive industry in the region, which grows rapidly due to its requirement for polyamides, which deliver essential vehicle performance attributes through their lightweight, high-strength and durable material properties. The increased demand for vehicles drives up the consumption of polyamides in automotive applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East polyamide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jubail SPARK

- KEZAD

- NCS Resins

- Hellermann Tyton

- Kainotomia Polymers

- CG Plastics

- Spintellect Polymers

- DaVinci Lab

- Fiber Rope Solutions

- Maizey Plastics Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2025, ALBIS announced that it had partnered with Arkema to distribute the companys high performance, medical grade polymers, effective immediately.

Market Segment

This study forecasts revenue at the Middle East, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Middle East Polyamide Market based on the below mentioned segments:

Middle East Polyamide Market, By Resin Type

- Aramid

- Polyamide 6

- Polyamide 66

- Polyphthalamide

Middle East Polyamide Market, By End User

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Middle East polyamide market size?A: The Middle East Polyamide Market size is expected to grow from USD 625.7 million in 2024 to USD 1443.6 million by 2035, growing at a CAGR of 15.45% during the forecast period 2025-2035.

-

Q: What is polyamide, and its primary use?A: Polyamide, also known as nylon. The polymer functions as a material because its chemical structure contains repeating units that are linked by amide bonds.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the use of polyamides in electric vehicle (EV) production because these materials provide better performance than metal for manufacturing under-hood components and fuel systems and battery parts.

-

Q: What factors restrain the Middle East polyamide market?A: The market is restrained by system exhibits high sensitivity to three external factors which include worldwide crude oil price changes and supply chain interruptions and geopolitical conflict situations.

-

Q: How is the market segmented by resin type?A: The market is segmented into aramid, polyamide 6, polyamide 66, and polyphthalamide.

-

Q: Who are the key players in the Middle East polyamide market?A: Key companies include Jubail & SPARK, KEZAD, NCS Resins, Hellermann Tyton, Kainotomia Polymers, CG Plastics, Spintellect Polymers, DaVinci Lab, Fiber Rope Solutions, and Maizey Plastics Pty Ltd.

Need help to buy this report?