Middle East Offshore Wind Turbine Market Size, Share, By Capacity (Up to 3 MW, 3 MW to 5 MW, Above 5 MW), By Water Depth (Shallow Water (<30 M Depth), Transitional Water (30-60 M Depth), Deepwater (More Than 60 M Depth)), Middle East Offshore Wind Turbine Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerMiddle East Offshore Wind Turbine Market Size Insights Forecasts to 2035

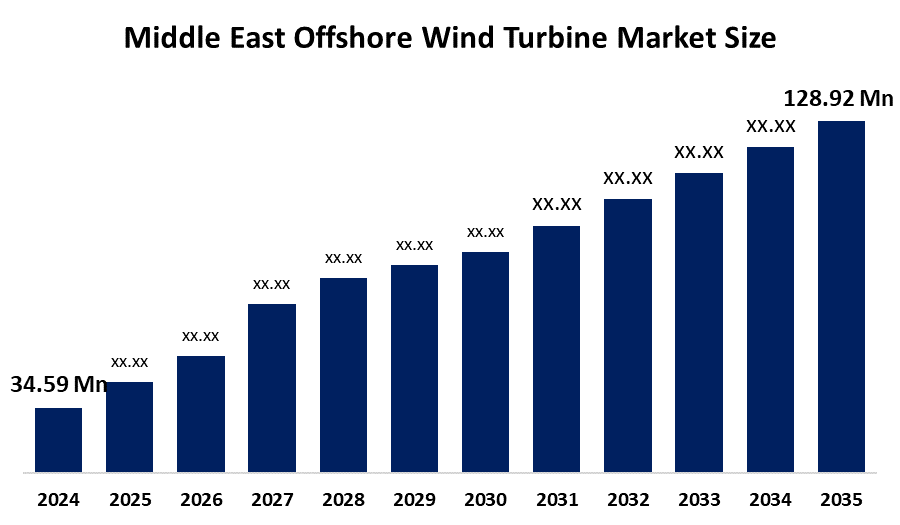

- Middle East Offshore Wind Turbine Market Size 2024: USD 34.59 Mn

- Middle East Offshore Wind Turbine Market Size 2035: USD 128.92 Mn

- Middle East Offshore Wind Turbine Market CAGR 2024: 12.7%

- Middle East Offshore Wind Turbine Market Segments: Capacity and Water Depth

Get more details on this report -

The Market Size is concerned with the wind turbine's installation, operation, and production that are placed in the Middle East's sea to produce renewable electricity. The wind is being captured to sustain power generation and, at the same time, replace the traditional sources of energy.

AD Ports Group, along with Masdar, at first was just a small partnership but gradually turned into one of the most important players that moved the world offshore wind energy projects further, consequently, also showing the already daring investments and cooperation increasing in the renewable sector of the region.

The UAE has set the Energy Strategy 2050 goal of reducing its dependence on oil and gas by greatly increasing the output of electric power from renewable sources, thus diversifying its energy mix. The UAE's draft plan envisages the country sourcing 44% of its electricity from renewable means by 2050, and the amount of investment in renewable energy infrastructure will be between AED 150-200 billion, both of which are conducive to laying the policy groundwork for future offshore wind power development and making it part of the cleaner energy aspiration.

The Middle East offshore wind turbine market is going to see potential in future, such as new offshare wind power projects, collaboration between the public and private sectors, new turbine technologies, making the wind power regional and combining it with smart grids and green hydrogen projects.

Market Dynamics of the Middle East Offshore Wind Turbine Market:

The Middle East offshore wind turbine market is driven by demand for clean and sustainable energy in the region, the supportive governments through initiatives like the UAE Energy Strategy 2050 and Saudi Vision 2030, and large-scale offshore wind projects that keep coming up as a result of the acquisition of finance strategy and the attractiveness of the projects. On top of that, there is also rising electricity consumption, the need to diversify energy sources, and technological advancements in high-capacity turbines that are further driving the Gulf countries' fast-paced adoption of offshore wind solutions.

The Middle East offshore wind turbine market is restrained by several hurdles, such as high initial capital investment, complex offshore installation challenges, limited offshore infrastructure, and regulatory barriers, among others. Furthermore, the prevailing wind conditions that are not steady and the unavailability of skilled labour in the area are also factors that delay large-scale adoption and consequently increase project risks for developers and investors.

The future of the Middle East offshore wind turbine market is bright and promising, with government backing, big investments in projects, new technologies, and wider adoption of renewable energy are among the factors that are going to be responsible for the significant growth, in the Gulf region and the whole of the Middle East, associated with the Offshore Wind Turbine market in the Middle East.

Market Segmentation

The Middle East offshore wind turbine market share is classified into capacity and water depth.

By Capacity:

The Middle East offshore wind turbine market is divided by capacity into up to 3 mw, 3 mw to 5 mw, and above 5 mw. Among these, the above 5 mw segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Turbines with a capacity of more than 5 MW are the ones that clearly lead the market since their output is noticeably higher, the cost for installation per MW is lower, they take less offshore space, and they are quite efficient in supplying the needed power in different regions.

By Water Depth:

The Middle East offshore wind turbine market is divided by water depth into shallow water (<30 m depth), transitional water (30-60 m depth), and Deepwater (more than 60 m depth. Among these, the shallow water (<30 m depth) segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main reason for the dominance of shallow water areas (less than 30 meters) is that the whole procedure of building and keeping the plants is not only cheaper but also easier. Thus, they do not require as many modern vessels and technologies, and most of the shallow seabed in the coastal areas of the Middle East is suitable for that, which makes the projects quicker and cheaper.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Middle East offshore wind turbine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Middle East Offshore Wind Turbine Market:

- Orsted A/S

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Goldwind

- RWE Renewables

- Equinor ASA

- Shell plc

- Masdar (Abu Dhabi Future Energy Company)

- Lamprell

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Middle East, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Middle East offshore wind turbine market based on the below-mentioned segments:

Middle East Offshore Wind Turbine Market, By Capacity

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

Middle East Offshore Wind Turbine Market, By Water Depth

- Shallow Water (<30 M Depth)

- Transitional Water (30-60 M Depth)

- Deepwater (More than 60 M Depth)

Frequently Asked Questions (FAQ)

-

Q: What is the Middle East offshore wind turbine market size?A: Middle East offshore wind turbine market is expected to grow from USD 34.59 million in 2024 to USD 128.92 million by 2035, growing at a CAGR of 12.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for clean and sustainable energy in the region, the supportive governments through initiatives like the UAE Energy Strategy 2050 and Saudi Vision 2030, and large-scale offshore wind projects that keep coming up as a result of the acquisition of finance strategy and the attractiveness of the projects.

-

Q: What factors restrain the Middle East offshore wind turbine market?A: Constraints include several hurdles like high initial capital investment, complex offshore installation challenges, limited offshore infrastructure, and regulatory barriers, among others.

-

Q: How is the market segmented by Capacity?A: The market is segmented into Up to 3 MW, 3 MW to 5 MW, and Above 5 MW.

-

Q: Who are the key players in the Middle East offshore wind turbine market?A: Key companies include Ørsted A/S, Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Goldwind, RWE Renewables, Equinor ASA, Shell plc, Masdar (Abu Dhabi Future Energy Company), Lamprell, Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?