Middle East & Africa Plastic Recycling Market Size, Share, and COVID-19 Impact Analysis, By Type (Plastic Bottles, Plastic Films, Polymer Foam, and Others), By Process (Mechanical and Chemical), and Middle East & Africa Plastic Recycling Market Size Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsMiddle East & Africa Plastic Recycling Market Size Insights Forecasts to 2035

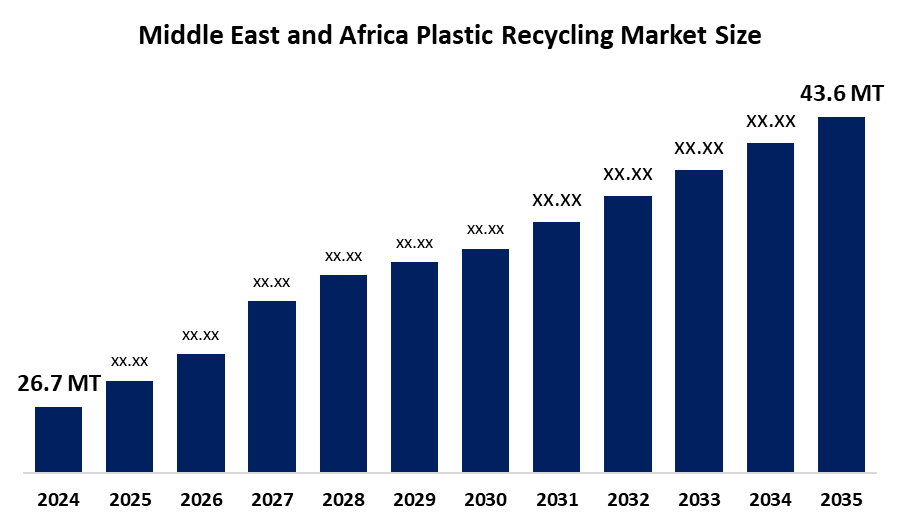

- The Middle East & Africa Plastic Recycling Market Size Was Estimated at 26.7 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.56% from 2025 to 2035

- The Middle East & Africa Plastic Recycling Market Size is Expected to Reach 43.6 Million Tonnes by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Middle East & Africa Plastic Recycling Market Size is Anticipated to reach 43.6 Million Tonnes by 2035, Growing at a CAGR of 4.56% from 2025 to 2035. The market is driven by the rising adoption of recycled plastic for construction activities due to its property of enhancing the strength of the concrete material, which is expected to increase the demand for the Plastic Recycling Market Size.

Market Overview

The plastics recycling market, which originates from consumer waste and industrial waste, has become a vital material for Middle Eastern and African industries because of their economic value, its ability to lessen environmental impact and its suitability for sustainable packaging, construction and automotive manufacturing processes. The material serves permanent products, which include piping, insulation panels and geomembranes. This is the fastest-growing segment, with an expected CAGR of 21.5% as urbanization increases in Egypt and Kenya.

The recycling program, which Amazon UAE launched in 2025, provides Dubai customers with new options to recycle their Amazon.ae delivery packaging materials. International Holding Company (IHC), which operates in Abu Dhabi, announced its plan to establish Rebound Ltd in February 2022. The new company, Rebound Ltd, will create a groundbreaking solution that aims to decrease global plastic pollution.

The Saudi Investment Recycling Company (SIRC) signed a landmark deal to divert 94% of landfill waste by 2035. The recent 2026 updates introduced a complete prohibition on plastic bags, which serve to package cooked food. The U.A.E. held the top position in the Middle East and Africa Recycled Plastic Market during 2024 with its 37% revenue share resulting from its established recycling systems, governmental support, and its local and international companies' commitment to sustainable material usage.

Report Coverage

This research report categorises the Middle East & Africa Plastic Recycling Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East & Africa Plastic Recycling Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Middle East & Africa Plastic Recycling Market Size.

Middle East and Africa Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 26.7 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.56% |

| 2035 Value Projection: | 43.6 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Process |

| Companies covered:: | BariQ, Veolia, Remondis, Beeah Group, Napco National, Integrated Plastics Packaging LLC & ENPI Group, SABIC, Dow, LG Chem, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Plastic Recycling Market Size in Middle East & Africa is driven by the demand for plastics from different end-user industries, which will rise due to the growing need for plastic packaging products. The implementation of AI-based sorting systems together with robotic automation systems in the UAE and South Africa will enhance material purity while increasing output quality. E-commerce growth with population expansion results in excessive plastic waste, which provides recyclers with continuous access to recycling materials.

Restraining Factors

The Plastic Recycling Market Size in Middle East & Africa is restrained by the absence of specialized material recovery facilities (MRFs) with efficient waste collection systems that operate in an organized manner in many regions. The presence of plastic waste contamination at high levels leads to decreased quality of materials, which results in higher expenses for processing.

Market Segmentation

The Middle East & Africa Plastic Recycling Market Size share is categorised into type and process.

- The plastic bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Middle East & Africa Plastic Recycling Market Size is segmented by type into plastic bottles, plastic films, polymer foam, and others. Among these, the plastic bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the recycling process, which has experienced a significant increase in PET bottle collection from the beverage and water industries. Bottles serve as the preferred choice for recycled plastic production because they provide cleaner feedstock, which leads to simpler processing methods.

- The mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on process, the Middle East & Africa Plastic Recycling Market Size is segmented into mechanical and chemical. Among these, the mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by industries such as automotive, electronics, and packaging, which look to reduce their reliance on virgin plastics; they now turn to mechanically recycled plastics as their sustainable solution. The major companies in the market now use recycled materials for product development because their customers prefer environmentally friendly products and their corporate social responsibility (CSR) programs require it.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East & Africa Plastic Recycling Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BariQ

- Veolia

- Remondis

- Beeah Group

- Napco National

- Integrated Plastics Packaging LLC & ENPI Group

- SABIC

- Dow

- LG Chem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Middle East & Africa, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Middle East & Africa Plastic Recycling Market Size based on the below-mentioned segments:

Middle East & Africa Plastic Recycling Market Size, By Type

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Others

Middle East & Africa Plastic Recycling Market Size, By Process

- Mechanical

- Chemical

Frequently Asked Questions (FAQ)

-

What is the Middle East & Africa Plastic Recycling Market Size?The Middle East & Africa Plastic Recycling Market Size is expected to grow from USD 26.7 Million Tonnes in 2024 to USD 43.6 Million Tonnes by 2035, growing at a CAGR of 4.56% during the forecast period 2025-2035

-

What is plastic recycling, and its primary use?The plastics recycling market, which originates from consumer waste and industrial waste, has become a vital material for Middle Eastern and African industries because of its economical value, its ability to lessen environmental impact and its suitability for sustainable packaging, construction and automotive manufacturing processes.

-

What are the key growth drivers of the market?Market growth is driven by the demand for plastics from different end-user industries, which will rise because of the growing need for plastic packaging products.

-

What factors restrain the Middle East & Africa Plastic Recycling Market Size?The market is restrained by the absence of specialized material recovery facilities (MRFs) with efficient waste collection systems that operate in an organized manner in many regions.

-

How is the market segmented by type?The market is segmented into plastic bottles, plastic films, polymer foam, and others

-

Who are the key players in the Middle East & Africa Plastic Recycling Market Size?Key companies include BariQ, Veolia, Remondis, Beeah Group, Napco National, Integrated Plastics Packaging LLC & ENPI Group, SABIC, Dow, and LG Chem.

Need help to buy this report?